STANDARD FORM

INDUSTRIAL BUILDING LEASE

1. BASIC TERMS.

This Section 1 contains the Basic Terms of this lease (this “Lease”) between Landlord and Tenant, as each is named below. Other Sections of the Lease referred to in this Section 1 explain and define the Basic Terms and are to be read in conjunction with the Basic Terms.

1.1 Effective Date of Lease: September 9, 2014.

1.2 Landlord: First Industrial, L.P.

1.3 Tenant: Clearfield, Inc. a Minnesota corporation.

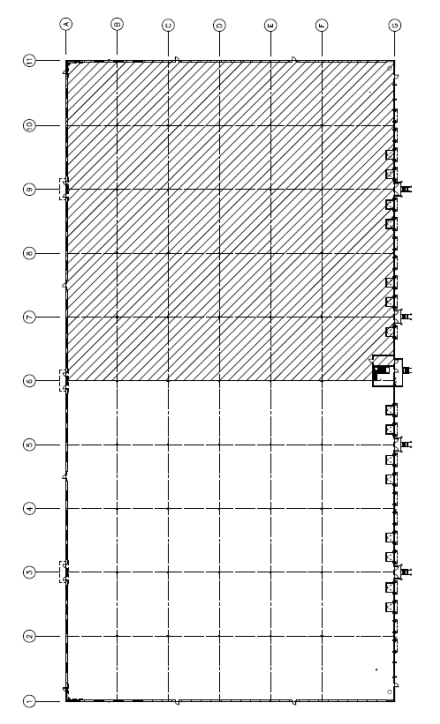

1.4 Premises: Suite 100 approximately 70,771 rentable square feet in the building commonly known as 7050 Winnetka Avenue North, Brooklyn Park MN 55428 (the “Building”). The Building’s total square feet is 142,291. The Premises are depicted on Exhibit A-1.

1.5 Property: The real property on which the Building is located, as legally described on Exhibit A.

1.6 Lease Term: ten (10) years and approximately two (2) months (“Term”), commencing on the later to occur of: (a) January 1, 2015 and (b) the Substantial Completion Date (as defined in Exhibit C) (the later to occur of (a) and (b), the “Commencement Date”) and ending, subject to Section 2.4 below, on the last day of the month in which the day that is ten (10) years and two (2) months after the Commencement Date occurs (“Expiration Date”). On Landlord’s prior notice to Tenant to be given approximately two (2) weeks prior to the Commencement Date, Landlord shall permit Tenant to have access to, or possession of, the Premises prior to the Commencement Date, on all of the terms and conditions of this Lease (except the obligation to pay Base Rent, as defined below), as more particularly set forth in Section 5.4. Tenant shall also have the Renewal Option described in the attached addendum.

1.7 Permitted Uses: (See Section 4.1) Light manufacturing and related industrial activities, general warehousing and distribution of non-hazardous goods, and office use.

1.8 Tenant’s Guarantor: None.

1.9 Brokers: (A) Tenant’s Broker: Tegra Group; and (B) Landlord’s Broker: Colliers.

1.10 Security/Damage Deposit: (See Section 4.4) $50,000.00, either in cash or a letter of credit that satisfies the terms and conditions of Section 4.4.1.

1.11 Tenant’s Proportionate Share: 49.84%.

1.12 Addendums to Lease: The following addendums are attached to and made a part of this Lease:

Lease Option – Right of First Opportunity to Lease Contiguous Space

Lease Option – Termination

Lease Option - Renewal

Exhibits to Lease: The following exhibits are attached to and made a part of this Lease: A (Legal Description); A-1 (Depiction of Premises); B (Tenant Operations Inquiry Form); C (Landlord’s Work, if any); D (Confirmation of Commencement Date); E (Broom Clean Condition and Repair Requirements); Exhibit F (Rules and Regulations); Exhibit G (Tenant Contacts).

2. LEASE OF PREMISES; RENT.

2.1 Lease of Premises for Lease Term. Landlord hereby leases the Premises to Tenant, and Tenant hereby rents the Premises from Landlord, for the Term and subject to the conditions of this Lease.

2.2 Types of Rental Payments. Tenant shall pay net base rent (the “Base Rent”) to Landlord in monthly installments, in advance, on the first day of each and every calendar month during the Term, in the amounts and for the periods as set forth below:

|

Lease Period

|

Monthly Base Rent

|

Base Rent Net of Abated Rent (If Applicable) *

|

|

Month 1 – Month 2

|

$0.00 (Gross Free)

|

$0.00 (Gross free)

|

|

Month 3 – Month 14

|

$29,193.04

|

N/A

|

|

Month 15 – Month 26

|

$29,922.86

|

N/A

|

|

Month 27 – Month 38

|

$30,670.93

|

N/A

|

|

Month 39 – Month 50

|

$31,437.71

|

N/A

|

|

Month 51 – Month 62

|

$32,223.64

|

N/A

|

|

Month 63 – Month 74

|

$33,029.23

|

N/A

|

|

Month 75 – Month 86

|

$33,854.96

|

N/A

|

|

Month 87 – Month 98

|

$34,701.35

|

N/A

|

|

Month 99 – Month 110

|

$35,568.87

|

N/A

|

|

Month 111 – Month 122

|

$36,458.10

|

N/A

|

If the Commencement Date does not fall on the first day of a calendar month, then Months 1 – 2, as set forth above, shall mean the two (2) month period commencing with the Commencement Date, Month 3 shall mean the period commencing with the first day after the last day of Month 2 and continuing through and including the last day of the first full calendar month to elapse following the calendar month in which the last day of Month 2 occurs, and Month 4, Month 5, Month 6, Month 7, etc., shall mean the successive full calendar months thereafter. By way of illustration only, if the Commencement Date is January 11, 2015 then the last day of Month 2 is March 10, 2015, Month 3 will mean the period from March 11, 2015 to April 30, 2015, and Month 4 will mean May of 2015. Notwithstanding anything to the contrary, for Month3 only, Base Rent shall be calculated on a per day basis, at a rate of $975.12 per day multiplied by the number of days in Month 3. Rent (as hereinafter defined) shall be abated 100% for Month 1 and Month 2, such that Rent shall be $0.00 per month for Months 1 and 2, subject to all of the terms of this Section 2.

Tenant shall also pay (a) Tenant’s Proportionate Share (as set forth in Section 1.12) of Operating Expenses (as hereinafter defined), and (b) any other amounts owed by Tenant hereunder (the sums described in (a) and (b), collectively, “Additional Rent”).

In the event any monthly installment of Base Rent or Additional Rent, or both, is not paid within 5 calendar days of the date when due, a late charge in an amount equal to 5% of the then delinquent installment of Base Rent and/or Additional Rent (the “Late Charge”) shall be imposed with respect to the then-delinquent Rent (as defined below) payment.

For purposes of this Lease, the Late Charge, Default Interest, as defined in Section 23.3 below, Base Rent and Additional Rent shall collectively be referred to as “Rent.” All Rent shall be paid by Tenant to Landlord, c/o First Industrial, L.P. , P.O. Box 932251 , Cleveland, OH 44193, or if sent by overnight courier, PNC BANK C/O FIRST INDUSTRIAL LP, 4100 W. 150TH STREET, LOCKBOX NUMBER 932251, CLEVELAND, OH 44135 (or such other entity designated as Landlord’s management agent, if any, and if Landlord so appoints such a management agent, the “Agent”), or pursuant to such other directions as Landlord shall designate in this Lease or otherwise in writing.

2.3 Required Payments at Execution. Simultaneously with the execution and delivery of this Lease, Tenant shall deposit with Landlord or Agent an amount equal to the Security Deposit ($70,000.00) specified in Section 1.10 above and shall constitute a condition precedent to the Landlord’s obligations under this Lease.

2.4 Covenants Concerning Rental Payments. Tenant shall pay the Rent promptly when due, without notice or demand, and without any abatement, deduction or setoff, except as otherwise expressly set forth herein. No payment by Tenant, or receipt or acceptance by Agent or Landlord, of a lesser amount than the correct Rent shall be deemed to be other than a payment on account, nor shall any endorsement or statement on any check or letter accompanying any payment be deemed an accord or satisfaction, and Agent or Landlord may accept such payment without prejudice to Landlord’s right to recover the balance due or to pursue any other remedy available to Landlord. If the Commencement Date occurs on a day other than the first day of a calendar month, the Rent due for the first calendar month of the Term shall be prorated on a per diem basis (based on a 365 (366 in leap years) day, 12 month year) and paid to Landlord on the Commencement Date, and the Term will be extended to terminate on the last day of the calendar month in which the Expiration Date stated in Section 1.6 occurs.

3. OPERATING EXPENSES.

3.1 Definitional Terms Relating to Additional Rent. For purposes of this Section and other relevant provisions of the Lease:

3.1.1 Operating Expenses. The term “Operating Expenses” shall mean all costs and expenses paid or incurred by Landlord with respect to, or in connection with, the ownership, repair, restoration, maintenance and operation of the Property. Operating Expenses may include, but are not limited to, any or all of the following: (i) services provided directly by employees of Landlord or Agent in connection with the operation, maintenance or rendition of other services to or for the Property (including, but not limited to, the Common Areas, as defined below); (ii) to the extent not separately metered, billed, or furnished, all charges for utilities and services furnished to either or both of the Property and the Premises, including, without limitation, the Common Areas, together with any taxes on such utilities; (iii) all market-based premiums for commercial property, casualty, general liability, boiler, flood, earthquake, terrorism and all other types of insurance provided by Landlord and relating to the Property; all reasonable administrative costs incurred in connection with the procurement and implementation of such insurance policies; the amount of any deductible(s) if and to the extent a loss(es) is incurred and the applicable insurer(s) applies the deductible before making payment of any available insurance proceeds; and (iv) management fees to Landlord or Agent or other persons or management entities actually involved in the management and operation of the Property, not to exceed 3% of annual Rent, (v) any capital improvements made by, or on behalf of, Landlord to the Property that are either or both (a) designed to reduce Operating Expenses and (b) required to keep the Property in compliance with all governmental laws, rules and regulations applicable thereto, from time to time, the cost of which capital improvements shall be amortized by Landlord over the useful life of such item; (vi) all professional fees incurred in connection with the operation, management and maintenance of the Property; (vii) Taxes, as hereinafter defined in Section 3.1.2; and (viii) dues, fees or other costs and expenses, of any nature, due and payable to any association or comparable entity to which Landlord, as owner of the Property, is a member or otherwise belongs and that governs or controls any aspect of the ownership and operation of the Property; (ix) any real estate taxes and common area maintenance expenses levied against, or attributable to, the Property under any declaration of covenants, conditions and restrictions, reciprocal easement agreement or comparable arrangement that encumbers and benefits the Property and other real property (e.g., a business park); and (x) all costs and expenses incurred to maintain, repair and replace all or any of the Common Areas. Notwithstanding anything contained above, the following shall be excluded from amounts payable by Tenant under this Lease as Operating Expenses: (a) except to the extent that any of the following are incurred or paid in connection with this Lease or this Tenant, leasing costs and commissions, costs of tenant disputes, leasehold improvements and other costs of preparing space for tenants, other tenant incentives, and expenses incurred in negotiating or enforcing leases; (b) interest, principal or any other payments under any mortgage or rental or any other payments under any ground lease; (c) costs for which Landlord is reimbursed, to the extent of such actual reimbursement received by Landlord, including costs covered by proceeds of insurance, condemnation awards or court judgments, amounts specially billed to and payable by an individual tenant (other than through operating expenses provisions of a lease) and costs covered by any manufacturer’s, contractor’s or other warranty to the extent of actual coverage; (d) fees and other costs for professional services provided by attorneys, space planners and architects, except as otherwise expressly set forth herein; (d) marketing and advertising expenses; (f) costs which under generally accepted accounting principles, consistently applied, are capitalized, except to the extent such costs are authorized pursuant to 3.1.1(v) above; (g) costs of curing construction defects in Landlord’s Work (but not any work performed by or on behalf of Tenant), if any; (h) depreciation; (ix) attorneys fees incurred by Landlord in any dispute with, or litigation brought by or against, any tenant, other than Tenant, and any attorneys’ fees incurred by Landlord in connection with any lease (other than this Lease) and any act of negligence or tortuous misconduct by Landlord, its employees, agents, and contractors; (x) costs incurred because Landlord violates any lease; (xi) any fines, penalties, or costs incurred because Landlord violated any governmental law, ordinance, rule or regulation, including any environmental laws; (xii) any costs incurred in connection with any corrective action, investigation of site conditions, cleanup, removal, remediation, or restorative work required pursuant to complying with health and safety laws including OSHA or any environmental laws, except to the extent Tenant has any liability therefor pursuant to Section 9; (xiii) costs associated with the financing or refinancing of the Building; (xiv) intentionally deleted; (xv) any fines, penalties, late fees, or interest attributable to the negligent act or omission of the Landlord, or its agents, employees, or contractors in failing to make prompt payments of any kind, except to the extent that Tenant made any late payments to Landlord for such expenses; (xvi) the costs of any work performed or services rendered by Landlord or an affiliate of Landlord pursuant to its obligations hereunder to the extent such costs demonstrably exceed that which would have been charged by an unaffiliated third party of similar skill, competence and experience; and (xvii) travel, entertainment, lobbying, political contributions, and charitable contributions.

3.1.2 Taxes. The term “Taxes,” as referred to in Section 3.1.1(vii) above shall mean (i) all governmental taxes, assessments, fees and charges of every kind or nature (other than Landlord’s income taxes), whether general, special, ordinary or extraordinary, due at any time or from time to time, during the Term and any extensions thereof, in connection with the ownership, leasing, or operation of the Property, or of the personal property and equipment located therein or used in connection therewith; and (ii) any reasonable expenses incurred by Landlord in contesting either or both of (x) such taxes or assessments and (y) the assessed value of the Property. Where Landlord has the option to pay any special assessments in installments, Landlord shall elect the option to pay such special assessments over the longest permissible time period and Tenant shall be responsible for that portion of the assessments to be paid during the Term and any extension thereof. For purposes hereof, Tenant shall be responsible for any Taxes that are due and payable at any time or from time to time during the Term and for any Taxes that are assessed, become a lien, or accrue during any Operating Year, which obligation shall survive the termination or expiration of this Lease. Tenant will not be entitled to Tax Appeal Refunds if in default or if any Tax Appeal Fees are unpaid.

3.1.3 Operating Year. The term “Operating Year” shall mean the calendar year commencing January 1st of each year (including the calendar year within which the Commencement Date occurs) during the Term.

3.2. Payment of Operating Expenses. Tenant shall pay, as Additional Rent and in accordance with the requirements of Section 3.3, Tenant’s Proportionate Share of the Operating Expenses as set forth in Section 3.3. Additional Rent commences to accrue on March 1, 2015. The Tenant’s Proportionate Share of Operating Expenses payable hereunder for the Operating Years in which the Term begins and ends shall be prorated to correspond to that portion of said Operating Years occurring within the Term. Tenant’s Proportionate Share of Operating Expenses and any other sums due and payable under this Lease shall be adjusted upon receipt of the actual bills therefor, and the obligations of this Section 3 shall survive the termination or expiration of the Lease.

3.3 Payment of Additional Rent. Landlord shall have the right to reasonably estimate the Operating Expenses for each Operating Year. Upon Landlord’s or Agent’s notice to Tenant of such estimated amount, Tenant shall pay, on the first day of each month during that Operating Year, an amount (the “Estimated Additional Rent”) equal to the estimate of the Tenant’s Proportionate Share of Operating Expenses divided by 12 (or the fractional portion of the Operating Year remaining at the time Landlord delivers its notice of the estimated amounts due from Tenant for that Operating Year). If the aggregate amount of Estimated Additional Rent actually paid by Tenant during any Operating Year is less than Tenant’s actual ultimate liability for Operating Expenses for that particular Operating Year, Tenant shall pay the deficiency within thirty (30) days of Landlord’s written demand therefor. If the aggregate amount of Estimated Additional Rent actually paid by Tenant during a given Operating Year exceeds Tenant’s actual liability for such Operating Year (“Excess Additional Rent”), the Excess Additional Rent shall be credited against the Estimated Additional Rent next due from Tenant after Landlord’s determination that Excess Additional Rent has been paid by Tenant; provided, however, in the event that Tenant pays Excess Additional Rent during the final Lease Year, then upon the expiration of the Term, and determination, by Landlord, of the actual amount of Excess Additional Rent, Landlord or Agent shall pay Tenant the then-applicable Excess Additional Rent.

3.4 Auditing of Operating Expenses. As soon as is reasonably practical after each Operating Year, Landlord shall provide Tenant with a statement (a “Statement”) setting forth Tenant’s actual ultimate liability for its Proportionate Share of Operating Expenses for the subject Operating Year. If Tenant disputes the amount set forth in a given Statement, Tenant shall have the right, at Tenant's sole expense, to cause Landlord's books and records with respect to the particular Operating Year that is the subject of that particular Statement to be audited (the “Audit”) by a qualified employee of Tenant mutually acceptable to Landlord and Tenant, if any, or by a certified public accountant mutually acceptable to Landlord and Tenant (the “Accountant”), provided Tenant (i) has not defaulted under this Lease and failed to cure such default on a timely basis and (ii) delivers written notice (an “Audit Notice”) to Landlord on or prior to the date that is sixty (60) days after Landlord delivers the Statement in question to Tenant (such 60-day period, the “Response Period”). If Tenant fails to timely deliver an Audit Notice with respect to a given Statement, then Tenant's right to undertake an Audit with respect to that Statement and the Operating Year to which that particular Statement relates shall automatically and irrevocably be waived. Any Statement shall be final and binding upon Tenant and shall, as between the parties, be conclusively deemed correct, at the end of the applicable Response Period, unless prior thereto, Tenant timely delivers an Audit Notice with respect to the then-applicable Statement. If Tenant timely delivers an Audit Notice, Tenant must commence such Audit within sixty (60) days after the Audit Notice is delivered to Landlord, and the Audit must be completed within ninety (90) days of the date on which it is begun. If Tenant fails, for any reason, to commence and complete the Audit within such periods, the Statement that Tenant elected to Audit shall be deemed final and binding upon Tenant and shall, as between the parties, be conclusively deemed correct. The Audit shall take place at the offices of Landlord where its books and records are located, at a mutually convenient time during Landlord's regular business hours. Before conducting the Audit, Tenant must pay the full amount of Operating Expenses billed under the Statement then in question. Tenant hereby covenants and agrees that the Accountant engaged by Tenant to conduct the Audit shall be compensated on an hourly basis and shall not be compensated based upon a percentage of overcharges it discovers. If an Audit is conducted in a timely manner, such Audit shall be deemed final and binding upon Landlord and Tenant and shall, as between the parties, be conclusively deemed correct. If the results of the Audit reveal that the Tenant’s ultimate liability for Operating Expenses does not equal the aggregate amount of Estimated Additional Rent actually paid by Tenant to Landlord during the Operating Year that is the subject of the Audit, the appropriate adjustment shall be made between Landlord and Tenant, and any payment required to be made by Landlord or Tenant to the other shall be made within thirty (30) days after the Accountant’s determination. In no event shall this Lease be terminable nor shall Landlord be liable for damages based upon any disagreement regarding an adjustment of Operating Expenses. Tenant agrees that the results of any Audit shall be kept strictly confidential by Tenant and shall not be disclosed to any other person or entity, provided, however, Tenant may disclose such confidential information to its employees, attorneys, brokers, agents, accountants, lenders, prospective lenders, prospective buyers and as otherwise required by Laws, to comply with its regulatory requirements, and/or pursuant to an order of court of competent jurisdiction.

4. USE OF PREMISES AND COMMON AREAS; SIGNAGE; SECURITY DEPOSIT.

4.1 Use of Premises and Property. The Premises shall be used by the Tenant for the purpose(s) set forth in Section 1.7 above and for no other purpose whatsoever. Tenant shall not, at any time, use or occupy, or suffer or permit anyone to use or occupy, the Premises, or do or permit anything to be done in the Premises or the Property, in any manner that may (a) violate any “Certificate of Occupancy” (or comparable permit or license) for either or both of the Premises and the Property; (b) cause, or be liable to cause, injury to, or in any way impair the value or proper utilization of, all or any portion of the Property or any equipment, facilities or systems therein; (c) constitute a violation of the laws and requirements of any public authority or the requirements of insurance bodies or the rules and regulations of the Property, including, but not limited to, any covenant, condition or restriction encumbering the Property; (d) exceed the load bearing capacity of the floor of the Premises; (e) impair the character, reputation or appearance of the Property; or (f) unreasonably inconvenience or disrupt the operations or tenancies of other tenants or permitted users of the Property. On or prior to the date hereof, Tenant has completed and delivered for the benefit of Landlord a “Tenant Operations Inquiry Form,” in the form attached hereto as Exhibit B, describing the nature of Tenant’s proposed business operations at the Premises, which form is intended to be, and shall be, relied upon by Landlord. From time to time during the Term (but no more often than once in any twelve month period unless Tenant is in default hereunder or unless Tenant assigns this Lease or subleases all or any portion of the Premises, whether or not in accordance with Section 8), Tenant shall provide an updated and current Tenant Operations Inquiry Form upon Landlord’s request. The load bearing capacity of the floor in the Premises is 500 pounds per foot.

4.2 Use of Common Areas. As used herein, “Common Areas” shall mean all areas within the Property that are available for the common use of tenants of the Property and that are not leased or held for the exclusive use of Tenant or other tenants or licensees, including, but not limited to, parking areas, driveways, sidewalks, loading areas, access roads, corridors, landscaping and planted areas. Tenant shall have the nonexclusive right to use the Common Areas for the purposes intended, subject to such reasonable rules and regulations as Landlord may uniformly establish from time to time. Tenant shall not interfere with the rights of any or all of Landlord, other tenants or licensees, or any other person entitled to use the Common Areas. Without limitation of the foregoing, Tenant shall not park or store any vehicles or trailers on, or conduct truck loading and unloading activities in, the Common Areas in a manner that unreasonably disturbs, disrupts or prevents the use of the Common Areas by any or all of Landlord, other tenants or licensees or other persons entitled to use the Common Areas. Landlord, from time to time, may change any or all of the size, location, nature and use of any of the Common Areas although such changes may result in inconvenience to Tenant, so long as such changes do not materially and adversely affect Tenant’s use of the Premises. In addition to the foregoing, Landlord may, at any time, close or suspend access to any Common Areas to perform any acts in the Common Areas as, in Landlord’s reasonable judgment, are desirable to improve or maintain either or both of the Premises and the Property, or are required in order to satisfy Landlord’s obligations under this Lease; provided, however, that Landlord shall use reasonable efforts to limit any disruption of Tenant’s use and operation of the Premises in connection therewith. Notwithstanding anything contained in this Lease to the contrary, if at any time, Landlord determines, in its sole discretion, that the parking areas at the Property are or have become overburdened, Landlord may allocate parking on a proportionate basis or assign parking spaces among all tenants at the Property.

4.3 Signage. Tenant may affix an exterior sign to the façade of the Building, subject to obtaining prior written approval of Landlord as to the size, content and character, which approval shall not be unreasonably withheld or delayed, and then only in compliance with all applicable Laws. Tenant shall remove all signs of Tenant upon the expiration or earlier termination of this Lease and immediately repair any damage to either or both of the Property and the Premises caused by, or resulting from, such removal, or the installation or existence of the signs.

4.4 Security/Damage Deposit. Simultaneously with the execution and delivery of this Lease, Tenant shall deposit with Landlord or Agent the sum set forth in Section 1.10 above, in cash (the “Security”), representing security for the performance by Tenant of the covenants and obligations hereunder. The Security shall be held by Landlord or Agent, without interest, in favor of Tenant; provided, however, that no trust relationship shall be deemed created thereby; the Security may be commingled with other assets of Landlord; and Landlord shall not be required to pay any interest on the Security. If Tenant defaults in the performance of any of its covenants hereunder, Landlord or Agent may, without notice to Tenant, apply all or any part of the Security to the cure of such default or the payment of any sums then due from Tenant under this Lease (including, but not limited to, amounts due under Section 22.2 of this Lease as a consequence of termination of this Lease or Tenant’s right to possession), in addition to any other remedies available to Landlord. In the event the Security is so applied, Tenant shall, upon demand, immediately deposit with Landlord or Agent a sum equal to the amount so used. If Tenant fully and faithfully complies with all the covenants and obligations hereunder, the Security (or any balance thereof) shall be returned to Tenant within thirty (30) days after the later to occur of (i) the date the Term expires or terminates or (ii) delivery to Landlord of possession of the Premises. Landlord may deliver the Security to any lender with a mortgage lien encumbering the Property or to any Successor Landlord (defined below), and thereupon Landlord and Agent shall be discharged from any further liability with respect to the Security.

4.4.1 Letter of Credit. Provided Tenant has not been in Default under this Lease, Tenant many notify Landlord that Tenant desires to change the form of the Security to a letter of credit, and provided that the letter of credit satisfies all of the terms and conditions of this Section 4.4.1, Landlord shall accept it and return the cash Security to Tenant. Tenant may deliver to Landlord or Agent an irrevocable letter of credit (“L/C”) issued by a national U.S. banking institution (the “Issuer”) acceptable to Landlord, in its sole, but reasonable discretion, and in form and substance reasonably satisfactory to Landlord, in the amount set forth in Section [1.10] above (which shall, for the avoidance of doubt, also be referred to hereunder as the “Security”), representing security for the performance by Tenant of the covenants and obligations hereunder. Tenant specifically acknowledges and agrees that Landlord shall not be deemed to act unreasonably if Landlord refuses to accept an L/C issued by a financial institution that has been placed in receivership or declared insolvent by the FDIC, or has accepted any federal assistance from the Troubled Assets Relief Program or any similar or comparable program or legislation. In addition to any other items that Landlord may reasonably require, the L/C shall: (a) name Landlord as its beneficiary; (b) have an initial term of no less than one year; (c) automatically renew for one year periods unless the issuer provides Landlord with at least 60 days’ advance written notice that the L/C will not be renewed; (d) the L/C shall permit partial draws; (e) the sole and exclusive condition to any draw on the L/C shall be that Landlord certifies to the issuer that either or both of the following is/are true: (i) Tenant is the debtor in a pending bankruptcy proceeding; and (ii) Tenant is not in compliance with any of the terms of this Lease; and (f) be transferable to Successor Landlords (defined below) on as many occasions as desired. In the event that: (w) the expiration date of any L/C occurs before the Expiration Date, (x) the issuer has advised Landlord that the issuer will not automatically renew the L/C; (y) Tenant fails to deliver to Landlord at least forty-five (45) days prior to the expiration of such L/C either (A) an amendment thereto extending the expiration date of such L/C for not less than twelve (12) months, or (B) a new L/C, in form and substance in accordance with (a) through (f) above and otherwise satisfactory to Landlord (in its reasonable discretion) or (z) (1) the credit rating of the Issuer is down-graded (from its rating in effect on the date on which the L/C is initially issued) by a reputable rating agency such as Moody’s or Standard & Poor’s; (2) Landlord advises Tenant that, as a result of the Issuer down-grade, Landlord desires Tenant to procure a new L/C from an Issuer reasonably acceptable to Landlord, which new L/C shall be in form and substance to satisfy the requirements of (a) through (f) above and otherwise satisfactory to Landlord (in its reasonable discretion); and (3) Tenant fails to deliver such new L/C satisfying the requirements set forth in clause (2) above within forty-five (45) days after Landlord’s request, then in any of the instances described in (w) through (z), Landlord may draw on the L/C then in Landlord’s possession, and thereafter (in addition to any other remedies available to Landlord under this Lease) apply the proceeds of such L/C in whatever manner or for whatever purpose Landlord reasonably deems appropriate in the event that Tenant fails to timely comply with any or all of the covenants and obligations imposed on Tenant under this Lease. In the event that, upon the occurrence of any of the instances described in (w) through (z), Tenant delivers to Landlord a new L/C that satisfies the requirements of this Section 4.4, then upon Landlord’s receipt of such new L/C, Landlord shall promptly release the original L/C to Tenant. If Tenant fails to comply with any or all of its covenants or obligations hereunder, Landlord or Agent may, upon three (3) days prior written notice to Tenant, draw on the L/C and apply the proceeds in whatever manner Landlord deems appropriate, in addition to any and all other remedies available to Landlord under this Lease. In the event Landlord draws against the L/C, Tenant shall, upon demand, at Tenant’s option, immediately either (aa) deposit with Landlord or Agent a sum equal to amount drawn under the L/C or (bb) deliver to Landlord an additional L/C in an amount equal to the amount drawn. If Tenant fully and faithfully complies with all the covenants hereunder, the Security (or any balance thereof) together with Landlord’s written consent to the cancellation of any and all outstanding L/Cs constituting part of the Security shall be delivered to Tenant within thirty (30) days after the last to occur of (1) the date the Term expires or terminates or (2) delivery to Landlord of possession of the Premises. Landlord may deliver the Security to any purchaser of Landlord’s interest in the Premises or any Successor Landlord, if applicable, whereupon Landlord and Agent shall be discharged from any further liability with respect to the Security. In the event that Landlord exercises its right under the preceding sentence, Tenant shall fully cooperate with Landlord, in all reasonable respects, to cause the L/C to be assigned and conveyed to, or reissued to, such purchaser or Successor Landlord, as the case may be, and Tenant shall bear any expenses incurred in connection therewith.

5. CONDITION AND DELIVERY OF PREMISES.

5.1 Condition of Premises. Landlord, at its expense, shall cause the shell building improvements described on Exhibit C to be completed pursuant to the plans and specifications set forth in Exhibit C (such improvements set forth on Exhibit C, “Landlord’s Work”). Tenant acknowledges that neither Landlord nor Agent, nor any representative of Landlord, has made any representation as to the condition of the foregoing or the suitability of the foregoing for Tenant’s intended use. Neither Landlord nor Agent shall be obligated to make any repairs, replacements or improvements (whether structural or otherwise) of any kind or nature to the foregoing in connection with, or in consideration of, this Lease, except as expressly and specifically set forth in this Lease, including, but not limited to, Landlord’s Work described in Exhibit C.

5.2 Delay in Commencement. Landlord shall not be liable to Tenant if Landlord fails to deliver possession of the Premises to Tenant on the Commencement Date. The obligations of Tenant under the Lease shall not be affected thereby, except that the Commencement Date shall be delayed until Landlord delivers possession of the Premises to Tenant, and the Term shall be extended by a period equal to the number of days of delay in delivery of possession of the Premises to Tenant, plus the number of days necessary to end the Term on the last day of a month. Notwithstanding the foregoing, if the Substantial Completion Date (as defined in Exhibit C) has not occurred on or prior to February 1, 2015, and the delay is not a Delay Event (as hereinafter defined in Exhibit C), then for every day that elapses between February 1, 2015 and the date the Landlord’s Work is substantially completed, Tenant shall receive one (1) day of free Base Rent (in addition to the free gross Rent described in Section 2.1 above). If a Delay Event occurs, then the substantial completion of Landlord’s Work shall be deemed to have occurred on the date that it would have occurred but for the occurrence of the Delay Event, as determined in Landlord’s reasonable, good faith discretion.

5.3 Confirmation of Commencement Date. Upon Landlord’s delivery of possession, and as a condition precedent to such delivery, of the Premises to Tenant, and Tenant shall deliver to Landlord a Confirmation of Commencement Date in substantially the form attached hereto as Exhibit D.

5.4 Early Access. Notwithstanding the stated Commencement Date in Section 1.6, Landlord has agreed that Tenant may have access to, and take possession of, the Premises prior to the Commencement Date, on the date Landlord gives Tenant notice that such early occupancy will be permitted (such date to be specified by Landlord by notice to Tenant, “Early Access Date”). The period from the Early Access Date through the day before the Commencement Date shall be the “Early Occupancy Period.” From and after the Early Access Date, Tenant shall comply with all of the terms and provisions of this Lease, except the obligation to pay Base Rent. Prior to the Early Access Date, Tenant shall deliver to Landlord evidence (in form and substance reasonably acceptable to Landlord) that Tenant is in compliance with the insurance requirements of Section 10.2 of this Lease. The parties hereby acknowledge that any occupancy of the Premises by Tenant during the Early Occupancy Period shall be on all the same terms and conditions as set forth in this Lease except for the payment of Rent, and that such early occupancy will occur during the performance of Landlord’s Work. Throughout the performance of Landlord’s Work, Landlord will have employees, agents, suppliers, workmen and contractors performing Landlord’s Work at the Premises, and neither Tenant nor Tenant’s Parties (as hereinafter defined) may interfere with the performance of Landlord’s Work. Tenant hereby indemnifies and holds Landlord harmless from and against all Losses (as hereinafter defined) incurred by Landlord or Landlord’s Parties (as hereinafter defined) in connection with the presence of Tenant or Tenant’s Parties in or about the Premises during the performance of Landlord’s Work. Further, Tenant hereby acknowledges that construction activities will be ongoing at the Premises until Landlord’s Work is completed; and Tenant and any Tenant’s Parties shall occupy the Premises at their own risk and in no event shall Landlord be liable to Tenant or any Tenant’s Parties for any damage or injury to person or property that might occur while Landlord’s Work is ongoing. Tenant and Tenant’s Parties shall cooperate in all reasonable respects with Landlord and Landlord’s Parties in facilitating Landlord’s Work, including moving any of Tenant’s personal property, as applicable, upon reasonable request and otherwise adjusting Tenant’s operations to facilitate the expeditious completion of Landlord’s Work.

6. SUBORDINATION; ESTOPPEL CERTIFICATES; ATTORNMENT.

6.1 Subordination, Non-disturbance and Attornment. This Lease is and shall be subject and subordinate at all times to (a) all ground leases or underlying leases that may now exist or hereafter be executed affecting either or both of the Premises and the Property and (b) any mortgage or deed of trust that may now exist or hereafter be placed upon, and encumber, any or all of (x) the Property; (y) any ground leases or underlying leases for the benefit of the Property; and (z) all or any portion of Landlord’s interest or estate in any of said items. Tenant shall execute and deliver, within ten (10) days of Landlord’s request, and in the form reasonably requested by Landlord (or its lender), any documents evidencing the subordination of this Lease. Tenant hereby covenants and agrees that Tenant shall attorn to any successor to Landlord. Landlord acknowledges that Landlord there is not, as of the Effective Date, a lender or mortgagee holding a mortgage or deed of trust on the Property. Landlord shall deliver to Tenant a subordination, nondisturbance and attornment agreement from any future Mortgagees on each such Mortgagee’s then-current form.

6.2 Estoppel Certificate. Tenant agrees, from time to time and within ten (10) days after request by Landlord, to deliver to Landlord, or Landlord’s designee, an estoppel certificate stating such matters pertaining to this Lease as may be reasonably requested by Landlord. Failure by Tenant to timely execute and deliver such certificate shall constitute a Default, as defined below (without any obligation to provide any notice thereof or any opportunity to cure such failure to timely perform).

6.3 Transfer by Landlord. In the event of a sale or conveyance by Landlord of the Property, the same shall operate to release Landlord from any future liability for any of the covenants or conditions, express or implied, herein contained in favor of Tenant and first arising or accruing after the effective date of Landlord’s transfer of its interest in the Premises, and in such event Tenant agrees to look solely to Landlord’s successor in interest (“Successor Landlord”) with respect thereto and agrees to attorn to such successor.

7. QUIET ENJOYMENT.

Subject to the provisions of this Lease, so long as Tenant pays all of the Rent and performs all of its other obligations hereunder, Tenant shall not be disturbed in its possession of the Premises by Landlord, Agent or any other person lawfully claiming through or under Landlord; provided, however, in addition to Landlord’s rights under Section 16 and elsewhere in this Lease, Landlord and Landlord’s agents, employees, contractors and representatives shall be provided reasonable access to the Premises such that Landlord and Landlord’s agents, employees, contractors and representatives may perform the General Maintenance Services (as hereinafter defined) without undue interruption, delay or hindrance. This covenant shall be construed as a covenant running with the Property and is not a personal covenant of Landlord. Tenant shall not unreasonably interrupt, delay, prevent or hinder the performance of the General Maintenance Services by or on behalf of Landlord. Notwithstanding the foregoing, however, Tenant acknowledges and agrees that Landlord shall have the unfettered and unilateral right to use portions of the Common Areas (inclusive of the roof of the Building) for such purposes and uses as Landlord may desire; provided, however, that in all events and under all circumstances, Landlord’s use of any portion of the Common Areas shall not interfere, in any material respect, with any or all of (a) Tenant’s rights to occupy and use the Common Areas (in the manner and for the purposes contemplated hereunder); (b) Tenant’s right to utilize the vehicular parking areas located on the Common Areas; and (c) Tenant’s right(s) of access, ingress and egress to and from the Common Areas.

8. ASSIGNMENT AND SUBLETTING.

Tenant shall not (a) assign (whether directly or indirectly), in whole or in part, this Lease, or (b) if Tenant is no longer a public company, allow this Lease to be assigned, in whole or in part, by operation of law or otherwise, including, without limitation, by transfer of a controlling interest (i.e. greater than a 49% interest) of stock, membership interests or partnership interests, or by merger or dissolution, which transfer of a controlling interest, merger or dissolution shall be deemed an assignment for purposes of this Lease, or (c) mortgage Tenant’s interest in either or both of the Premises and this Lease or pledge its interest in this Lease, or (d) sublet the Premises, in whole or in part, without (in the case of any or all of (a), (c) and (d) above, or if Tenant is no longer a public company, then also (b) above) the prior written consent of Landlord (and Landlord’s lender, if applicable), which consent shall not be unreasonably withheld or delayed. In making its determination to provide or withhold its consent, it shall be reasonable for Landlord to take into consideration both the business experience and the financial condition of the entity that shall constitute its tenant after the occurrence of any of (a) through (d) above, and Landlord may impose conditions precedent to the issuance of its consent (e.g. delivery of a guarantee or other collateral, whether in the form of a security deposit or otherwise). Notwithstanding the foregoing, Tenant may, however, assign this Lease or sublease a portion of the Premises to a wholly-owned subsidiary, or, if Tenant is no longer a public company, to the surviving entity after a change in control or change of ownership of its stock or the sale of substantially all of its assets, provided that such surviving entity has a tangible net worth that is at least as equal to or higher than the greater of the tangible net worth of Tenant as of the Effective Date, or the Tangible Net Worth of Tenant immediately prior to the applicable transfer, provided that the successor assumes in writing all of the liabilities and obligations of Tenant under this Lease and provided that Tenant advises Landlord (and Landlord’s lender, if applicable), in writing, in advance, delivering evidence of such satisfactory tangible net worth, and otherwise complies with the succeeding provisions of this Section 8. For the purpose of this Section 9 "Tangible Net Worth" shall mean the excess of the value of tangible assets (i.e. assets excluding those which are intangible such as goodwill, patents and trademarks) over liabilities. Notwithstanding anything herein to the contrary, so long as Tenant is a publicly traded company there are no restrictions on any changes in its control or ownership. In no event shall any assignment or sublease ever release Tenant or any guarantor from any obligation or liability hereunder; and in the case of any assignment, Landlord shall retain all rights with respect to the Security. Any purported assignment, mortgage, transfer, pledge or sublease made without the prior written consent of Landlord (and Landlord’s lender, if applicable) shall be absolutely null and void. No assignment of this Lease shall be effective and valid unless and until the assignee executes and delivers to Landlord (and Landlord’s lender, if applicable) any and all documentation reasonably required by Landlord (and Landlord’s lender, if applicable) in order to evidence assignee’s assumption of all obligations of Tenant hereunder. Regardless of whether or not an assignee or sublessee executes and delivers any documentation to Landlord pursuant to the preceding sentence, any assignee or sublessee shall be deemed to have automatically attorned to Landlord in the event of any termination of this Lease. If this Lease is assigned, or if the Premises (or any part thereof) are sublet or used or occupied by anyone other than Tenant, whether or not in violation of this Lease, Landlord or Agent may (without prejudice to, or waiver of Landlord’s rights), collect Rent from the assignee, subtenant or occupant.

9. COMPLIANCE WITH LAWS.

9.1 Compliance with Laws. Landlord represents and warrants to Tenant that, upon substantial completion of Landlord’s Work, the Premises shall be in conformance with Laws such that an occupancy permit for the occupancy of a shell building could be issued (it being acknowledged and agreed that Tenant shall be solely responsible for causing completion of the remainder of the tenant improvement work necessary for a full certificate of occupancy to be issued). Tenant shall, at its sole expense (regardless of the cost thereof), comply with all local, state and federal laws, rules, regulations and requirements now or hereafter in force and all judicial and administrative decisions in connection with the enforcement thereof (collectively, “Laws”), pertaining to either or both of the Premises and Tenant’s use and occupancy thereof, and including, but not limited to, all Laws concerning or addressing matters of an environmental nature. If any license or permit is required for the conduct of Tenant’s business in the Premises, Tenant, at its expense, shall procure such license prior to the Commencement Date, and shall maintain such license or permit in good standing throughout the Term. Tenant shall give prompt notice to Landlord of any written notice it receives of the alleged violation of any Law or requirement of any governmental or administrative authority with respect to either or both of the Premises and the use or occupation thereof.

9.2 Hazardous Materials. If, at any time or from time to time during the Term (or any extension thereof), any Hazardous Material (defined below) is generated, transported, stored, used, treated or disposed of at, to, from, on or in either or both of the Premises and the Property by, or as a result of any act or omission of, any or all of Tenant and any or all of Tenant’s Parties (defined below): (i) Tenant shall, at its own cost, at all times comply (and cause all Tenant’s Parties to comply) with all Laws relating to Hazardous Materials, and Tenant shall further, at its own cost, obtain and maintain in full force and effect at all times all permits and other approvals required in connection therewith; (ii) Tenant shall promptly provide Landlord or Agent with complete copies of all communications, permits or agreements with, from or issued by any governmental authority or agency (federal, state or local) or any private entity relating in any way to the presence, release, threat of release, or placement of Hazardous Materials on or in the Premises or any portion of the Property, or the generation, transportation, storage, use, treatment, or disposal at, on, in or from the Premises, of any Hazardous Materials; (iii) Landlord, Agent and their respective agents and employees shall have the right to either or both (x) enter the Premises and (y) conduct appropriate tests, at Tenant’s expense, for the purposes of ascertaining Tenant’s compliance with all applicable Laws or permits relating in any way to the generation, transport, storage, use, treatment, disposal or presence of Hazardous Materials on, at, in or from all or any portion of either or both of the Premises and the Property; and (iv) upon written request by Landlord or Agent, Tenant shall cause to be performed, and shall provide Landlord with the results of, reasonably appropriate tests of air, water or soil to demonstrate that Tenant complies with all applicable Laws or permits relating in any way to the generation, transport, storage, use, treatment, disposal or presence of Hazardous Materials on, at, in or from all or any portion of either or both of the Premises and the Property. At Tenant’s sole cost, Tenant will at all times during the Term (and at all times thereafter that Tenant remains in possession of the Premises) take all reasonable measures to prevent the release or discharge of Hazardous Materials at or from the Premises, which measures shall include, but are not limited to, making regular inspections of all areas, containers and apparatus in which Hazardous Materials are stored, used, generated or otherwise present, and installing and maintaining appropriate containment and secondary containment devices. This Section 9.2 does not authorize the generation, transportation, storage, use, treatment or disposal of any Hazardous Materials at, to, from, on or in the Premises in contravention of this Section 9.2. Tenant covenants to investigate, clean up and otherwise remediate, at Tenant’s sole expense, any release of Hazardous Materials caused, contributed to, or created by any or all of (A) Tenant and (B) any or all of Tenant’s officers, directors, members, managers, partners, invitees, agents, employees, contractors or representatives (collectively, “Tenant’s Parties”) during the Term. Such investigation and remediation shall be performed only after Tenant has obtained Landlord’s prior written consent; provided, however, that Tenant shall be entitled to respond (in a reasonably appropriate manner) immediately to an emergency without first obtaining such consent, if Tenant promptly thereafter delivers to Landlord written notice of the emergency and the action taken to remedy it. All remediation shall be performed in strict compliance with Laws and to the reasonable satisfaction of Landlord. Tenant shall not enter into any settlement agreement, consent decree or other compromise with respect to any claims relating to any Hazardous Materials in any way connected to the Premises without first obtaining Landlord’s written consent (which consent may be given or withheld in Landlord’s sole, but reasonable, discretion) and affording Landlord the reasonable opportunity to participate in any such proceedings. As used herein, the term, “Hazardous Materials,” shall mean any waste, material or substance (whether in the form of liquids, solids or gases, and whether or not airborne) that is or may be deemed to be or include a pesticide, petroleum, asbestos, polychlorinated biphenyl, radioactive material, urea formaldehyde or any other pollutant or contaminant that is or may be deemed to be hazardous, toxic, ignitable, reactive, corrosive, dangerous, harmful or injurious, or that presents a risk to public health or to the environment, and that is or becomes regulated by any Law. The undertakings, covenants and obligations imposed on Tenant under this Section 9.2 shall survive the termination or expiration of this Lease.

9.3 Landlord represents and warrants that, based solely on the results of a Phase I Environmental Site Assessment dated April 8, 2014 and Phase II Environmental Site Assessment dated April 14, 2014, prepared by Braun Intertec Corporation, and the Petroleum Storage Tank Release Site File Closure Confirmation dated June 6, 2014 prepared by the Minnesota Pollution Control Agency (the foregoing, collectively, the “Reports”) on behalf of Landlord in connection with Landlord's acquisition of the Property, Landlord is not aware of any Hazardous Materials contamination on the Property except as expressly identified in the Reports, and Landlord shall indemnify, defend and hold Tenant harmless against any remediation costs actually incurred by Tenant (up to the maximum amount of Landlord's interest in the Property as of the first date of such Losses) as a result of any remediation order by any federal, state and/or local environmental protection agency related to contamination in violation of Laws existing on the Property prior to the Commencement Date or as a direct result of Landlord's negligent, intentional or willful acts or omissions.

10. INSURANCE.

10.1 Insurance to be Maintained by Landlord. Landlord shall maintain: (a) a commercial property insurance policy covering the Property (at its full replacement cost), but excluding Tenant’s personal property; (b) commercial general liability insurance covering Landlord for claims arising out of liability for bodily injury, death, personal injury, advertising injury and property damage occurring in and about the Property and otherwise resulting from any acts and operations of Landlord, its agents and employees; (c) business income/rental value insurance; and (d) any other insurance coverage deemed appropriate by Landlord or required by Landlord’s lender. All of the coverages described in (a) through (d) shall be determined from time to time by Landlord, in its sole discretion. All insurance maintained by Landlord shall be in addition to and not in lieu of the insurance required to be maintained by the Tenant.

10.2 Insurance to be Maintained by Tenant. Tenant shall purchase, at its own expense, and keep in force at all times from and after the date of this Lease, the policies of insurance set forth below (collectively, “Tenant’s Policies”). All Tenant’s Policies shall (a) be issued by an insurance company with a Best’s rating/financial size category of A/VIII or better and otherwise reasonably acceptable to Landlord and shall be licensed to do business in the state in which the Property is located; (b) provide for deductible amounts that are reasonably acceptable to Landlord (and its lender, if applicable) and (c) otherwise be in such form, and include such coverages, as Landlord may reasonably require. The Tenant’s Policies described in (i) and (ii) below shall (1) provide coverage on an occurrence basis; (2) name Landlord (and its lender, if applicable) as an additional insured; (3) provide coverage, to the extent insurable, for the indemnity obligations of Tenant under this Lease; (4) contain a separation of insured parties provision; (5) be primary, not contributing with, and not in excess of, coverage that Landlord may carry; and (6) provide coverage with no exclusion for a pollution incident arising from a hostile fire. Certified copies of Tenant’s Policies (or, at Landlord’s option, Certificates of Insurance and applicable endorsements, including, without limitation, an "Additional Insured Managers or Landlords of Premises" endorsement) shall be delivered to Landlord prior to the Commencement Date and renewals thereof shall be delivered to Landlord’s notice addresses prior to the applicable expiration date of each Tenant’s Policy or as soon as reasonably practicable. In the event that Tenant fails, at any time or from time to time, to comply with the requirements of the preceding sentence, Landlord may (x) order such insurance and charge the cost thereof to Tenant, which amount shall be payable by Tenant to Landlord upon demand, as Additional Rent or (y) impose on Tenant, as Additional Rent, a monthly delinquency fee, for each month during which Tenant fails to comply with the foregoing obligation, in an amount equal to five percent (5%) of the Base Rent then in effect. Tenant shall give prompt notice to Landlord and Agent of any bodily injury, death, personal injury, advertising injury or property damage occurring in and about the Property. Tenant shall provide written notice to Landlord in accordance with Section 24.2 below prior to the cancelation or material modification of any of Tenant’s Policies.

Tenant shall purchase and maintain, throughout the Term, a Tenant’s Policy(ies) of (i) commercial general liability insurance, including personal injury and property damage, in the amount of not less than $2,000,000.00 per occurrence, and $5,000,000.00 annual general aggregate, per location (these limits may be achieved by a combination of a primary policy and an excess or umbrella liability policy); (ii) business auto liability insurance covering Tenant, against any personal injuries or deaths of persons and property damage based upon or arising out of the ownership, use, occupancy or maintenance of a motor vehicle at the Premises and all areas appurtenant thereto in the amount of not less than $1,000,000, combined single limit; (iii) commercial property insurance covering Tenant’s personal property (at its full replacement cost); (iv) workers’ compensation insurance per the applicable state statutes covering all employees of Tenant ; and (v) if Tenant handles, stores or utilizes Hazardous Materials in its business operations, pollution legal liability insurance with limits acceptable to Landlord.

10.3 Waiver of Subrogation. Notwithstanding anything to the contrary in this Lease, Landlord and Tenant mutually waive their respective rights of recovery against each other and each other’s officers, directors, constituent partners, members, agents and employees, and Tenant further waives such rights against (a) each lessor under any ground or underlying lease encumbering the Property and (b) each lender under any mortgage or deed of trust or other lien encumbering the Property (or any portion thereof or interest therein), for any Losses (defined in Section 17.2 below) to the extent any such Losses are insured against or required to be insured against under this Lease; including, but not limited to, Losses, deductibles or self-insured retentions covered by Landlord’s or Tenant’s policies described above. This provision is intended to waive, fully and for the benefit of each party to this Lease, any and all rights and claims that might give rise to a right of subrogation by any insurance carrier. Each party shall cause its respective insurance policy(ies) to be endorsed to evidence compliance with such waiver .

11. ALTERATIONS.

Tenant may, from time to time, at its expense, make alterations or improvements in and to the Premises (hereinafter collectively referred to as “Alterations”), provided that Tenant first obtains the written consent of Landlord, except that Tenant does not have to request Landlord’s consent for any Alterations that are purely cosmetic and non-structural, and cost less than $50,000.00 per project. All of the following shall apply with respect to all Alterations: (a) the Alterations are non-structural and the structural integrity of the Property shall not be affected; (b) the Alterations are to the interior of the Premises; (c) the proper functioning of the mechanical, electrical, heating, ventilating, air-conditioning (“HVAC”), sanitary and other service systems of the Property shall not be affected and the usage of such systems by Tenant shall not be increased; and (d) Tenant shall have appropriate insurance coverage, reasonably satisfactory to Landlord, regarding the performance and installation of the Alterations. Additionally, before proceeding with any Alterations, Tenant shall (i) at Tenant’s expense, obtain all necessary governmental permits and certificates for the commencement and prosecution of Alterations; (ii) if Landlord’s consent is required for the planned Alteration, submit to Landlord, for its written approval, working drawings, plans and specifications and all permits for the work to be done and Tenant shall not proceed with such Alterations until it has received Landlord’s approval (if required); and (iii) cause those contractors, materialmen and suppliers engaged to perform the Alterations to deliver to Landlord certificates of insurance (in a form reasonably acceptable to Landlord) evidencing policies of commercial general liability insurance and workers’ compensation insurance. Such insurance policies shall satisfy all obligations imposed under Section 10.2. Tenant shall cause the Alterations to be performed in compliance with all applicable permits, Laws and requirements of public authorities, and with Landlord’s reasonable rules and regulations or any other restrictions that Landlord may impose on the Alterations. Tenant shall cause the Alterations to be diligently performed in a good and workmanlike manner, using new materials and equipment at least equal in quality and class to the standards for the Property established by Landlord. With respect to any and all Alterations for which Landlord’s consent is required, Tenant shall provide Landlord with “as built” plans (upon completion), copies of all construction contracts, governmental permits and certificates and proof of payment for all labor and materials, including, without limitation, copies of paid invoices and final lien waivers. If Landlord’s consent to any Alterations is required, and Landlord provides that consent, then at the time Landlord so consents, Landlord shall also advise Tenant whether or not Landlord shall require that Tenant remove such Alterations at the expiration or termination of this Lease. If Landlord requires Tenant to remove the Alterations, then, during the remainder of the Term, Tenant shall be responsible for the maintenance of appropriate commercial property insurance (pursuant to Section 10.2) therefor; however, if Landlord shall not require that Tenant remove the Alterations, such Alterations shall constitute Landlord’s Property (defined below) and Landlord shall be responsible for the insurance thereof, pursuant to Section 10.2. Landlord shall not charge Tenant any oversight, management, administrative or other fee for any Alterations or approvals of Alterations.

12. LANDLORD’S AND TENANT’S PROPERTY.

All fixtures, machinery, equipment, improvements and appurtenances attached to, or built into, the Premises at the commencement of, or during the Term, whether or not placed there by or at the expense of Tenant, shall become and remain a part of the Premises; shall be deemed the property of Landlord (the “Landlord’s Property”), without compensation or credit to Tenant; and shall not be removed by Tenant at the Expiration Date unless Landlord requires their removal (including, but not limited to, Alterations pursuant to Section 11). In addition to the immediately preceding sentence, for purposes of this Lease, any references to “Tenant’s Property” shall mean any property for which Tenant has itself paid or manufactured, together with any machinery and equipment for which Tenant has paid and that is located in the Premises. In no event shall Tenant remove any of the following materials or equipment without Landlord’s prior written consent (which consent may be given or withheld in Landlord’s sole discretion): any power wiring or power panels, lighting or lighting fixtures, wall or window coverings, carpets or other floor coverings, heaters, air conditioners or any other HVAC equipment, fencing or security gates, or other similar building operating equipment and decorations. At or before the Expiration Date, or the date of any earlier termination, Tenant, at its expense, shall remove from the Premises all of Tenant’s Property and any Alterations that Landlord requires be removed pursuant to Section 11, and Tenant shall repair (to Landlord’s reasonable satisfaction) any damage to the Premises or the Property resulting from either or both of such installation and removal. Any other items of Tenant’s Property that remain in the Premises after the Expiration Date, or following an earlier termination date, may, at the option of Landlord, be deemed to have been abandoned, and in such case, such items of Tenant’s Property may be retained by Landlord as its property or be disposed of by Landlord, in Landlord’s sole and absolute discretion and without accountability, at Tenant’s expense.

13. REPAIRS AND MAINTENANCE.

13.1 Tenant Repairs and Maintenance.

13.1.1 Tenant Responsibilities. Subject to Landlord’s obligation to complete the Landlord’s Work, except for events of damage, destruction or casualty to the Premises or Property (which are addressed in Section 18), throughout the Term, Tenant shall, at its sole cost and expense: (i) both (x) maintain and preserve, in a good and safe condition, repair and appearance (the “Required Condition”), and (y) perform any and all repairs and replacements required in order to so maintain and preserve, in the Required Condition, the Premises and the fixtures and appurtenances therein (including, but not limited to, the Premises’ plumbing and HVAC systems, all doors, overhead or otherwise, glass and levelers located in the Premises or otherwise available in the Property for Tenant’s sole use; and excluding, however, only those specific components of the Premises for which Landlord is expressly responsible under Section 13.1.4); and (ii) except to the extent Landlord elects to repair and maintain the HVAC systems as part of General Maintenance Services, maintain, in full force and effect, a preventative maintenance and service contract with a reputable service provider for quarterly maintenance of the HVAC systems of the Premises (the “HVAC Maintenance Contract”). In addition to Tenant’s obligations under (i) and (ii) above, Tenant shall also be responsible for all costs and expenses incurred to perform any and all repairs and replacements (whether structural or non-structural; interior or exterior; and ordinary or extraordinary), in and to the Premises and the Property and the facilities and systems thereof, if and to the extent that the need for such repairs or replacements arises directly or indirectly from any act, omission, misuse, or neglect of any or all of Tenant, any of its subtenants, any Tenant’s Parties, or others entering into, or utilizing, all or any portion of the Premises for any reason or purpose whatsoever, including, but not limited to (a) the performance or existence of any Alterations, (b) the installation, use or operation of Tenant’s Property in the Premises; and (c) the moving of Tenant’s Property in or out of the Property (collectively, “Tenant-Related Repairs”). All such repairs or replacements required under this Section 13.1.1 shall be subject to the supervision and control of Landlord, and all repairs and replacements shall be made with materials of equal or better quality than the items being repaired or replaced.

13.1.2 General Maintenance Services. Notwithstanding any of the foregoing, however, from time to time during the Term, Landlord may elect, in its sole discretion and by delivery of written notice to Tenant, to perform on behalf of Tenant, all or some portion of the repairs, maintenance, restoration and replacement in and to the Premises required to be performed by Tenant under this Lease (any such repairs, maintenance, restoration and/or replacement activities that Landlord elects to perform on behalf of Tenant are herein collectively referred to as “General Maintenance Services”). Tenant shall reimburse Landlord for the cost or value of all General Maintenance Services provided by Landlord as Additional Rent, simultaneously with the payment of Operating Expenses as part of Estimated Additional Rent (on a monthly estimated basis subject to annual reconciliation, as described in Section 3.3 above). Unless and until Landlord affirmatively elects to provide General Maintenance Services, nothing contained herein shall be construed to obligate Landlord to perform any General Maintenance Services or, except as otherwise expressly provided in Section 13.1.4, to repair, maintain, restore or replace any portion of the Premises. Landlord may from time to time, in its sole discretion, (x) reduce or expand the scope of the General Maintenance Services that Landlord has elected to provide or (y) revoke its election to provide any or all of the General Maintenance Services, in either event, upon delivery of not less than thirty (30) days’ prior written notice to Tenant.

13.1.3 HVAC Maintenance Contract. Tenant shall also maintain, in full force and effect, a preventative maintenance and service contract with a reputable, fully licensed and insured/bonded third-party service provider for maintenance of the HVAC systems of the Premises (the “HVAC Maintenance Contract”). The terms and provisions of any HVAC Maintenance Contract shall require that the service provider maintain the Premises’ HVAC system in accordance with the manufacturer’s recommendations and be reasonably acceptable to Landlord and shall otherwise in accordance with normal, customary and reasonable practices in the geographic area in which the Premises is located and for HVAC systems comparable to the Premises’ HVAC system, but not less than quarterly preventative maintenance visits. If Landlord does not elect to repair and maintain the HVAC systems as part of General Maintenance Services, or revokes such election at any time after having made such election, then, within 30 days following either (a) the Commencement Date or (b) the date on which Landlord advises Tenant that Landlord will no longer provide General Maintenance Services for the HVAC system, whichever date is applicable, Tenant shall procure and deliver to Landlord the HVAC Maintenance Contract. Thereafter, Tenant shall provide to Landlord a copy of renewals or replacements of such HVAC Maintenance Contract no later than 30 days prior to the then-applicable expiry date of the existing HVAC Maintenance Contract. If Tenant fails to timely deliver to Landlord the HVAC Maintenance Contract (or any applicable renewal or replacement thereof), then Landlord shall have the right to contract directly for the periodic maintenance of the HVAC systems in the Premises and to charge the cost thereof back to Tenant as Additional Rent.

13.1.4 Landlord Repairs. Landlord shall repair, replace and restore the (a) foundation, exterior and interior load-bearing walls, roof structure and roof covering of the Property and (b) the Common Areas; provided, however, that in the case of both (a) and (b): (i) all costs and expenses so incurred by Landlord to repair, replace and restore the above items shall constitute Operating Expenses; provided, however, that with respect to any costs incurred in the replacement context, those costs shall not constitute an Operating Expense except to the extent that such costs so qualify under Section 3.1.1(v); and (ii) notwithstanding (i) above, in the event that any such repair, replacement or restoration is a Tenant-Related Repair, then Tenant shall be required to reimburse Landlord for all costs and expenses that Landlord incurs in order to perform such Tenant-Related Repair, and such reimbursement shall be paid, in full, within ten (10) days after Landlord’s delivery of demand therefor.

14. UTILITIES.

Tenant shall purchase all utility services and shall provide for scavenger, cleaning and extermination services. As provided in Section 3.1.1. above, utility charges may be included within Operating Expenses; nevertheless, at Landlord’s election or with Landlord’s consent, (a) Tenant may pay the utility charges for its Premises directly to the utility or municipality providing such service, and in that event all charges shall be paid by Tenant before they become delinquent; and (b) Landlord may directly bill Tenant for Tenant’s Proportionate Share of utility expenses when and as such expenses are incurred. Tenant shall be solely responsible for the repair and maintenance of any meters necessary in connection with such utility services to the Premises. Tenant’s use of electrical energy in the Premises shall not, at any time, exceed the capacity of either or both of (x) any of the electrical conductors and equipment in or otherwise servicing the Premises; and (y) the HVAC systems of either or both of the Premises and the Property.

If Landlord is required by law to perform energy benchmarking of the Premises, Tenant hereby authorizes Landlord to obtain information, from time to time throughout the Term, regarding Tenant's utility and energy usage at the Premises directly from the applicable utility providers and Tenant shall execute, within five (5) days of Landlord's request, any additional documentation required by any applicable utility provider evidencing such authorization. Further, throughout the Term, (i) within five (5) days of Landlord's request, Tenant shall provide to Landlord all requested information regarding Tenant's utility, energy and space usage at the Premises, and (ii) upon Landlord's delivery to Tenant of written request, Tenant shall deliver to Landlord copies of its utilities bills for the immediately preceding twelve (12) calendar months.

15. INVOLUNTARY CESSATION OF SERVICES.

Landlord reserves the right, without any liability to Tenant and without affecting Tenant’s covenants and obligations hereunder, to stop service of any or all of the HVAC, electric, sanitary, elevator (if any), and other systems serving the Premises, or to stop any other services required by Landlord under this Lease, whenever and for so long as may be necessary by reason of (i) accidents, emergencies, strikes, or the making of repairs or changes which Landlord or Agent, in good faith, deems necessary or (ii) any other cause beyond Landlord’s reasonable control. Further, it is also understood and agreed that Landlord or Agent shall have no liability or responsibility for a cessation of services to the Premises or to the Property that occurs as a result of causes beyond Landlord’s or Agent’s reasonable control. No such interruption of service shall be deemed an eviction or disturbance of Tenant’s use and possession of the Premises or any part thereof, or render Landlord or Agent liable to Tenant for damages, or relieve Tenant from performance of Tenant’s obligations under this Lease, including, but not limited to, the obligation to pay Rent; provided, however, that if any interruption of services persists for a period in excess of five (5) consecutive business days Tenant shall, as Tenant’s sole remedy, be entitled to a proportionate abatement of Rent to the extent, if any, of any actual loss of use of the Premises by Tenant.

16. LANDLORD’S RIGHTS.

Landlord, Agent and their respective agents, employees and representatives shall have the right to enter and/or pass through the Premises at any time or times upon reasonable prior notice (except in the event of emergency): (a) to examine and inspect the Premises and to show them to actual and prospective lenders, prospective purchasers or mortgagees of the Property or providers of capital to Landlord and its affiliates; and in connection with the foregoing, to install a sign at or on the Property to advertise the Property for lease or sale; (b) to make such repairs, alterations, additions and improvements in or to all or any portion of either or both of the Premises and the Property, or the Property’s facilities and equipment as Landlord is required or desires to make. During the period of six (6) months prior to the Expiration Date (or at any time, if Tenant has vacated or abandoned the Premises or is otherwise in default under this Lease), Landlord and its agents may exhibit the Premises to prospective tenants. Additionally, Landlord and Agent shall have the following rights with respect to the Premises, exercisable without notice to Tenant, without liability to Tenant, and without being deemed an eviction or disturbance of Tenant’s use or possession of the Premises or giving rise to any claim for setoff or abatement of Rent: (i) to have pass keys, access cards, or both, to the Premises; and (ii) to decorate, remodel, repair, alter or otherwise prepare the Premises for reoccupancy at any time after Tenant vacates or abandons the Premises for more than sixty (60) consecutive days or without notice to Landlord of Tenant’s intention to reoccupy the Premises.

17. NON-LIABILITY AND INDEMNIFICATION; FORCE MAJEURE.