EXHIBIT 99.2

Hello, this is Cheri Beranek, President and CEO of Clearfield. Welcome to our fiscal second quarter 2017 FieldReport. Before we begin today, I’d like to provide some important cautions regarding forward - looking statements made during today’s presentation.

Certain important factors could have a material impact on the Company's performance, including those set forth in the slide entitled “Important Cautions Regarding Forward - Looking Statements,” as well as the factors set forth in Clearfield's Annual Report on Form 10 - K for the fiscal year ended September 30, 2016 and other filings with the Securities and Exchange Commission.

Once again, we have proven our commitment to expanding our presence in the Tier 1 market, with more than 11% of our revenue in the quarter coming from this customer segment. Our growth in this market has been very encouraging, as reflected by the increased amount of orders, as well as the fact that we were able to achieve an important industry certification. As reported earlier this week, certification to Level 3 NEBS will enable us to more aggressively pursue additional Tier 1 business. Yet revenue growth of 4% for second quarter and 10% year - to - date is beneath our expectation and plan for this six month period. We did experience a noticeable dip in demand for our solutions from our customers in the wireless market. We see this as a short - term shift in procurement patterns as these carriers reduce their near - term capital expenditures in preparation for the enhancement of the optical fiber required for higher speed networks. In addition, momentum within our alternative carrier markets has stalled, but it is important to note that this is consistent with the market speculation that has surrounded this customer group. I want to assure shareholders that while it is unfortunate that the short - term volatility of spend among these two groups is reflected in our year - to - date performance, I do not want it to mask the strong execution of Clearfield’s strategy to establish ourselves as a key supplier of fiber management and distribution products for all broadband service providers, regardless of size or network type. But before I discuss our operational results, growth strategies, and future outlook in greater detail, I would like to turn the presentation over to our CFO, Dan Herzog, who will walk us through our full financial performance for the second quarter of fiscal 2017.

Thank you, Cheri. Now, looking at our financial results in more detail…

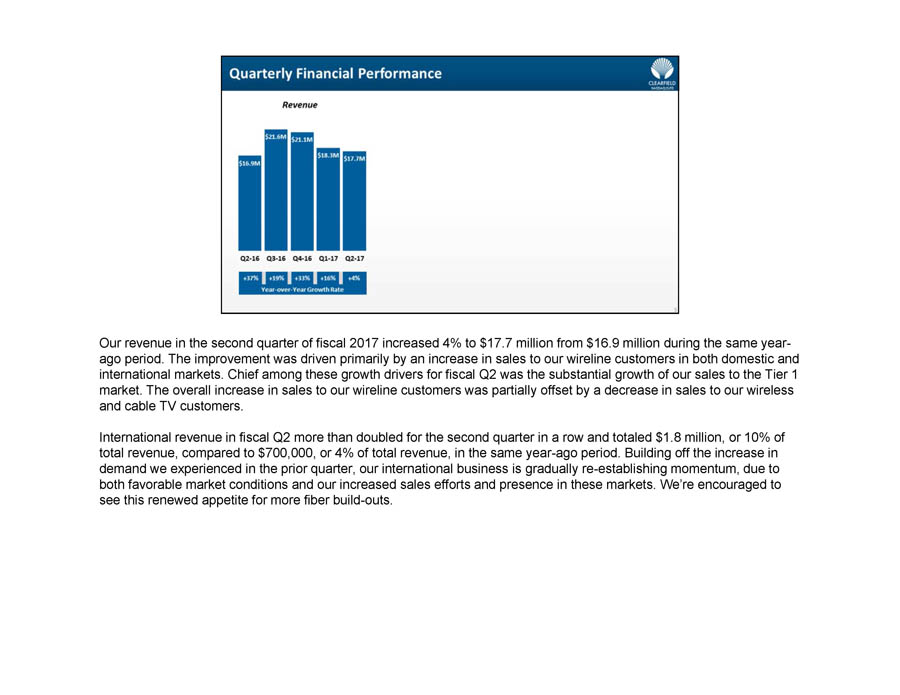

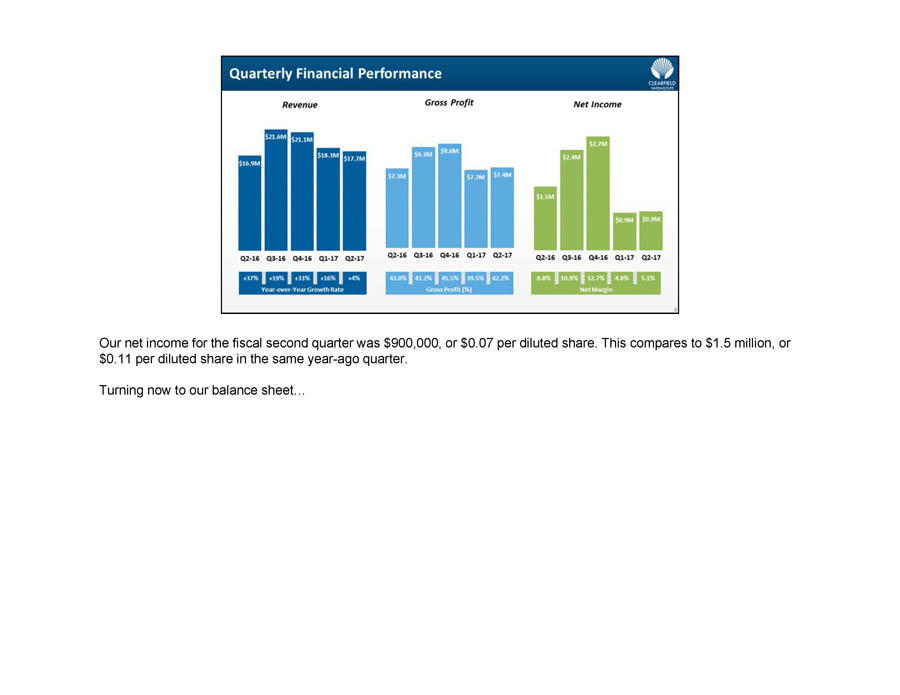

Our revenue in the second quarter of fiscal 2017 increased 4% to $17.7 million from $16.9 million during the same year - ago period. The improvement was driven primarily by an increase in sales to our wireline customers in both domestic and international markets. Chief among these growth drivers for fiscal Q2 was the substantial growth of our sales to the Tier 1 market. The overall increase in sales to our wireline customers was partially offset by a decrease in sales to our wireless and cable TV customers. International revenue in fiscal Q2 more than doubled for the second quarter in a row and totaled $1.8 million, or 10% of total revenue, compared to $700,000, or 4% of total revenue, in the same year - ago period. Building off the increase in demand we experienced in the prior quarter, our international business is gradually re - establishing momentum, due to both favorable market conditions and our increased sales efforts and presence in these markets. We’re encouraged to see this renewed appetite for more fiber build - outs.

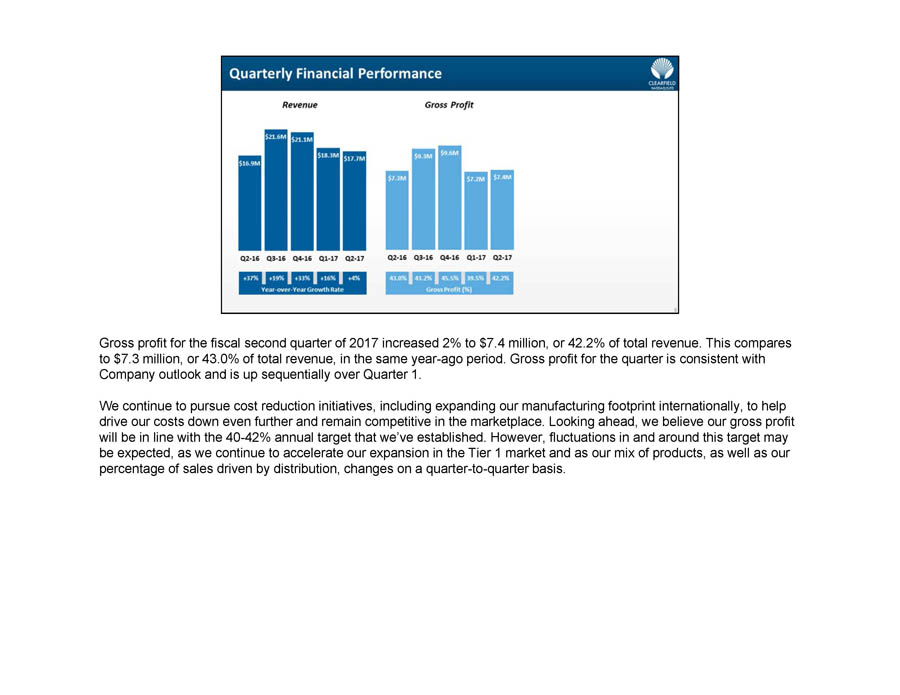

Gross profit for the fiscal second quarter of 2017 increased 2% to $7.4 million, or 42.2% of total revenue. This compares to $7.3 million, or 43.0% of total revenue, in the same year - ago period. Gross profit for the quarter is consistent with Company outlook and is up sequentially over Quarter 1. We continue to pursue cost reduction initiatives, including expanding our manufacturing footprint internationally, to help drive our costs down even further and remain competitive in the marketplace. Looking ahead, we believe our gross profit will be in line with the 40 - 42% annual target that we’ve established. However, fluctuations in and around this target may be expected, as we continue to accelerate our expansion in the Tier 1 market and as our mix of products, as well as our percentage of sales driven by distribution, changes on a quarter - to - quarter basis.

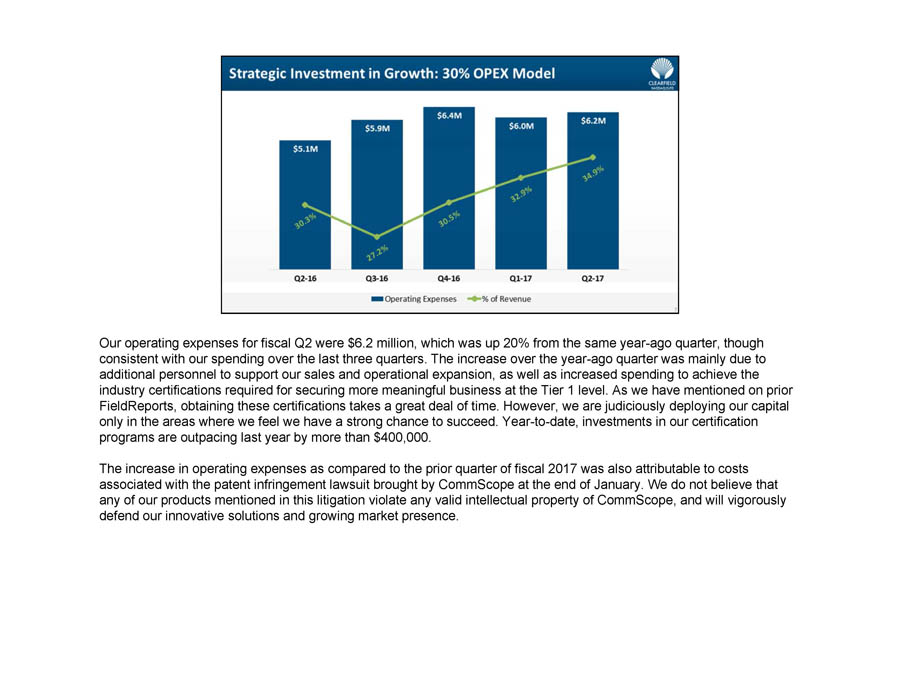

Our operating expenses for fiscal Q2 were $6.2 million, which was up 20% from the same year - ago quarter, though consistent with our spending over the last three quarters. The increase over the year - ago quarter was mainly due to additional personnel to support our sales and operational expansion, as well as increased spending to achieve the industry certifications required for securing more meaningful business at the Tier 1 level. As we have mentioned on prior FieldReports, obtaining these certifications takes a great deal of time. However, we are judiciously deploying our capital only in the areas where we feel we have a strong chance to succeed. Year - to - date, investments in our certification programs are outpacing last year by more than $400,000. The increase in operating expenses as compared to the prior quarter of fiscal 2017 was also attributable to costs associated with the patent infringement lawsuit brought by CommScope at the end of January. We do not believe that any of our products mentioned in this litigation violate any valid intellectual property of CommScope, and will vigorously defend our innovative solutions and growing market presence.

Our net income for the fiscal second quarter was $900,000, or $0.07 per diluted share. This compares to $1.5 million, or $0.11 per diluted share in the same year - ago quarter. Turning now to our balance sheet…

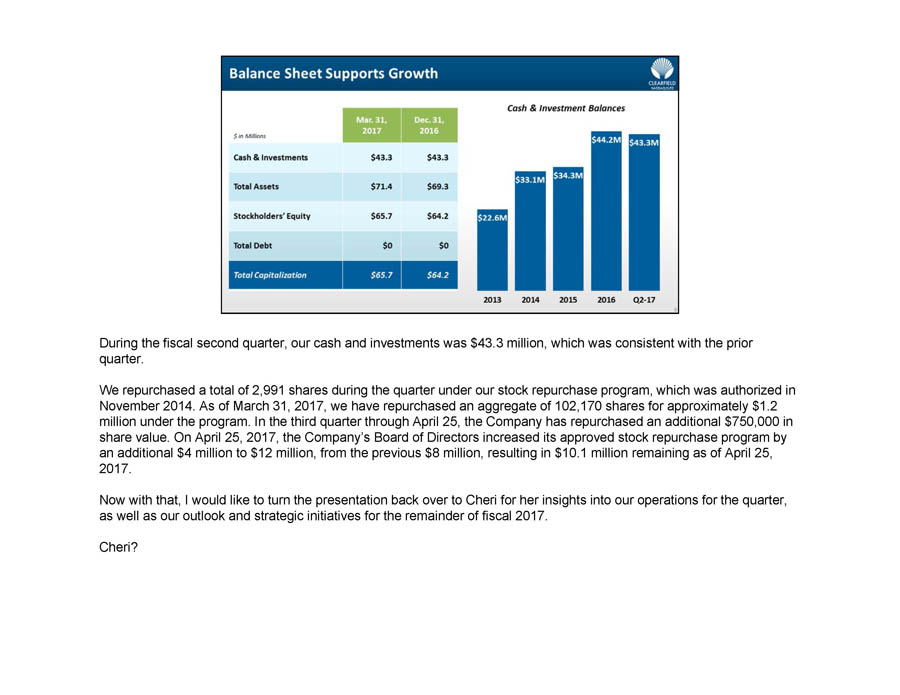

During the fiscal second quarter, our cash and investments was $43.3 million, which was consistent with the prior quarter. We repurchased a total of 2,991 shares during the quarter under our stock repurchase program, which was authorized in November 2014. As of March 31, 2017, we have repurchased an aggregate of 102,170 shares for approximately $1.2 million under the program. In the third quarter through April 25, the Company has repurchased an additional $750,000 in share value. On April 25, 2017, the Company’s Board of Directors increased its approved stock repurchase program by an additional $4 million to $12 million, from the previous $8 million, resulting in $10.1 million remaining as of April 25, 2017. Now with that, I would like to turn the presentation back over to Cheri for her insights into our operations for the quarter, as well as our outlook and strategic initiatives for the remainder of fiscal 2017. Cheri?

Thanks, Dan.

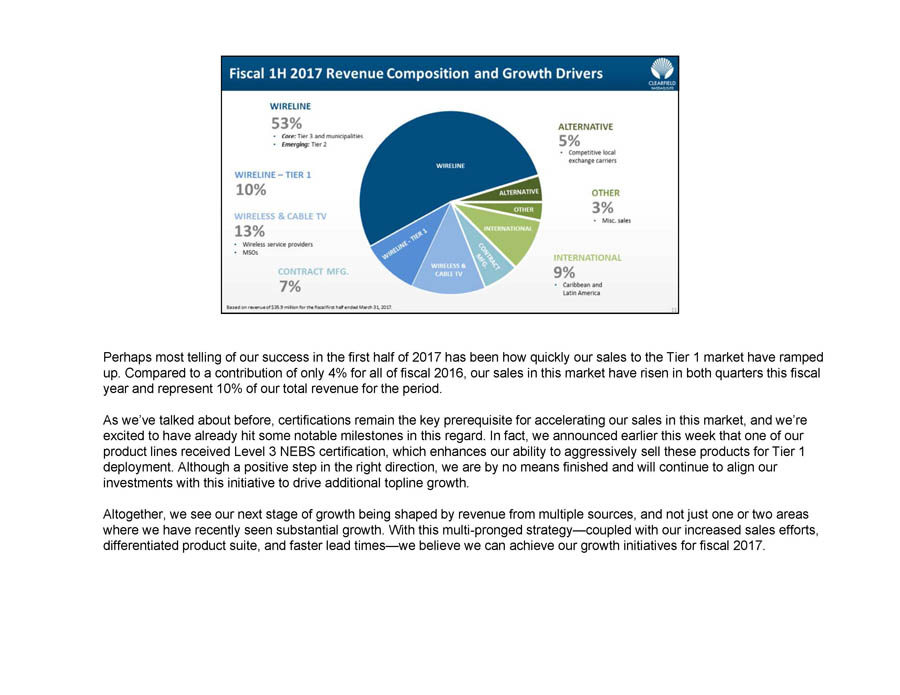

Perhaps most telling of our success in the first half of 2017 has been how quickly our sales to the Tier 1 market have ramped up . Compared to a contribution of only 4 % for all of fiscal 2016 , our sales in this market have risen in both quarters this fiscal year and represent 10 % of our total revenue for the period . As we’ve talked about before, certifications remain the key prerequisite for accelerating our sales in this market, and we’re excited to have already hit some notable milestones in this regard. In fact, we announced earlier this week that one of our product lines received Level 3 NEBS certification, which enhances our ability to aggressively sell these products for Tier 1 deployment. Although a positive step in the right direction, we are by no means finished and will continue to align our investments with this initiative to drive additional topline growth. Altogether, we see our next stage of growth being shaped by revenue from multiple sources, and not just one or two areas where we have recently seen substantial growth. With this multi - pronged strategy — coupled with our increased sales efforts, differentiated product suite, and faster lead times — we believe we can achieve our growth initiatives for fiscal 2017.

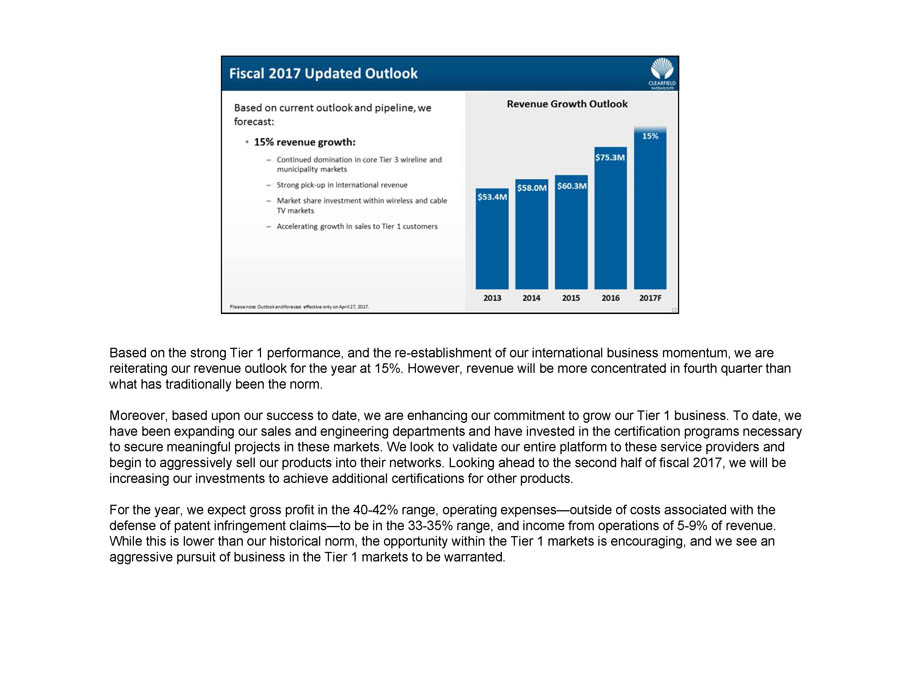

Based on the strong Tier 1 performance, and the re - establishment of our international business momentum, we are reiterating our revenue outlook for the year at 15%. However, revenue will be more concentrated in fourth quarter than what has traditionally been the norm. Moreover, based upon our success to date, we are enhancing our commitment to grow our Tier 1 business. To date, we have been expanding our sales and engineering departments and have invested in the certification programs necessary to secure meaningful projects in these markets. We look to validate our entire platform to these service providers and begin to aggressively sell our products into their networks. Looking ahead to the second half of fiscal 2017, we will be increasing our investments to achieve additional certifications for other products. For the year, we expect gross profit in the 40 - 42 % range, operating expenses — outside of costs associated with the defense of patent infringement claims — to be in the 33 - 35 % range, and income from operations of 5 - 9 % of revenue . While this is lower than our historical norm, the opportunity within the Tier 1 markets is encouraging, and we see an aggressive pursuit of business in the Tier 1 markets to be warranted .

The execution of these and other initiatives should enable us to further scale our business, enhance our market position, and continue our track record of delivering profits for our shareholders. The expansion of our stock repurchase program is evidence of our confidence in this strategy. We remain committed to exploring all options available to Clearfield to serve our customers and enhance shareholder value. In closing, we encourage you to review today’s earnings release and filings, and we welcome any questions you may have about our financial performance, operations, products or industry. Please send any inquiries you may have to CLFD@liolios.com. We will post the most relevant questions and answers in the ‘For Investors’ section of our website. This wraps up today’s FieldReport. Thank you for your interest and support, and we look forward to speaking again with you soon.