EXHIBIT 99.2

Hello, this is Cheri Beranek, President and CEO of Clearfield. Welcome to our fiscal third quarter 2017 FieldReport. Before we begin today, I’d like to provide some important cautions regarding forward - looking statements made during today’s presentation.

Certain important factors could have a material impact on the Company's performance, including those set forth in the slide entitled “Important Cautions Regarding Forward - Looking Statements,” as well as the factors set forth in Clearfield's Annual Report on Form 10 - K for the fiscal year ended September 30, 2016 and other filings with the Securities and Exchange Commission. I also would like to add that we will be answering questions previously submitted by investors and analysts at the conclusion of this FieldReport.

The results for this fiscal third quarter are lower than our expectations, driven primarily by volatility within several significant customers. While third quarter revenue is disappointing, we are pleased with the overall progress we’re seeing in the business as a whole, especially at the national carrier level. In a moment, I’ll demonstrate the traction we’re gaining in our key growth markets, which has been masked by temporary subpar performance in other markets . However, before I do so, I’d like to spend some time outlining the individual factors that led to our softer results for Q 3 .

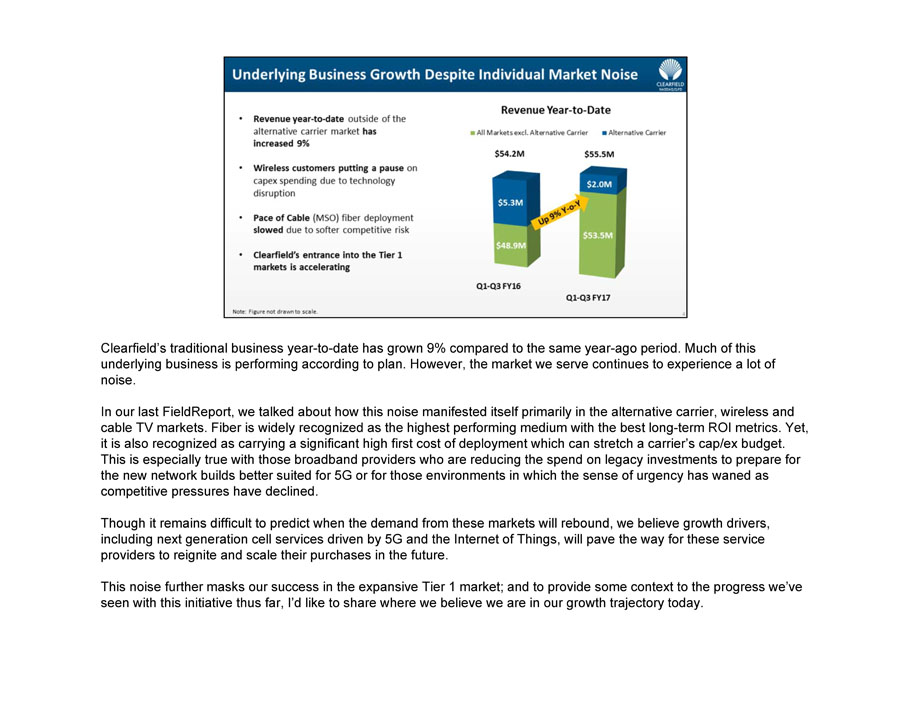

Clearfield’s traditional business year - to - date has grown 9% compared to the same year - ago period. Much of this underlying business is performing according to plan. However, the market we serve continues to experience a lot of noise. In our last FieldReport, we talked about how this noise manifested itself primarily in the alternative carrier, wireless and cable TV markets. Fiber is widely recognized as the highest performing medium with the best long - term ROI metrics. Yet, it is also recognized as carrying a significant high first cost of deployment which can stretch a carrier’s cap/ex budget. This is especially true with those broadband providers who are reducing the spend on legacy investments to prepare for the new network builds better suited for 5G or for those environments in which the sense of urgency has waned as competitive pressures have declined. Though it remains difficult to predict when the demand from these markets will rebound, we believe growth drivers, including next generation cell services driven by 5G and the Internet of Things, will pave the way for these service providers to reignite and scale their purchases in the future. This noise further masks our success in the expansive Tier 1 market; and to provide some context to the progress we’ve seen with this initiative thus far, I’d like to share where we believe we are in our growth trajectory today.

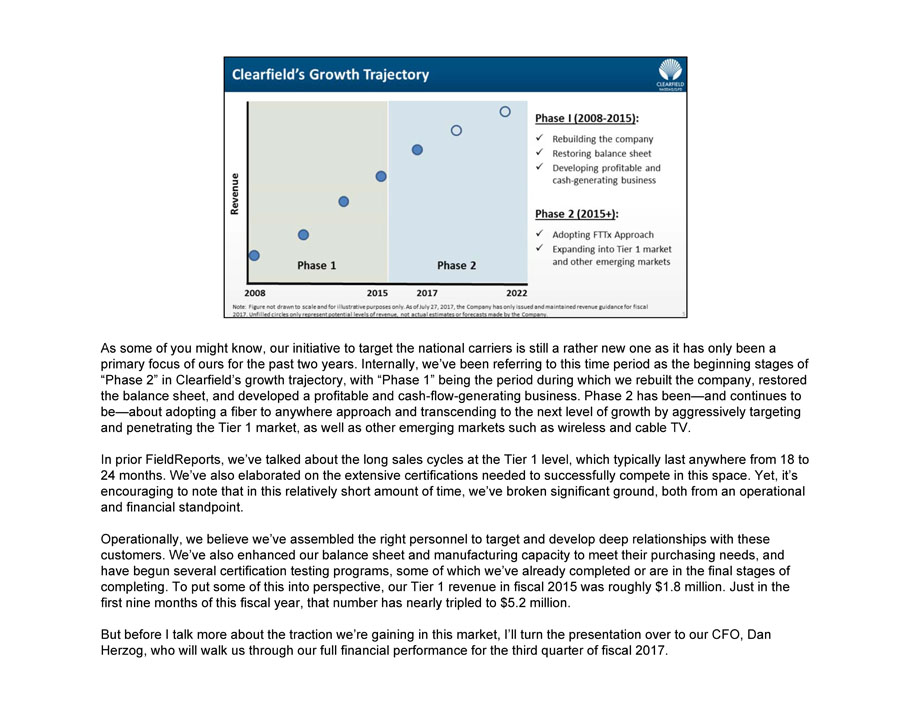

As some of you might know, our initiative to target the national carriers is still a rather new one as it has only been a primary focus of ours for the past two years. Internally, we’ve been referring to this time period as the beginning stages of “Phase 2” in Clearfield’s growth trajectory, with “Phase 1” being the period during which we rebuilt the company, restored the balance sheet, and developed a profitable and cash - flow - generating business. Phase 2 has been — and continues to be — about adopting a fiber to anywhere approach and transcending to the next level of growth by aggressively targeting and penetrating the Tier 1 market, as well as other emerging markets such as wireless and cable TV. In prior FieldReports, we’ve talked about the long sales cycles at the Tier 1 level, which typically last anywhere from 18 to 24 months. We’ve also elaborated on the extensive certifications needed to successfully compete in this space. Yet, it’s encouraging to note that in this relatively short amount of time, we’ve broken significant ground, both from an operational and financial standpoint. Operationally, we believe we’ve assembled the right personnel to target and develop deep relationships with these customers. We’ve also enhanced our balance sheet and manufacturing capacity to meet their purchasing needs, and have begun several certification testing programs, some of which we’ve already completed or are in the final stages of completing. To put some of this into perspective, our Tier 1 revenue in fiscal 2015 was roughly $1.8 million. Just in the first nine months of this fiscal year, that number has nearly tripled to $5.2 million. But before I talk more about the traction we’re gaining in this market, I’ll turn the presentation over to our CFO, Dan Herzog, who will walk us through our full financial performance for the third quarter of fiscal 2017.

Thank you, Cheri. Now, looking at our financial results in more detail…

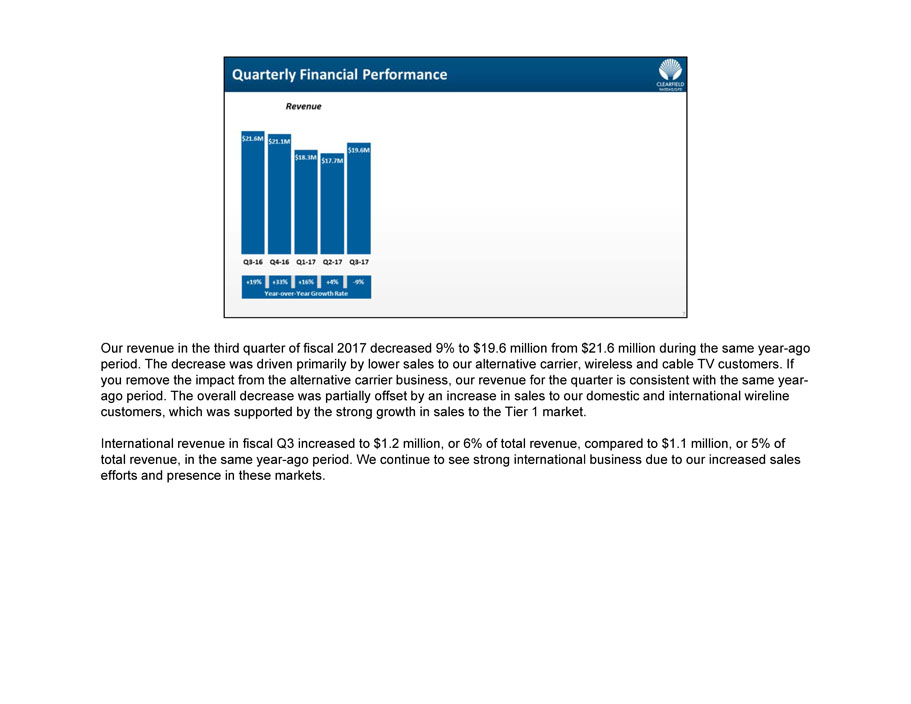

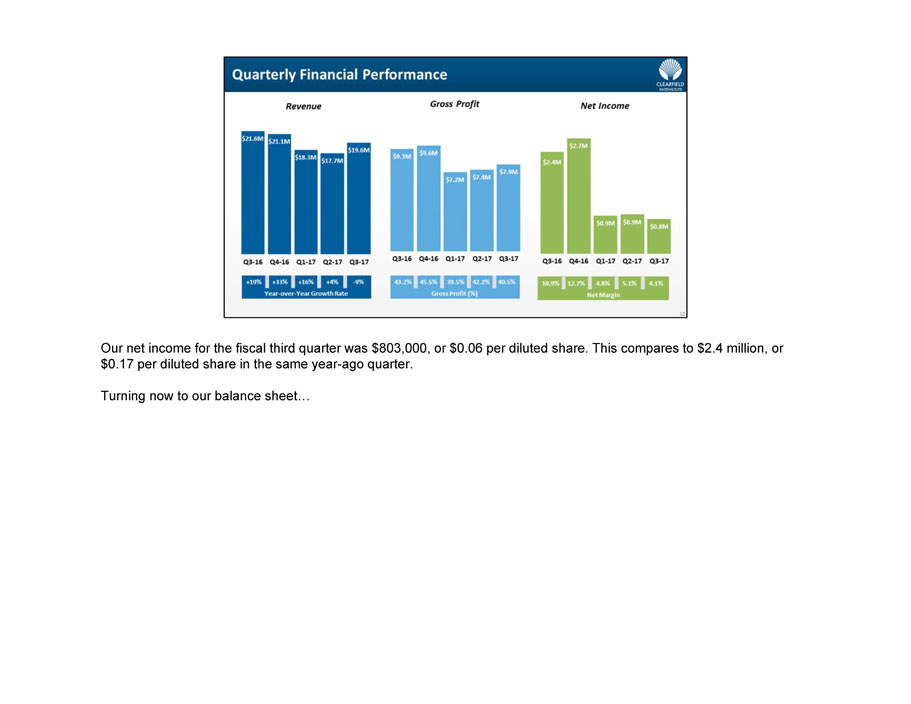

Our revenue in the third quarter of fiscal 2017 decreased 9% to $19.6 million from $21.6 million during the same year - ago period. The decrease was driven primarily by lower sales to our alternative carrier, wireless and cable TV customers. If you remove the impact from the alternative carrier business, our revenue for the quarter is consistent with the same year - ago period. The overall decrease was partially offset by an increase in sales to our domestic and international wireline customers, which was supported by the strong growth in sales to the Tier 1 market. International revenue in fiscal Q3 increased to $1.2 million, or 6% of total revenue, compared to $1.1 million, or 5% of total revenue, in the same year - ago period. We continue to see strong international business due to our increased sales efforts and presence in these markets.

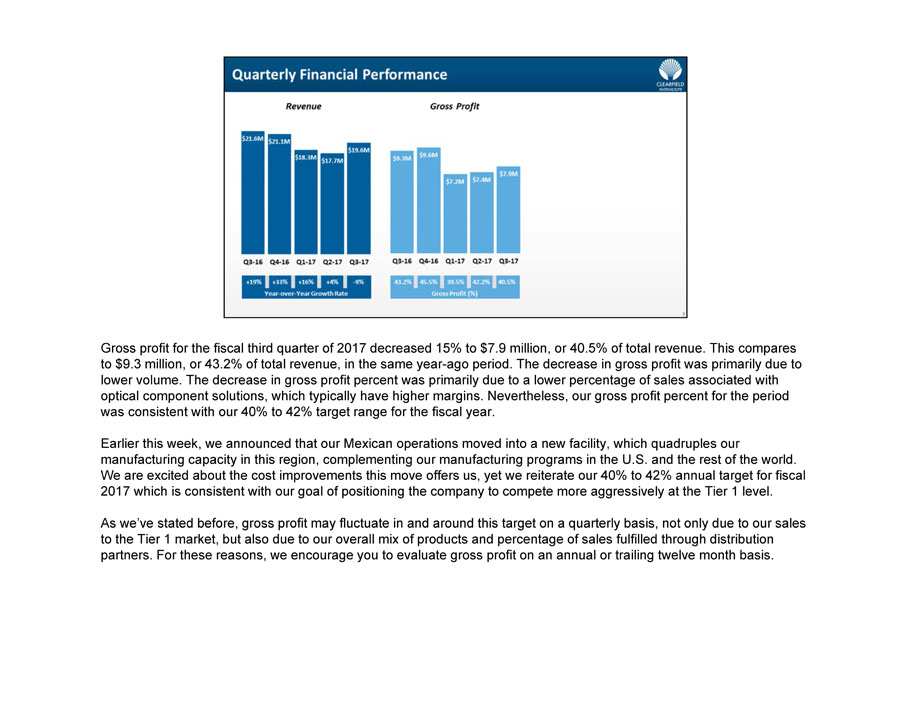

Gross profit for the fiscal third quarter of 2017 decreased 15% to $7.9 million, or 40.5% of total revenue. This compares to $9.3 million, or 43.2% of total revenue, in the same year - ago period. The decrease in gross profit was primarily due to lower volume. The decrease in gross profit percent was primarily due to a lower percentage of sales associated with optical component solutions, which typically have higher margins. Nevertheless, our gross profit percent for the period was consistent with our 40% to 42% target range for the fiscal year. Earlier this week, we announced that our Mexican operations moved into a new facility, which quadruples our manufacturing capacity in this region, complementing our manufacturing programs in the U.S. and the rest of the world. We are excited about the cost improvements this move offers us, yet we reiterate our 40% to 42% annual target for fiscal 2017 which is consistent with our goal of positioning the company to compete more aggressively at the Tier 1 level. As we’ve stated before, gross profit may fluctuate in and around this target on a quarterly basis, not only due to our sales to the Tier 1 market, but also due to our overall mix of products and percentage of sales fulfilled through distribution partners. For these reasons, we encourage you to evaluate gross profit on an annual or trailing twelve month basis.

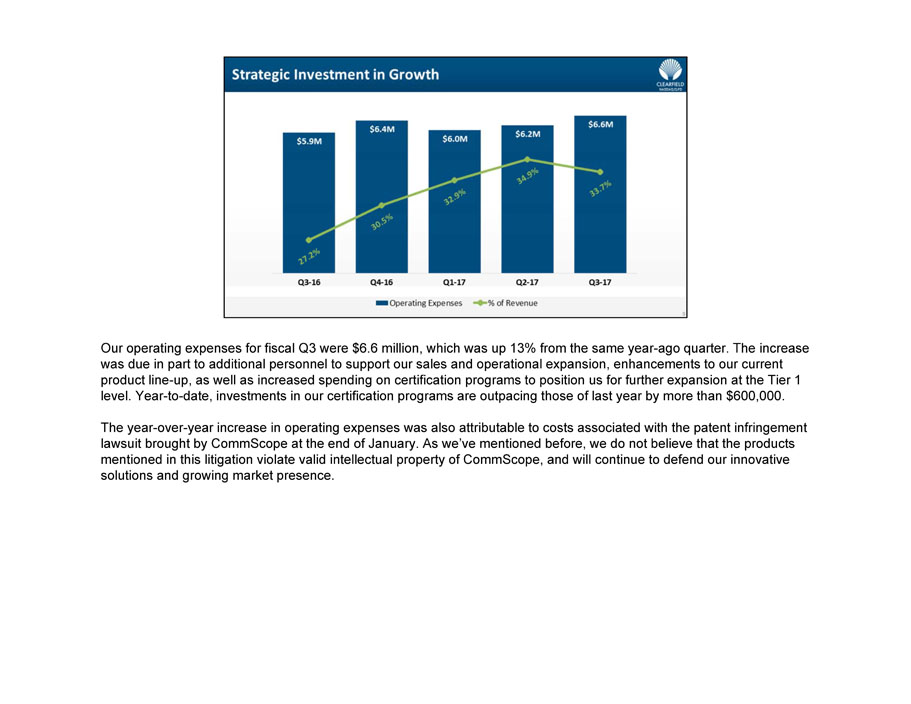

Our operating expenses for fiscal Q3 were $6.6 million, which was up 13% from the same year - ago quarter. The increase was due in part to additional personnel to support our sales and operational expansion, enhancements to our current product line - up, as well as increased spending on certification programs to position us for further expansion at the Tier 1 level. Year - to - date, investments in our certification programs are outpacing those of last year by more than $600,000. The year - over - year increase in operating expenses was also attributable to costs associated with the patent infringement lawsuit brought by CommScope at the end of January. As we’ve mentioned before, we do not believe that the products mentioned in this litigation violate valid intellectual property of CommScope, and will continue to defend our innovative solutions and growing market presence.

Our net income for the fiscal third quarter was $803,000, or $0.06 per diluted share. This compares to $2.4 million, or $0.17 per diluted share in the same year - ago quarter. Turning now to our balance sheet…

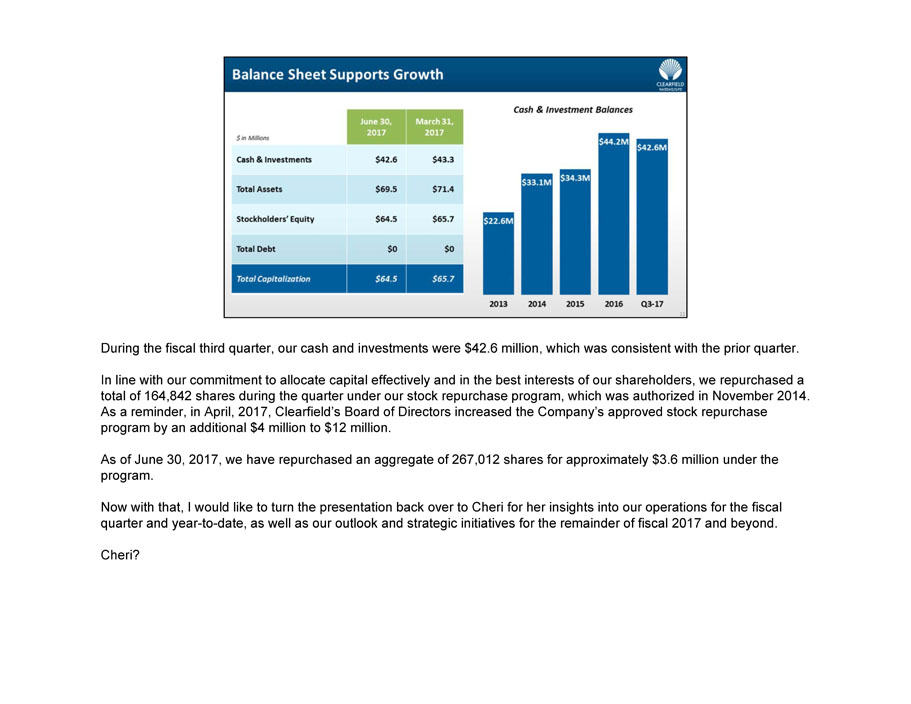

During the fiscal third quarter, our cash and investments were $42.6 million, which was consistent with the prior quarter. In line with our commitment to allocate capital effectively and in the best interests of our shareholders, we repurchased a total of 164,842 shares during the quarter under our stock repurchase program, which was authorized in November 2014. As a reminder, in April, 2017, Clearfield’s Board of Directors increased the Company’s approved stock repurchase program by an additional $4 million to $12 million. As of June 30, 2017, we have repurchased an aggregate of 267,012 shares for approximately $3.6 million under the program. Now with that, I would like to turn the presentation back over to Cheri for her insights into our operations for the fiscal quarter and year - to - date, as well as our outlook and strategic initiatives for the remainder of fiscal 2017 and beyond. Cheri?

Thanks, Dan.

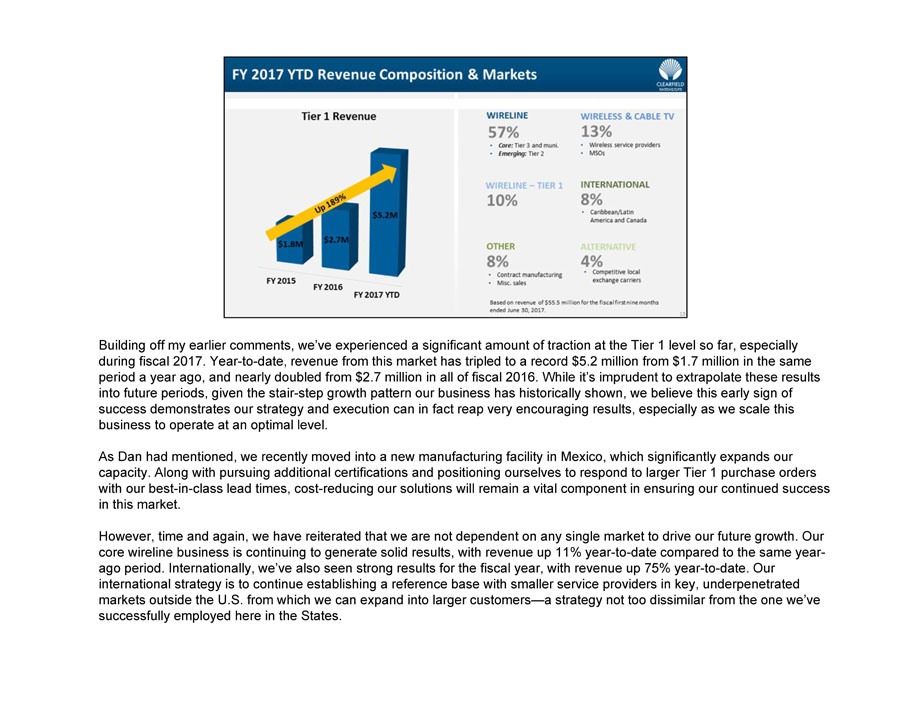

Building off my earlier comments, we’ve experienced a significant amount of traction at the Tier 1 level so far, especially during fiscal 2017. Year - to - date, revenue from this market has tripled to a record $5.2 million from $1.7 million in the same period a year ago, and nearly doubled from $2.7 million in all of fiscal 2016. While it’s imprudent to extrapolate these results into future periods, given the stair - step growth pattern our business has historically shown, we believe this early sign of success demonstrates our strategy and execution can in fact reap very encouraging results, especially as we scale this business to operate at an optimal level. As Dan had mentioned, we recently moved into a new manufacturing facility in Mexico, which significantly expands our capacity. Along with pursuing additional certifications and positioning ourselves to respond to larger Tier 1 purchase orders with our best - in - class lead times, cost - reducing our solutions will remain a vital component in ensuring our continued success in this market. However, time and again, we have reiterated that we are not dependent on any single market to drive our future growth. Our core wireline business is continuing to generate solid results, with revenue up 11% year - to - date compared to the same year - ago period. Internationally, we’ve also seen strong results for the fiscal year, with revenue up 75% year - to - date. Our international strategy is to continue establishing a reference base with smaller service providers in key, underpenetrated markets outside the U.S. from which we can expand into larger customers — a strategy not too dissimilar from the one we’ve successfully employed here in the States.

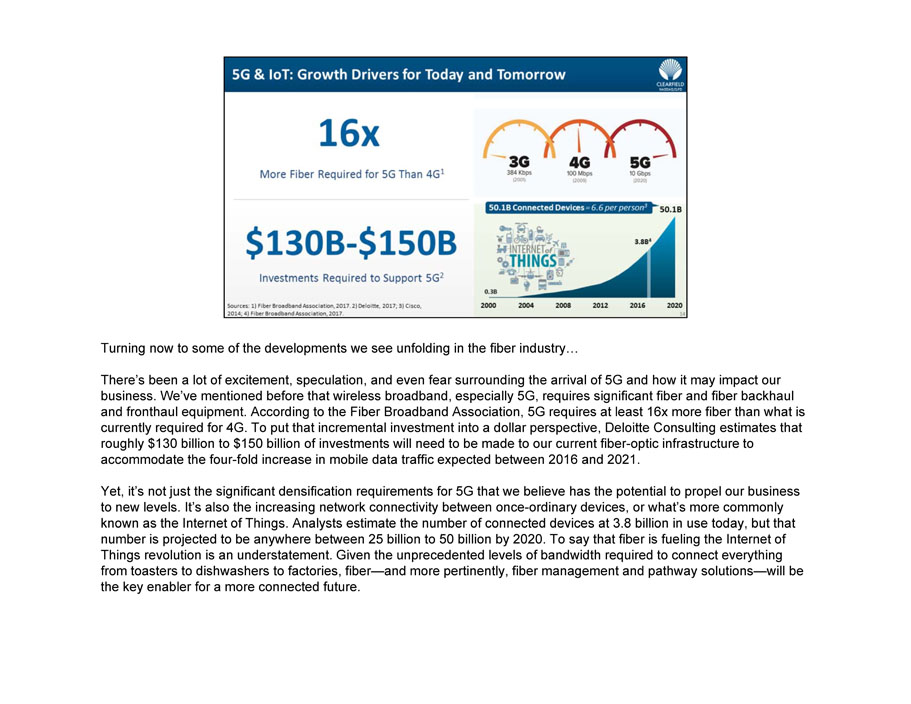

Turning now to some of the developments we see unfolding in the fiber industry… There’s been a lot of excitement, speculation, and even fear surrounding the arrival of 5G and how it may impact our business. We’ve mentioned before that wireless broadband, especially 5G, requires significant fiber and fiber backhaul and fronthaul equipment. According to the Fiber Broadband Association, 5G requires at least 16x more fiber than what is currently required for 4G. To put that incremental investment into a dollar perspective, Deloitte Consulting estimates that roughly $130 billion to $150 billion of investments will need to be made to our current fiber - optic infrastructure to accommodate the four - fold increase in mobile data traffic expected between 2016 and 2021. Yet, it’s not just the significant densification requirements for 5G that we believe has the potential to propel our business to new levels. It’s also the increasing network connectivity between once - ordinary devices, or what’s more commonly known as the Internet of Things. Analysts estimate the number of connected devices at 3.8 billion in use today, but that number is projected to be anywhere between 25 billion to 50 billion by 2020. To say that fiber is fueling the Internet of Things revolution is an understatement. Given the unprecedented levels of bandwidth required to connect everything from toasters to dishwashers to factories, fiber — and more pertinently, fiber management and pathway solutions — will be the key enabler for a more connected future.

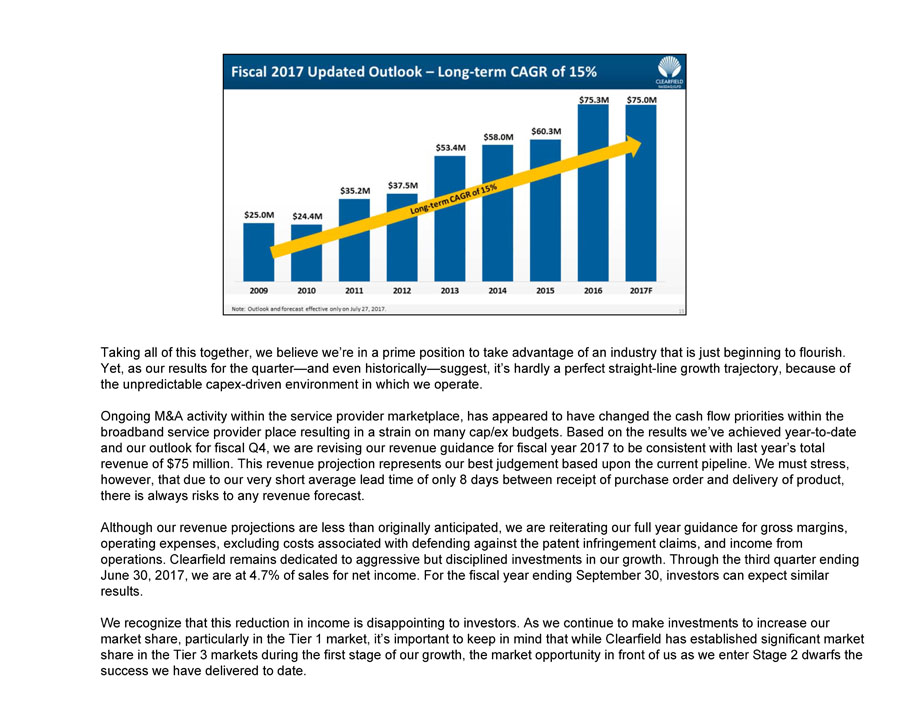

Taking all of this together, we believe we’re in a prime position to take advantage of an industry that is just beginning to flourish. Yet, as our results for the quarter — and even historically — suggest, it’s hardly a perfect straight - line growth trajectory, because of the unpredictable capex - driven environment in which we operate. Ongoing M&A activity within the service provider marketplace, has appeared to have changed the cash flow priorities within the broadband service provider place resulting in a strain on many cap/ex budgets. Based on the results we’ve achieved year - to - date and our outlook for fiscal Q4, we are revising our revenue guidance for fiscal year 2017 to be consistent with last year’s total revenue of $75 million. This revenue projection represents our best judgement based upon the current pipeline. We must stress, however, that due to our very short average lead time of only 8 days between receipt of purchase order and delivery of product, there is always risks to any revenue forecast. Although our revenue projections are less than originally anticipated, we are reiterating our full year guidance for gross margins, operating expenses, excluding costs associated with defending against the patent infringement claims, and income from operations. Clearfield remains dedicated to aggressive but disciplined investments in our growth. Through the third quarter ending June 30, 2017, we are at 4.7% of sales for net income. For the fiscal year ending September 30, investors can expect similar results. We recognize that this reduction in income is disappointing to investors. As we continue to make investments to increase our market share, particularly in the Tier 1 market, it’s important to keep in mind that while Clearfield has established significant market share in the Tier 3 markets during the first stage of our growth, the market opportunity in front of us as we enter Stage 2 dwarfs the success we have delivered to date.

And with that, I’d like to transition to the Q&A session of the FieldReport. Over the last couple of weeks, we have received several questions from analysts, investors, and thought leaders in the investment community. Dan and I will now take the time to answer a few of those questions. Dan?

Thank you, Cheri. Our first question is what does the additional capacity in Mexico mean to Clearfield’s overall capacity, and can we expect gross margin gains? You know, Dan, Clearfield’s dedicated to establishing a best - cost manufacturing environment as well as the maintenance of our nimble - response manufacturing programs. So the Mexican enhancement plus the capacity of Mexico really puts us on - par with the U.S. operation. This enhancement is about a long - term strategy; it’s not specific to any short - term opportunity as I would think that to be irresponsible. It’s really our intention to have the Mexican and U.S. operations provide a primary and a secondary source for all of our parts, that will provide us ultimate flexibility and scalability to each plant. I think in addition to these sites, we also use sub - contracting operations, both domestic and globally, to augment what we can do ourselves, so our goal with the plant is to allow us to remain competitive in the marketplace. We’re reiterating our gross margin goals of 40 to 42% because we think that is really what allows us to be strategic for Tier 1 competitiveness. Okay. Our next question is what is the status of the patent lawsuit brought by CommScope? You know, as we’ve stated in the past, Clearfield is defending our product lines as we do not believe that any of our products violate any valid patent owned by CommScope or any other party. Unfortunately, patent litigation is a laborious and lengthy series of steps, and that means there’s a lot of time and expense associated with the process. Unfortunately, this could take well over a year to proceed. However, we’re confident that we are well represented, and we will update our shareholders when there is news to share.

Alright. The next question is how are the certification programs moving forward, and what has been the effect of the NEBS certification? Certification is meant to allow companies to compete for business on a level playing field; it does not guarantee the order, but NEBS certification has certainly served as a validation to our quality and our performance capabilities. It’s served to raise our visibility for that particular product as well as our entire product line as a whole among the national carriers. Shareholders can anticipate additional announcements of certifications in the months ahead. We are dedicated to that process and continue to make significant investments in that regard. Thanks, Cheri. Our last question is will we be providing guidance for fiscal year 18? Revenue and profitability guidance is a difficult challenge, especially when you are pursuing significant opportunities with new customers. Our market is so full of noise, with many of these customers currently going through some strategic issues of their own within their own organizations – mergers, management changes, technology disruptions and the like. Notably, we have experienced some headwinds in fiscal year 17, but Clearfield has always been about building a profitable foundation with the demonstrated ability to scale to big project opportunities when they are presented to us, so our outlook is consistent with some of the analyst expectations, but probably delayed a year due to the headwinds that we’ve experienced this past year. I believe shareholders are best served with a revenue projection that is in line with our long - term compounded annual growth rate which really provides that guidance of about 15% on an annual basis. We as a management team and as a Board are committed to the SG&A investments that are needed to fuel this growth potential. Based upon our run - rate growth in our core markets, the prudent estimate – on an annual basis – with lumpiness quarter to quarter, would be net income percentage levels consistent with fiscal year 17, with some upside potential as those project opportunities come to fruition.

This wraps up today’s FieldReport. If your question was not addressed during the Q&A session or you would like to submit another question, please email Clearfield’s investor relations at CLFD@Liolios.com . We will post the most relevant questions and answers in the ‘For Investors’ section of our website. In closing, we encourage you to review today’s earnings release and filings, and we welcome any additional questions you may have about our financial performance, operations, products or industry. Thank you again for your interest and support, and we look forward to updating you on our progress soon.