Exhibit 99.1

NASDAQ:CLFD Leader in Fiber Optic Management & Connectivity Solutions Fiscal Q4 2017 Earnings Call FieldReport November 9, 2017 NASDAQ : CLFD

NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in the FieldReport are made pursuant to the safe harbor provisions of the Privat e Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or c omp arable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, growth of the FTTx markets, effectiveness of the Company’s sales and marketing strategies and organization, utilization of manufacturing capacity, and the development and marketing of products. These statements are based upon the Com pan y's current expectations and judgments about future developments in the Company's business. Certain important factors could have a materi al impact on the Company's performance, including, without limitation: our success depends upon adequate protection of our patent and intellec tua l property rights and our ability to successfully defend against claims of infringement; our results of operations could be adversely affected now that the stimulus funds of the American Recovery and Reinvestment Act are fully allocated and projections are nearing completion; National Broa dba nd Plan’s transitioning from the USF to the CAF program may cause our customers and prospective customers to delay or reduce purchases; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers, and the loss of these m ajo r customers would adversely affect us; intense competition in our industry may result in price reductions, lower gross profits and loss of mark et share; our results of operations could be adversely affected by economic conditions and the effects of these conditions on our customers’ businesse s; our operating results may fluctuate significantly from quarter to quarter, which may make budgeting for expenses difficult and may negative ly affect the market price of our common stock; to compete effectively, we must continually improve existing products and introduce new products t hat achieve market acceptance; we may face circumstances in the future that will result in impairment charges, including, but not limited to, si gni ficant goodwill impairment charges; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completi ng customer orders, all of which could materially harm our business; we face risks associated with expanding our sales outside of the United Stat es; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combination s a nd related integration activities; we are dependent on key personnel; product defects or the failure of our products to meet specificati ons could cause us to lose customers and sales or to incur unexpected expenses; and other factors set forth in Part I, Item IA. Risk Factors of Clearfie ld' s Annual Report on Form 10 - K for the year ended September 30, 2016 as well as other filings with the Securities and Exchange Commission. The Company und ertakes no obligation to update these statements to reflect actual events. © Copyright 2017 Clearfield, Inc. All Rights Reserved. 2

NASDAQ:CLFD Welcome 3 Cheri Beranek President & CEO

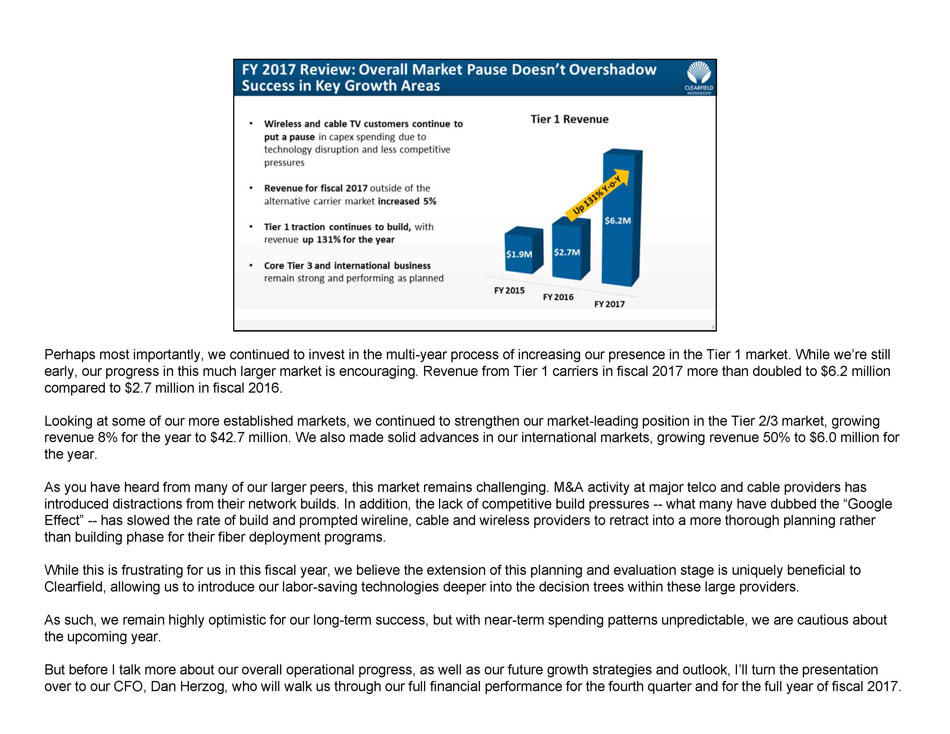

NASDAQ:CLFD FY 2017 Review: Overall Market Pause Doesn’t Overshadow Success in Key Growth Areas 4 • Wireless and cable TV customers continue to put a pause in capex spending due to technology disruption and less competitive pressures • Revenue for fiscal 2017 outside of the alternative carrier market increased 5% • Tier 1 traction continues to build, with revenue up 131% for the year • Core Tier 3 and international business remain strong and performing as planned FY 2015 FY 2016 FY 2017 $1.9M $2.7M $6.2M Tier 1 Revenue

NASDAQ:CLFD Financial Update 5 Dan Herzog Chief Financial Officer

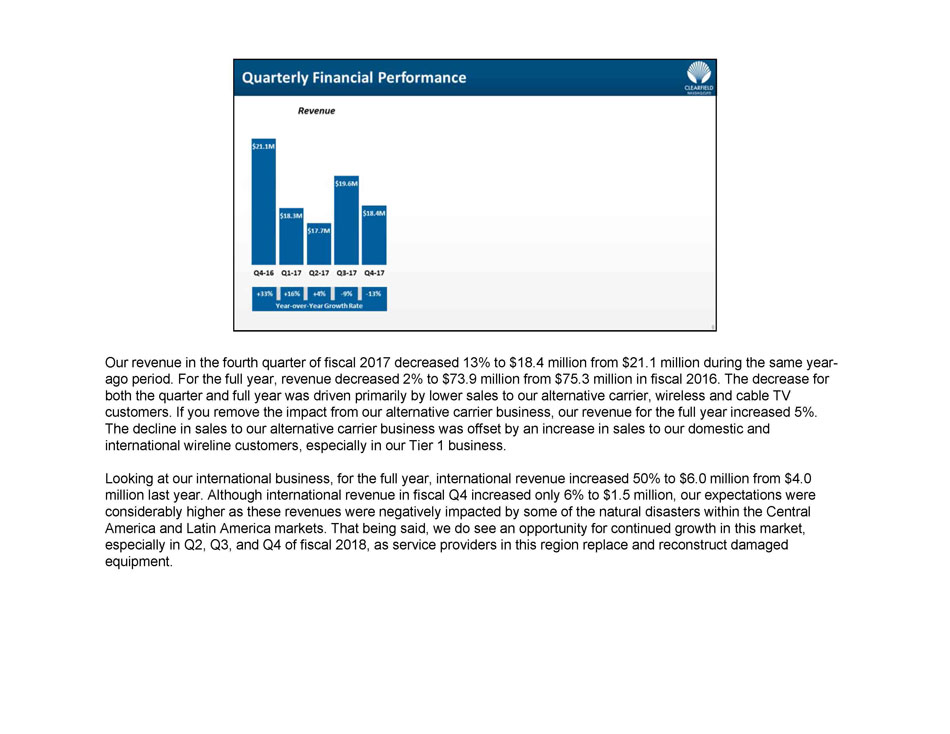

NASDAQ:CLFD Quarterly Financial Performance $21.1M $18.3M $17.7M $19.6M $18.4M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Revenue +33% +16% +4% - 9% - 13% Year - over - Year Growth Rate 6

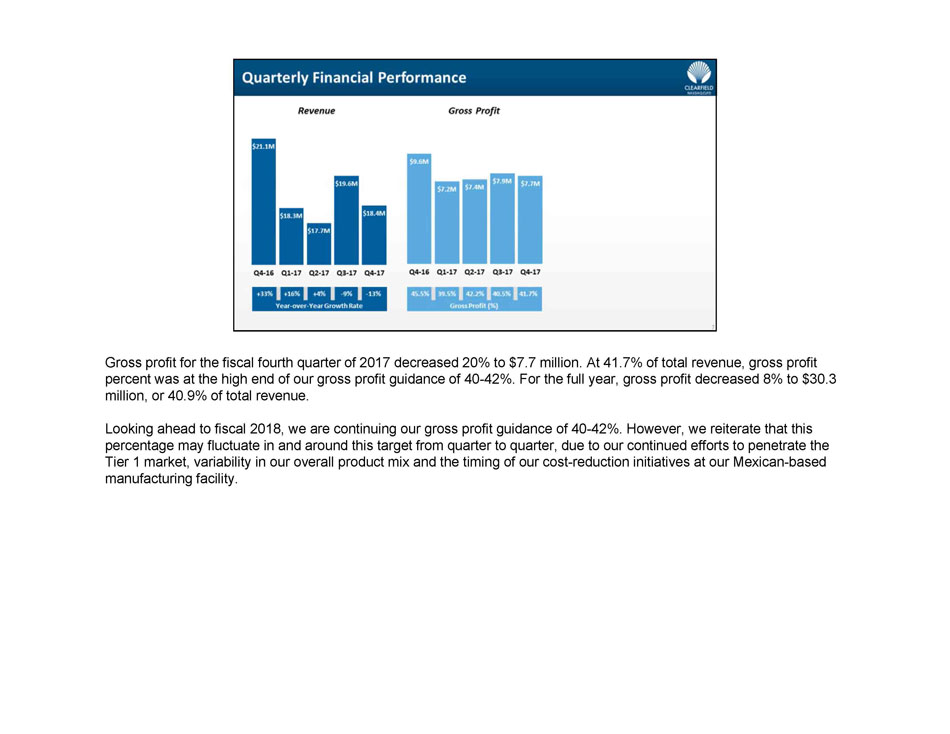

NASDAQ:CLFD Quarterly Financial Performance $9.6M $7.2M $7.4M $7.9M $7.7M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Gross Profit 45.5% 39.5% 42.2% 40.5% 41.7% Gross Profit (%) 7 $21.1M $18.3M $17.7M $19.6M $18.4M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Revenue +33% +16% +4% - 9% - 13% Year - over - Year Growth Rate

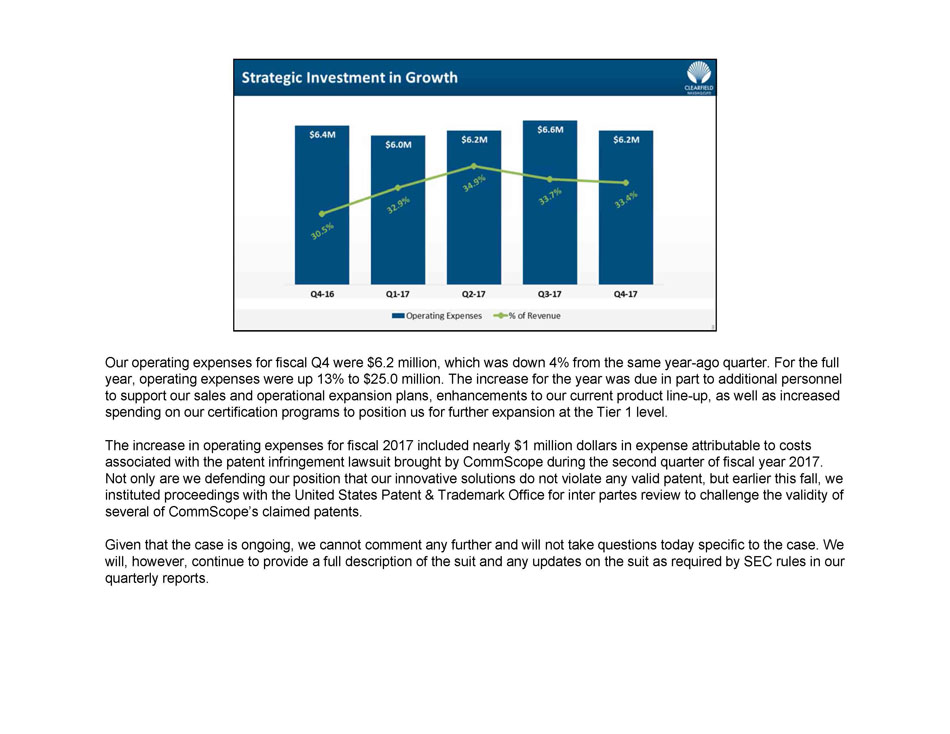

NASDAQ:CLFD Strategic Investment in Growth $6.4M $6.0M $6.2M $6.6M $6.2M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Operating Expenses % of Revenue 8

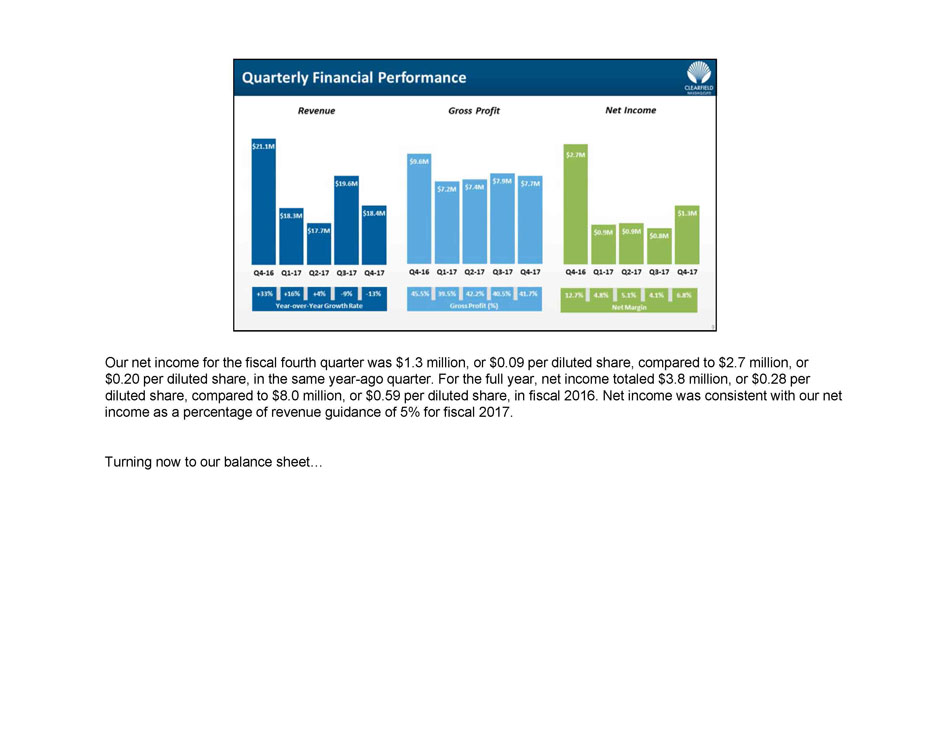

NASDAQ:CLFD Quarterly Financial Performance $2.7M $0.9M $0.9M $0.8M $1.3M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Net Income 12.7% 4.8% 5.1% 4.1% 6.8% Net Margin 9 $21.1M $18.3M $17.7M $19.6M $18.4M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Revenue +33% +16% +4% - 9% - 13% Year - over - Year Growth Rate $9.6M $7.2M $7.4M $7.9M $7.7M Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Gross Profit 45.5% 39.5% 42.2% 40.5% 41.7% Gross Profit (%)

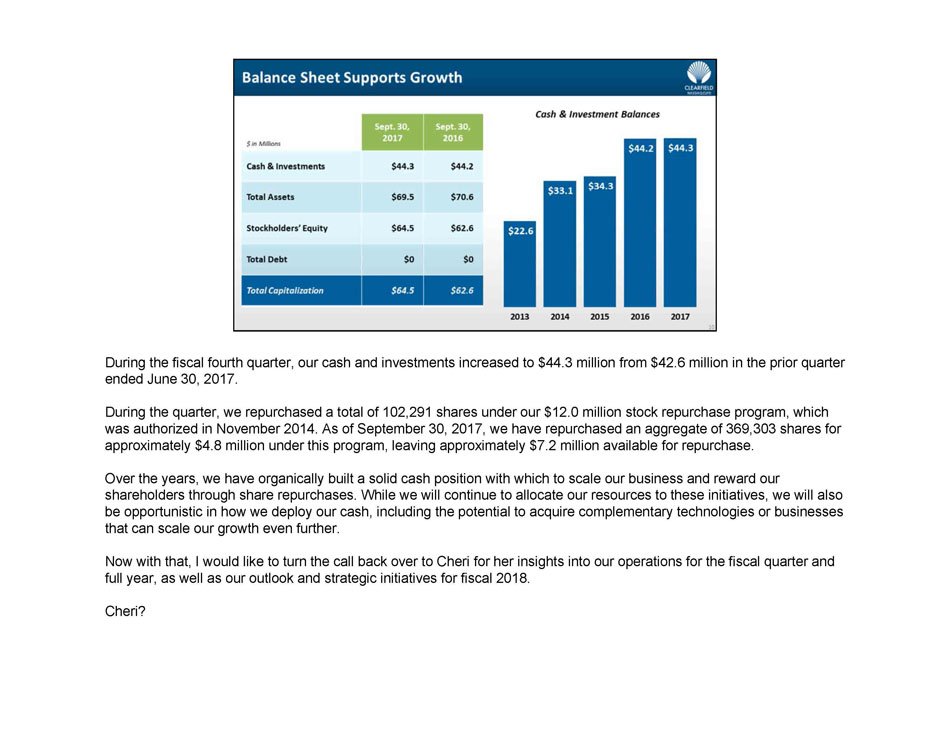

NASDAQ:CLFD Balance Sheet Supports Growth $ in Millions Sept. 30, 2017 Sept. 30, 2016 Cash & Investments $44.3 $44.2 Total Assets $69.5 $70.6 Stockholders’ Equity $64.5 $62.6 Total Debt $0 $0 Total Capitalization $64.5 $62.6 $22.6 $33.1 $34.3 $44.2 $44.3 2013 2014 2015 2016 2017 Cash & Investment Balances 10

NASDAQ:CLFD Operational Update and Outlook 11 Cheri Beranek President & CEO

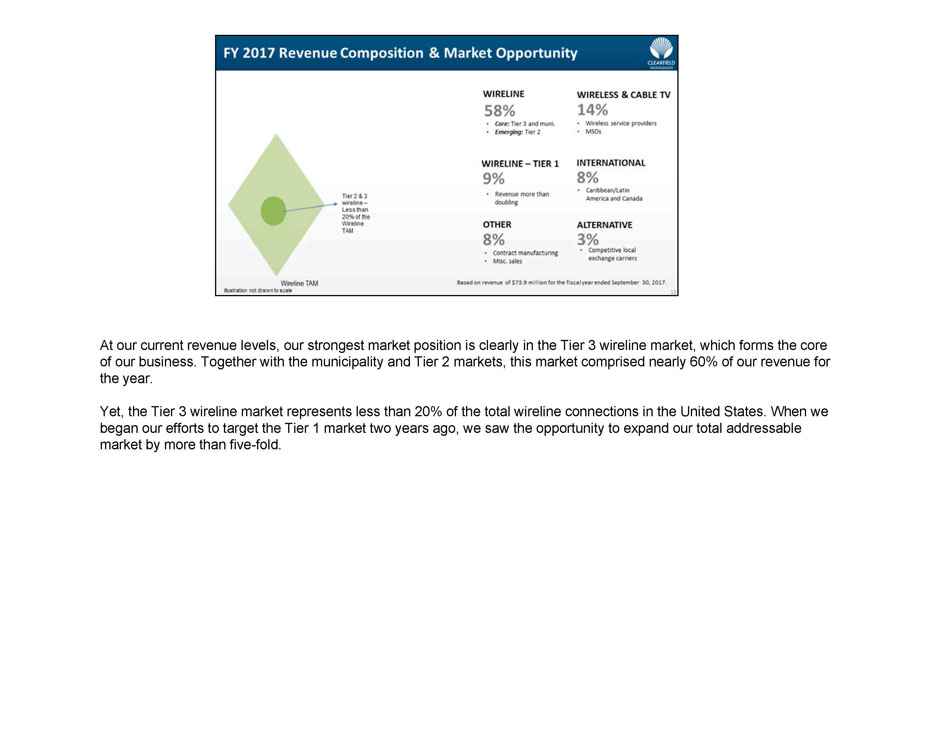

NASDAQ:CLFD FY 2017 Revenue Composition & Market Opportunity Based on revenue of $73.9 million for the fiscal year ended September 30, 2017. 14% WIRELESS & CABLE TV 8% INTERNATIONAL 9 % WIRELINE – TIER 1 3% ALTERNATIVE 58% WIRELINE 8% OTHER 12 • Wireless service providers • MSOs • Competitive local exchange carriers • Contract manufacturing • Misc. sales • Caribbean/Latin America and Canada • Core: Tier 3 and muni. • Emerging: Tier 2 • Revenue more than doubling Wireline TAM Tier 2 & 3 wireline – Less than 20 % of the Wireline TAM Illustration not drawn to scale

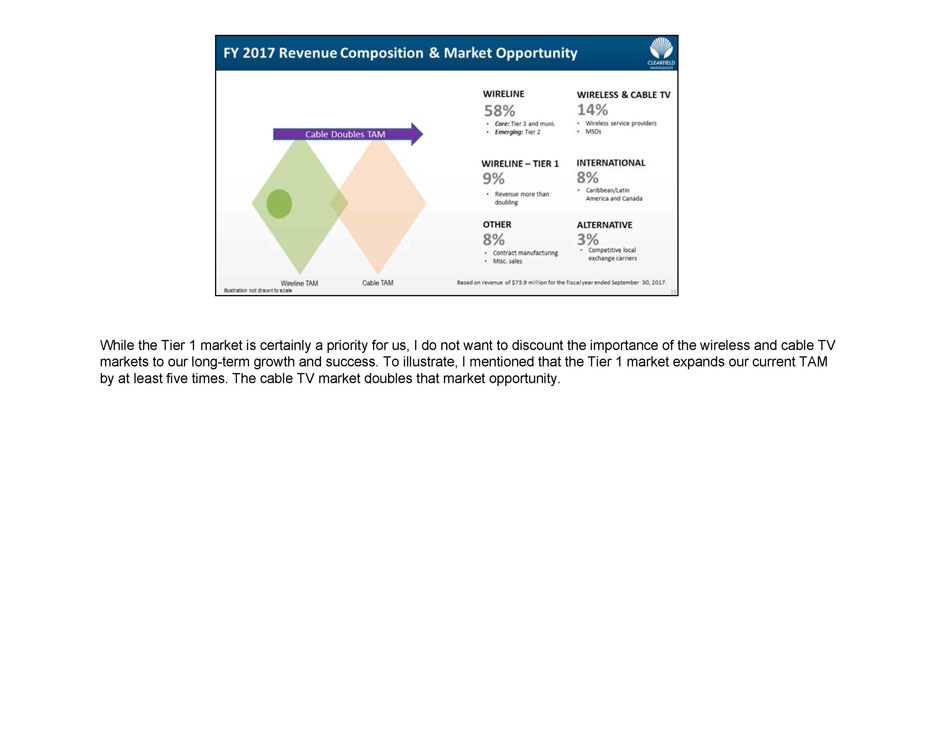

NASDAQ:CLFD FY 2017 Revenue Composition & Market Opportunity Based on revenue of $73.9 million for the fiscal year ended September 30, 2017. 13 Wireline TAM Cable TAM 14% WIRELESS & CABLE TV 8% INTERNATIONAL 9 % WIRELINE – TIER 1 3% ALTERNATIVE 58% WIRELINE 8% OTHER • Wireless service providers • MSOs • Competitive local exchange carriers • Contract manufacturing • Misc. sales • Caribbean/Latin America and Canada • Core: Tier 3 and muni. • Emerging: Tier 2 • Revenue more than doubling Illustration not drawn to scale Cable Doubles TAM

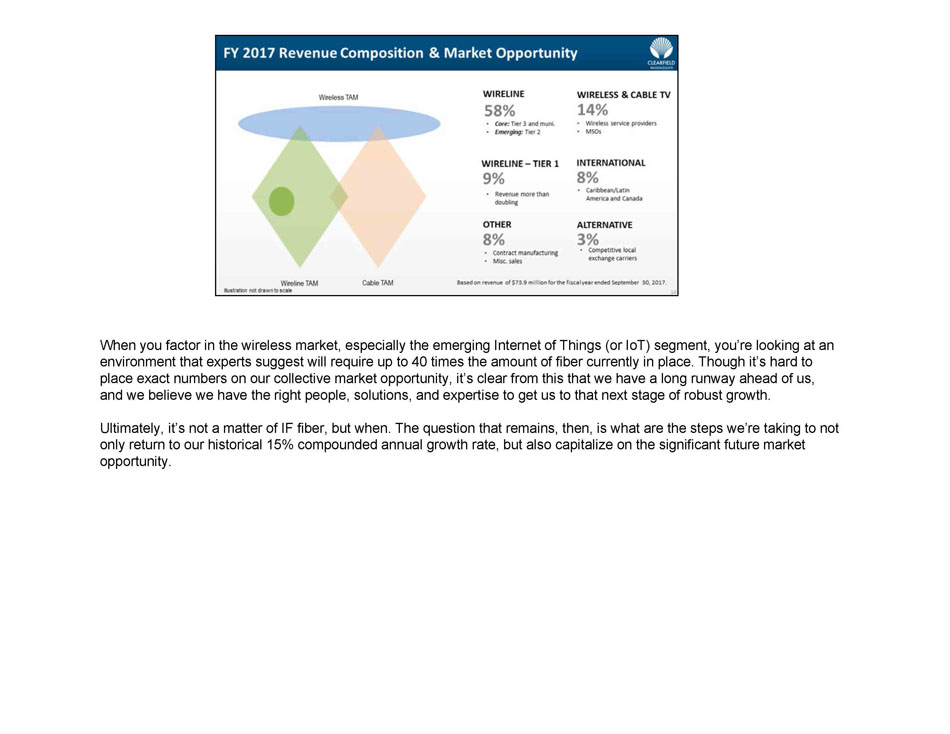

NASDAQ:CLFD FY 2017 Revenue Composition & Market Opportunity Based on revenue of $73.9 million for the fiscal year ended September 30, 2017. 14 Wireless TAM Wireline TAM Cable TAM 14% WIRELESS & CABLE TV 8% INTERNATIONAL 9 % WIRELINE – TIER 1 3% ALTERNATIVE 58% WIRELINE 8% OTHER • Wireless service providers • MSOs • Competitive local exchange carriers • Contract manufacturing • Misc. sales • Caribbean/Latin America and Canada • Core: Tier 3 and muni. • Emerging: Tier 2 • Revenue more than doubling Illustration not drawn to scale

NASDAQ:CLFD Phase I (2008 - 2015) Phase II (2015+) Phase III (2018+) • Rebuild the company • Restore balance sheet and develop profitable and sustainable growth business • Build and expand the value proposition through patented and cost - minimizing solutions • Expand into Tier 1 market through product approvals and certifications: • Certifications achieved: NEBS (central office panels); GR - 326 (SC and LC connectors and cables); GR - 487 ( Makwa ) • Product approvals gained at Verizon, AT&T, CenturyLink, Frontier, Windstream, and Charter • Secure additional partnerships that will expand “feet on the street” • Dedicate sales resources to align company with industry EF&I firms, along with optical fiber and electronics vendors for referral business opportunities • Expand product suite to add more revenue to existing clients and new markets for existing product technologies The Road to Profitably Growing Revenue Faster Than 15% 15 15 FIBER MANAGEMENT FIELDSHIELD CERTIFICATIONS NATIONAL CARRIER PRODUCT APPROVALS CHANNEL DEVELOPMENT STRATEGIC ALLIANCES MARKET & PRODUCT LINE ENHANCEMENTS

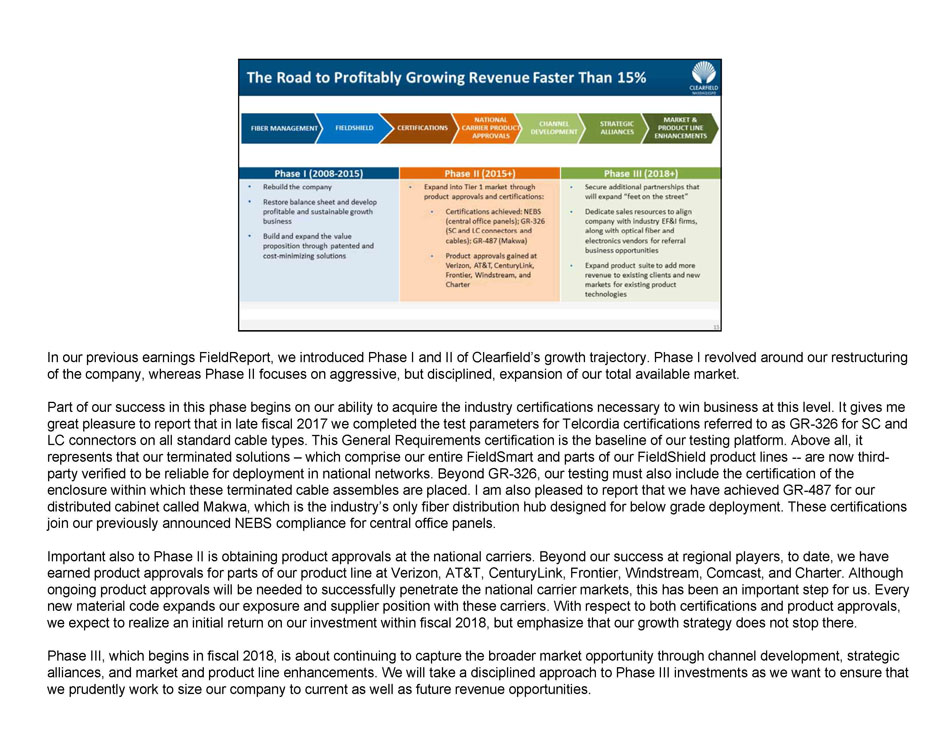

NASDAQ:CLFD Fiscal 2018 Outlook and Guidance • 5% revenue growth: – 1H 2018 to be flat, while 2H 2018 to grow 10% year - over - year – Wireline to continue growing at high single digits – Wireless and cable TV markets to continue to be at a pause – Continued acceleration in the Tier 1 market • 40 - 42% gross profit margins; • Operating expenses consistent with fiscal 2017; and • 5% net income as a percent of revenue. $37.5 $53.4 $58.0 $60.3 $75.3 $73.9 $77.6 2012 2013 2014 2015 2016 2017 2018F Revenue Growth Outlook ($ in Millions) Please note: Outlook and forecast effective only on November 9, 2017. 16

NASDAQ:CLFD Q&A 17 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

NASDAQ:CLFD Q&A 18 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

NASDAQ:CLFD Q&A 19 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

NASDAQ:CLFD Q&A 20 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

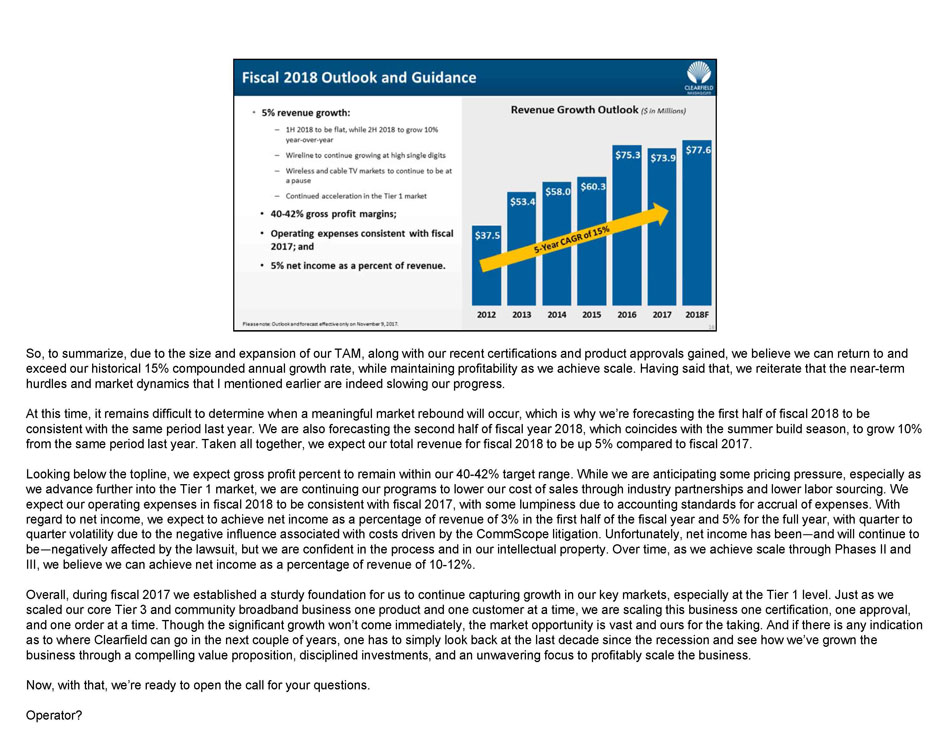

NASDAQ:CLFD 21

NASDAQ:CLFD Thank You 22 Cheri Beranek President & CEO

NASDAQ:CLFD Company Contact: Cheri Beranek CEO & President Clearfield, Inc. IR@clfd.net Investor Relations: Matt Glover or Najim Mostamand, CFA Liolios Group, Inc. (949) 574 - 3860 CLFD@liolios.com 23