Exhibit 99.1

Good afternoon. Welcome to Clearfield’s fiscal third quarter 2018 earnings conference call. My name is Ariel, and I will be your operator this afternoon.

Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions.

I would like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website.

NASDAQ:CLFD Leader in Fiber Optic Management and Connectivity Solutions Fiscal Q3 2018 Earnings Call FieldReport July 26, 2018 NASDAQ : CLFD

Please note that during the course of this call, management will be making forward-looking statements regarding future events and the future financial performance of the Company. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements.

It is important to note also that the Company undertakes no obligation to update such statements. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward-looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10-K filing with the Securities and Exchange Commission provides descriptions of those risks. As a reminder, the slides in this presentation are not controlled by the speaker but rather by you, the listener. Please advance forward through the presentation as the speaker presents their remarks.

With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek.

Please proceed.

NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlo ok, ” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example , statements about the Company’s future revenue and operating performance, integration of the acquired powered cabinet line, trends in and growt h o f the FTTx markets, effectiveness of the Company’s sales and marketing strategies and organization, utilization of manufacturing capacity, and th e d evelopment and marketing of products. These statements are based upon the Company's current expectations and judgments about future developm ent s in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without l imi tation: further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of busine ss combinations and related integration activities; to compete effectively, we must continually improve existing products and introduce new produ cts that achieve market acceptance; we must successfully integrate the acquired powered cabinet line in order to obtain the anticipated financial res ult s and customer synergies within the timeframes expected; our operating results may fluctuate significantly from quarter to quarter, which may make bud get ing for expenses difficult and may negatively affect the market price of our common stock; our success depends upon adequate protection of our pa tent and intellectual property rights; intense competition in our industry may result in price reductions, lower gross profits and loss of market s har e; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders, all of which could mat eri ally harm our business; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers, and the los s o f these major customers or significant decline in business with these major customers would adversely affect us; our planned implementation of infor mat ion technology systems could result in significant disruptions to our operations; product defects or the failure of our products to meet specificati ons could cause us to lose customers and sales or to incur unexpected expenses; we are dependent upon key personnel; we face risks associated with expan din g our sales outside of the United States; our results of operations could be adversely affected by economic conditions and the effects of these c ond itions on our customers’ businesses; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2017 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these st ate ments to reflect actual events . © Copyright 2018 Clearfield, Inc. All Rights Reserved. 2

Good afternoon, and thank you everyone for joining us today.

As expected, the fiscal third quarter represented a significant improvement from the previous quarter, largely due to the increased sales related to the summer build season. In addition to the stronger seasonality, we experienced strong sales from our acquired powered cabinet product line as well as a rebound in some of our key growth markets which had stalled in recent quarters. Revenue in the cable TV market, in particular, was up nearly 50% year-over-year and more than doubled on a sequential basis, as we took advantage of the market’s increasing appetite for fiber-deep deployments by bringing our cost-efficient FieldShield solutions deeper into our customers’ access environments. The trend in this market appears positive, and we are cautiously optimistic that we’ll be able to continue introducing this disruptive technology into the marketplace and making it easier for our customers to reap considerable labor cost savings and higher returns on investment.

On the Tier 1 front, revenues improved to be largely consistent with the same period last year. Revenues from our traditional products increased at all customers in this market segment. While we believe it is still too early to gauge how this market will shape up in the coming quarters, we are gaining confidence by the fact that all FieldShield fiber drop technology is being used in an increasing number of communities for the connection of residential as well as business class customers. Moreover, revenues resulting from the acquisition of our powered cabinet line contributed to our presence in this market segment.

Stepping back for a minute, though, to review the quarter at a higher level…

NASDAQ:CLFD Welcome 3 Cheri Beranek President & CEO

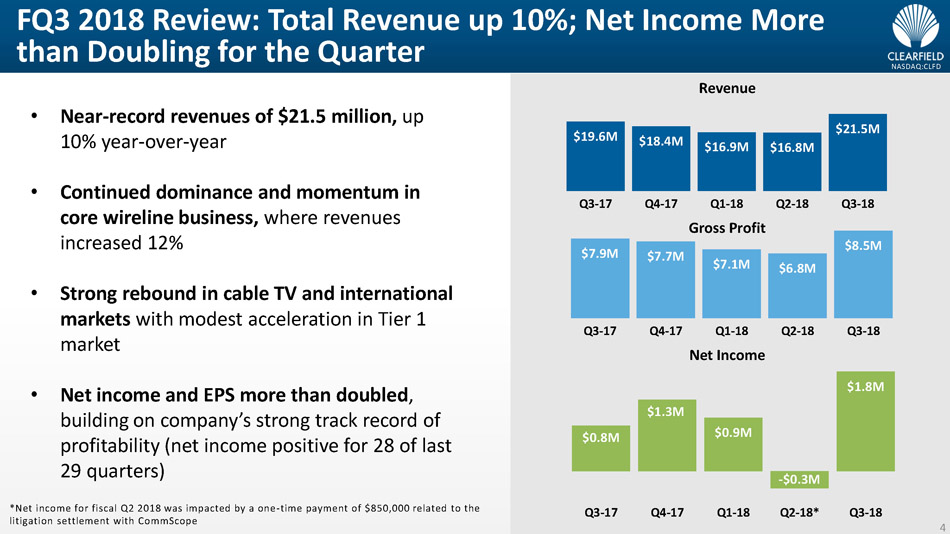

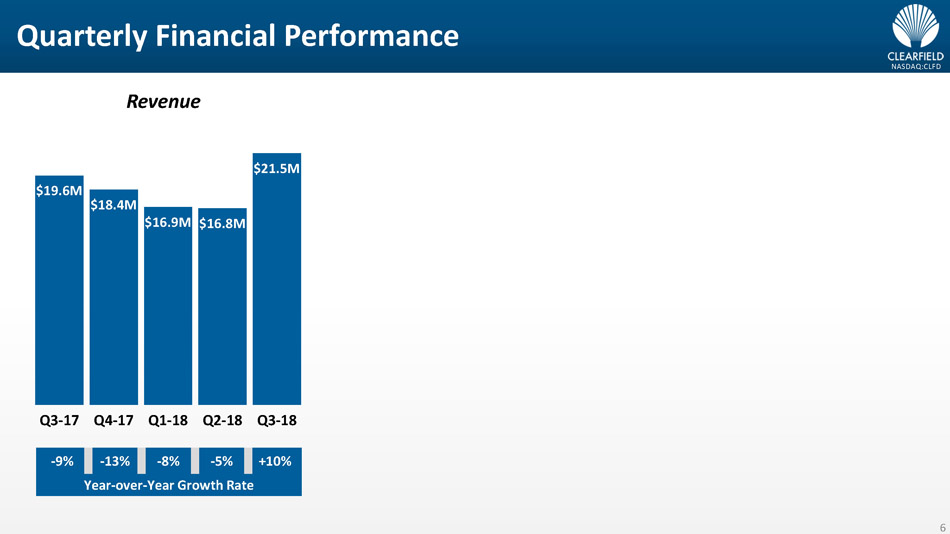

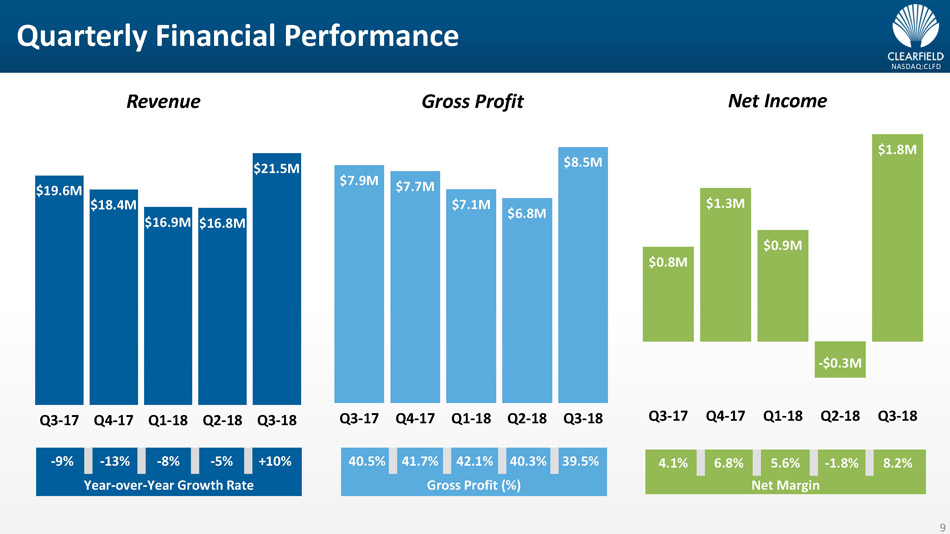

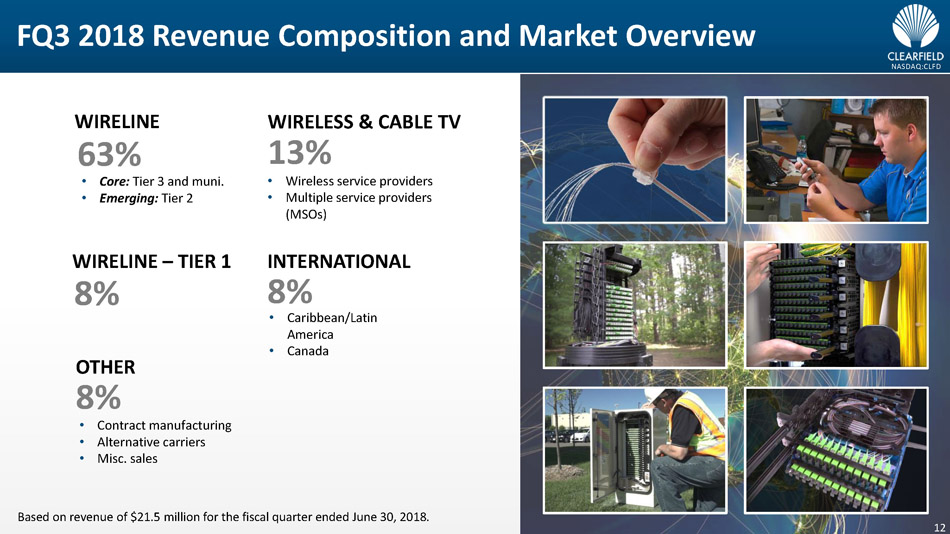

We returned to year-over-year growth for the quarter with total revenue of $21.5 million, up 10% compared to the same period last year. This strong growth was driven by our new powered cabinet line as well as the resurgence of our cable TV and international markets and the continued strength of our wireline market.

Coupled with our lower operating expenses for the quarter, our healthy topline growth resulted in income from operations increasing 82% and net income and earnings per share more than doubling for the quarter. While we are still not past some of the spending pauses that have impacted our growth in recent quarters, particularly in the wireless market, we have consistently done well in the community broadband market, chiefly Tier 3 and municipal-based broadband service providers. Revenue from this core market was up 12% year-over-year and up more than 20% on a sequential basis, demonstrating our increasing dominance in this space.

We expect fiscal fourth quarter to continue this strong performance, but note that there is some uncertainty relating to potential cost increases as we evaluate the impact of the import tariffs that were recently enacted.

But before I talk more about our overall progress as well as our future growth strategies and outlook, I’ll turn the presentation over to our CFO, Dan Herzog, who will walk us through our full financial performance for the quarter.

NASDAQ:CLFD FQ3 2018 Review: Total Revenue up 10%; Net Income More than Doubling for the Quarter 4 $19.6M $18.4M $16.9M $16.8M $21.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 $7.9M $7.7M $7.1M $6.8M $8.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Net Income Revenue Gross Profit $0.8M $1.3M $0.9M - $0.3M $1.8M Q3-17 Q4-17 Q1-18 Q2-18* Q3-18 • Near - record revenues of $21.5 million, up 10% year - over - year • Continued dominance and momentum in core wireline business, where revenues increased 12% • Strong rebound in cable TV and international markets with modest acceleration in Tier 1 market • Net income and EPS more than doubled , building on company’s strong track record of profitability (net income positive for 28 of last 29 quarters) *Net income for fiscal Q2 2018 was impacted by a one - time payment of $850,000 related to the litigation settlement with CommScope

Thank you, Cheri.

Now, looking at our financial results in more detail…

NASDAQ:CLFD Financial Update 5 Dan Herzog Chief Financial Officer

Our revenue in the third quarter of fiscal 2018 increased 10% to $21.5 million from $19.6 million in the same year-ago period. The increase, as Cheri mentioned, was driven primarily by higher sales to our Tier 3 wireline and municipal, cable TV, as well as international customers. Sales to the Tier 1 customer base were consistent with fiscal Q3 of last year at $1.6 million, whereas sales to our wireless & cable TV customers were up slightly at $2.7 million. Revenues from our traditional product categories were in line with last year’s revenue for the quarter while revenues from the acquisition of our powered cabinet line were approximately $2 million for the quarter.

Looking at our international business, revenue increased 54% to $1.8 million from $1.2 million in the same year-ago period. This increase was driven by a resurgence in the Central and Latin America, or CALA, market, where we began to receive orders that were anticipated but delayed earlier in the year.

NASDAQ:CLFD Quarterly Financial Performance $19.6M $18.4M $16.9M $16.8M $21.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Revenue - 9% - 13% - 8% - 5% +10% Year - over - Year Growth Rate 6

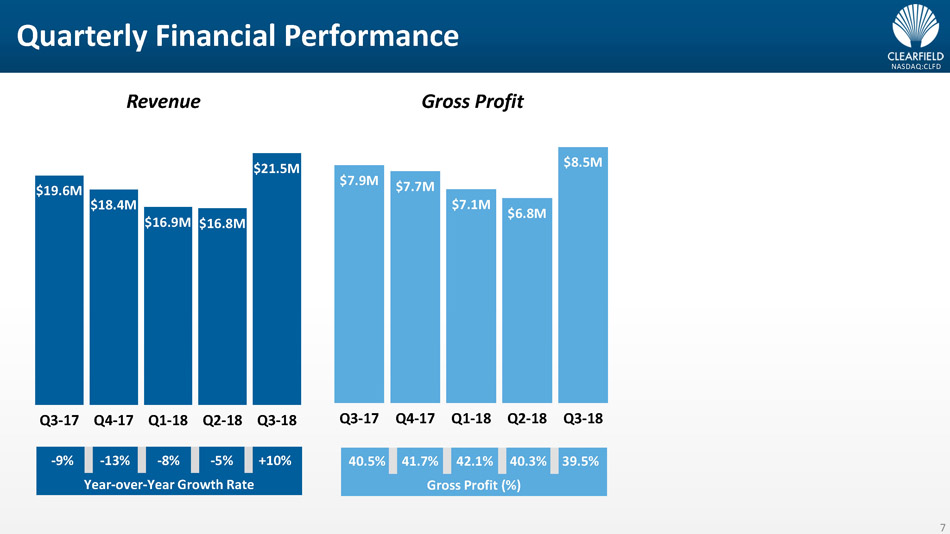

Gross profit for the third quarter of fiscal 2018 increased 7%, as compared to the third quarter of fiscal 2017, to $8.5 million. At 39.5% of total revenue, gross profit percent was lower than the same quarter last year but near our target range of 40-42%.

As we forecasted last quarter, we experienced slightly lower margins in fiscal Q3 due to the assimilation of our acquired powered cabinet line into our manufacturing processes. While these products have been immediately accretive to our bottom line, they do have margins that are lower than our overall corporate margins. As a result, we anticipate gross margins to hover around the lower-end of our target range for the remainder of fiscal 2018.

As we look to the next fiscal year, we are evaluating the potential impact of the import tariffs that were recently enacted on our operating expense profile. While we are confident in our supply chain as well as our domestic and Mexican-based manufacturing operations, we recognize that there is uncertainty related to potential cost increases related to these actions.

NASDAQ:CLFD Quarterly Financial Performance $7.9M $7.7M $7.1M $6.8M $8.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Gross Profit 40.5% 41.7% 42.1% 40.3% 39.5% Gross Profit (%) 7 $19.6M $18.4M $16.9M $16.8M $21.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Revenue - 9% - 13% - 8% - 5% +10% Year - over - Year Growth Rate

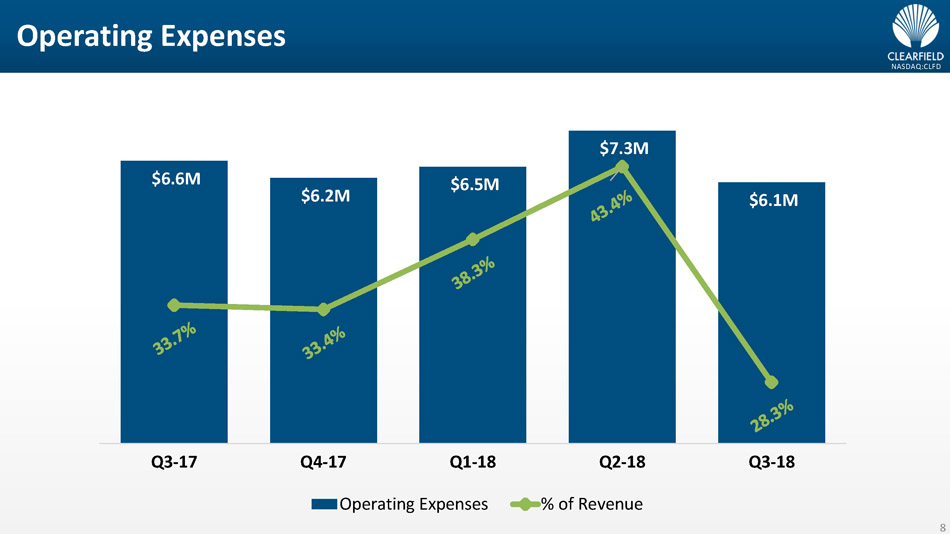

Our operating expenses for fiscal Q3 were $6.1 million, which were down 8% from the same year-ago quarter. The decrease was primarily due to a one-time charge associated with the impairment of a long-lived asset that occurred during the third quarter of fiscal 2017. Operating expenses were down $1.2 million from the second quarter of fiscal 2018 primarily due to the one-time costs that occurred last quarter associated with the settlement of the patent infringement lawsuit. As expected, our legal expenses have returned to normalized levels, and as such, we continue to anticipate operating expenses for fiscal 2018 to range between 35% and 37% of revenue.

NASDAQ:CLFD Operating Expenses $6.6M $6.2M $6.5M $7.3M $6.1M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Operating Expenses % of Revenue 8

Net income for the fiscal third quarter was up 118% to $1.8 million, or $0.13 per diluted share, from $803,000, or $0.06 per diluted share, in the same year-ago quarter. With the settlement of the litigation, we expect to continue generating healthy bottom-line results going forward.

Turning now to our balance sheet…

NASDAQ:CLFD Quarterly Financial Performance 4.1% 6.8% 5.6% - 1.8% 8.2% Net Margin 9 $19.6M $18.4M $16.9M $16.8M $21.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Revenue - 9% - 13% - 8% - 5% +10% Year - over - Year Growth Rate $7.9M $7.7M $7.1M $6.8M $8.5M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Gross Profit 40.5% 41.7% 42.1% 40.3% 39.5% Gross Profit (%) $0.8M $1.3M $0.9M - $0.3M $1.8M Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Net Income

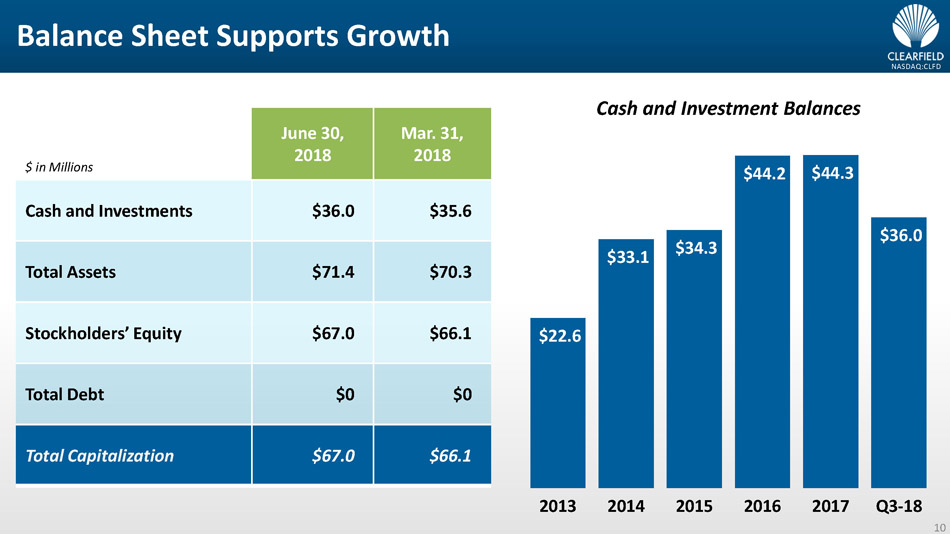

During the fiscal third quarter, our cash, cash equivalents and investments increased to $36.0 million from $35.6 million in the prior quarter ended March 31, 2018. The increase in cash and investments was primarily due to strong cash flow from operations.

During the third quarter, we repurchased a total of 100,133 shares, utilizing $1.1 million in cash. As of June 30, 2018, we have repurchased an aggregate of 489,018 shares for approximately $6.2 million under the program, leaving approximately $5.8 million available within our $12 million stock repurchase program.

Now with that, I would like to turn the call back over to Cheri for her insights into our operations for the fiscal quarter, as well as our outlook and strategic initiatives for the remainder of fiscal 2018 and beyond.

Cheri?

NASDAQ:CLFD Balance Sheet Supports Growth $ in Millions June 30, 2018 Mar. 31, 2018 Cash and Investments $36.0 $35.6 Total Assets $71.4 $70.3 Stockholders’ Equity $67.0 $66.1 Total Debt $0 $0 Total Capitalization $67.0 $66.1 $22.6 $33.1 $34.3 $44.2 $44.3 $36.0 2013 2014 2015 2016 2017 Q3-18 Cash and Investment Balances 10

Thanks, Dan.

NASDAQ:CLFD Operational Update and Outlook 11 Cheri Beranek President & CEO

NASDAQ:CLFD FQ3 2018 Revenue Composition and Market Overview Based on revenue of $21.5 million for the fiscal quarter ended June 30, 2018. 13% WIRELESS & CABLE TV 8 % INTERNATIONAL 8 % WIRELINE – TIER 1 63% WIRELINE 8% OTHER 12 • Wireless service providers • Multiple service providers (MSOs) • Contract manufacturing • Alternative carriers • Misc. sales • Caribbean/Latin America • Canada • Core: Tier 3 and muni. • Emerging: Tier 2

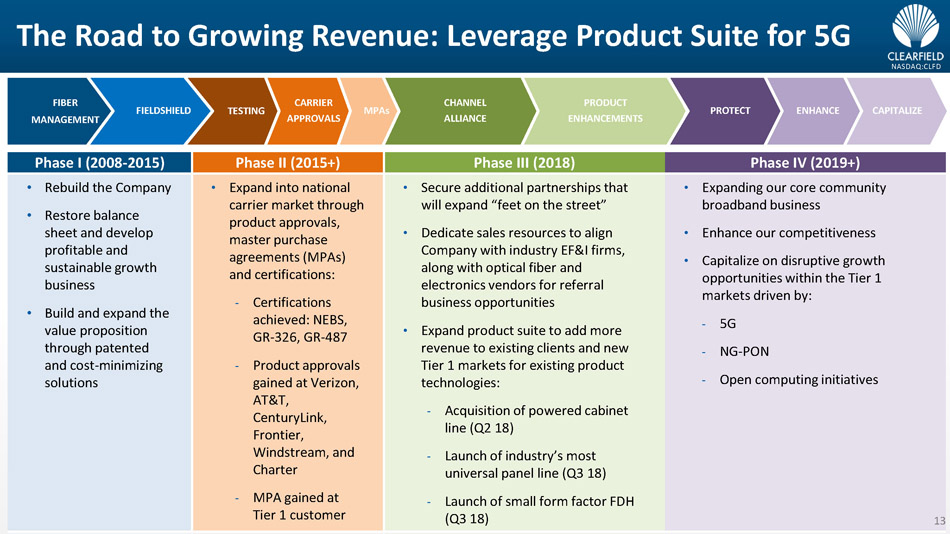

As we look forward, our growth strategies will support the continued expansion of our core, which represents our market-leading position in the community broadband marketplace. As I alluded to earlier, we’ve consistently been growing between 8%-12% in this market, and we plan to maintain this steady growth rate by attracting utilities, cooperatives and competitive local exchange carriers as they enter these under-served communities.

Building off this, we will also be looking to enhance our competitive position. By investing in our products, manufacturing, and supply chain, our aim is to proactively cost-reduce our solutions. During the fiscal third quarter, we took several steps to integrate the manufacturing processes of our recently acquired cabinet line into our supply chain so that we can improve lead times, increase contribution margins, expand our total addressable market, and ultimately, position the platform so that it can serve as a critical and modular piece to the rollout of emerging technologies, such as 5G and NG-PON2. In addition, we launched two new products last quarter—our new aerial terminal and small-count fiber distribution hub—which have both been performing better than expected and give us a stronger foothold in our markets. Though by no means all-inclusive, these are just some of the initiatives we’re undertaking to make headway in this second component of our growth strategy.

We are always looking to capitalize on disruptive growth opportunities that can scale our business. This is done by listening to the needs of our constituencies and leveraging our application knowledge to help our customers build the fiber networks of tomorrow. Perhaps the best historical example of this has been our early work with Google Fiber, who utilized our OSP cabinet platform for some of the industry’s first success-based deployment programs. More recently, diverse organizations such as Windstream and CableOne are pioneering innovative deployment models of their own, and we’re proud that our technology platforms are a strategic element of their growth initiatives.

NASDAQ:CLFD Phase I (2008 - 2015) Phase II (2015+) Phase III ( 2018) Phase IV (2019+) • Rebuild the Company • Restore balance sheet and develop profitable and sustainable growth business • Build and expand the value proposition through patented and cost - minimizing solutions • Expand into national carrier market through product approvals, master purchase agreements (MPAs) and certifications: - Certifications achieved: NEBS, GR - 326, GR - 487 - Product approvals gained at Verizon, AT&T, CenturyLink, Frontier, Windstream, and Charter - MPA gained at Tier 1 customer • Secure additional partnerships that will expand “feet on the street” • Dedicate sales resources to align Company with industry EF&I firms, along with optical fiber and electronics vendors for referral business opportunities • Expand product suite to add more revenue to existing clients and new Tier 1 markets for existing product technologies: - Acquisition of powered cabinet line (Q2 18) - Launch of industry’s most universal panel line (Q3 18) - Launch of small form factor FDH (Q3 18) • Expanding our core community broadband business • Enhance our competitiveness • Capitalize on disruptive growth opportunities within the Tier 1 markets driven by: - 5G - NG - PON - Open computing initiatives The Road to Growing Revenue: Leverage Product Suite for 5G 13 FIBER MANAGEMENT FIELDSHIELD TESTING CARRIER APPROVALS MPAs CHANNEL ALLIANCE PRODUCT ENHANCEMENTS PROTECT ENHANCE CAPITALIZE

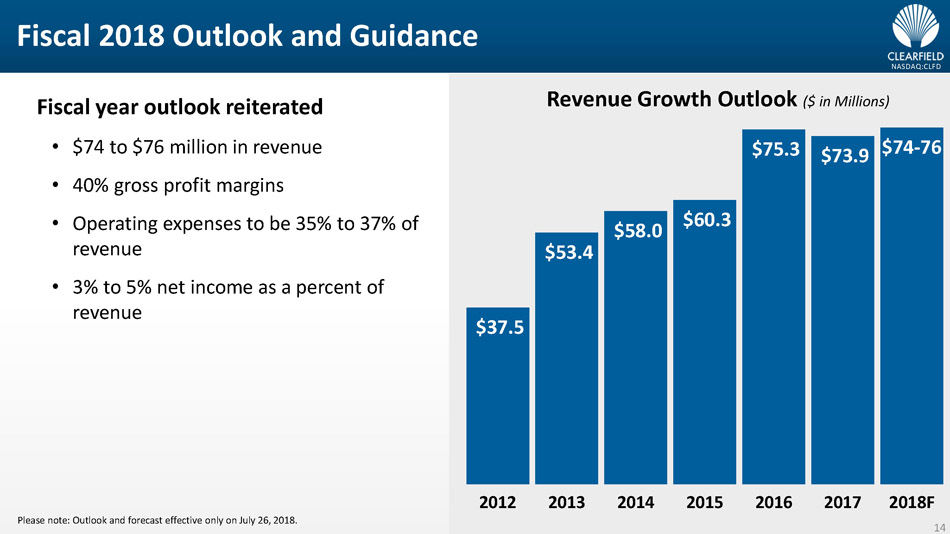

With the strong backlog we had entering the quarter and the bookings we have secured so far, we are confident in achieving our guidance for fiscal 2018. Fiscal year 2018 guidance is revenue of $74 to $76 million, gross profit margins around 40%, operating expenses between 35% and 37% of revenue, and net income as a percentage of revenue between 3% and 5%.

While this forecast represents revenue growth for the year of flat to 2% as compared to the prior fiscal year, it’s important to note this forecast represents a growth rate of 5 to 10% in revenue and more than a 50% increase in net income for the six month period ending September 30, 2018 compared to that same period in 2017.

Now, with that, we’re ready to open the call for your questions.

Operator?

NASDAQ:CLFD Fiscal 2018 Outlook and Guidance $37.5 $53.4 $58.0 $60.3 $75.3 $73.9 $74 - 76 2012 2013 2014 2015 2016 2017 2018F Revenue Growth Outlook ($ in Millions) Please note: Outlook and forecast effective only on July 26, 2018. 14 Fiscal year outlook reiterated • $74 to $76 million in revenue • 40 % gross profit margins • Operating expenses to be 35% to 37% of revenue • 3% to 5% net income as a percent of revenue

Operator

Our first question comes from Jaeson Schmidt of Lake Street Capital Markets.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

I just want to start on a quick clarification on gross margin. Cheri, I know you mentioned that you expect 40% for fiscal '18. Should we expect that sort of level for the September quarter as well?

Cheri Beranek

Chief Executive Officer, President & Director

That would be consistent, yes.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay, perfect. And I'm wondering if you could just comment on what you've seen as far as visibility, has that improved over the past 3 months? Or has it remained relatively unchanged?

Cheri Beranek

Chief Executive Officer, President & Director

It's still pretty unchanged. The -- there's -- I would say that there's a little bit of stabilization in that we're not seeing huge aggressive build plans on some of the -- in the Tier 1 markets that we saw stabilize earlier. So I don't think we're going to see a change in that space. So I guess in that standpoint, the visibility is there. But in general, I think we're seeing fiscal year '18 stabilize and that fiscal year '19, is when we're going to see a broader orientation of the marketplace being a little bit more sure about what they're looking to do.

NASDAQ:CLFD Q & A 15 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay, that makes sense. And it sounds like the Calix business continues to perform well. I know it's early, but curious if you could comment on how the customer engagement has been overall. I know one of the big pros of that purchase was strengthening the customer relationship throughout the channel. Just curious, if you could comment on that.

Cheri Beranek

Chief Executive Officer, President & Director

We're very pleased to begin integrating powered cabinets into our portfolio, and that we think the opportunity to provide powered cabinets to all of our customers regardless of the electronics platform that they're using is an important growth initiative for us. Working with the Calix sales organization has -- it's been a long-term initiative for Clearfield and the acquisition of that cabinet line from them I think further cements that, and we've been very pleased to support their sales organization of -- from a manufacturing and enablement basis. That said, I think it's important for us to know that we stand behind and in support of the Calix organization, but we also stand in support of other electronics spenders in the marketplace as we've always maintained a vendor-neutral position in that category.

NASDAQ:CLFD Q & A 16 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

Timothy Savageaux

Northland Capital Markets, Research Division

First question, you saw a nice rebound on the Tier 1 side from previous levels, at least on a sequential basis. And I wonder, if you can comment more on that, whether that may be connected to kind of a wrapping up of whatever merger-related reviews might be going on or your own kind of efforts to penetrate various carriers or if there any broader trends underlying that uptick you saw on a Tier 1 basis sequentially?

Cheri Beranek

Chief Executive Officer, President & Director

There are really three aspects of that rebound in that quarter 3 revenues were consistent with revenues of quarter three of last year. The -- certainly some of it is the stabilization of the merger-related activities at one of our larger Tier 1 providers. Second of it is, as we pointed out the acquisition of powered cabinet line did contribute to that uptick in that a portion of those sales were sold into the Tier 1 market. And then finally, we do -- have been continuing to expand our sale of FieldShield technologies to other Tier 1 carriers and that we now have three customers for FieldShield in the Tier 1 market.

Timothy Savageaux

Northland Capital Markets, Research Division

Got it. And then, I guess similar question on the cable TV side. I know, I think that it was last call, you talked about some potential for a rebound, and I thought in fiscal Q4. Did that come earlier than expected, or is this some kind of separate driver in terms of renewed cable strength?

Cheri Beranek

Chief Executive Officer, President & Director

I think the cable TV market is rebounding in regard to its -- our availability into that space. You saw that we did pick up a -- another national contract. The -- or purchase agreement -- material purchase agreement and that was instrumental. We didn't know when that was going to happen, so we're really pleased that Q3 happened and we were able to pull that forward. And we're also seeing strong opportunities in not only the national of broader-base cable TV markets, but also the regional carriers such as CableOne or Mediacom that I pointed out earlier in the presentation.

NASDAQ:CLFD Q & A 17 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

Timothy Savageaux

Northland Capital Markets, Research Division

Got it. And you mentioned Google Fiber, I think, just sort of in passing. But at least they seem potentially excited about some of this activity at the FCC around pole attachments. And I guess it's coming up pretty soon. I don't know if you -- I don't know -- you probably don't break out the CLEC portion of your revenues anymore, it's gotten pretty small. But I wonder if you could kind of comment on the potential for that segment to rebound at all, and what your expectations might be there.

Cheri Beranek

Chief Executive Officer, President & Director

I'm not going to address specific accounts in that regard because we certainly don't -- we're not privy to any of their particular build plans. But I think this is the opportunity at the SEC to be able to address One Touch Make Ready and some of the other challenges that are in front of them will be an important growth initiative for everyone in this market. And to be clear in regard to where the expectations are, it's going to be an important means for us to all be able to move forward. I think the -- another aspect of that is really some of the Make Ready world for 5G that has -- you've I'm sure heard some of the calls in the last couple of days on how -- while some of these cable providers numbers are significantly up, the CapEx spend in wireless is significantly down. And that's waiting for that Make Ready, that One Touch capability is to ensure that they're touching their networks once, their touching their towers once. And that really will position all of us that are a part of that initiative, whether it's wireline, wireless or CLEC for growth as we move forward.

Timothy Savageaux

Northland Capital Markets, Research Division

Got it. Last question from me on the OpEx side. If you take out that one-time item from last quarter, your OpEx has been trending flat to down pretty nicely, and I think year-to-date, you might even be a little bit below the low end of your range from an OpEx to revenue standpoint on that basis. Is there any reason to expect a big uptick in OpEx in Q4? Or you can describe the (inaudible)

Cheri Beranek

Chief Executive Officer, President & Director

No, we're at a -- Yes. I mean it's as if we -- I don't believe in lumpiness. And so we're -- when we had factors that were outside of our control such as the litigation issues, we saw lumpiness. But for the full year, we're really looking at that 35% to 37% range. And we're underneath that in Q3. But for a full year program, that's the model you should use. And there's going to be some lumps in regard to bonus accruals and lumps associated with trade show activities, those kinds of things. But for a full year model, that 35% range is a nice target.

NASDAQ:CLFD Q & A 18 Cheri Beranek President & CEO Dan Herzog Chief Financial Officer

This concludes our question and answer session.

If your question was not taken, you may contact Clearfield’s investor relations team at CLFD@liolios.com. The Company will post the most relevant questions and answers in the ‘For Investors’ section of Clearfield’s website.

I’d now like to turn the call back over to CEO, Cheri Beranek, for her closing comments.

NASDAQ:CLFD 19

Thanks again today for joining the call. Thank you to our employees and partners of course who have their continued support. Thank you to you, our shareholders, who are supporting the Company's evolution into this next phase of our growth.

We look forward to updating you on our progress soon. Bye for now.

NASDAQ:CLFD Thank You 20 Cheri Beranek President & CEO

Thank you for joining us today for Clearfield’s fiscal third quarter 2018 earnings conference call. You may now disconnect.

NASDAQ:CLFD Company Contact: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net Investor Relations: Matt Glover or Najim Mostamand, CFA Liolios Group, Inc. (949) 574 - 3860 CLFD@liolios.com 21