Exhibit 99.1

NASDAQ:CLFD Leader in Fiber Optic Management and Connectivity Solutions 2019 Shareholder Meeting February 2019 NASDAQ: CLFD 1

NASDAQ:CLFD Call to Order This meeting was called by a notice and proxy statement first mailed on January 8, 2019 to all shareholders of record on December 26, 2018 We have received proxies representing more than a majority of the outstanding shares of common stock. Therefore, this meeting has been duly called and a quorum is present. 2

NASDAQ:CLFD Agenda • Elect six (6) directors to serve until the next Annual Meeting of the Shareholders or until their respective successors have been elected and qualified; • Approve, on a non - binding advisory basis, the compensation paid to our named executive officers; and • Ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm for Clearfield, Inc. for the fiscal year ending September 30, 2019. 3

NASDAQ:CLFD Voting 4

NASDAQ:CLFD Adjournment 5

NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, integration of the acquired active cabinet line, trends in and growth of the FTTx markets, market segments or customer purchases, effectiveness of the Company’s sales and marketing strategies and organization, utilization of manufacturing capacity, and the development and marketing of products. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; we must successfully integrate the acquired active cabinet line in order to obtain the anticipated financial results and customer synergies within the timeframes expected; our operating results may fluctuate significantly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market price of our common stock; our success depends upon adequate protection of our patent and intellectual property rights; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders, all of which could materially harm our business; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers, and the loss of these major customers or significant decline in business with these major customers would adversely affect us; our planned implementation of information technology systems could result in significant disruptions to our operations; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent upon key personnel; we face risks associated with expanding our sales outside of the United States; our results of operations could be adversely affected by economic conditions and the effects of these conditions on our customers’ businesses; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2018 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2019 Clearfield, Inc. All Rights Reserved. 6

NASDAQ:CLFD What We Do With unrivaled product innovations and agile service response, Clearfield ® is accelerating cost - effective fiber fed deployments with the industry's most craft - friendly fiber management and pathway products 7

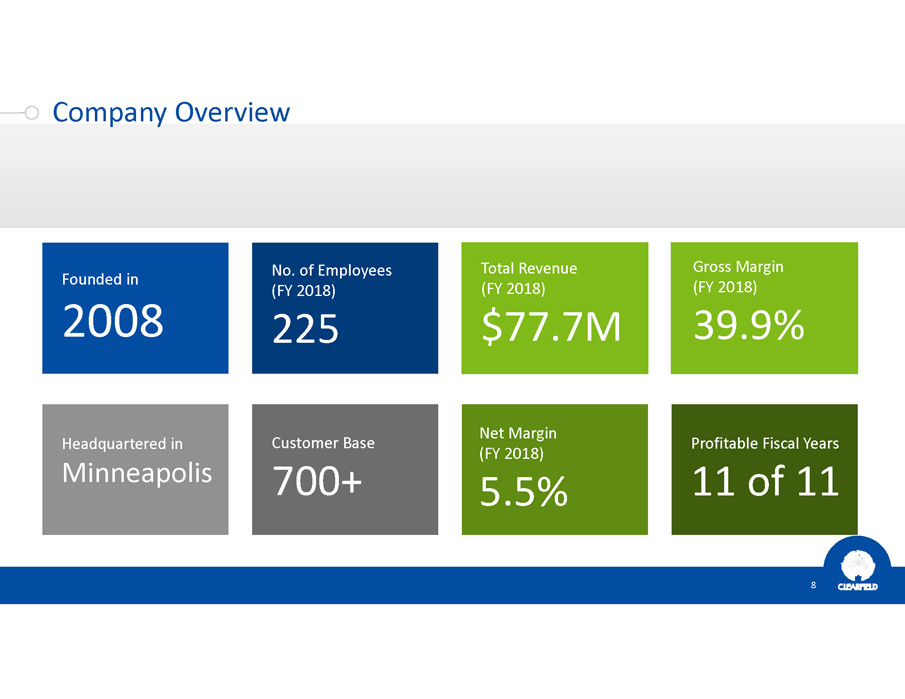

NASDAQ:CLFD Company Overview 8 Founded in 2008 Headquartered in Minneapolis No. of Employees (FY 2018) 225 Customer Base 700+ Total Revenue (FY 2018) $77.7M Gross Margin (FY 2018) 39.9% Net Margin (FY 2018) 5.5% Profitable Fiscal Years 11 of 11

NASDAQ:CLFD Celebrating 11th Anniversary: 20+ Million Fiber Ports Delivered 9 Clearfield ® is born Launched patented Clearview ® Cassette Recognized for optical component packaging for hardened environments Entered Caribbean and Latin America (CALA) markets Launched FieldShield ® Expanded manufacturing capacity with Mexico facility Moved to larger U.S. facility to expand manufacturing and operations capacity YOURx ™ platform launched Telcordia certifications announced Expanded TAM by 10% with acquisition of Calix powered cabinet line Included in 700+ fiber deployments 2008 2008 2010 2012 2013 2014 2015 2016 2017 2018 Today

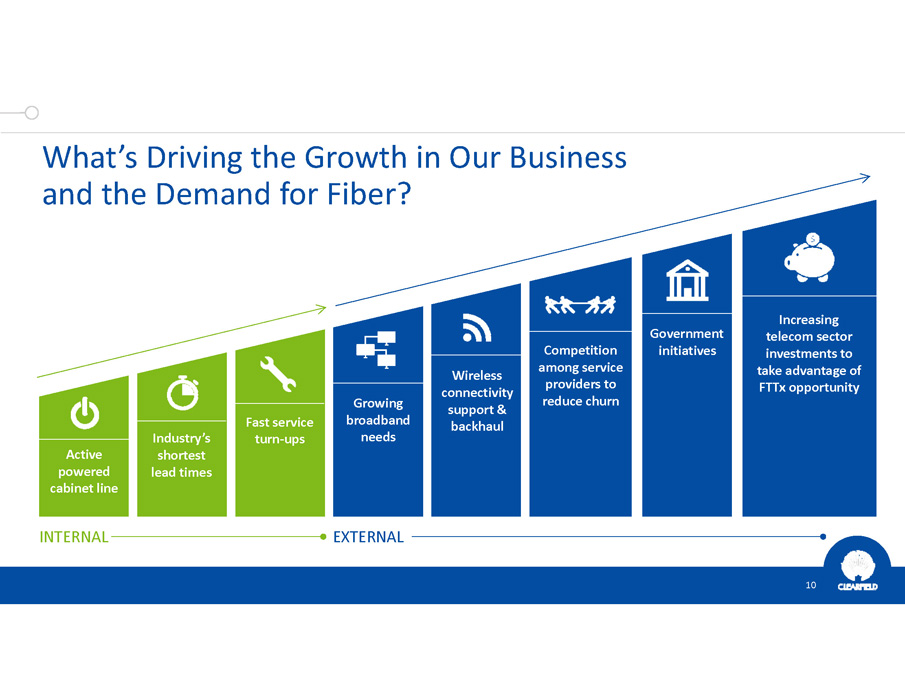

NASDAQ:CLFD What’s Driving the Growth in Our Business and the Demand for Fiber? 10 Active powered cabinet line Industry’s shortest lead times Fast service turn - ups INTERNAL EXTERNAL Growing broadband needs Wireless connectivity support & backhaul Competition among service providers to reduce churn Increasing telecom sector investments to take advantage of FTTx opportunity Government initiatives

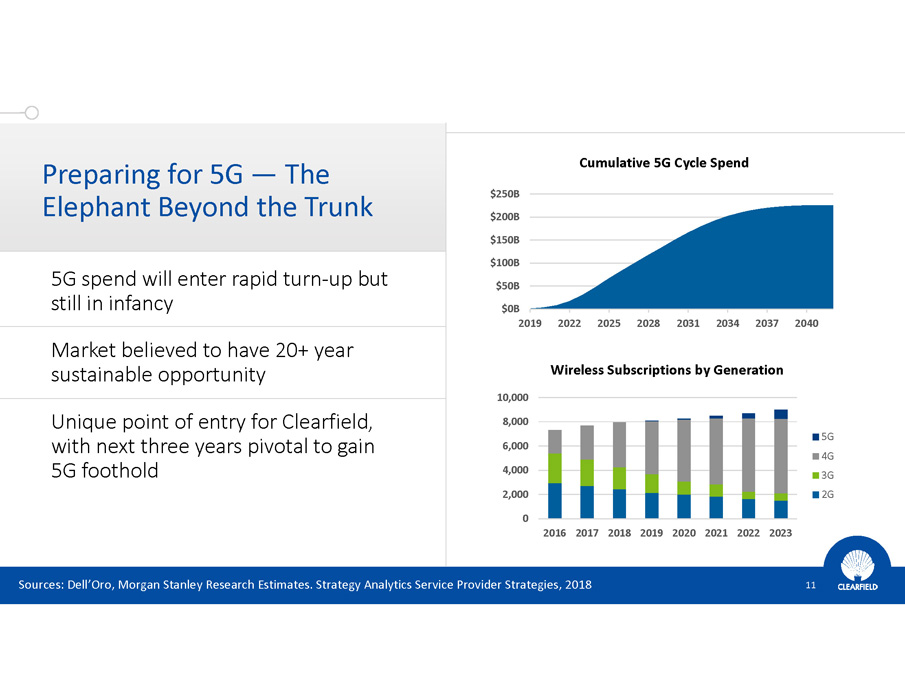

NASDAQ:CLFD Preparing for 5G — The Elephant Beyond the Trunk 5G spend will enter rapid turn - up but still in infancy Market believed to have 20+ year sustainable opportunity Unique point of entry for Clearfield, with next three years pivotal to gain 5G foothold 11 $0B $50B $100B $150B $200B $250B 2019 2022 2025 2028 2031 2034 2037 2040 Cumulative 5G Cycle Spend 0 2,000 4,000 6,000 8,000 10,000 2016 2017 2018 2019 2020 2021 2022 2023 5G 4G 3G 2G Wireless Subscriptions by Generation Sources: Dell’Oro , Morgan Stanley Research Estimates. Strategy Analytics Service Provider Strategies, 2018

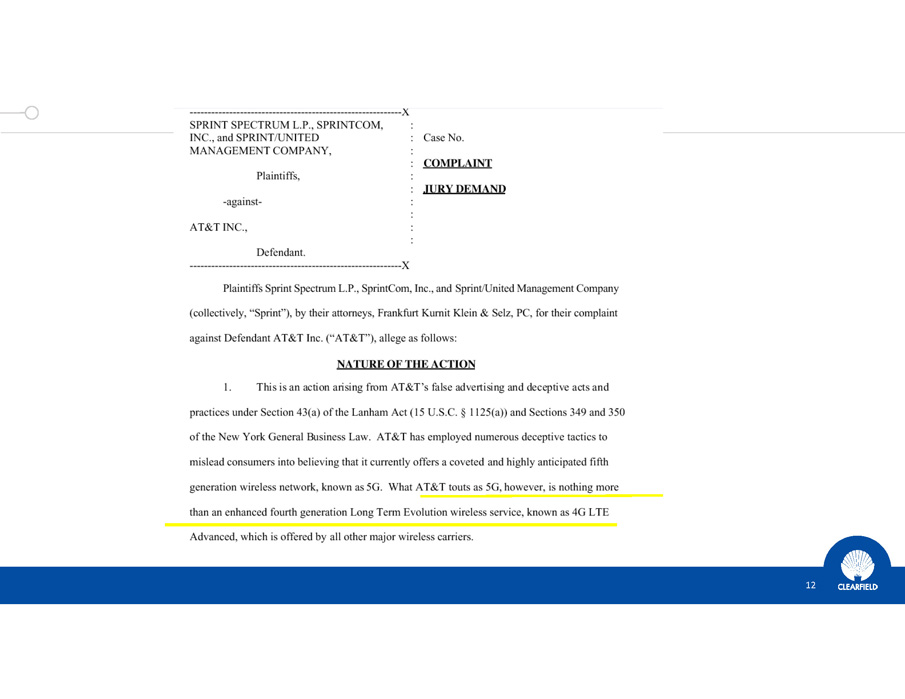

NASDAQ:CLFD 12

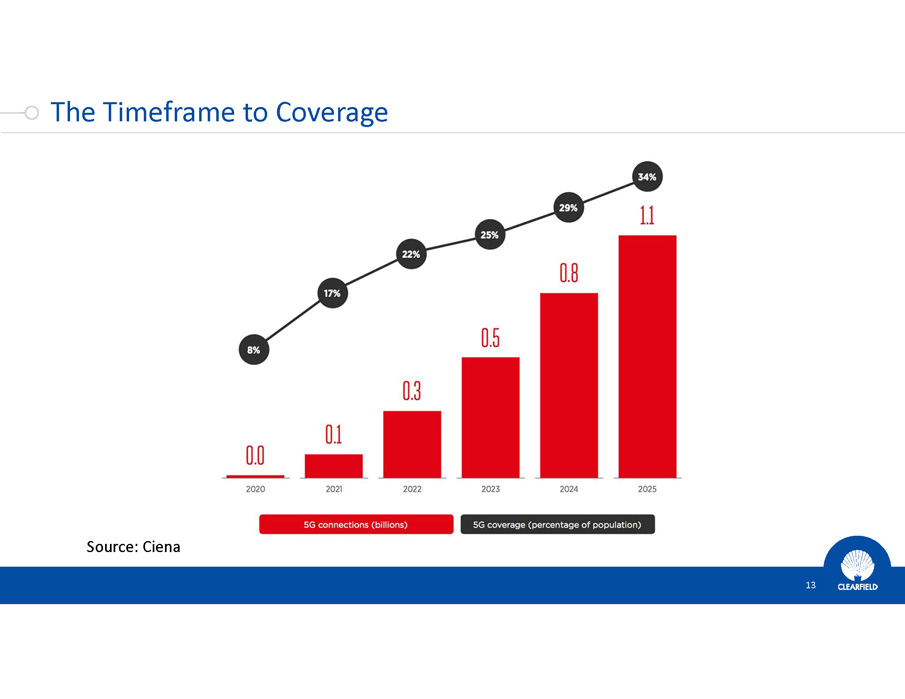

NASDAQ:CLFD Source: Ciena The Timeframe to Coverage 13

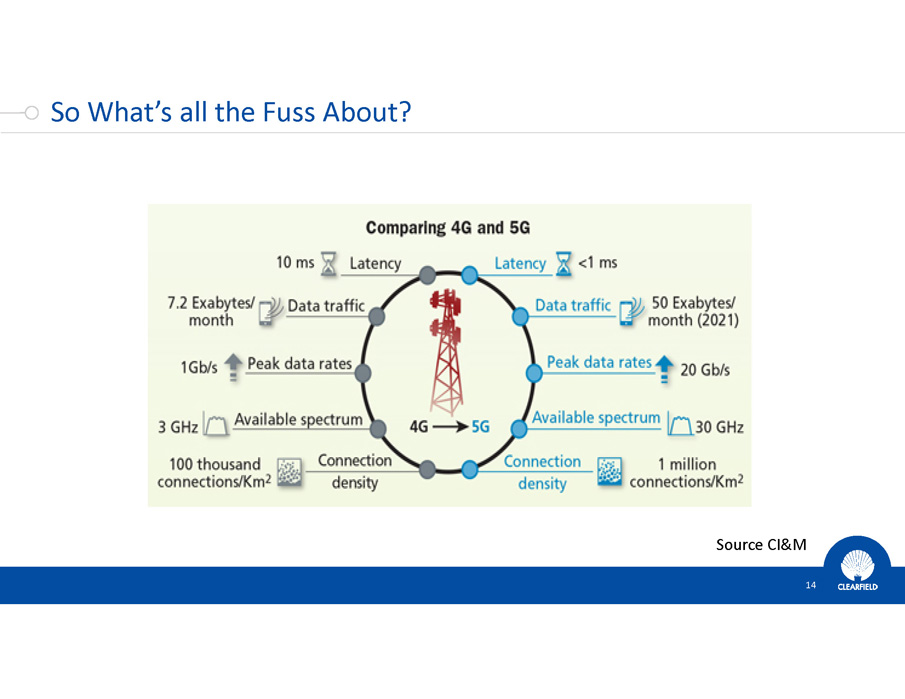

NASDAQ:CLFD Source CI&M So What’s all the Fuss About? 14

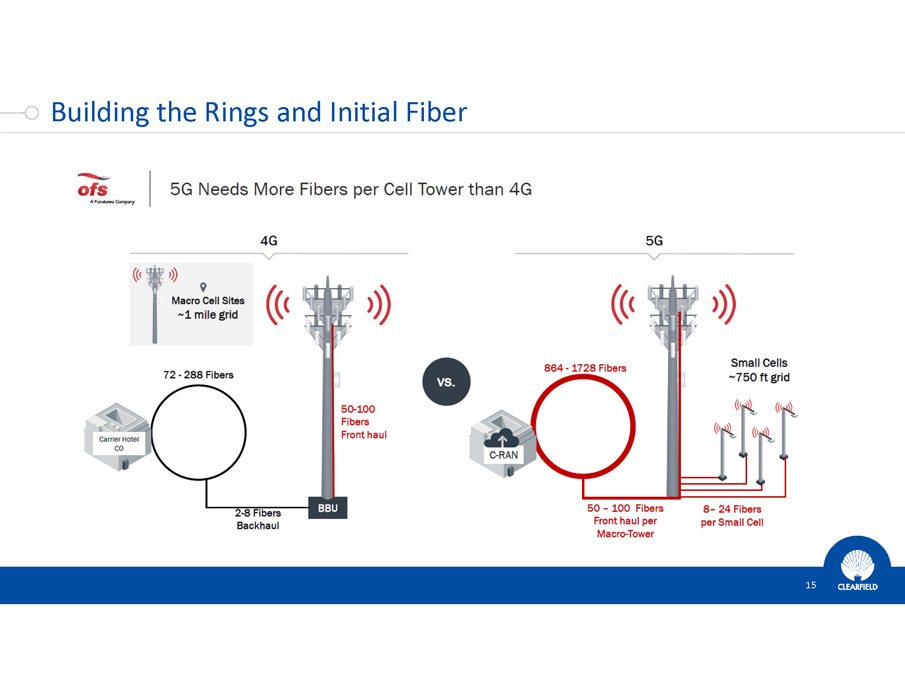

NASDAQ:CLFD Building the Rings and Initial Fiber 15

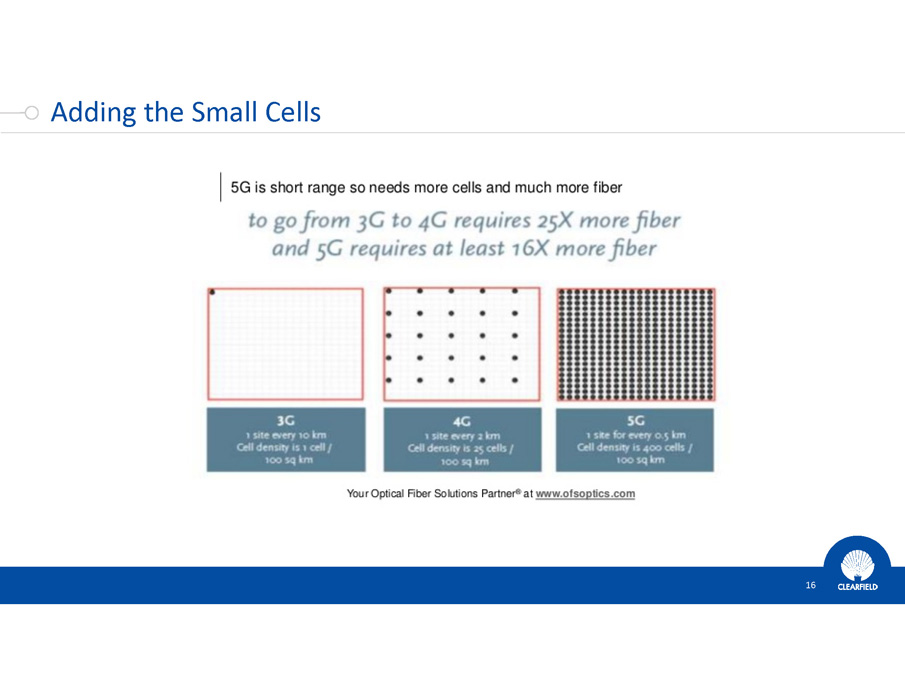

NASDAQ:CLFD Adding the Small Cells 16

NASDAQ:CLFD Source: Broadband Properties Integrating the Small Cells 17

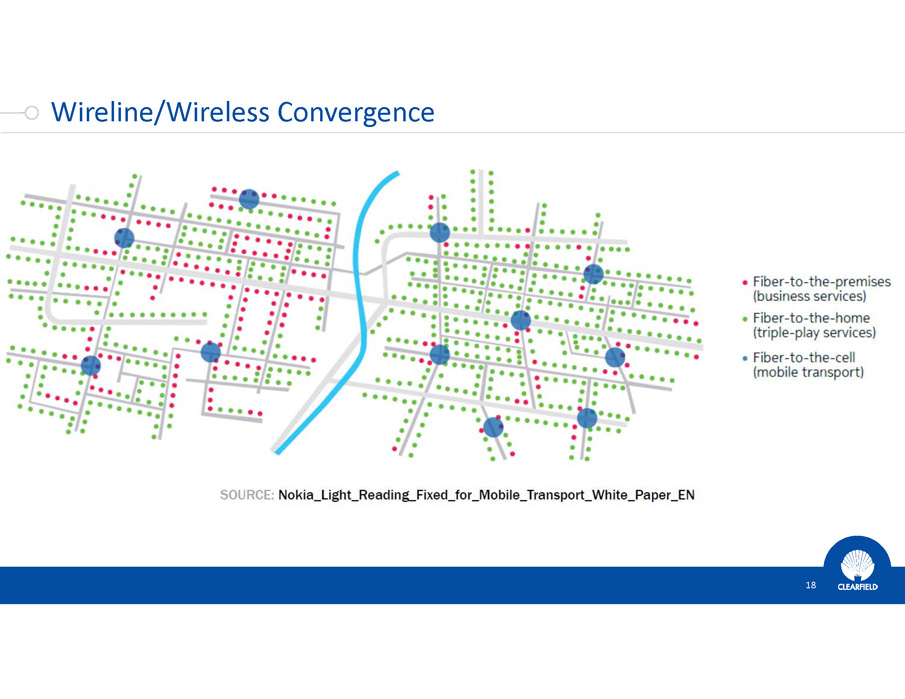

NASDAQ:CLFD Wireline/Wireless Convergence 18

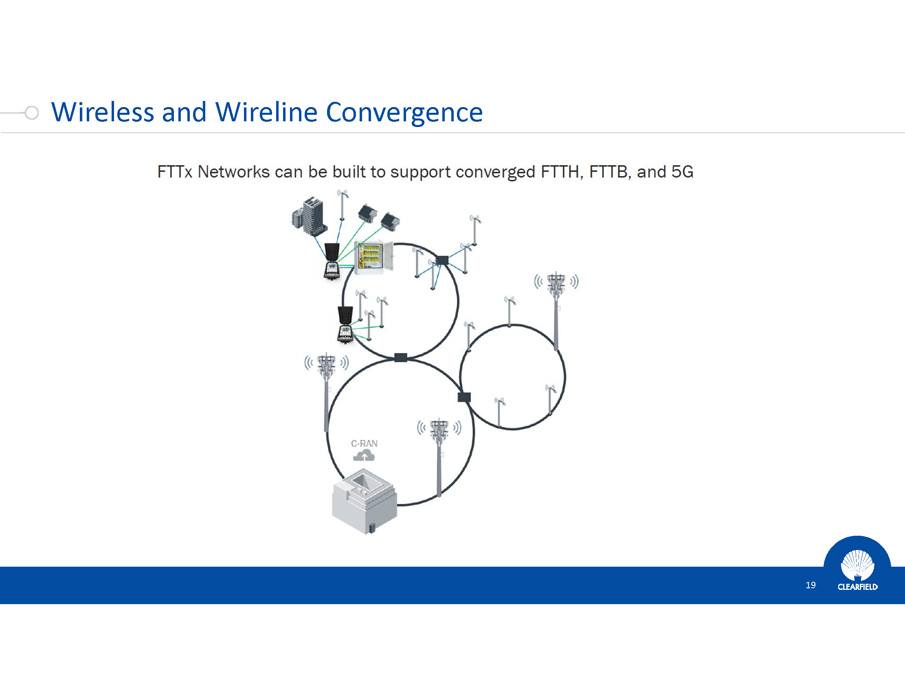

NASDAQ:CLFD Wireless and Wireline Convergence 19

NASDAQ:CLFD Our 5G Play: Foundation of our Fiber to Anywhere Architecture 20 Passive panels, frames, cabinets, wallboxes, and pedestals for the inside plant, outside plant and access network Powered cabinets for the outside plant and access network Patented cassettes that connect multiple fiber optic cables Fiber pathway and protection system consisting of m icroducts, cables, drop cables, connectors and terminals Fiber Management Fiber Protection & Delivery FieldSmart Passive Architecture FieldSmart Active Architecture Clearview FieldShield & YOURx 1) Fiber densification at the Small Cell; 2) Fiber demarc point between wireline and wireless; 3) Future cabinet requirements for 5G Hardened Electronics;

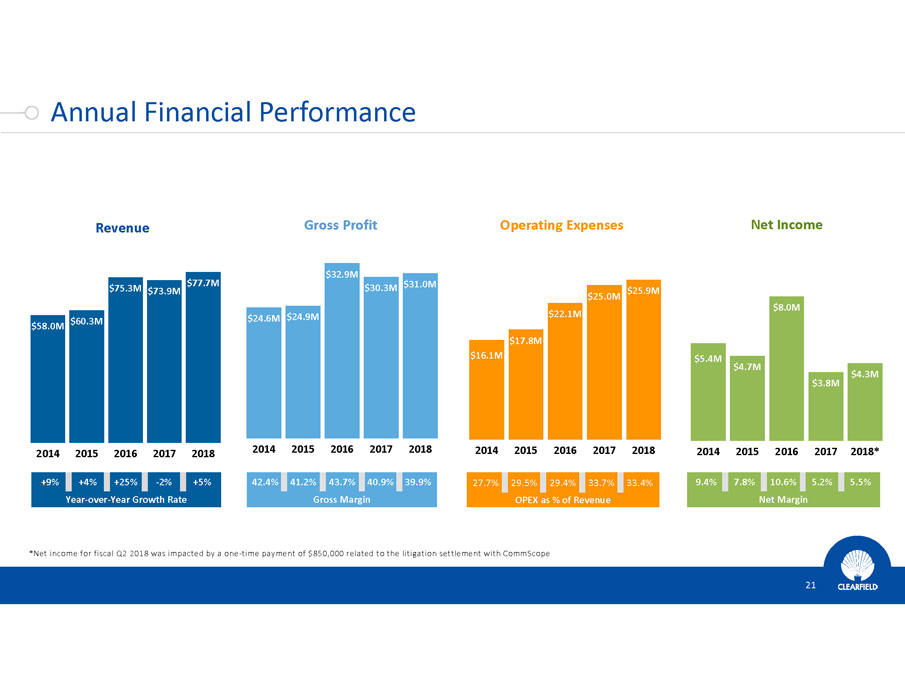

NASDAQ:CLFD Annual Financial Performance 21 $58.0M $60.3M $75.3M $73.9M $77.7M 2014 2015 2016 2017 2018 Revenue $24.6M $24.9M $32.9M $30.3M $31.0M 2014 2015 2016 2017 2018 Gross Profit $5.4M $4.7M $8.0M $3.8M $4.3M 2014 2015 2016 2017 2018* Net Income 42.4% 41.2% 43.7% 40.9% 39.9% Gross Margin +9% +4% +25% - 2% +5% Year - over - Year Growth Rate 9.4% 7.8% 10.6% 5.2% 5.5% Net Margin *Net income for fiscal Q2 2018 was impacted by a one - time payment of $850,000 related to the litigation settlement with CommScop e $16.1M $17.8M $22.1M $25.0M $25.9M 2014 2015 2016 2017 2018 Operating Expenses 27.7% 29.5% 29.4% 33.7% 33.4% OPEX as % of Revenue

NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan 22 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, and maintaining steady growth rate of 8 - 12% Enhancing Competitive Position and Operational Effectiveness Investing in products, manufacturing and supply chain to increase competitiveness and maintain and reduce costs Capitalizing on Disruptive Growth Opportunities Within Tier 1 Markets Leveraging customer relationships and application knowledge to capture opportunities related to 5G, NG - PON, and open computing initiatives

NASDAQ:CLFD Why Invest in Clearfield Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in an rapidly growing multi - billion - dollar fiber optics industry, especially with the roll - out of 5G and NG - PON2 technologies Healthy balance sheet: $42 million in cash and investments with no debt Eleven - year history of profitability and positive free cash flow 11 23