UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [x] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to SS.240.14a-11(c) or SS.240.14a-12 |

| CLEARFIELD, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [x] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of its filing. | |

| 1) | Amount previously paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

Clearfield, Inc.

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(763) 476-6866

____________________

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

To Be Held February 27, 2020

____________________

TO THE SHAREHOLDERS OF

CLEARFIELD, INC.:

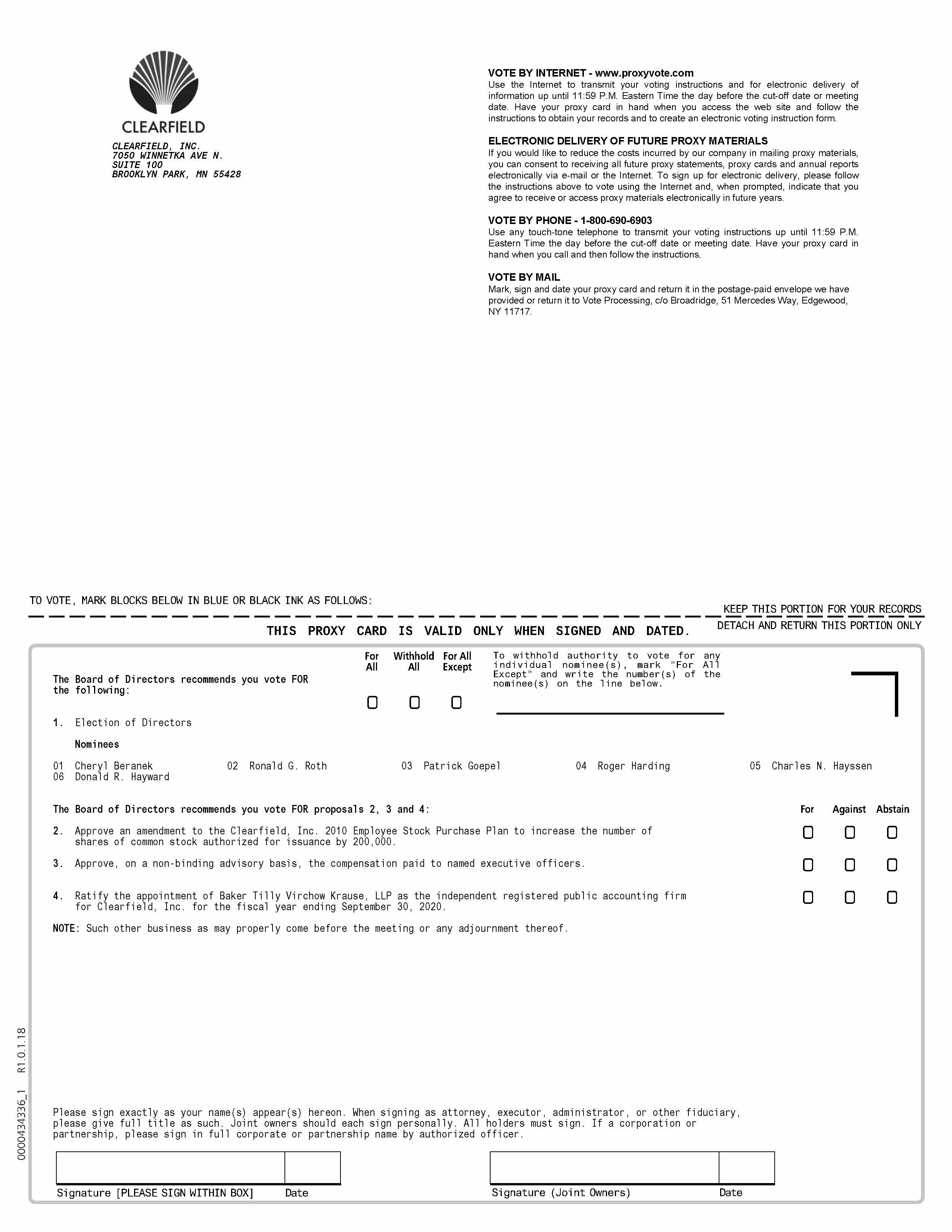

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Clearfield, Inc., a Minnesota corporation, will be held on Thursday, February 27, 2020, at 2:00 p.m. (local time), at the Minneapolis Marriott Northwest, 7025 Northland Drive North, Brooklyn Park, MN 55428 for the following purposes:

| 1. | Elect six (6) directors to serve until the next Annual Meeting of the Shareholders or until their respective successors have been elected and qualified. |

| 2. | To approve an amendment to the Clearfield, Inc. 2010 Employee Stock Purchase Plan to increase the number of shares of common stock authorized for issuance by 200,000. |

| 3. | To approve, on a non-binding advisory basis, the compensation paid to our named executive officers. |

| 4. | Ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm for Clearfield, Inc. for the fiscal year ended September 30, 2020. |

Only holders of record of Clearfield, Inc.’s common stock at the close of business on December 31, 2019 are entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors

Ronald G. Roth

Chairman of the Board of Directors

January 14, 2020

| WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE VOTE YOUR SHARES IN ONE OF THE WAYS DESCRIBED IN THE PROXY STATEMENT AS PROMPTLY AS POSSIBLE. |

IMPORTANT NOTICE REGARDING AVAILABILITY

OF PROXY MATERIALS FOR THE

2020 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, FEBRUARY 27, 2020

We are making our proxy materials available electronically via the Internet. You may access the following proxy materials at http://materials.proxyvote.com:

— Notice of 2020 Annual Meeting of Shareholders to be held on Thursday, February 27, 2020;

— Proxy Statement for 2020 Annual Meeting of Shareholders; and

— Annual Report on Form 10-K for the fiscal year ended September 30, 2019.

On or about January 14, 2020, we mailed to some of our shareholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability includes instructions to access your proxy card to vote via the Internet, as well as how to request paper or e-mail copies of our proxy materials. Other shareholders received an e-mail notification that provided instructions on how to access our proxy materials and vote via the Internet, or were mailed paper copies of our proxy materials and a proxy card that provides instructions for voting via the Internet, by telephone or by mail.

If you received the Notice of Internet Availability and would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive e-mails with instructions to access these materials via the Internet unless you elect otherwise.

These proxy materials are available free of charge and will remain available through the conclusion of the Annual Meeting. Additionally, we will not collect information, such as “cookies,” that would allow us to identify visitors to the site.

i

table of contents

Page

| PROXY STATEMENT | 1 |

| Solicitation of Proxies | 1 |

| Cost and Method of Solicitation | 1 |

| Voting | 1 |

| Differences Between Shareholder of Record and Beneficial Owners | 1 |

| Quorum and Voting Requirements | 2 |

| Casting Your Vote as a Record Holder | 2 |

| Casting Your Vote as a Street Name Holder | 2 |

| Revoking a Proxy | 3 |

| Annual Meeting and Special Meetings; Bylaw Amendments | 3 |

| OWNERSHIP OF VOTING SECURITIES BY PRINCIPAL HOLDERS AND MANAGEMENT | 4 |

| PROPOSAL 1: ELECTION OF DIRECTORS | 5 |

| Information Regarding Nominees | 5 |

| Vote Required for Proposal 1 | 6 |

| PROPOSAL 2: APPROVAL OF AMENDMENT TO 2010 EMPLOYEE STOCK PURCHASE PLAN | 7 |

| General Information | 7 |

| Amendment to the ESPP | 7 |

| Summary of the ESPP | 7 |

| New Plan Benefits | 9 |

| Federal Income Tax Consequences | 9 |

| Registration with the SEC | 10 |

| Vote Required for Proposal 2 | 10 |

| PROPOSAL 3: ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION | 11 |

| Vote Required for Proposal 3 | 11 |

| CORPORATE GOVERNANCE | 12 |

| Board Independence | 12 |

| Committees of the Board of Directors and Committee Independence | 12 |

| Board Leadership Structure | 13 |

| Board’s Role in Risk Oversight | 13 |

| Director Nominations | 14 |

| Board Attendance at Board, Committee and Annual Shareholder Meetings | 15 |

| Communications with Directors | 15 |

| Code of Ethics | 16 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 16 |

| EXECUTIVE OFFICERS | 17 |

| EXECUTIVE COMPENSATION | 17 |

| Explanation of Compensation | 17 |

| Summary Compensation Table | 20 |

| Outstanding Equity Awards at Fiscal Year-End | 21 |

| Employment Arrangements with Named Executive Officers | 22 |

| DIRECTOR COMPENSATION | 26 |

| PROPOSAL 4: APPOINTMENT OF INDEPENDENT AUDITORS | 27 |

| Vote Required for Proposal 4 | 27 |

| RELATIONSHIP WITH INDEPENDENT ACCOUNTANTS | 27 |

| Accountant Fees and Services | 27 |

| Audit Committee Pre-Approval Procedures | 28 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 28 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 28 |

| SHAREHOLDER PROPOSALS AND SHAREHOLDER NOMINEES FOR 2021 ANNUAL MEETING | 28 |

| OTHER BUSINESS | 29 |

Appendix A: 2010 Employee Stock Purchase Plan, as amended through December 3, 2019

ii

Clearfield, Inc.

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(763) 476-6866

____________________

PROXY STATEMENT

____________________

Solicitation of Proxies

The accompanying Proxy is solicited on behalf of the Board of Directors of Clearfield, Inc. (“we,” “Clearfield” or the “Company”) for use at the Annual Meeting of Shareholders to be held on Thursday, February 27, 2020, at 2:00 p.m. (local time) at the Minneapolis Marriott Northwest, 7025 Northland Drive North, Brooklyn Park, MN 55428, and at any postponements or adjournments thereof (the “Annual Meeting”). The mailing of this proxy statement to our shareholders commenced on or about January 14, 2020.

Cost and Method of Solicitation

This solicitation of proxies to be voted at the Annual Meeting is being made by our Board of Directors. The cost of this solicitation of proxies will be borne by us. In addition to solicitation by mail, our officers, directors and employees may solicit proxies by telephone or in person. We may also request banks, brokers and other nominees to solicit their customers who have a beneficial interest in our common stock registered in the names of nominees and will reimburse such banks, brokers or nominees for their reasonable out-of-pocket expenses.

Voting

The total number of shares outstanding and entitled to vote at the Annual Meeting as of December 31, 2019 consisted of 13,657,459 shares of common stock, $0.01 par value. Each share of common stock is entitled to one vote. Only shareholders of record at the close of business on December 31, 2019 will be entitled to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy as promptly as possible (or follow instructions to grant a proxy to vote by means of telephone or internet) in order to ensure your representation at the Annual Meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares. Additionally, in order to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name.

Differences Between Shareholder of Record and Beneficial Owners

You are a shareholder of record if at the close of business on the record date your shares were registered directly in your name with Equiniti Trust Company (doing business as EQ Shareowner Services), our transfer agent.

You are a beneficial owner if at the close of business on the record date your shares were held by a bank, brokerage firm or other nominee and not in your name. Being a beneficial owner means that, like many of our shareholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other nominee provides. If you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee will not be able to vote your shares with respect to any proposal except for Proposal 4: Appointment of Independent Auditors being presented to shareholders at the Annual Meeting.

1

Record holders should review the additional information below under “Casting Your Vote as a Record Holder.”

Street name holders should review the additional information below under “Casting Your Vote as a Street Name Holder.”

Quorum and Voting Requirements

A quorum, consisting of a majority of the shares of common stock entitled to vote at the Annual Meeting, must be present, in person or by proxy, before action may be taken at the Annual Meeting.

Proposal 1 relates to the election of directors. Directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing six directors, the six nominees receiving the highest number of votes will be elected. You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the Board of Directors. If you withhold authority to vote for the election of one of the directors, it has the same effect as a vote against that director.

The affirmative vote of the holders of the majority of the shares present, in person or by proxy, and entitled to vote is required for approval of Proposal 2: Approval of Amendment to 2010 Employee Stock Purchase Plan. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 2.

The affirmative vote of the holders of the majority of the shares present, in person or by proxy, and entitled to vote is required for approval of Proposal 3: Advisory Vote on Named Executive Officer Compensation. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 3.

The affirmative vote of the holders of the majority of the shares present, in person or by proxy, and entitled to vote is required for approval of Proposal 4: Appointment of Independent Auditors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 4.

Abstentions will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but are not counted for the purposes of determining whether shareholders have approved that matter. Therefore, if you abstain from voting on Proposal 2, Proposal 3 or Proposal 4, it has the same effect as a vote against that proposal. A “broker non-vote” occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote with respect to a particular proposal. Thus, a broker non-vote will not affect the outcome of the vote on Proposal 1: Election of Directors, Proposal 2: Approval of Amendment to 2010 Employee Stock Purchase Plan or Proposal 3: Advisory Vote on Named Executive Officer Compensation. Brokers and other nominee holders may use their discretion to vote on the proposal to ratify the selection of our independent registered public accounting firm if no instructions are provided.

So far as our management is aware, no matters other than those described in this proxy statement will be acted upon at the Annual Meeting. In the event that any other matters properly come before the Annual Meeting calling for a vote of shareholders, the persons named as proxies in the enclosed form of proxy will vote in accordance with their best judgment on such other matters.

Casting Your Vote as a Record Holder

If you are the shareholder of record of your shares and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting. If you are a record holder and you vote your shares, the individuals named on the proxy card will vote your shares as you have directed. If you just sign and submit your proxy without voting instructions, your shares will be voted “FOR” each director nominee identified in Proposal 1, “FOR” Proposal 2, “FOR” Proposal 3 and “FOR” Proposal 4.

Casting Your Vote as a Street Name Holder

If you are a street name holder and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Your broker is entitled to vote in its discretion on Proposal 4: Appointment of Independent Auditors.

If you hold your shares in street name and do not vote or do not provide voting instructions to your broker or nominee, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. This is sometimes called a “broker non-vote.” Brokers and nominees do not have discretionary authority to vote on Proposal 1: Election of Directors, Proposal 2: Approval of Amendment to 2010 Employee Stock Purchase Plan or Proposal 3: Advisory Vote on Named Executive Officer Compensation.

2

As a result, if you hold your shares in street name and do not vote or do not provide voting instructions to your broker or nominee, no votes will be cast on your behalf on Proposal 1, Proposal 2 or Proposal 3. Because of these broker voting rules, all street name holders are urged to provide instructions to their brokers or nominees on how to vote their shares at the Annual Meeting.

Make your vote count! Instruct your broker how to cast your vote!

If you hold your shares in street name, your broker will continue to have discretion to vote any uninstructed shares on Proposal 4: Appointment of Independent Auditors.

Revoking a Proxy

You may change your vote and revoke your proxy at any time before it is voted by:

| · | Sending a written statement to that effect to the Secretary of Clearfield, Inc.; |

| · | Submitting a properly signed proxy card with a later date; |

| · | If you voted by telephone or through the Internet, by voting again either by telephone or through the Internet prior to the close of the voting facility; or |

| · | Voting in person at the Annual Meeting. |

All shares represented by valid, unrevoked proxies will be voted at the Annual Meeting and any adjournment(s) or postponement(s) thereof. Our principal offices are located at 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, Minnesota 55428, and our telephone number is (763) 476-6866.

Annual Meeting and Special Meetings; Bylaw Amendments

This 2020 Annual Meeting of Shareholders is a regular meeting of our shareholders and has been called by our Board of Directors in accordance with our bylaws, as amended. Under the bylaws, special meetings of our shareholders may be held at any time and for any purpose and may be called by our Chief Executive Officer, Chief Financial Officer, any two directors or by a shareholder or shareholders holding 10% or more of shares entitled to vote, except that a special meeting for the purpose of considering any action to directly or indirectly facilitate or affect a business combination, including any action to change or otherwise affect the composition of the Board of Directors for that purpose, must be called by 25% or more of the shares entitled to vote. We will not accept, and shall consider ineffective, a written demand from a shareholder to call a special meeting that does not meet the requirements of Section 2.04-b of our bylaws.

The bylaws contain advance notice requirements relating to director nominations by shareholders and shareholder proposals. For more information, please review the section of this proxy statement entitled “Shareholder Proposals and Shareholder Nominees for 2021 Annual Meeting.”

The bylaws may be amended or altered by an action of the Board of Directors at any meeting. The authority of the Board is subject to the power of our shareholders, exercisable in the manner provided by Minnesota law, to adopt or amend, repeal bylaws adopted, amended, or repealed by the Board. Additionally, under the bylaws the Board may not make or alter any bylaws fixing a quorum for meetings of shareholders, prescribing procedures for removing directors or filling vacancies in the Board of Directors, or fixing the number of directors or their classifications, qualifications, or terms of office.

3

OWNERSHIP OF VOTING SECURITIES BY PRINCIPAL HOLDERS AND MANAGEMENT

The following table sets forth certain information as of December 31, 2019 with respect to our common stock beneficially owned by (i) each director and each nominee for director, (ii) each person known to us to beneficially own more than five percent of our common stock, (iii) each executive officer named in the Summary Compensation Table (the “named executive officers”), and (iv) all current executive officers and directors as a group. Unless otherwise indicated, all beneficial owners have sole voting and investment power over the shares held. Except as indicated below, the business address of each individual set forth below is 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, Minnesota 55428.

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned (1) |

Percent of Outstanding |

| BlackRock, Inc. (2) 55 East 52nd Street New York, NY 10055 |

818,955 |

6.0% |

| Ronald G. Roth (3)(4) | 1,417,959 | 10.38% |

| Cheryl Beranek (3)(5) | 567,156 | 4.15% |

| Patrick Goepel (3)(6) | 115,211 | * |

| Roger Harding (3) | 23,024 | * |

| Charles N. Hayssen (3) | 176,484 | 1.29% |

| Donald R. Hayward (3) | 13,194 | * |

| John P. Hill (5) | 223,997 | 1.64% |

| Daniel R. Herzog (5) | 49,148 | * |

| All current executive officers and directors as a group (8 persons) |

2,586,172 |

18.93% |

| * | Less than one percent |

| (1) | Includes the following number of shares that could be purchased within 60 days of December 31, 2019 upon the exercise of stock options: Ms. Beranek, 6,667 shares; Mr. Hill, 6,667 shares; Mr. Herzog, 8,000 shares; and all current directors and executive officers as a group, 21,333 shares. |

| (2) | Based upon an Amendment No. 4 to Schedule 13G filed by BlackRock, Inc. on February 4, 2019 in which the shareholder reports sole voting power over 804,095 shares of our common stock and sole dispositive power over 818,955 shares of our common stock as of December 31, 2018. |

| (3) | Currently serves as our director and nominated for election as a director at the Annual Meeting. |

| (4) | Includes 176,760 shares owned by Mr. Roth’s spouse. |

| (5) | Named Executive Officer. |

| (6) | Includes 16,750 shares owned by Mr. Goepel’s spouse. |

4

PROPOSAL

1:

ELECTION OF DIRECTORS

Six directors will be elected at the Annual Meeting to serve until the next Annual Meeting of Shareholders or until their successors have been elected and shall qualify. Proxies cannot be voted for a greater number of persons than the number of nominees named. Pursuant to our bylaws, the authorized number of directors is set at six and the Board of Directors has nominated for election the six persons named below. Each nominee is currently a director of Clearfield. All nominees were elected by the shareholders at our 2019 Annual Meeting of Shareholders.

The persons named in the accompanying proxy card intend to vote the proxies held by them in favor of the nominees named below as directors, unless otherwise directed. Should any nominee for director become unable to serve as a director for any reason, the proxies have indicated they will vote for such other nominee as the Board of Directors may propose. The Board of Directors has no reason to believe that any candidate will be unable to serve if elected and each has consented to being named a nominee.

We know of no arrangements or understandings between a director or nominee and any other person pursuant to which he or she has been selected as a director or nominee. There is no family relationship between any of the nominees, our directors or our executive officers except that Ms. Beranek and Mr. Hill are related through the marriage of their daughter and son, respectively.

Information Regarding Nominees

Set forth below is biographical and other information with respect to each nominee, as well as a discussion of the specific experience, qualifications, attributes and skills that led to the conclusion that the nominee should serve as a director of Clearfield at this time.

Cheryl Beranek, age 57, has served as our director since 2007. Ms. Beranek has also served as our President and Chief Executive Officer since June 2007. From July 2003 to June 2007, Ms. Beranek served as President of our former subsidiary, APA Cables and Networks. Prior to joining the Company, Ms. Beranek was President of Americable from 2002 until July 2003, when we acquired Americable. She also served as the Chief Operating Officer of Americable in 2001 and 2002. Ms. Beranek holds a Bachelor of Science degree from Southwest Minnesota State University and a Master’s of Science degree from North Dakota State University.

Ms. Beranek is qualified to serve on the Clearfield Board of Directors because she brings to the Board a keen understanding of our business and industry developed through her tenure as our President and Chief Executive Officer and in her previous position as the President of our former subsidiary. Additionally, Ms. Beranek’s role as our President and Chief Executive Officer allows her to provide the Board with her unique insight as a member of management on our business and our operations.

Ronald G. Roth, age 74, has served as our director since 2002. Mr. Roth is currently retired. Mr. Roth was Chairman of the Board and Chief Executive Officer of Waste Systems Corp., a privately held waste hauling and disposal company, for 25 years prior to its sale to a national solid waste management company in 1995. From 1995 to 2001, he was Chairman of the Board of Access Cash International L.L.C., a North American provider of ATMs and related processing and financial services until its sale. Since 1990 he has been an owner of, and has served in various capacities, including Chairman of the Board and an officer, with Phillips Recycling Systems. Mr. Roth holds a Bachelor of Arts degree in marketing from Michigan State University.

Mr. Roth is qualified to serve on the Clearfield Board of Directors because he brings to the Board a strong background in executive management through his service for more than 25 years as the Chief Executive Officer or executive officer of several companies.

Roger Harding, age 65, has served as our director since July 14, 2016. From 1972 to 2008, Mr. Harding served in multiple leadership roles with Alcatel-Lucent, including as the Vice President & General Manager, Global Switching from 2001 until his retirement in 2008. Mr. Harding received a Bachelor of Arts degree in business administration and management from the University of Central Oklahoma.

Mr. Harding has a strong background in operations and the execution of operational strategies, as well as a deep understanding of the telecommunications and networking markets. These attributes qualify him to serve as a director of Clearfield. In addition, Mr. Harding qualifies as an audit committee financial expert.

5

Charles N. Hayssen, age 68, has served as our director since 2008. Since January 2009, Mr. Hayssen has served as the President of Safeway Driving School, a privately-held provider of driver’s education services. From August 2007 to September 2008, Mr. Hayssen was a private investor. From August 2004 until August 2007, Mr. Hayssen was Chief Operating Officer of AllOver Media, Inc., a privately-held out-of-home media company. From September 2002 to April 2004, Mr. Hayssen was the Chief Financial Officer of ThinkEquity Partners LLC, an equity capital markets firm. From March 2004 to May 2009, Mr. Hayssen was a director of Lenox Group Inc., a publicly held designer, distributor, wholesaler and retailer of fine quality tableware, collectible and other giftware products, until it filed petition for reorganization relief in November 2008. Mr. Hayssen holds a Bachelor of Arts degree from Dartmouth and from the University of Chicago Graduate School of Business, a Masters of Business Administration degree.

Mr. Hayssen brings strong executive management and financial management experience to the Board, as well as experience as a director of a publicly traded company, all of which qualify him to serve as a director of Clearfield. In addition, Mr. Hayssen qualifies as an audit committee financial expert.

Donald R. Hayward, age 62, has served as our director since 2007. From 2006 to his retirement in 2017, Mr. Hayward served as the President of Engel Diversified Industries, a privately held manufacturing company. Beginning in 2017, Mr. Hayward has been leading Schaffer Manufacturing, a privately held metal fabrication manufacturing company. From 1997 until joining EDI, Mr. Hayward was Director of Corporate Services at Minnesota Technology, Inc. a publicly funded, private non-profit in support of Minnesota’s technology community. Mr. Hayward holds a Bachelor of Science degree in business administration and economics from the University of Wisconsin.

Mr. Hayward’s executive leadership experience, his familiarity with the business and operations of a manufacturing company developed through his service at Schaffer Manufacturing and Engel Diversified Industries, and his background in technology qualify him to serve as a director of Clearfield.

Patrick Goepel, age 58, has served as our director since September 1, 2015. Since January 2010, Mr. Goepel has served as the President and Chief Executive Officer of Asure Software, Inc., a publicly-held provider of workplace management software (NasdaqCM: ASUR). He previously served as Asure Software’s Interim Chief Executive Officer from September 2009 to January 2010 and has served as its director since August 2009. Previously, he was the President and Chief Executive Officer of Fidelity Investment’s Human Resource Services Division from 2006 to 2008 and President and Chief Executive Officer of Advantec from 2005 to 2006. A former board member of iEmployee, Mr. Goepel currently serves on the board of directors of APPD Investments, and SafeGuard World International. He also served on the board of AllOver Media Holdings, Inc. until its sale to a private equity firm in March 2015.

Mr. Goepel’s public company executive management and board experience, as well as his background in successful execution of global expansion, operational and M&A initiatives, qualify him to serve as a director of Clearfield. In addition, Mr. Goepel qualifies as an audit committee financial expert.

Vote Required for Proposal 1

Under Minnesota law and our bylaws, directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing six directors, the six nominees receiving the highest number of votes will be elected.

The Board of Directors Recommends

Shareholders Vote FOR the Election of Each Nominee Identified in Proposal 1

_________________________________

6

PROPOSAL

2:

APPROVAL OF AMENDMENT TO 2010 EMPLOYEE STOCK PURCHASE PLAN

General Information

On December 3, 2019, the Board of Directors adopted, subject to shareholder approval at the Annual Meeting, an amendment to the Clearfield, Inc. 2010 Employee Stock Purchase Plan (the “ESPP”) to increase the number of shares of common stock authorized for issuance by 200,000 shares from 300,000 to 500,000 shares of our common stock. The amendment to the ESPP was recommended by the Compensation Committee.

Attached to this proxy statement as Appendix A is the full text of the ESPP, as amended by the Compensation Committee and Board of Directors through December 3, 2019. The summary of the ESPP below is qualified in its entirety by reference to Appendix A.

The purpose of the ESPP, which was first adopted by the Board on January 5, 2010 and approved by our shareholders at the 2010 Annual Meeting, is to provide employees of Clearfield with an opportunity to share in the ownership of Clearfield by providing them with a convenient and cost-effective means to purchase our common stock to provide a stronger incentive to work for the continued success of Clearfield. The ESPP also enhances our ability to obtain and retain the services of employees. The ESPP is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code.

Amendment to the ESPP

As of September 30, 2019, there were only 49,846 shares of our common stock available for future issuance under the ESPP.

The Compensation Committee and the Board of Directors believe the ESPP is, and will continue to be, an important tool in attracting and retaining employees for Clearfield. Without the ability to grant additional awards under the ESPP, we may not have the appropriate tools to attract and retain talented employees. Awards under the ESPP will also align the interests of participants with those of our shareholders.

In determining to increase the number of shares reserved and available for issuance under the ESPP by 200,000 shares, the Compensation Committee reviewed the potential dilution to our shareholders, our historical use of stock incentives, the number of shares remaining for grant under the ESPP, the rate of participation by our employees in the ESPP, and other factors. The Compensation Committee believes that the potential dilution from employee purchases of Clearfield’s common stock under the ESPP represents an acceptable balance between the interests of our shareholders in supporting the growth of our business while appropriately managing dilution from our equity compensation programs.

Summary of the ESPP

The principal features of the 2007 Plan are summarized below.

Administration

The Compensation Committee administers the ESPP. It has full power to adopt, amend and rescind any rules deemed desirable and appropriate for the administration of the ESPP and not inconsistent with the ESPP, to construe and interpret the ESPP, and to make all other determinations necessary or advisable for the administration of the ESPP. The Compensation Committee may delegate ministerial duties to our employees, outside entities and outside professionals as the Compensation Committee so determines. The Board of Directors may also exercise the Compensation Committee’s powers and duties under the ESPP.

Share Purchases

Participation in the ESPP is voluntary. The ESPP permits shares of our common stock to be sold to participating employees on the last calendar day of any contribution period at a price not less than the lesser of (1) 85% of the fair market value of our common stock on the first calendar day of the contribution period or (2) 85% of the fair market value of our common stock on the last calendar day of each contribution period.

Unless otherwise determined by the Board of Directors, each six-month period is a contribution period under the ESPP. The Board of Directors may, in its discretion and with prior notice, change the duration and/or frequency of contribution periods from time to time, provided that in no event will a contribution period be greater than 27 months.

7

Eligible Participants

Each of our employees is eligible to participate in the ESPP, provided that:

| · | The employee’s customary employment is at least 20 hours per week and is more than five months per year; |

| · | The employee has been continuously employed by us or a designated subsidiary for at least 30 days prior to the start of the next available contribution period; and |

| · | Immediately after the grant of the share purchase rights under the ESPP, the employee would not own shares (including shares which such employee may purchase under the ESPP or under outstanding share purchase rights) having 5% or more of the total combined voting power or value of all classes of our capital stock or of any subsidiary. |

The Compensation Committee also has the power and authority to allow employees who are employed by any subsidiary we may have in the future to participate in the ESPP.

As of December 31, 2019, approximately 227 employees were eligible as a class to participate in the ESPP.

Number of Shares

The aggregate number of shares of our common stock that are available for purchase as of September 30, 2019 under the ESPP is 49,846 shares. The amendment approved by our Board of Directors on December 3, 2019 increased the number of shares reserved for issuance by 200,000 shares to a total of 249,846 shares. The number of shares of common stock available for purchase under the ESPP, as well as the price per share of our common stock covered by share purchase rights that have not been exercised, are subject to adjustment in the event of a stock split, reverse stock split, stock dividend, combination or reclassification of our common stock (including any such change in the number of shares effected in connection with a change in domicile of Clearfield), reorganization, recapitalization, rights offering or other increase or reduction of our outstanding common stock, and in the event that Clearfield is consolidated with or merged into any other corporation.

No participant may purchase (1) shares having a fair market value (determined at the beginning of each contribution period) exceeding $25,000 under the ESPP and all other employee stock purchase plans (if any) for any calendar year or (2) more than 12,500 shares under the ESPP for any calendar year.

Terms and Conditions

Participating employees may direct us to make payroll deductions for each payroll paid during the contribution period in full dollar amounts not less than $10 and not more than 10% (or such other maximum as may be established by the Board of Directors) of such participant’s regular straight time earnings, commissions and commission-based sales bonuses (excluding payments, if any, for overtime, incentive compensation, incentive payments, premiums, bonuses (including bonuses paid under our cash incentive plan) and any other special compensation) on each payroll paid during the contribution period. A participant may not increase or decrease the amount of his or her contributions during a contribution period.

Participating employees, other than employees who are executive officers under Section 16 of the Exchange Act, may withdraw from the ESPP at least 30 days prior to the end of a contribution period and be paid in cash all contributions in their contribution accounts. Participants who withdraw from the ESPP will not be permitted to re-enroll in the ESPP until the next contribution period. Upon a participant’s termination of employment with Clearfield or a designated subsidiary for any reason, including the death or retirement of the participant, the participant’s participation in the ESPP will cease and the participant, or the participant’s beneficiary or estate, as the case may be, will be paid in cash all contributions in the participant’s contribution account. The ESPP does not provide for the payment of interest on a participant’s contributions.

Participants have no interest or voting rights in shares of our common stock covered by share purchase rights until such rights have been exercised.

8

Duration, Termination and Amendment

Unless earlier terminated by the Board of Directors, the ESPP will continue in effect until all of the shares of common stock issuable under the ESPP have been exhausted. The ESPP permits the Board of Directors to amend or terminate the ESPP at any time, except that:

| · | No amendment to the ESPP may make any change in any share purchase rights previously granted that adversely affects the rights of any participant, except as otherwise provided in the ESPP; and |

| · | Prior shareholder approval will be required for any amendment to the ESPP to the extent necessary to comply with Rule 16b-3 under the Exchange Act or Section 423 of the Internal Revenue Code or the requirements of The Nasdaq Stock Market or any other securities exchange that are applicable to us. |

Transferability of Contributions and Purchase Rights

During a participant’s lifetime, a participant’s share purchase rights under the ESPP are exercisable only by the participant. Neither contributions credited to a participant’s account nor any rights with regard to the exercise of share purchase rights or the right to receive shares under the ESPP may be assigned, transferred, pledged or otherwise disposed of in any way (except as otherwise set forth in the ESPP in the event of the participant’s death) by the participant.

New Plan Benefits

Because the amount of future benefits under the ESPP will depend on which of our employees elect to participate, the amount of their contribution elections and the fair market value of our common stock, it is not possible to determine the benefits that will be received by eligible participants if the amendment to the ESPP is approved by our shareholders. The closing price of a share of our common stock as reported on the Global Market of The Nasdaq Stock Market, Inc. on December 31, 2019, was $13.94.

Federal Income Tax Consequences

The following is a brief summary of the federal income tax aspects of the share purchase rights that may be granted under the ESPP based upon federal income tax laws in effect on the date of this proxy statement. This summary is not intended to be exhaustive and does not describe foreign, state or local tax consequences.

The ESPP, and the right of participants to make purchases of our common stock pursuant to the ESPP, are intended to be eligible for the favorable tax treatment provided by Sections 421 and 423 of the Internal Revenue Code. The amounts of payroll deductions under the ESPP will be taxable to a participant as compensation for the year in which such amounts otherwise would have been paid to the participant. A participant will realize no income upon the grant of the share purchase rights or upon the purchase of common stock under the ESPP, and we will not be entitled to any deduction at the time of grant of the rights or purchase of the shares. Taxable income will not be recognized until there is a sale or other disposition of the shares acquired under the ESPP.

The amount of a participant’s tax liability upon disposition of the shares acquired will depend on whether or not the participant satisfies the prescribed holding period as summarized below. If the participant holds the shares purchased for the prescribed holding period of two years from the grant of the share purchase right and one year from the purchase date, then upon disposition of shares we will receive no deduction and the participant will recognize:

| · | Ordinary income on the lesser of the participant’s gain on the sale or the purchase price discount under the ESPP, applied to the fair market value of the shares at the first day of the contribution period; and |

| · | Long-term capital gain (or loss) on the difference between the sale price and the sum of the purchase price and any ordinary income recognized on the disposition. |

However, consequences for both us and the participant would differ if the participant did not satisfy the prescribed holding period described above. In the event that the shares are sold or disposed of (including by way of gift) before the expiration of the prescribed holding periods, the excess of the fair market value of the shares on the date such shares are purchased over the purchase price of such shares will be treated as ordinary income to the participant. This excess will constitute ordinary income in the year of sale or other disposition even if no gain is realized on the sale or a gratuitous transfer of the shares is made. The balance of any gain will be treated as capital gain and will be treated as long-term capital gain if the shares have been held more than one year. Even if the shares are sold for less than their fair market value on the date the shares are purchased, the same amount of ordinary income is attributed to a participant and a capital loss is recognized equal to the difference between the sales price and the value of the shares on such date of purchase. We ordinarily will be allowed a tax deduction at the time and in the amount of the ordinary income recognized by the participant.

9

Registration with the SEC

If shareholders approve this Proposal 2: Approval of Amendment to 2010 Employee Stock Purchase Plan, we intend to file a registration statement with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, covering the offering of the 200,000 additional shares of common stock issuable under the ESPP.

Vote Required for Proposal 2

Approval of this Proposal 2 requires the affirmative vote of the holders of a majority of the shares present, in person or by proxy, and entitled to vote on Proposal 2.

The Board of Directors Recommends

Shareholders Vote FOR

Proposal 2: Approval of Amendment to 2010 Employee Stock Purchase Plan

10

PROPOSAL

3:

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Our Board of Directors determined that an advisory vote on named executive officer compensation (commonly referred to as “say-on-pay”) will be held every year. Accordingly, pursuant to the requirements of Section 14A of the Exchange Act and the related rules of the Securities and Exchange Commission, we are asking our shareholders to cast an advisory vote on named executive officer compensation at the Annual Meeting.

As described in detail in the Executive Compensation section of this proxy statement, our named executive officers have the opportunity to earn significant portions of their compensation based on the achievement of specific annual goals intended to drive financial performance of our business and the realization of increased shareholder value. The say-on-pay proposal presented at our 2019 Annual Meeting of Shareholders received 83.2% approval by our shareholders. Based upon these voting results, the Compensation Committee believes that shareholders support our executive compensation programs and practices. The Compensation Committee continued to apply the same principles in determining fiscal year 2019 compensation for the named executive officers.

Shareholders are encouraged to read the Executive Compensation section of this proxy statement for more information about fiscal year 2019 compensation of our named executive officers.

We are asking our shareholders to indicate their support for our named executive officer compensation as described in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask our shareholder to vote “FOR” the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of Clearfield, Inc. approve, on an advisory basis, the compensation of the named executive officers as disclosed in Clearfield’s proxy statement for the 2020 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

Vote Required for Proposal 3

Approval of this Proposal 3 requires the affirmative vote of the holders of the majority of the shares present, in person or by proxy, and entitled to vote on this Proposal 3.

While this vote is advisory, and not binding on the Compensation Committee or the Board of Directors, it will provide valuable information to us that the Compensation Committee will be able to consider when determining executive compensation philosophy, policies and practices for the remainder of fiscal year 2020 and beyond. It is expected that the next say-on-pay vote will occur at the Company’s 2021 Annual Meeting of Shareholders.

The Board of Directors Recommends

Shareholders Vote FOR

Proposal 3: Advisory Vote on Executive Compensation

_______________________

11

CORPORATE GOVERNANCE

Board Independence

The Board of Directors undertook a review of director independence in November 2019 as to all six directors then serving. As part of that process, the Board reviewed all transactions and relationships between each director (or any member of his or her immediate family) and Clearfield, our executive officers and our auditors, and other matters bearing on the independence of directors. As a result of this review, the Board of Directors affirmatively determined that each of the directors, with the exception of Ms. Beranek, is independent according to the “independence” definition of the Nasdaq Listing Rules. Ms. Beranek is not independent under the Nasdaq Listing Rules because she is employed by Clearfield and serves as our executive officer.

Committees of the Board of Directors and Committee Independence

The Board of Directors has established a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee. The composition and function of these committees are set forth below.

Compensation Committee. The Compensation Committee reviews and approves the compensation and other terms of employment of our Chief Executive Officer and other executive officers of the Company. Among its other duties, the Compensation Committee oversees all significant aspects of our compensation plans and benefit programs, including succession plans for executive officers. The Compensation Committee annually reviews and approves corporate goals and objectives for the compensation of the Chief Executive Officer and the other executive officers, as well as the Board of Directors evaluation of the Chief Executive Officer pursuant to the evaluation process established by the Nominating and Corporate Governance Committee. In connection with its review of compensation of executive officers or any form of incentive or performance based compensation, the Committee will also review and discuss risks arising from our compensation policies and practices. The Compensation Committee also administers our 2007 Stock Incentive Plan (the “2007 Plan”).

The charter of the Compensation Committee requires that this Committee consist of no fewer than two Board members who satisfy the requirements of the Nasdaq Stock Market, the “non-employee director” requirements of Section 16b-3 of the Securities Exchange Act of 1934, and the “outside director” requirements of Section 162(m) of the Internal Revenue Code. Each member of our Compensation Committee meets these requirements. A copy of the current charter of the Compensation Committee is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com.

The current members of the Compensation Committee are Ronald G. Roth (Chair), Patrick Goepel and Donald R. Hayward. During fiscal year 2019, the Compensation Committee met two times, including in executive session without management present.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is charged with the responsibility of identifying, evaluating and approving qualified candidates to serve as directors of the Company, ensuring that our Board and governance policies are appropriately structured, developing and recommending a set of corporate governance guidelines, overseeing Board orientation, training and evaluation, and establishing an evaluation process for the Chief Executive Officer. The Nominating and Corporate Governance Committee is also responsible for the leadership structure of our Board, including the composition of the Board and its committees, and an annual review of the position of Chairman of the Board. As part of its annual review, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to serve as Chairman and recommending to the Board of Directors any changes in such position. The Nominating and Corporate Governance Committee also has responsibility for overseeing our annual process of self-evaluation by members of the committees and the Board of Directors as a whole.

The charter of the Nominating and Corporate Governance Committee requires that this Committee consist of no fewer than two Board members who satisfy the “independence” requirements of the Nasdaq Stock Market. Each member of our Nominating and Corporate Governance Committee meets these requirements. A copy of the current charter of the Nominating and Corporate Governance Committee is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. A copy of our current Governance Guidelines is also available in the “Corporate Governance” section of our website, found through the link to the “For Investors” section. The current members of the Nominating and Corporate Governance Committee are Donald R. Hayward (Chair), Roger Harding and Ronald G. Roth. During fiscal year 2019, the Nominating and Corporate Governance Committee met three times.

12

Audit Committee. The Audit Committee assists the Board by reviewing the integrity of our financial reporting processes and controls; the qualifications, independence and performance of the independent auditors; and compliance by us with certain legal and regulatory requirements. The Audit Committee has the sole authority to retain, compensate, oversee and terminate the independent auditors. The Audit Committee reviews our annual audited financial statements, quarterly financial statements and filings with the Securities and Exchange Commission. The Audit Committee reviews reports on various matters, including our critical accounting policies, significant changes in our selection or application of accounting principles and our internal control processes. Under its charter, the Audit Committee exercises oversight of significant risks relating to financial reporting and internal control over financial reporting, including discussing these risks with management and the independent auditor and assessing the steps management has taken to minimize these risks. The Audit Committee also pre-approves all audit and non-audit services performed by the independent auditor.

The Audit Committee operates under a written charter and a copy of the current Audit Committee charter is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. Our Audit Committee presently consists of four directors: Charles N. Hayssen (Chair), Patrick Goepel, Roger Harding and Donald R. Hayward. During fiscal year 2019, the Audit Committee met four times, including in executive session without management present.

The Board of Directors has determined that all members of the Audit Committee are “independent” directors under the rules of the Nasdaq Stock Market and the rules of the Securities and Exchange Commission. Our Board of Directors has reviewed the education, experience and other qualifications of each of the members of its Audit Committee. After review, the Board of Directors has determined that Mr. Hayssen, Mr. Goepel and Mr. Harding each meet the Securities and Exchange Commission definition of an “audit committee financial expert.” The members of the Audit Committee also meet the Nasdaq Stock Market requirements regarding the financial sophistication and the financial literacy of members of the audit committee. A report of the Audit Committee is set forth below.

Board Leadership Structure

The Board consists of a non-executive Chairman of the Board and three standing committees that are each led by a chair. The members of each committee are “independent directors” under the Nasdaq Listing Rules and meet the other similar independence requirements applicable to that committee. Our Chief Executive Officer is a director, but she does not serve as chair of the Board and does not serve on any committee.

We believe that the current Board leadership structure is appropriate for Clearfield at this time because it allows the Board and its committees to fulfill their responsibilities, draws upon the experience and talents of all directors, encourages management accountability to the Board, and helps maintain good communication among Board members and with management. In particular, we believe that having our Chief Executive Officer serve as a member of the Board and having a separate individual serve as Chairman of the Board allows the independent directors and the Chief Executive Officer to contribute their different perspectives and roles to our strategy development. Our current Board leadership structure is part of the policies reflected in our Governance Guidelines and the Nominating and Corporate Governance Committee is empowered through its charter to consider and make changes to the structure if necessary.

Board’s Role in Risk Oversight

We face a number of risks, including financial, technological, operational, regulatory, strategic and competitive risks. Management is responsible for the day-to-day management of risks we face, while the Board has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors ensures that the processes for identification, management and mitigation of risk by our management are adequate and functioning as designed.

Our Board exercises its oversight both through the full Board and through the three standing committees of the Board: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The three standing committees exercise oversight of the risks within their areas of responsibility, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees.

13

The Board and the three committees receive information used in fulfilling their oversight responsibilities through our executive officers and advisors, including our outside legal counsel and our independent registered public accounting firm. At meetings of the Board, management makes presentations to the Board regarding our business strategy, operations, financial performance, fiscal year budgets, technology, quality, regulatory, and other matters. Many of these presentations include information relating to the challenges and risks to our business and the Board and management engage in discussion on these topics. Each of the committees also receives reports from management regarding matters relevant to the work of that committee. These management reports are supplemented by information relating to risk from our advisors. Additionally, following committee meetings, the Board receives reports by each committee chair regarding the committee’s considerations and actions. In this way, the Board also receives additional information regarding the risk oversight functions performed by each of these committees.

Director Nominations

The Nominating and Corporate Governance Committee will consider candidates for Board membership suggested by its members, other Board members, as well as management and shareholders. Shareholders who wish to recommend a prospective nominee should follow the procedures set forth in Section 2.14 of our bylaws as described in the section of this proxy statement entitled “Shareholder Proposals for Nominees.” The Nominating and Corporate Governance Committee has not adopted a formal policy for increasing or decreasing the size of the Board of Directors. Our Governance Guidelines provides that the Board should generally have between five and seven directors. The Board of Directors is currently comprised of six directors. The Nominating and Corporate Governance Committee believes that a six person Board of Directors is appropriate. At six directors, the Board of Directors has a diversity of talent and experience to draw upon, is able to appropriately staff the committees of the Board and is able to engage the directors in Board and committee service, all while maintaining efficient function and communication among members. If appropriate, the Board may determine to increase or decrease its size, including in order to accommodate the availability of an outstanding candidate.

Criteria for Nomination to the Board; Diversity Considerations. The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and approving qualified candidates for nomination as directors. The Nominating and Corporate Governance Committee has not adopted minimum qualifications that nominees must meet in order for the Nominating and Corporate Governance Committee to recommend them to the Board of Directors, as the Nominating and Corporate Governance Committee believes that each nominee should be evaluated based on his or her merits as an individual, taking into account the needs of Clearfield and the Board of Directors. The Nominating and Corporate Governance Committee has determined that it will evaluate each prospective nominee against the following standards and qualifications:

| · | Background, including demonstrated high personal and professional ethics and integrity; |

| · | The ability to exercise good business judgment and enhance the Board’s ability to manage and direct the affairs and business of Clearfield; |

| · | Commitment, including the willingness to devote adequate time to the work of the Board and its committees; |

| · | The ability to represent the interests of all shareholders and not a particular interest group; |

| · | The skills needed by the Board, within the context of the existing composition of the Board, including knowledge of our industry and business or experience in business, finance, law, education, research or government; |

| · | The candidate’s qualification as “independent” under Nasdaq or other standards and qualification to serve on Board committees; and |

| · | Diversity, in terms of knowledge, experience, skills, expertise, and other demographics which contribute to the Board’s diversity. |

The Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity. However, as part of the nominee selection process for this Annual Meeting, the Nominating and Corporate Governance Committee reviewed the knowledge, experience, skills, expertise, and other characteristics of each director nominee. Based upon that review, the Nominating and Corporate Governance Committee believes that each director contributes to the Board’s diversity in terms of knowledge, experience, skills, expertise, and other demographics that particular director brings to the Board.

In reviewing prospective nominees, the Nominating and Corporate Governance Committee reviews the number of public company boards on which a director nominee serves to determine if the nominee will have the ability to devote adequate time to the work of our Board and its committees. Our Governance Guidelines provide that non-employee directors should serve on no more than four boards of other publicly-held companies, subject to Board waiver with respect to this guideline on a case-by-case basis.

14

The Nominating and Corporate Governance Committee also considers such other relevant factors as it deems appropriate. The Nominating and Corporate Governance Committee will consider persons recommended by the shareholders using the same standards used for other nominees.

Process for Identifying and Evaluating Nominees. The process for identifying and evaluating nominees to the Board of Directors is initiated by identifying a slate of candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board and, if the Nominating and Corporate Governance Committee deems appropriate, a third-party search firm. The Nominating and Corporate Governance Committee evaluates these candidates by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. One or more Nominating and Corporate Governance Committee members may interview the prospective nominees in person or by telephone. After completing the evaluation, the Nominating and Corporate Governance Committee makes a recommendation to the full Board of the nominees to be presented for the approval of the shareholders or for election to fill a vacancy.

Board Nominees for the 2020 Annual Meeting. The nominees for the Annual Meeting were selected by the Nominating and Corporate Governance Committee in November 2019. All nominees were elected by shareholders at the 2019 Annual Meeting of Shareholders. We have not engaged a third-party search firm to assist us in identifying potential director candidates, but the Nominating and Corporate Governance Committee may choose to do so in the future.

Shareholder Proposals for Nominees. The Nominating and Corporate Governance Committee will consider written proposals from shareholders for nominees for director. Any such nominations should be submitted to the Nominating and Corporate Governance Committee c/o the Secretary of Clearfield, Inc. To be considered, the written notice must be timely received and in proper form as described in our bylaws and in the section of this proxy statement entitled “Shareholder Proposals and Shareholder Nominees for 2021 Annual Meeting.”

Board Attendance at Board, Committee and Annual Shareholder Meetings

During fiscal year 2019, the Board of Directors met four times. Each nominee for director attended at least 75% of the meetings of the Board and committees on which he or she served during fiscal year 2019. The Board of Directors regularly meets in executive session without the presence of members of management, including the Chief Executive Officer. We do not have a formal policy on attendance at meetings of our shareholders. However, we encourage all Board members to attend all meetings, including the annual meeting of shareholders. All of the directors then serving, with the exception of Mr. Hayward, attended the 2019 Annual Meeting of Shareholders.

Communications with Directors

Shareholders may communicate with the Board of Directors as a group, the chair of any committee of the Board of Directors, or any individual director by sending an e-mail to board@clfd.net or by directing the communication in care of the Secretary of Clearfield, to the address set forth on the front page of this proxy statement. Shareholders making a communication in this manner will receive a confirmation of receipt of the communication if the Secretary is provided with an address for that purpose and the shareholder does not otherwise request that no confirmation be sent.

All communications that are not excluded for the reasons stated below will be forwarded unaltered to the director(s) to which the communication is addressed or to the other appropriate director(s). Communications received from shareholders will be forwarded as part of the materials sent before the next regularly scheduled Board or committee meeting, although the Board has authorized the Secretary, in his or her discretion, to forward communications on a more expedited basis if circumstances warrant.

The Board of Directors has authorized the Secretary to exclude a communication on matters that are unrelated to the duties and responsibilities of the Board, such as:

| · | Product inquiries, complaints or suggestions |

| · | New product suggestions |

| · | Resumes and other forms of job inquiries |

| · | Surveys |

| · | Business solicitations or advertisements |

15

In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded. Any excluded communication will be made available to the Board of Directors upon request of any director.

If shareholders have a communication that is a proposal for a nominee for director or is a proposal for shareholder action to be included in our proxy statement, the communication must be directed to Secretary and must conform to the requirements of Clearfield’s bylaws. For more information, please review our bylaws and the sections of this proxy statement entitled “Director Nominations – Shareholder Proposals for Nominees” and “Shareholder Proposals and Shareholder Nominees for 2021 Annual Meeting.”

Code of Ethics

We have adopted a code of ethics that applies to all directors, officers and employees, including our principal executive officer, principal financial officer and controller. This code of ethics is included in our Code of Business Conduct and Ethics Policy which is publicly available under the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. To the extent permitted, we intend to disclose any amendments to, or waivers from, the code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions or with respect to the required elements of the code of ethics on our website under the “Corporate Governance” section.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following report of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the 1934 Securities Exchange Act, as amended, except to the extent that we specifically incorporate it by reference in such filing.

In accordance with its charter, the Audit Committee reviewed and discussed the audited financial statements with management and Baker Tilly Virchow Krause, LLP, our independent registered public accounting firm. The discussions with Baker Tilly Virchow Krause, LLP also included the matters required by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

Baker Tilly Virchow Krause, LLP provided to the Audit Committee the written disclosures and the letter regarding its independence as required by the Public Company Accounting Oversight Board. This information was discussed with Baker Tilly Virchow Krause, LLP.

Based on the review and discussions referred to above, the Audit Committee recommended to our Board that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2019.

BY: THE AUDIT COMMITTEE

Charles N. Hayssen (Chair)

Patrick Goepel

Roger Harding

Donald R. Hayward

16

EXECUTIVE OFFICERS

Set forth below is biographical and other information for our current executive officers. Information about Ms. Cheryl Beranek, our President and Chief Executive Officer, may be found in this proxy statement under the heading “Election of Directors.”

John P. Hill, 54, was appointed as our Chief Operating Officer effective October 30, 2008. Prior to being appointed in this position, Mr. Hill had been our Vice President of Engineering and Product Management since 2007. He also served as our Vice President of Product Management and Development from 2004 to 2007 and was our first Vice President of Sales from 2003 to 2004. Mr. Hill attended Macalester College and the University of Minnesota.

Daniel R. Herzog, 55, has been Chief Financial Officer since August 25, 2011 and served as Interim Chief Financial Officer from February 19, 2011 until his appointment in August 2011. He served as Clearfield’s Vice President of Administration from June 2009, until his appointment as Interim Chief Financial Officer, which also includes the duties of Vice President of Administration. Mr. Herzog previously served as our Comptroller and principal accounting officer from September 2003 through February 2006. Mr. Herzog held positions of Controller and Chief Financial Officer in his 13 years at Americable, which was acquired by Clearfield in 2003. Mr. Herzog received his Bachelors of Arts degree in Accounting in 1986 from Gustavus Adolphus College in St. Peter, Minnesota.

EXECUTIVE COMPENSATION

Explanation of Compensation

The following is an explanation of compensation during fiscal year 2019 to the persons who are referred to in this proxy statement as our “named executive officers”:

| · | Cheryl Beranek, our President and Chief Executive Officer |

| · | Daniel R. Herzog, our Chief Financial Officer |

| · | John P. Hill, our Chief Operating Officer |

This section is intended to provide a framework within which to understand the actual compensation awarded to, earned or held by each named executive officer during fiscal year 2019, as reported in the compensation tables and accompanying narrative sections appearing on pages 17 to 25 of this proxy statement.

Our Compensation Philosophy

Our philosophy with respect to the compensation of executive officers is based upon the following principles, which are also applicable to compensation of all employees:

| · | Base salaries should be set at levels that recognize the significant potential compensation opportunities available through performance based compensation; and |

| · | Performance-based compensation should constitute a significant portion of the executive’s overall compensation and be available to the executive when they individually deliver, and we as a company deliver, high performance. |

The Compensation Committee reviews our compensation philosophy and our compensation programs regularly (no less than annually). The Compensation Committee’s review is two-fold: first, to ensure our philosophy and programs meet our objectives of providing compensation that attracts and retains superior executive talent and encourages our executive officers to achieve our business goals and second, to identify changes and trends in executive compensation policies and practices.

Overview of Compensation Process – Use of Compensation Consultant and Role of Management

The responsibility of the Compensation Committee is to review and approve the compensation and other terms of employment of our Chief Executive Officer and our other executive officers. The Compensation Committee has also been appointed by the Board of Directors to administer our equity compensation plans, which for fiscal year 2019 consisted of the 2007 Plan.

In carrying out its duties, the Compensation Committee participates in the design and implementation and ultimately reviews and approves specific compensation programs. On November 6, 2018, the Compensation Committee recommended and the Board of Directors approved the establishment of a cash incentive compensation program for fiscal year 2019 (the “2019 Bonus Program”) for certain of our employees including executive officers. The 2019 Bonus Program is summarized below.

17

Under the Compensation Committee’s charter, the Compensation Committee has the authority to retain, at our expense, such independent counsel or other advisers as it deems necessary to carry out its responsibilities. The compensation consultant and any other adviser retained by the Compensation Committee report to the Compensation Committee. For fiscal year 2019, the Compensation Committee did not retain a compensation consultant. Instead, the Compensation Committee reviewed certain aspects of our historical compensation practices and other information against which it measured the competitiveness of our compensation of the named executive officers in fiscal year 2019.

In determining compensation for named executive officers, other than the Chief Executive Officer, the Compensation Committee solicits input from the Chief Executive Officer regarding the duties and responsibilities of the other executive officers and the results of performance reviews. The Chief Executive Officer also recommends to the Compensation Committee the base salary for all named executive officers, the awards under the cash incentive compensation program such as the 2019 Bonus Program, discretionary bonuses, and equity awards. The Chief Executive Officer also recommended to the Compensation Committee the financial performance goals under the 2019 Bonus Program. No named executive officer, other than the Chief Executive Officer, has a role in establishing executive compensation. From time to time, the named executive officers are invited to attend meetings of the Compensation Committee. However, no named executive officer attends any executive session of the Compensation Committee or is present during deliberations or determination of such named executive officer’s compensation.

2019 Compensation for Named Executive Officers

For the named executive officers, the Compensation Committee considers the appropriate mix of components of compensation consisting of base salary, an annual cash bonus based on achievement of goals determined by the Compensation Committee, and long-term equity compensation. Ms. Beranek, who is both a director and a named executive officer, receives no compensation for her service as a Board member.

Base Salaries

In November 2016, the Committee recommended and Board of Directors set the annual base salaries of our executive officers and these amounts remained unchanged in fiscal year 2019. The annual base salaries of our named executive officers for fiscal year 2019 were: Cheryl Beranek, President and Chief Executive Officer, $322,317; John P. Hill, Chief Operating Officer, $322,317; and Daniel R. Herzog, Chief Financial Officer, $200,193.

Design of and Payouts under the 2019 Bonus Program

Consistent with its compensation philosophy and the objectives of annual cash incentive programs generally, the Compensation Committee adopted the 2019 Bonus Program as our performance based compensation program.

Under the 2019 Bonus Program, the Committee determined minimum, target and maximum performance goals relating to our revenue for fiscal year 2019, as well as the cash bonus that each executive officer could earn as a percentage of her or his base salary at the minimum, target and maximum level.

The following table shows the cash bonus as a percentage of salary that would be earned by each of the executive officer officers under the 2019 Bonus Program upon our achievement of the minimum, target and maximum fiscal year 2019 revenue.

18

| Executive Officer and Title | Bonus Opportunity As a Percentage of Base Salary | ||

Minimum Goal Achieved |

Target Goal Achieved |

Maximum Goal Achieved | |

|