Exhibit 99.1

NASDAQ:CLFD 1 2020 Shareholder Meeting February 2020 NASDAQ: CLFD

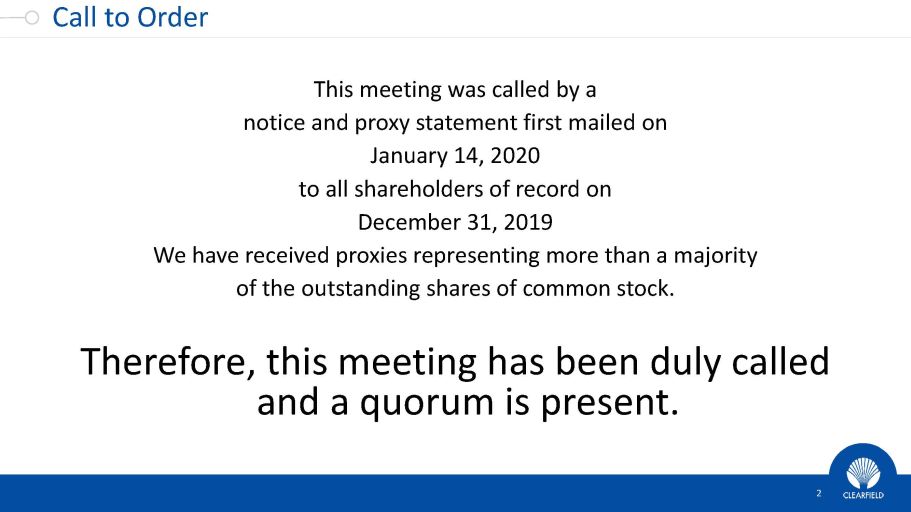

NASDAQ:CLFD Call to Order This meeting was called by a notice and proxy statement first mailed on January 14, 2020 to all shareholders of record on December 31, 2019 We have received proxies representing more than a majority of the outstanding shares of common stock. Therefore, this meeting has been duly called and a quorum is present. 2

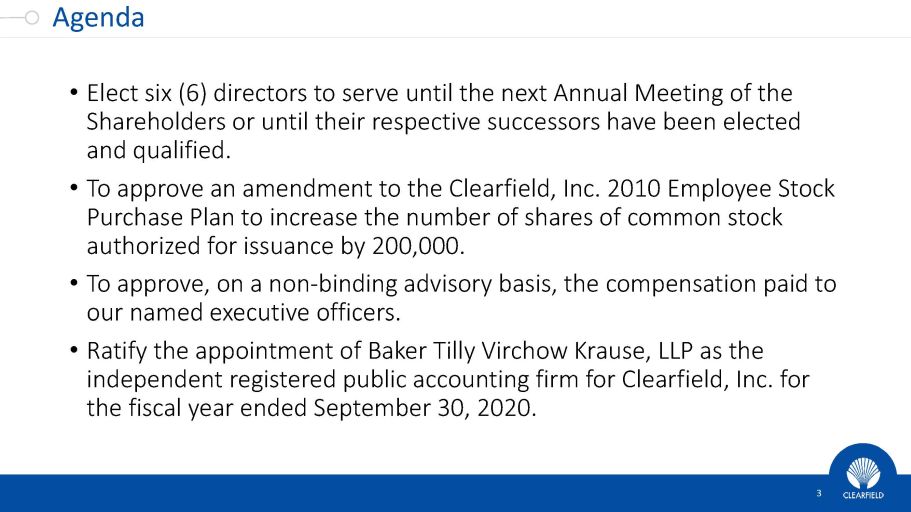

NASDAQ:CLFD Agenda • Elect six (6) directors to serve until the next Annual Meeting of the Shareholders or until their respective successors have been elected and qualified. • To approve an amendment to the Clearfield, Inc. 2010 Employee Stock Purchase Plan to increase the number of shares of common stock authorized for issuance by 200,000. • To approve, on a non - binding advisory basis, the compensation paid to our named executive officers. • Ratify the appointment of Baker Tilly Virchow Krause, LLP as the independent registered public accounting firm for Clearfield, Inc. for the fiscal year ended September 30, 2020. 3

NASDAQ:CLFD Voting 4

NASDAQ:CLFD Adjournment 5

NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “est ima te,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for exam ple, statements about the Company’s future revenue and operating performance, integration of the acquired active cabinet line, trends in and growth of the FTTx markets, market segments or customer purchases, effectiveness of the Company’s sales and marketing strategies and organization, utiliz ati on of manufacturing capacity, and the development and marketing of products. These statements are based upon the Company's current expectations a nd judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's perfor man ce, including, without limitation: to compete effectively, we must continually improve existing products and introduce new products that ach iev e market acceptance; our expected growth is based upon the expansion of the telecommunications market; our operating results may fluctuate signifi can tly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market price of our common stock; our suc cess depends upon adequate protection of our patent and intellectual property rights; intense competition in our industry may result in price r edu ctions, lower gross profits and loss of market share; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from co mpleting customer orders, all of which could materially harm our business; a significant percentage of our sales in the last three fiscal years have be en made to a small number of customers, and the loss of these major customers or significant decline in business with these major customers would adversel y a ffect us; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of busine ss combinations and related integration activities; we may be subject to risks associated with acquisitions that could adversely affect future op era ting results; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expen ses ; we are dependent upon key personnel; we face risks associated with expanding our sales outside of the United States; our business is dependent on e ffe ctive management information systems and information technology infrastructure; our results of operations could be adversely affected by econo mic conditions and the effects of these conditions on our customers’ businesses; changes in government funding programs may cause our customers and pro spective customers to delay or reduce purchases; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on F orm 10 - K for the year ended September 30, 2019 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2020 Clearfield, Inc. All Rights Reserved. NASDAQ:CLFD 6

NASDAQ:CLFD What We Do The Fiber to Anywhere Company With unrivaled product innovations and agile service response, Clearfield® is accelerating cost - effective fiber fed deployments with the industry's most craft - friendly fiber management and pathway products. 7

NASDAQ:CLFD Wireless What “G” Is it? Untangling Wireless Applications

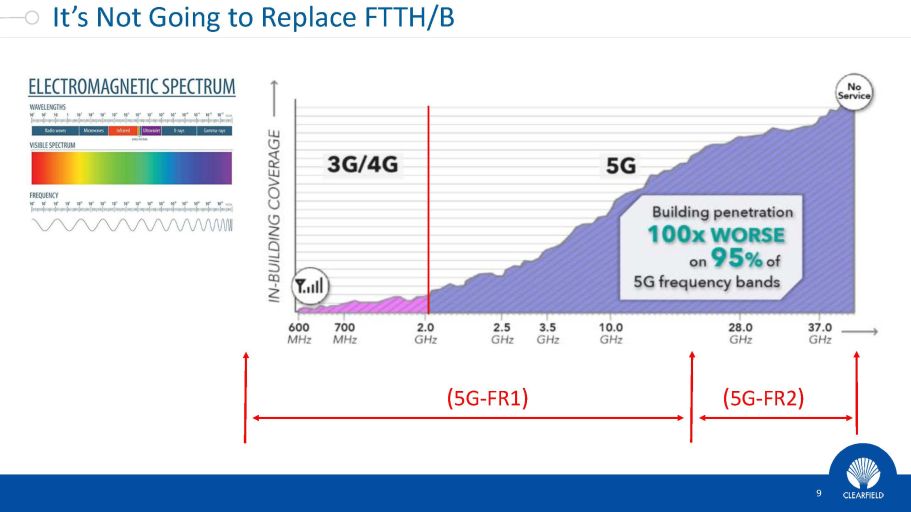

NASDAQ:CLFD It’s Not Going to Replace FTTH/B 9 ( 5G - FR1 ) ( 5G - FR2 )

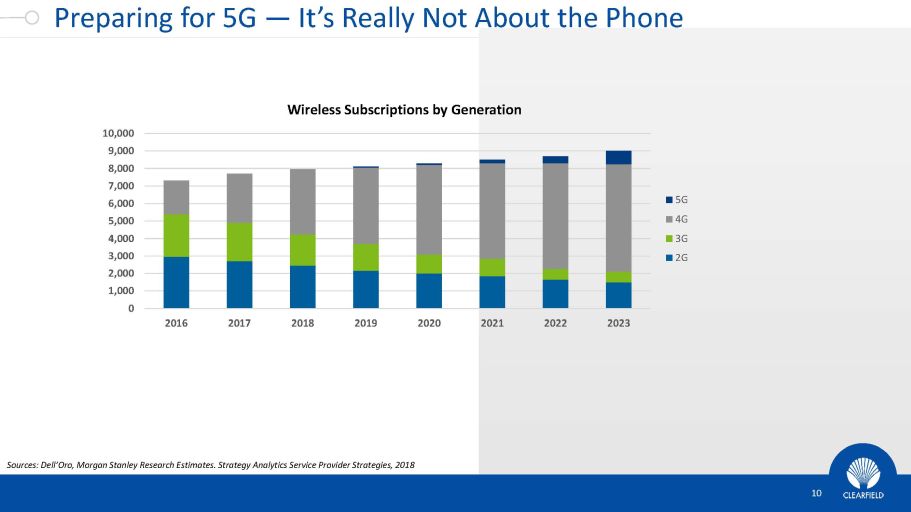

NASDAQ:CLFD Preparing for 5G — It’s Really Not About the Phone 10 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2016 2017 2018 2019 2020 2021 2022 2023 5G 4G 3G 2G Wireless Subscriptions by Generation Sources: Dell’Oro , Morgan Stanley Research Estimates. Strategy Analytics Service Provider Strategies, 2018

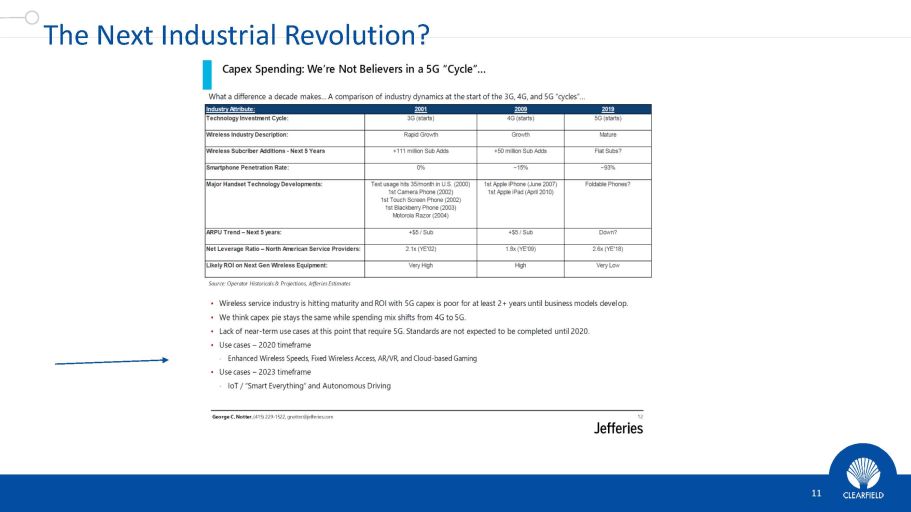

NASDAQ:CLFD The Next Industrial Revolution? 11

NASDAQ:CLFD 12 • Use cases – 2020 timeframe • Enhanced Wireless Speeds, Fixed Wireless Access, AR/VR and Cloud - based Gaming • Use cases – 2023 timeframe • IoT / “Smart Everything” and Autonomous Driving

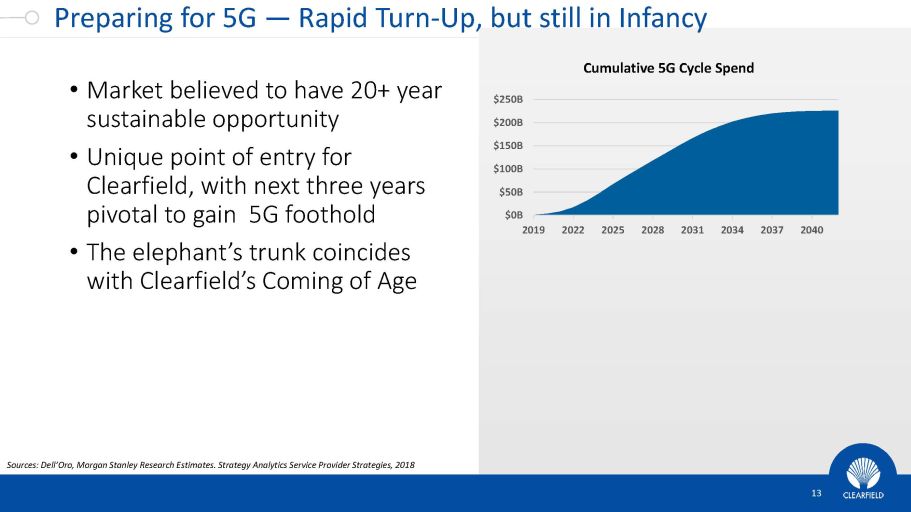

NASDAQ:CLFD Preparing for 5G — Rapid Turn - Up, but still in Infancy 13 • Market believed to have 20+ year sustainable opportunity • Unique point of entry for Clearfield, with next three years pivotal to gain 5G foothold • The elephant’s trunk coincides with Clearfield’s Coming of Age $0B $50B $100B $150B $200B $250B 2019 2022 2025 2028 2031 2034 2037 2040 Cumulative 5G Cycle Spend Sources: Dell’Oro , Morgan Stanley Research Estimates. Strategy Analytics Service Provider Strategies, 2018

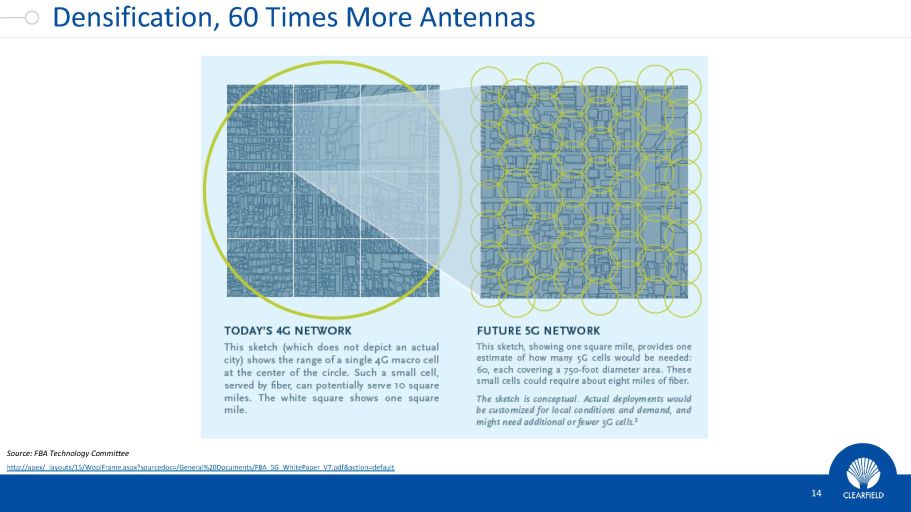

NASDAQ:CLFD Densification, 60 Times More Antennas 14 http://apex/_layouts/15/WopiFrame.aspx?sourcedoc=/General%20Documents/FBA_5G_WhitePaper_V7.pdf&action=default Source: FBA Technology Committee

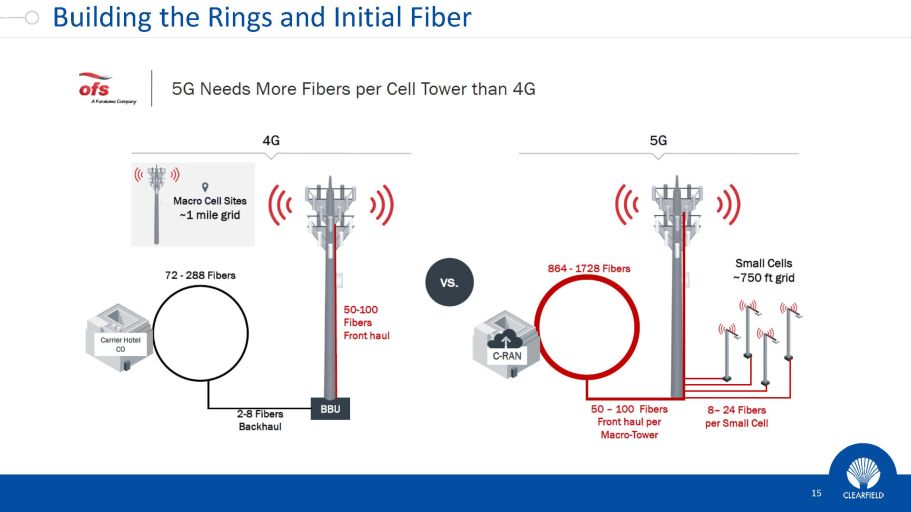

NASDAQ:CLFD Building the Rings and Initial Fiber 15

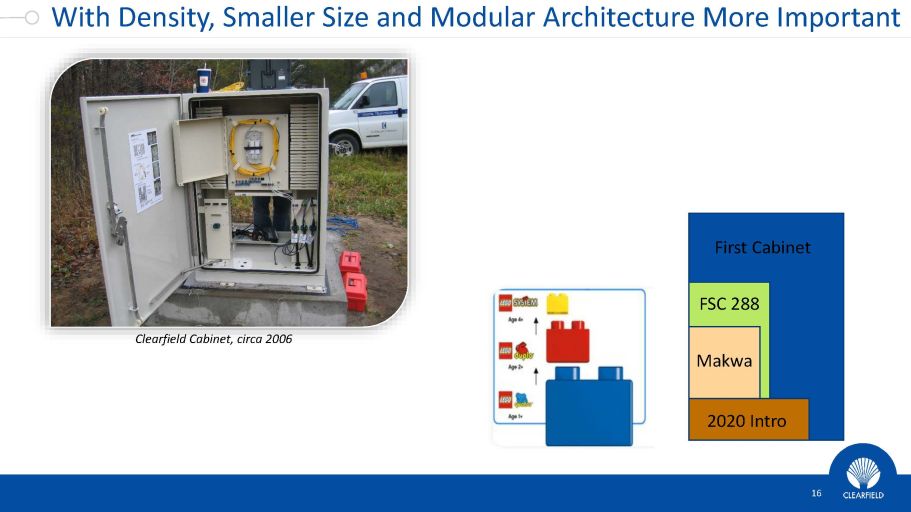

NASDAQ:CLFD With Density, Smaller Size and Modular Architecture More Important 16 First Cabinet FSC 288 Makwa 2020 Intro Clearfield Cabinet, circa 2006

NASDAQ:CLFD 17 https://vimeo.com/379273200/caa2d8d555

NASDAQ:CLFD 5G Product Shipping 18 https://www.seeclearfield.com/newsroom/clearfield - launches - streetsmart - fiber - management - portfolio.html

NASDAQ:CLFD