Exhibit 99.1

Good afternoon. Welcome to Clearfield’s fiscal third quarter 2020 earnings conference call. My name is Daryl, and I will be your operator this afternoon.

Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions.

I would now like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company's website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD The Industry Leader in Craft Friendly Fiber Optic Management and Connectivity Solutions Fiscal Q3 2020 Earnings Call FieldReport

Please note that during the course of this call, management will be making forward-looking statements regarding future events and the future financial performance of the Company. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements.

It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward-looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10-K filing with the Securities and Exchange Commission provides descriptions of those risks. As a reminder, the slides in this presentation are not controlled by the speaker but rather by you, the listener. Please advance forward through the presentation as the speakers present their remarks.

With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek.

Please proceed.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “est ima te,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements includ e, for example, statements about the expected impact of COVID - 19 and related economic uncertainty, the Company’s future revenue and operating pe rformance, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's busines s. Certain important factors could have a material impact on the Company's performance, including, without limitation: the as yet - unknown i mpact of COVID - 19 and related economic uncertainty; to compete effectively, we must continually improve existing products and introduce new pro duc ts that achieve market acceptance; our expected growth is based upon the expansion of the telecommunications market; our operating results ma y f luctuate significantly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market p ric e of our common stock; our success depends upon adequate protection of our patent and intellectual property rights; intense competition in ou r i ndustry may result in price reductions, lower gross profits and loss of market share; we rely on single - source suppliers, which could cause delays, in creases in costs or prevent us from completing customer orders, all of which could materially harm our business; a significant percentage of our sales in th e last three fiscal years have been made to a small number of customers, and the loss of these major customers or significant decline in business with the se major customers would adversely affect us; further consolidation among our customers may result in the loss of some customers and may reduce sal es during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions th at could adversely affect future operating results; product defects or the failure of our products to meet specifications could cause us to lose cu stomers and sales or to incur unexpected expenses; we are dependent upon key personnel; we face risks associated with expanding our sales outside of the United States; our business is dependent on effective management information systems and information technology infrastructure; our results of o per ations could be adversely affected by economic conditions and the effects of these conditions on our customers’ businesses; changes in govern men t funding programs may cause our customers and prospective customers to delay or reduce purchases; and other factors set forth in Part I, Item I A. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2019 as well as other filings with the Securities and E xchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2020 Clearfield, Inc. All Rights Reserved. NASDAQ:CLFD 2

Good afternoon, and thank you everyone for joining us today. I hope everyone is safe and healthy during these truly unprecedented times.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Welcome Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 3

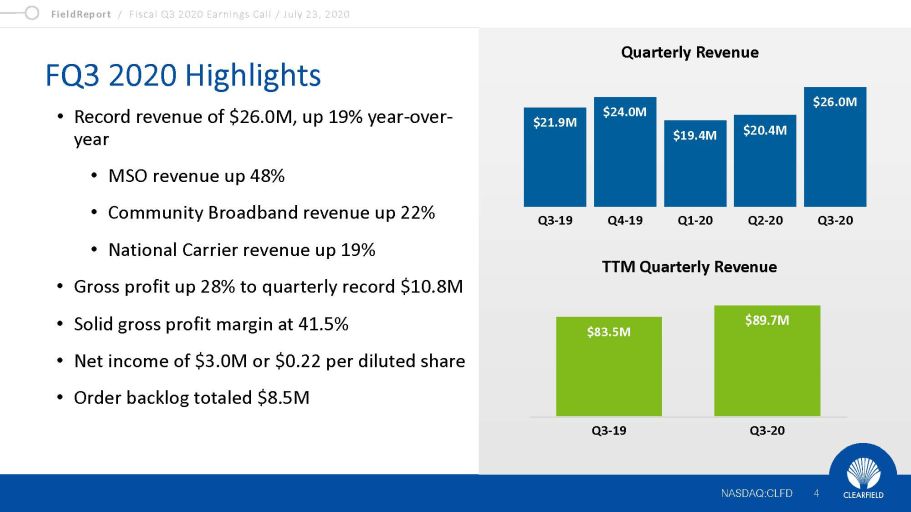

The third quarter of fiscal 2020 was a strong quarterly performance for Clearfield, as we achieved the highest level of revenue for any quarter in our company’s history. The $26.0 million we reported for Q3 was up 27% sequentially and 19% year-over-year. This robust growth was driven most significantly by contributions from our MSO and Community Broadband markets, which were up 48% and 22% year-over-year, respectively.

The record topline performance in the quarter helped produce record gross profit, which totaled $10.8 million. As a percentage of revenue, the 41.5% marked the highest gross profit margin we’ve achieved as a company in more than two years. Both these achievements were due to a favorable product mix in the quarter as well as the continued realization of the operational efficiency initiatives we’ve implemented since the start of fiscal 2020. This includes the expanded use of our Mexico manufacturing plant, a reduction in tariff costs, and the cost-reduction efforts across our product lines.

All of these measures have helped increase our efficiency and enabled us to keep our operating expenses relatively stable, while driving our topline. In fact, the $3.0 million of net income we generated in the quarter was the highest quarterly level in several years.

We ended the quarter with a robust order backlog of $8.5 million, which was down slightly from the prior quarter end, but up 68% from the same period last year. I am also encouraged to report that we continue to book at industry-leading lead times for our standard products.

Before I turn the call over to our CFO Dan Herzog I’d like to walk through our financial performance in more detail, spending a moment reviewing some of our recent operational updates and progress in our core end markets.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD FQ3 2020 Highlights NASDAQ:CLFD 4 • Record revenue of $26.0M, up 19% year - over - year • MSO revenue up 48% • Community Broadband revenue up 22% • National Carrier revenue up 19% • Gross profit up 28% to quarterly record $10.8M • Solid gross profit margin at 41.5% • Net income of $3.0M or $0.22 per diluted share • Order backlog totaled $8.5M $21.9M $24.0M $19.4M $20.4M $26.0M Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Quarterly Revenue TTM Quarterly Revenue $83.5M $89.7M Q3-19 Q3-20

I’m encouraged to report that Clearfield did not experience any particular customer ordering delays or negative changes in ordering patterns during fiscal Q3 due to COVID-19.

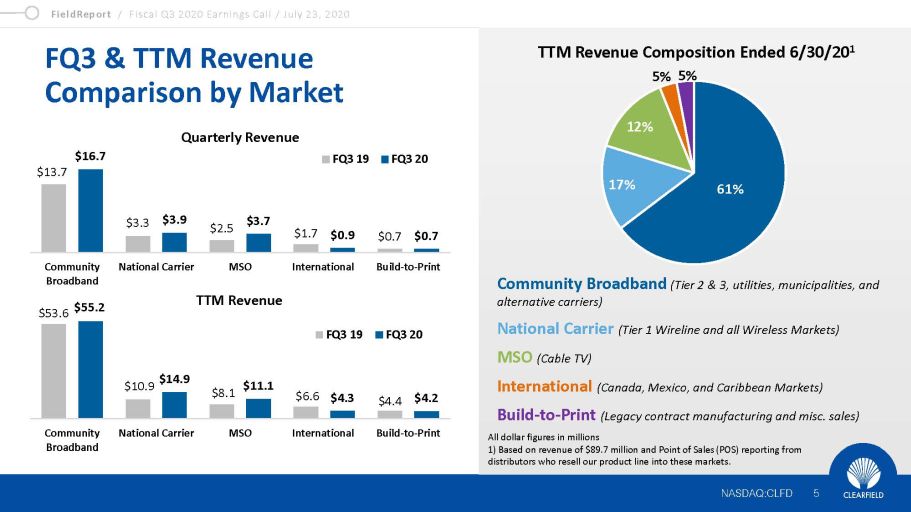

Within that context, let’s look at our market segments by revenue, starting first with our core Community Broadband market. In the third quarter, we generated revenue of $16.7 million, which was up 22% from the same period last year. On a trailing twelve-month basis ended June 30, 2020, Community Broadband market revenue totaled $55.2 million, which was up 3% from the comparable period last year.

Our National Carrier business was our second largest market, comprising 15% of our total revenue in fiscal Q3 and 17% for the trailing twelve-month period. From a growth standpoint, we built on the momentum we established over the last several quarters, realizing a 19% year-over-year increase in revenue to $3.9 million in the third quarter and a 37% year-over-year increase to $14.9 million for the trailing twelve-month period.

As I’ve addressed within prior FieldReports, the growth we’re seeing in the National Carrier market is related to

the continued demand from fiber-to-the-home and fiber-to-the-business applications. We believe the momentum in our National Carrier

market to date validates the strategic investments we’ve made to capitalize on the Tier 1 market.

In addition to the positive results we experienced in our National Carrier market, we realized another quarter of double-digit growth in our MSO, or Cable TV market. In fiscal Q3, we generated $3.7 million in revenue, which was up 48% year-over-year. For the trailing twelve-month period, we generated $11.1 million from this market, which was up 38% year-over-year.

Revenue in our International market was down 47% year-over-year, and down 35% on a trailing twelve-month basis. The decline in the quarter was primarily related to currency conversion rates which have yet to return to their pre-COVID level. This has made our products temporarily cost-prohibitive, causing customers to delay purchasing decisions.

Revenue in our legacy Build-to-Print business was down slightly in the third quarter, and down 5% over the trailing twelve-month period. On a trailing twelve-month basis, total revenue was $4.2 million, which is consistent with our expectations for this business to operate at approximately a $4 million annual run-rate for the foreseeable future.

With that, I’ll now turn the presentation over to Dan, who will walk us through our financial performance for the third quarter of fiscal 2020.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD FQ3 & TTM Revenue Comparison by Market NASDAQ:CLFD 5 All dollar figures in millions 1) Based on revenue of $89.7 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. TTM Revenue Composition Ended 6/30/20 1 Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Canada, Mexico, and Caribbean Markets) Build - to - Print (Legacy contract manufacturing and misc. sales) 61% 17% 12% 5% 5% $53.6 $10.9 $8.1 $6.6 $4.4 $55.2 $14.9 $11.1 $4.3 $4.2 Community Broadband National Carrier MSO International Build-to-Print FQ3 19 FQ3 20 Quarterly Revenue TTM Revenue $13.7 $3.3 $2.5 $1.7 $0.7 $16.7 $3.9 $3.7 $0.9 $0.7 Community Broadband National Carrier MSO International Build-to-Print FQ3 19 FQ3 20 $55.2

Thank you, Cheri, and good afternoon, everyone.

Now, looking at our third quarter financial results in more detail…

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Financial Update Dan Herzog CHIEF FINANCIAL OFFICER NASDAQ:CLFD 6

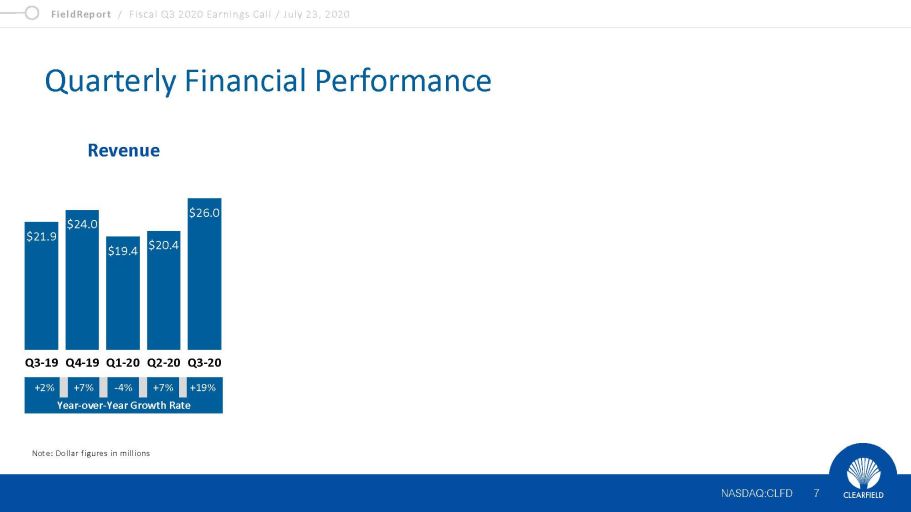

Our revenue in the third quarter of fiscal 2020 increased 19% to $26.0 million from $21.9 million in the same year-ago period. The increase in revenue was primarily due to higher sales in our Community Broadband, MSO and National Carrier markets, partially offset by lower International sales as Cheri just mentioned.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Quarterly Financial Performance 7 NASDAQ:CLFD Note: Dollar figures in millions $21.9 $24.0 $19.4 $20.4 $26.0 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenue +2% +7% - 4% +7% +19% Year - over - Year Growth Rate

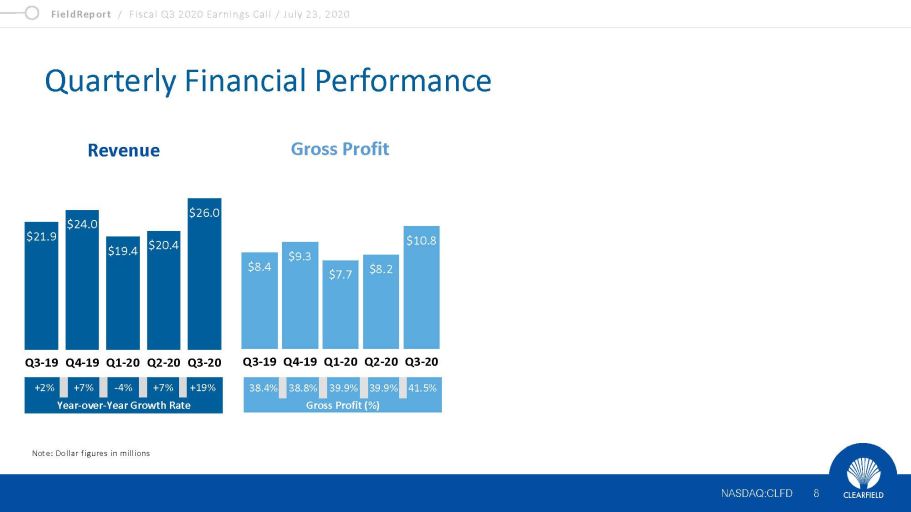

Gross profit for the third quarter of fiscal 2020 totaled $10.8 million, or 41.5% of total revenue. This was an improvement from $8.4 million, or 38.4% of total revenue, in the third quarter last year. The increase in gross profit dollars was due to increased sales volume. The increase in gross margin was due to a more favorable product mix as well as cost reduction efforts across our product lines, including expanded use of our Mexico manufacturing plant and efficiencies realized from our supply chain programs.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Quarterly Financial Performance 8 NASDAQ:CLFD Note: Dollar figures in millions $8.4 $9.3 $7.7 $8.2 $10.8 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Gross Profit 38.4% 38.8% 39.9% 39.9% 41.5% Gross Profit (%) $21.9 $24.0 $19.4 $20.4 $26.0 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenue +2% +7% - 4% +7% +19% Year - over - Year Growth Rate

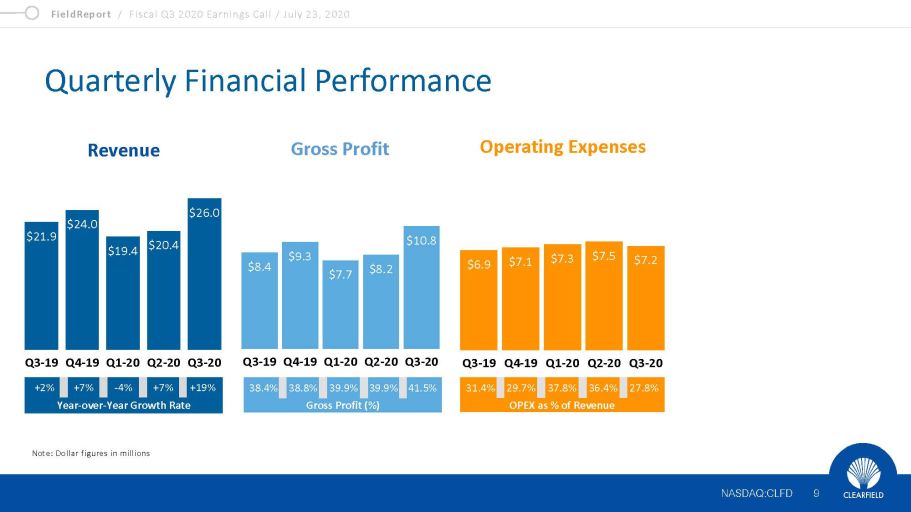

Our operating expenses for the third quarter of fiscal 2020 were $7.2 million, which were up from $6.9 million in the same year-ago quarter. As a percentage of total revenue, operating expenses in Q3 were 27.8% compared to 31.4% in the same year-ago period. The increase in operating expenses was primarily due to the higher compensation costs and costs associated with product testing required for Tier 1 certification, offset by lower travel, entertainment and marketing costs due to COVID-19 restrictions.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Quarterly Financial Performance 9 NASDAQ:CLFD Note: Dollar figures in millions 31.4% 29.7% 37.8% 36.4% 27.8% OPEX as % of Revenue $6.9 $7.1 $7.3 $7.5 $7.2 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Operating Expenses $8.4 $9.3 $7.7 $8.2 $10.8 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Gross Profit 38.4% 38.8% 39.9% 39.9% 41.5% Gross Profit (%) $21.9 $24.0 $19.4 $20.4 $26.0 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenue +2% +7% - 4% +7% +19% Year - over - Year Growth Rate

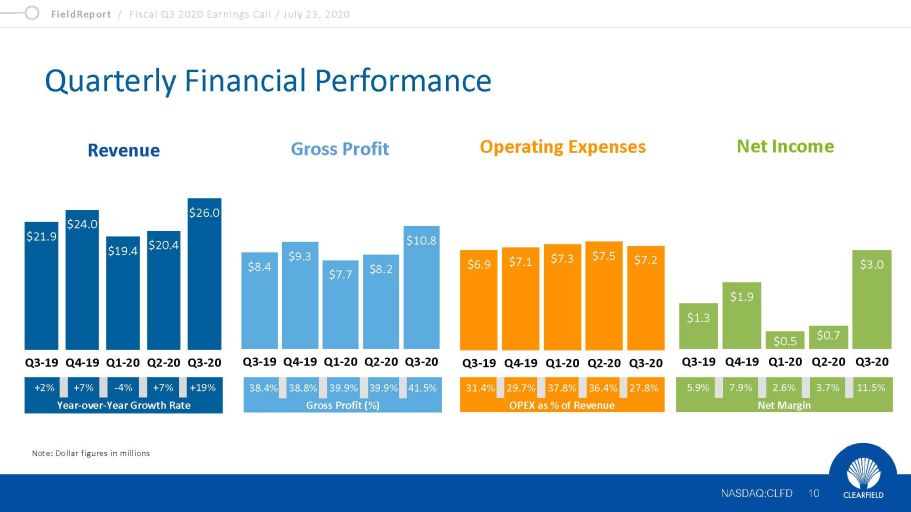

In terms of our profitability measures, income from operations was $3.6 million in the third quarter of fiscal 2020, which compares to $1.5 million in the same year-ago quarter. Income tax expense increased to $763,000 in the third quarter of fiscal 2020, up from $454,000 in the third quarter of 2019. In the third quarter of fiscal 2020, net income totaled $3.0 million, or $0.22 per diluted share, an improvement from $1.3 million, or $0.10 per diluted share, in the same year-ago quarter.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Quarterly Financial Performance 10 NASDAQ:CLFD Note: Dollar figures in millions 5.9% 7.9% 2.6% 3.7% 11.5% Net Margin $1.3 $1.9 $0.5 $0.7 $3.0 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Net Income 31.4% 29.7% 37.8% 36.4% 27.8% OPEX as % of Revenue $6.9 $7.1 $7.3 $7.5 $7.2 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Operating Expenses $8.4 $9.3 $7.7 $8.2 $10.8 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Gross Profit 38.4% 38.8% 39.9% 39.9% 41.5% Gross Profit (%) $21.9 $24.0 $19.4 $20.4 $26.0 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Revenue +2% +7% - 4% +7% +19% Year - over - Year Growth Rate

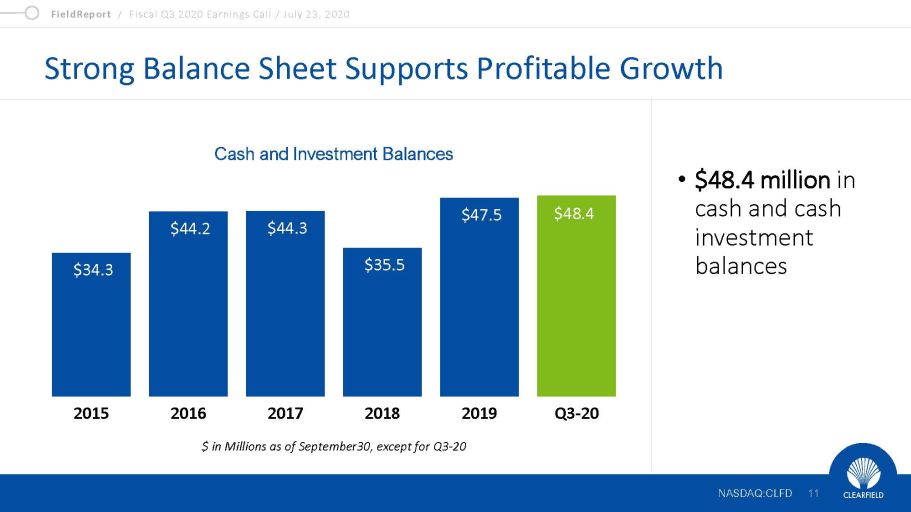

During the third quarter, our cash, cash equivalents and investments remained consistent at $48.4 million compared to the prior quarter end.

We believe the $48.4 million dollars of cash on hand and short-term investments, along with cash flow from operations, is sufficient to meet our working capital and investment requirements for beyond the next 12 months.

As I mentioned on our last FieldReport, our board of directors suspended the company’s share repurchase plan in April to further ensure our financial stability through the current COVID-19 operating environment. Our board and leadership team will continue to evaluate our capital allocation strategy for our shareholders.

That concludes my prepared remarks. I will now turn the call back over to Cheri.

Cheri?

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Strong Balance Sheet Supports Profitable Growth • $48.4 million in cash and cash investment balances NASDAQ:CLFD 11 $ in Millions as of September30, except for Q3 - 20 Cash and Investment Balances $34.3 $44.2 $44.3 $35.5 $47.5 2015 2016 2017 2018 2019 Q3-20 $48.4

Thanks, Dan.

Before I provide an update on our ‘Coming of Age’ plan, I’d like to spend a few moments providing an update on how we continue to navigate the COVID-19 pandemic and the operational measures we’ve taken over the last several months.

In March, Clearfield’s operations were classified as “critical sector work” due to the vital role our solutions play in supporting the communications infrastructure. Since that time, we have continued to be fully operational despite the unprecedented global business closures and the slowdown caused by the health crisis.

We continue with production operations in both our U.S. and Mexican manufacturing facilities and have established multiple contingency plans in the event our ability to operate is diminished or eliminated at either location.

I am encouraged to report that our production operations are working at normal capacity while adhering to state and federal government social distancing guidelines. Our non-production employees are all working remotely and we are actively promoting and demonstrating our product solutions effectively through video conferencing and other methods. I’m so very proud of how our team has seamlessly adapted to today’s dynamic working environment.

We dual source the majority of our components and, as of today, the majority of our supply chain partners remain operational and have continued to provide the necessary components for our products.

I am encouraged to report that we experienced limited impact in our supply chain in fiscal Q3 related to COVID-19 thanks to our forward planning such as strategically increasing our safety stock inventory levels at both our Minneapolis and Mexico facilities. It’s worth pointing out that rather than optimizing a plant for a particular product line, we made the decision to maximize the availability of all product lines by assuring that each location can manufacture across our broad product portfolio. This allowed us to meet customer orders in Q3 and enable us to continue to fulfill orders going forward as well.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD COVID - 19 Operational Update • Critical manufacturer status • Operating at normal capacity while adhering to state and federal government social distancing guidelines • Majority of supply chain remains operational • Placed significant stocking orders on component level inventory to meet customer needs NASDAQ:CLFD 12

Turning to our ‘Coming of Age Plan,’ which is our three-year strategic plan designed to strengthen our core business and position our company for disruptive growth opportunities. As our financial and operational performance in fiscal Q3 and the first nine months of fiscal 2020 have demonstrated, we’re beginning to realize the results from this plan. I'll now spend a moment providing a brief update on how our three major initiatives within that plan are working.

In terms of our first initiative, expanding our core Community Broadband business, during the third quarter we saw customers push forward with their purchase decisions and deployments in response to COVID-19. As I’ve talked about before, the global pandemic has absolutely highlighted the need for high-speed broadband front and center. This has created a swelling of demand, so to speak, that we believe will continue in our fiscal Q4 and into fiscal 2021.

Another driver for our Community Broadband market is the anticipated government funding on the horizon. In particular, the U.S. Rural Digital Opportunity Fund, or RDOF, is designed to bridge the digital divide to efficiently fund the deployment of broadband networks in rural America. Through a two-phase process, the FCC will direct up to $20.4 billion over ten years to finance up to gigabit speed broadband networks in unserved rural areas, connecting millions of American homes and businesses to digital opportunity. The RDOF Phase I auction is currently scheduled to begin on October 22, 2020 and will target over six million homes and businesses in census blocks that are entirely unserved by voice and broadband. Phase II will cover locations in census blocks that are partially served, as well as locations not funded in Phase I.

Earlier this month, there were two proposed bills in the U.S. Congress which would direct the FCC to more quickly hand out these monies from the RDOF program by condensing the application process, setting earlier buildout requirements, and automatically awarding funds to applicants that are in the sole bidder area that commits to offering symmetrical gigabit service. These measures would likely result in a notable proportion of funds going to rural cooperatives, local governments, and other community-based broadband providers to quickly build high-quality fiber networks.

We are continuing to watch these bills so we are poised for success in working with service providers who will benefit from the expanded funding programs.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan NASDAQ:CLFD 13 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, maintaining a steady growth rate

A longstanding competitive differentiator for Clearfield has been our innovative products. Our ability to listen to customer wants and market demands informs our product roadmap so that we’re introducing products that fill a need in the market. Along that line, during fiscal Q3 we introduced two new products: the Aerial Fiber Distribution Hub and the FiberFlex 2000.

The Aerial FDH, which is part of our StreetSmart portfolio, was specifically designed for environments where permitting and right of way have been a problem. Clearfield’s Aerial FDH can be placed directly on a strand in the same space as other aerial enclosures, eliminating the bulk of the engineering, permitting, construction and material time and costs associated with ground or pole mounted FDH options. The aerial FDH has seen strong interest from new alternative carriers looking to overcome right of way challenges.

The other new product, FiberFlex, is the industry’s first active cabinet design for fiber. The product is currently shipping and has been extremely well received by the market. FiberFlex is part of the future of both edge computing as well as the need to move electronics deeper into the access network.

Our success on our operational effectiveness initiatives over the last several quarters is perhaps most evident in our expanding gross profit. One of the chief underlying drivers for this is related to the investments we’ve made to our operations in Mexico, which are starting to yield dividends both in improved efficiencies and cost effectiveness.

As many of you know, we signed a lease for a second manufacturing facility in Mexico in fiscal Q2, which doubled our square footage there and allowed us to establish lean manufacturing initiatives. While COVID-19 caused temporary delays in our ability to begin shipping product from the new facility in fiscal Q2, the second facility is now fully operational, and we commenced shipping during the third quarter.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan NASDAQ:CLFD 14 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, maintaining a steady growth rate Enhancing Competitive Position and Operational Effectiveness Investing in products, manufacturing and supply chain to increase competitiveness and maintain and reduce costs

The third initiative of our plan involves capitalizing on disruptive growth opportunities within the wireline markets of national carriers and all wireless markets.

As reported earlier in this FieldReport, national carrier business was up 19% for the quarter. However, while national carriers have declared a commitment to capital equipment expenditures despite the COVID pandemic, COVID has impacted the deployment plans for 5G both in the near and mid-term. As it relates to the near term, certain carriers identified that in locations where 4G was available they deemed 5G as not an essential service. Accordingly, we saw a bit of a pause in new deployments by the carriers because of these restrictions. Within the general wireless carrier space, we saw growth in the deployment of optical component revenue, specifically as it related to optimizing existing fiber assets to meet exploding bandwidth requirements.

In environments where our technologies are used to lower the cost of access network deployment, revenues were slower than anticipated as COVID restrictions reduced the number of installation crews deployed in the hard-hit Northeast early in the quarter. As the COVID hot spots moved to other locations, COVID temporarily delayed two planned field trials with another Tier 1 customer. We are currently planning for one of the trials to commence in fiscal Q4 and then the other in fiscal 2021.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Clearfield’s ‘Coming of Age’ Plan NASDAQ:CLFD 15 Expanding Core Community Broadband Business Attracting utilities, co - ops and CLECs as they enter underserved communities, maintaining a steady growth rate Enhancing Competitive Position and Operational Effectiveness Investing in products, manufacturing and supply chain to increase competitiveness and maintain and reduce costs Capitalizing on Disruptive Growth Opportunities Within National Wireline and Wireless Markets Leveraging customer relationships and application knowledge to capture opportunities related to 5G, NG - PON, and edge computing initiatives

The third quarter was a strong period for Clearfield. Our financial performance and operational effectiveness demonstrated the resilience of our business, customer base and industry as a whole.

Our success in Q3 has given us significant momentum in Q4 and a positive outlook for fiscal 2021. At no time in our history, has the need for high-speed broadband connectivity been more apparent than during this COVID crisis. Working remotely, often from home, has blurred, or even destroyed the business versus consumer distinction within all networks now carrying business critical and entertainment data at the same time.

Service providers – who do not know where demand will come from next, are faced with needing to put capacity everywhere. The business case for optical fiber markets for 5G and Access Networks deployment couldn’t be more evident – or brighter.

And with that, we’re ready to open the call for your questions.

Operator?

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Key Takeaways Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in a rapidly growing multi - billion dollar fiber optics industry, especially with the roll - out of 5G & NG - PON2 technologies Healthy balance sheet: $48.4M in cash and investments Twelve - year history of profitability and positive free cash flow 12 NASDAQ:CLFD 16

Thank you.

We will now be taking questions from the company’s publishing sell-side analysts. Our first question will come from the line of Jaeson Schmidt of Lake Street Capital. Please proceed with your questions.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 17 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Hey, guys, thanks for taking my questions. I just want to start if you think, just given the momentum you saw in the June quarter. Do you think any orders got pulled in from the second-half of this calendar year?

Cheri Beranek

Chief Executive Officer, President & Director

No, I don’t think so. I mean, I think we saw – and Community Broadband has typically been strong in the third and fourth quarter. And so, we went into the quarter a little bit early. I mean, I think, we may have had a little bit of the backlog in March 31, might have been pulled in a little bit the last couple of weeks of the quarter as people kind of get ready and wanted to make sure they were in the front, but not significant, and that was in March. Our – the quarter here, it’s strong kind of across the markets. There’s no significant one large customer in Community Broadband or in cable TV, it’s really kind of a broad spacing. So really pleased with where it’s at.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 18 Dan Herzog CHIEF FINANCIAL OFFICER

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay, that’s helpful. And just curious if you could comment on the linearity of orders in the June quarter. Did it – was it fairly linear throughout the quarter?

Cheri Beranek

Chief Executive Officer, President & Director

Very consistent. So I mean, we’re – I actually – I have a graph that is our average daily bookings per month since the day we started Clearfield. So we track that very carefully and consistently, and we did have a very regular booking period throughout the quarter.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. And the last one for me, and I’ll jump back into queue. Obviously, a very strong gross margin in the June quarter, you laid out a number of drivers behind that. How should we think about gross margin going forward? Is this going to be sort of the new normal level?

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 19 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

I wouldn’t get too comfortable. We like it a lot. We work very hard to get here. And we think there’s room for improvement in that we believe in the world-class operations and I’ve got an amazing team to pull that together. But everything did click really nicely together here. So this might be a little high to model indefinitely moving forward. But I think we are kind of showing a little bit higher than what we originally forecasted for the year, because things did work nicely. But we made some strong investments by which to do that, putting inventory in both locations, ensuring that we didn’t have issues associated with expedites and all. We made a lot of the right decisions. And if you think back the last 100 days, the amount of guesswork that we were doing, we were right more times than not, and I think we’ve got some really good data that we used to do that. But as we move forward, there’s still an awful lot of change out there that we don’t quite know how to anticipate. So we’re being cautiously optimistic and working hard to stay here and improve, but I wouldn’t model at these levels quite yet.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. Thanks a lot.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 20 Dan Herzog CHIEF FINANCIAL OFFICER

Operator

Thank you. Our next question comes from the line of Tim Savageaux of Northland Capital Markets. Please proceed with your questions. Tim, would you be able to check if your phone is on mute, please?

Tim Savageaux

Northland Capital Markets, Research Division

Yes. Sorry about that.

Operator

No problem.

Tim Savageaux

Northland Capital Markets, Research Division

…and congratulations, folks, on the spectacular quarter.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 21 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Thank you.

Daniel Herzog

Chief Financial Officer

Yes. Thanks.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 22 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

And I wanted to talk a little bit more about that. Now, we’ve seen some of your peers as well, Calix earlier in the week, and some pretty strong growth in kind of Tier 3 Community Broadband markets around or over 20%. And that’s – I think you mentioned that you’re seeing that enhanced by increased capacity needs from – I think what’s more of a baseline of double digits or so. And I guess, my question is twofold, which is in saying, you expect this momentum to continue into Q4, which is usually a pretty strong seasonal period for you as well, notwithstanding any kind of network access impacts. Would you expect that type of growth rate to maintain into Q4? Would you expect to be able to grow sequentially in Q4? It looks like your backlog came down a bit, but stayed at pretty high levels. And then as you look into 2021, for your comments on feeling positive about growth, would you expect market growth to return back to that double-digit level? Or could RDOF or any other stimulus that, that might materialize, keep it closer to where we are now?

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 23 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Our third and fourth quarters tend to mirror each other pretty well. And so it’s less about growth in kind of the run rate of the market. And so, last year, our fourth quarter was higher than our third. So growth rate over that might be a little tough to maintain at that – the 22% that we are showing here. So I think fourth quarter was on par – the backlog went down a little bit. But I think fourth quarter, assuming COVID doesn’t hit one of our manufacturing plants. Demand should be consistent, and we expect to continue to be able to fulfill that. As we move into 2021, I don’t think people can wait. In the past, we were in a situation in which the potential government funding programs actually, while they helped after they were implemented, they slowed things down while we were waiting for them. And I think right now, the market is such that consumers are demanding their bandwidth. The difference between business service and consumer service has been blinded and kind of eroded, because we’re all working from home. And in order to protect and prevent churn in their consumer bases, the service providers are doing whatever they can to either increase bandwidth today or to promise bandwidth tomorrow by the investments that they’re making in infrastructure. So we’re very bullish about 2021, and think that there’s some really good opportunities that if we continue to execute that we should be able to bring in.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 24 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Great. And I’m just sorry, just a follow-up. And you mentioned – well, it sounds like you’re saying, whereas historically, you might have seen in discipline from the stimulus slow things down in this environment. It might be speeding it up to some degree, which is interesting. And you mentioned those two factors, I guess, maybe increased traffic overall or work from home and perhaps anticipation of RDOF or something along those lines. As you think about your Community Broadband market, I wonder if you might be able to weight those two factors in terms of what’s more – most important in terms of driving that growth or kind of order of magnitude, would it be two-thirds traffic and one-third stimulus, or I know, it’s kind of granular, but I’m just trying…

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 25 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Oh, yes. Right. I mean…

Tim Savageaux

Northland Capital Markets, Research Division

…to get a sense as you look at the market. What are the more important factors?

Cheri Beranek

Chief Executive Officer, President & Director

Oh, demand and – supply and demand without question. Dan, do you want to talk about to that?

Daniel Herzog

Chief Financial Officer

Yes, sure. No, I totally agree. It’s right there. It’s what’s happening right now versus the program that’s rolling out yet.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 26 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Right. And I know you commented on cable, I think, I might have missed it, though. In terms of – is that – I guess, can you talk a little bit more about the drivers of your strength in the total segment in the quarter? And is that subscriber growth-driven? Or is that more on the business side?

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 27 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

It’s definitely fiber investment. And it’s – I mean, we have emerging opportunities at the National Carriers, but just like we’re strong at the regional carriers within Community Broadband. We are strongest at the regional carriers within the cable TV market. And so in a regional carrier level, the investment by the Tier 3 provider provides an incentive for the regional cable TV provider to continue to invest in fiber. And so our success in Tier 3 Community Broadband has been instrumental in some of the successes that we have to date in MSO markets. And so, I mean, it’s off of a small base, but it’s grown now. I think this is the third quarter in a row, and I’m going to have to double check my numbers here. But I think it’s the third quarter in a row with more than double-digit growth. We also have some emerging opportunities at the National Carrier level. We don’t talk a lot about, but it’s about national standards, things that the National Carriers are looking at in order to where they want to go, especially now in this COVID space as to the kind of investment that they need to do next year and beyond, partially about subscribers and also about leveraging some of their networks for backhaul for the wireless carriers. So it’s truly that fiber to anywhere type protocol that we’ve been preaching for the last five years.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 28 Dan Herzog CHIEF FINANCIAL OFFICER

Tim Savageaux

Northland Capital Markets, Research Division

Great. Thanks very much and congrats again.

Cheri Beranek

Chief Executive Officer, President & Director

You’re very welcome.

Operator

At this time, this concludes the company’s question-and-answer session. If your question was not taken, you may contact Clearfield’s Investor Relations team at clfd@gatewayir.com. I’d now like to turn the call back over to Ms. Beranek for closing remarks.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 29 Dan Herzog CHIEF FINANCIAL OFFICER

Cheri Beranek

Chief Executive Officer, President & Director

Thank you, again, for joining us today. If any of you who are not part of the analyst community have an individual question, please feel free to send that to the IR address, and we will be sure to address those questions, get back to you on an individual basis. We look forward to updating you again on our progress soon. Stay safe and stay healthy.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Thank You Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 30

Thank you for joining us today for Clearfield’s fiscal third quarter 2020 earnings conference call. You may now disconnect.

FieldReport / Fiscal Q3 2020 Earnings Call / July 23, 2020 NASDAQ:CLFD Contact Us NASDAQ:CLFD 31 COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net INVESTOR RELATIONS: Matt Glover and Tom Colton Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com