EXHIBIT 99.2

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD The Industry Leader in Craft Friendly Fiber Optic Management and Connectivity Solutions Fiscal Q1 2021 Earnings Call FieldReport

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Important Cautions Regarding Forward - Looking Statements Forward - looking statements contained herein and in any related presentation or in the related FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “est ima te,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements includ e, for example, statements about the expected impact of COVID - 19 and related economic uncertainty, the Company’s future revenue and operating pe rformance, the impact of the CARES Act or other government programs on the demand for the Company’s products or timing of customer orders , and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important fac tors could have a material impact on the Company's performance, including, without limitation: the as yet - unknown impact of COVID - 19 and related economic uncertainty; to compete effectively, we must continually improve existing products and introduce new products that achieve ma rke t acceptance; our expected growth is based upon the expansion of the telecommunications market; our operating results may fluctuate significant ly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market price of our common stock; our suc cess depends upon adequate protection of our patent and intellectual property rights; intense competition in our industry may result in price r edu ctions, lower gross profits and loss of market share; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from co mpleting customer orders, all of which could materially harm our business; a significant percentage of our sales in the last three fiscal years ha ve been made to a small number of customers, and the loss of these major customers or significant decline in business with these major customers woul d a dversely affect us; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency o f b usiness combinations and related integration activities; we may be subject to risks associated with acquisitions that could adversely af fect future operating results; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent upon key personnel; we face risks associated with expanding our sales outside of the United States; our busi nes s is dependent on effective management information systems and information technology infrastructure; our results of operations could be advers ely affected by economic conditions and the effects of these conditions on our customers’ businesses; changes in government funding programs may cause our customers and prospective customers to delay or reduce purchases; and other factors set forth in Part I, Item IA. Risk Factor s o f Clearfield's Annual Report on Form 10 - K ended September 30, 2020 as well as other filings with the Securities and Exchange Commission. The Company u ndertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2021 Clearfield, Inc. All Rights Reserved. NASDAQ:CLFD 2

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Welcome Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 3

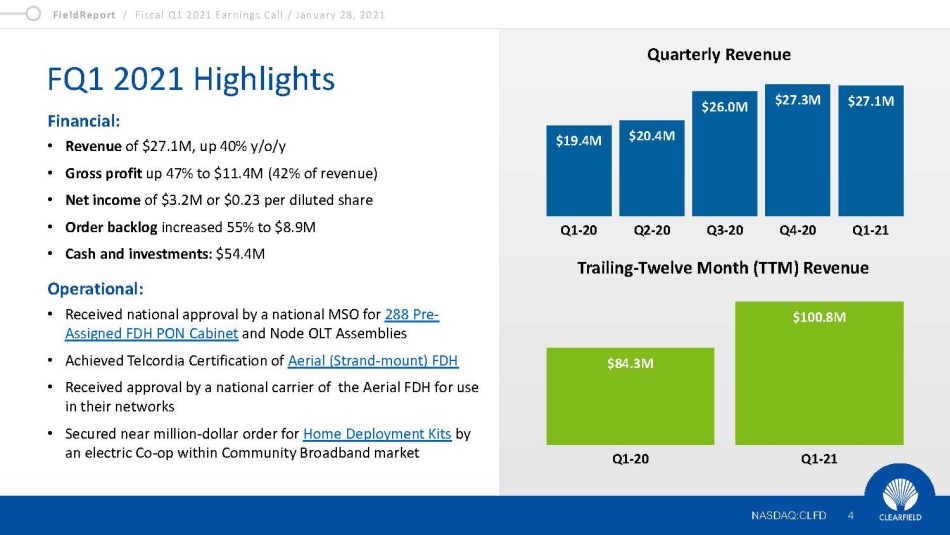

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD FQ1 2021 Highlights NASDAQ:CLFD 4 Financial: • Revenue of $27.1M, up 40% y/o/y • Gross profit up 47% to $11.4M (42% of revenue) • Net income of $3.2M or $0.23 per diluted share • Order backlog increased 55% to $8.9M • Cash and investments: $54.4M Operational: • Received national approval by a national MSO for 288 Pre - Assigned FDH PON Cabinet and Node OLT Assemblies • Achieved Telcordia Certification of Aerial (Strand - mount) FDH • Received approval by a national carrier of the Aerial FDH for use in their networks • Secured near million - dollar order for Home Deployment Kits by an electric Co - op within Community Broadband market $19.4M $20.4M $26.0M $27.3M $27.1M Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Quarterly Revenue $84.3M $100.8M Q1-20 Q1-21 Trailing - Twelve Month (TTM) Revenue

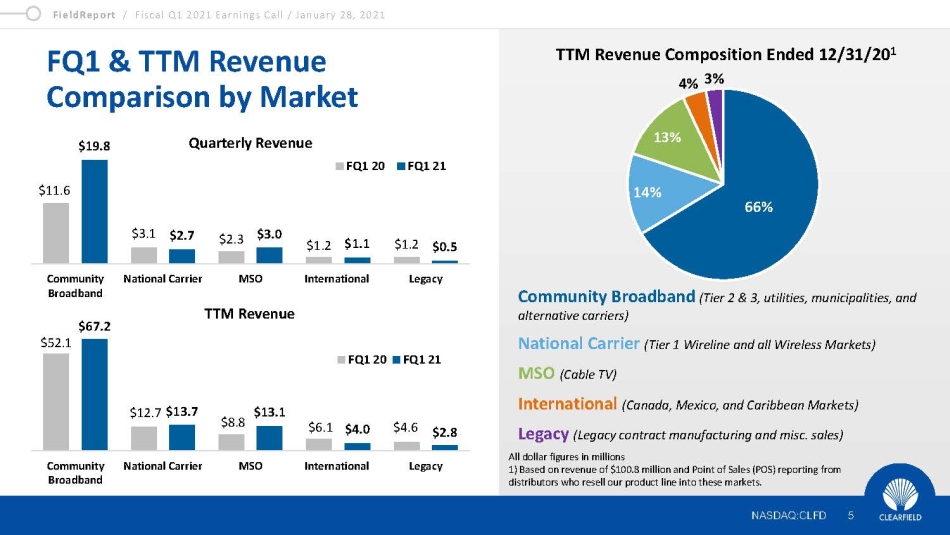

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD FQ1 & TTM Revenue Comparison by Market NASDAQ:CLFD 5 All dollar figures in millions 1) Based on revenue of $100.8 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. TTM Revenue Composition Ended 12/31/20 1 Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Canada, Mexico, and Caribbean Markets) Legacy (Legacy contract manufacturing and misc. sales) 66% 14% 13% 4% 3% $52.1 $12.7 $8.8 $6.1 $4.6 $13.7 $13.1 $4.0 $2.8 Community Broadband National Carrier MSO International Legacy FQ1 20 FQ1 21 Quarterly Revenue TTM Revenue $11.6 $3.1 $2.3 $1.2 $1.2 $19.8 $2.7 $3.0 $1.1 $0.5 Community Broadband National Carrier MSO International Legacy FQ1 20 FQ1 21 $67.2

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Financial Update Dan Herzog CHIEF FINANCIAL OFFICER NASDAQ:CLFD 6

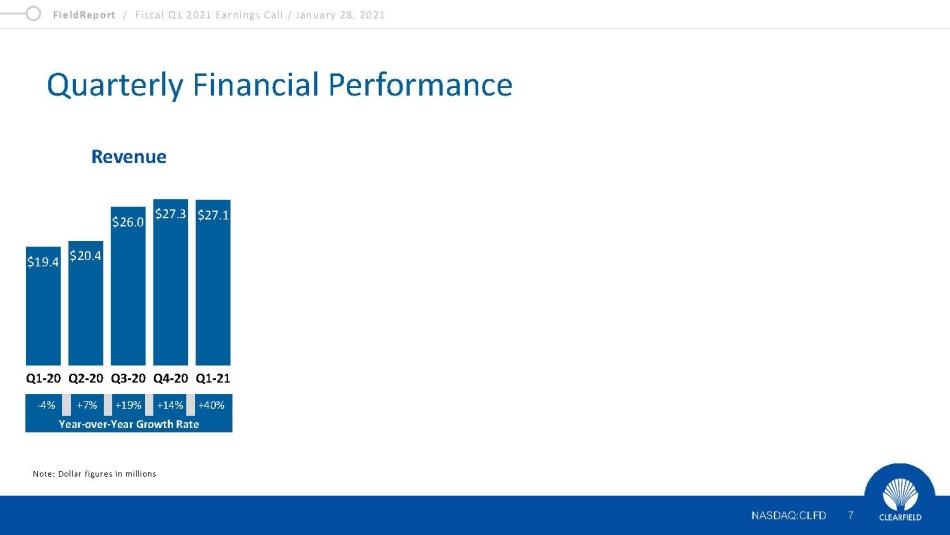

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Quarterly Financial Performance 7 NASDAQ:CLFD Note: Dollar figures in millions $19.4 $20.4 $26.0 $27.3 $27.1 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate

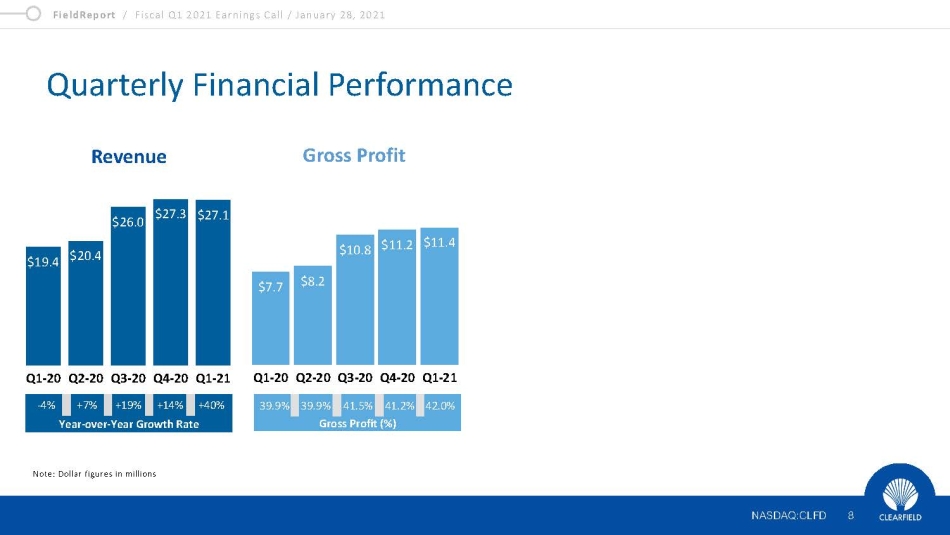

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Quarterly Financial Performance 8 NASDAQ:CLFD Note: Dollar figures in millions $19.4 $20.4 $26.0 $27.3 $27.1 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate $7.7 $8.2 $10.8 $11.2 $11.4 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Gross Profit 39.9% 39.9% 41.5% 41.2% 42.0% Gross Profit (%)

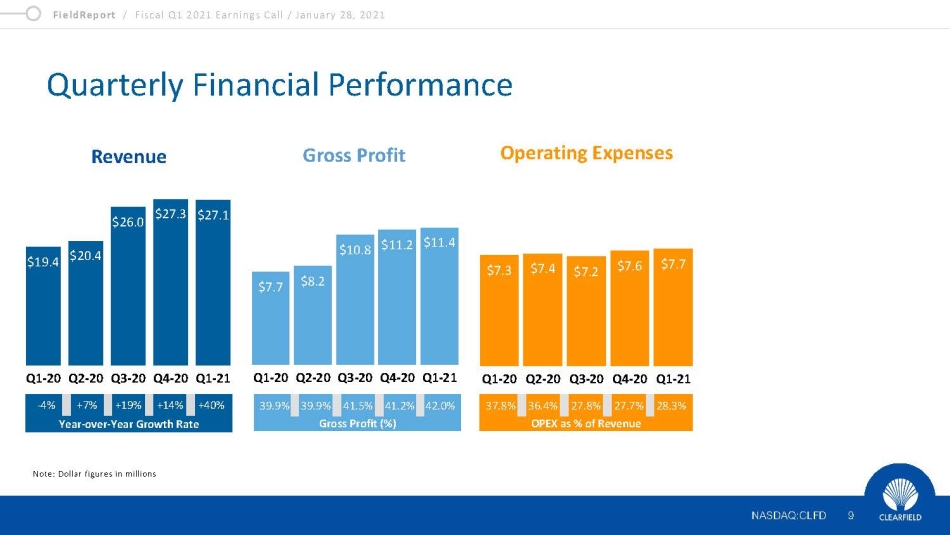

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Quarterly Financial Performance 9 NASDAQ:CLFD Note: Dollar figures in millions $19.4 $20.4 $26.0 $27.3 $27.1 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate $7.7 $8.2 $10.8 $11.2 $11.4 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Gross Profit 39.9% 39.9% 41.5% 41.2% 42.0% Gross Profit (%) 37.8% 36.4% 27.8% 27.7% 28.3% OPEX as % of Revenue $7.3 $7.4 $7.2 $7.6 $7.7 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Operating Expenses

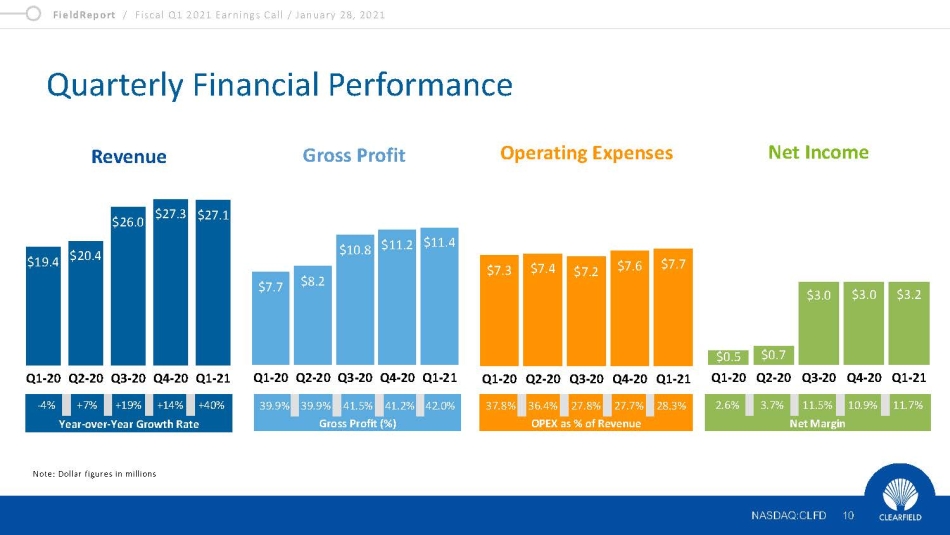

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Quarterly Financial Performance 10 NASDAQ:CLFD Note: Dollar figures in millions $19.4 $20.4 $26.0 $27.3 $27.1 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate $7.7 $8.2 $10.8 $11.2 $11.4 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Gross Profit 39.9% 39.9% 41.5% 41.2% 42.0% Gross Profit (%) 37.8% 36.4% 27.8% 27.7% 28.3% OPEX as % of Revenue $7.3 $7.4 $7.2 $7.6 $7.7 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Operating Expenses 2.6% 3.7% 11.5% 10.9% 11.7% Net Margin $0.5 $0.7 $3.0 $3.0 $3.2 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Net Income

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD COVID - 19 Operational Update • Critical manufacturer status • Operating at normal capacity while adhering to state and federal government social distancing guidelines and enhanced safety measures for on - site production personnel • Majority of supply chain remains operational • Established higher minimum stocking levels on component level inventory to ensure customer needs are met NASDAQ:CLFD 11

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Clearfield ‘Comes of Age’ Plan NASDAQ:CLFD 12 Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities

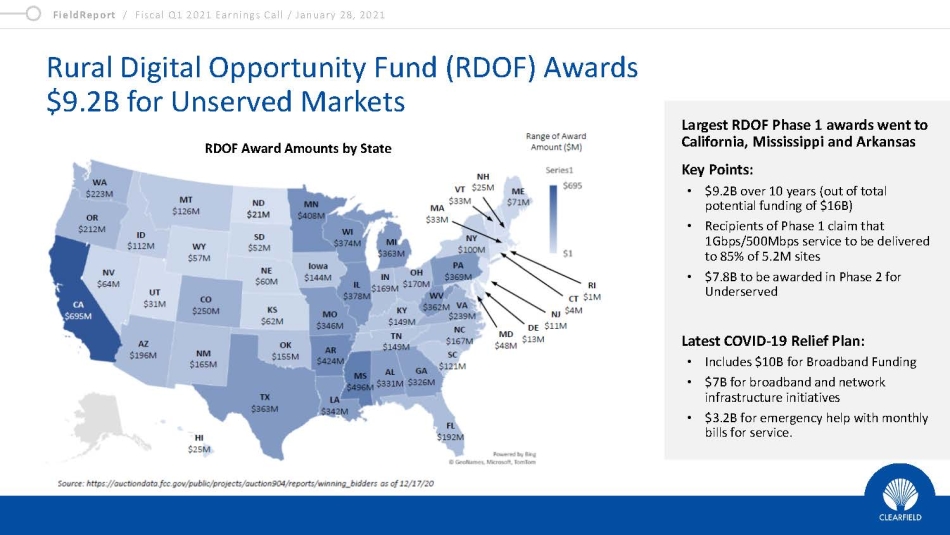

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Rural Digital Opportunity Fund (RDOF) Awards $9.2B for Unserved Markets Largest RDOF Phase 1 awards went to California, Mississippi and Arkansas Key Points: • $9.2B over 10 years (out of total potential funding of $16B) • Recipients of Phase 1 claim that 1Gbps/500Mbps service to be delivered to 85% of 5.2M sites • $7.8B to be awarded in Phase 2 for Underserved Latest COVID - 19 Relief Plan: • Includes $10B for Broadband Funding • $7B for broadband and network infrastructure initiatives • $3.2B for emergency help with monthly bills for service. RDOF Award Amounts by State

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Clearfield Has ‘Come of Age’ Plan NASDAQ:CLFD 14 Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities Delivering Innovation for True “One - Fiber” Deployment • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Clearfield ‘Comes of Age’ Plan NASDAQ:CLFD 15 Scaling Operational Excellence for a Superior Customer Experience • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Asian partnerships for faster product innovation and cost reduction programs Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities Delivering Innovation for True “One - Fiber” Deployment • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Key Takeaways Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in a rapidly growing multi - billion - dollar fiber optics industry, especially with the roll - out of 5G and NG - PON2 technologies Healthy balance sheet: $54.4M in cash and investments Year history of profitability and positive free cash flow 13 NASDAQ:CLFD

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Q&A Cheri Beranek PRESIDENT & CEO NASDAQ:CLFD 17 Dan Herzog CHIEF FINANCIAL OFFICER

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 NASDAQ:CLFD Contact Us NASDAQ:CLFD 19 COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net INVESTOR RELATIONS: Matt Glover and Tom Colton Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com