Exhibit 99.1

Good afternoon. Welcome to Clearfield’s fiscal first quarter 2021 earnings conference call. I will be your operator this afternoon.

Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions.

I would now like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company's website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 The Industry Leader in Craft Friendly Fiber Optic Management and Connectivity Solutions Fiscal Q1 2021 Earnings Call FieldReport

Please note that during this call, management will be making forward-looking statements regarding future events and the future financial performance of the Company. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements.

It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward-looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10-K filing with the Securities and Exchange Commission and its subsequent filings on Form 10-Q provides descriptions of those risks. As a reminder, the slides in this presentation are controlled you, the listener. Please advance forward through the presentation as the speakers present their remarks.

With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek.

Please proceed.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Important Cautions Regarding Forward - Looking Statements N A S D AQ:C L F D 2 Forward - looking statements contained herein and in any related presentation or in the related FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the expected impact of COVID - 19 and related economic uncertainty, the Company’s future revenue and operating performance, the impact of the CARES Act or other government programs on the demand for the Company’s products or timing of customer orders, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: the as yet - unknown impact of COVID - 19 and related economic uncertainty; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; our expected growth is based upon the expansion of the telecommunications market; our operating results may fluctuate significantly from quarter to quarter, which may make budgeting for expenses difficult and may negatively affect the market price of our common stock; our success depends upon adequate protection of our patent and intellectual property rights; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders, all of which could materially harm our business; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers, and the loss of these major customers or significant decline in business with these major customers would adversely affect us; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions that could adversely affect future operating results; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent upon key personnel; we face risks associated with expanding our sales outside of the United States; our business is dependent on effective management information systems and information technology infrastructure; our results of operations could be adversely affected by economic conditions and the effects of these conditions on our customers’ businesses; changes in government funding programs may cause our customers and prospective customers to delay or reduce purchases; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K ended September 30, 2020 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2021 Clearfield, Inc. All Rights Reserved.

Good afternoon and thank you everyone for joining us today. I hope you are all continuing to stay safe and healthy. It’s a pleasure to speak with you this afternoon to share Clearfield’s results for the fiscal first quarter 2021.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 W e l c ome Cheri Beranek PRESIDENT & CEO N A S D AQ:C L F D 3

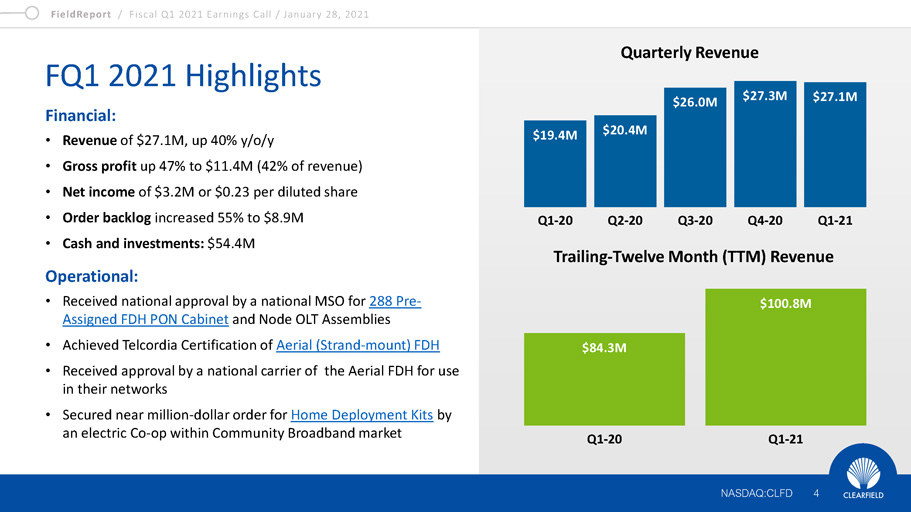

The first quarter of fiscal 2021 was an exceptionally strong start to our new fiscal year. As you can see on slide 4, the $27.1 million we generated in revenue was a 40% increase over last year and marked the highest revenue level for any fiscal first quarter in Clearfield history. Our growth in the period was again led by double-digit increases from our Community Broadband and Multiple-System Operator (MSO, or Cable TV) markets, which were up 71% and 30%, respectively. Our extended and ongoing strong topline performance over the last several quarters has enabled us to exceed the $100 million revenue level on a trailing 12-month basis for the first time.

The surging demand and need for high-speed internet access, accelerated by COVID-19, is prevalent across the country, especially in the Community Broadband market in which Clearfield commands strong market leadership. Our track record and reputation in the Community Broadband market has positioned us extremely well to take share and further capitalize on the expansion that is currently underway as our base of independent telephone providers is joined by utilities and municipalities in delivering high-speed broadband to consumers and businesses. Clearfield is helping these emerging providers meet the growing demand by providing our traditional products as well as helping them deploy innovative solutions like our Home Deployment Kit, which extends our field-proven fiber management expertise and leading-edge fiber connectivity performance all the way into the home. As evidence of the success of this initiative, during this past quarter, we secured a near million-dollar order for Home Deployment Kits by an electric co-op within our Community Broadband market. We recognized a portion of this win as revenue in Q1 and the balance is reflected in our $8.9 million backlog at quarter end.

The robust industry trends we have experienced since last year have continued into fiscal 2021, supported by sustained demand for broadband coupled with government programs such as The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, that are helping to fund and accelerate these deployments.

While the expansion currently underway is due in part to some pull-forward builds that work-from-home consumers are demanding, it nonetheless may accelerate due to the launch of the Rural Digital Opportunity Fund, or RDOF program. RDOF will finance up to $20.4 billion of gigabit speed broadband over the next 10 years to homes and businesses that would previously not be economically viable. It is worth mentioning that the $19.8 million of revenue we generated in our Community Broadband market for Q1 included dollars associated with The CARES Act but does not reflect any contribution from the recent awards related to RDOF.

In terms of our MSO market, much of our work in this area is an extension of what we are doing in Community Broadband. Tier 2 MSO carriers, or the regional players, are expanding their deployments of fiber community-by-community. We are also working to penetrate the national MSO market and are proud of a recent approval of our new 288 pre-assigned FDH PON Cabinet by one such carrier.

Our topline performance in fiscal Q1 also helped to drive solid gross profit dollars, which totaled $11.4 million in this most recent period. As a percentage of revenue, our 42.0% margin was up from the 41.2% we reported in the prior quarter and marked the highest gross profit margin we have achieved as a company in more than two years.

As it relates to our gross margin profitability, in Q1 we had a favorable revenue mix in the quarter, associated with the increased revenue in Community Broadband markets. In addition, meaningful efficiency gains were realized from our operations in Mexico.

Moving down the income statement, expenses increased slightly from last year’s first quarter, resulting in $3.2 million in net income, or $0.23 per diluted share. This was a significant improvement from the $0.5 million or $0.04 per diluted share in earnings we generated in Q1 of last year. We anticipate expenses to increase slightly in future quarters as we invest in additional resources within our Community Broadband programs.

In addition to our encouraging financial performance, we also made meaningful strides advancing our product portfolio. This included achieving Telcordia Certification for our Aerial Strand-mount FDH as well as receiving approval by a national carrier of the Aerial FDH for use in its network. Due to the COVID crisis gripping our country and market, the launch of our new technologies into the Tier 1 market faces headwinds associated with product introduction and training . As 5G deployments into the access network increase, we foresee increasing revenue among the Tier 1 market moving forward.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 FQ1 2021 Highlights Financial: • Revenue of $27.1M, up 40% y/o/y • Gross profit up 47% to $11.4M (42% of revenue) • Net income of $3.2M or $0.23 per diluted share • Order backlog increased 55% to $8.9M • Cash and investments: $54.4M Operational: • Received national approval by a national MSO for 288 Pre - Assigned FDH PON Cabinet and Node OLT Assemblies • Achieved Telcordia Certification of Aerial (Strand - mount) FDH • Received approval by a national carrier of the Aerial FDH for use in their networks • Secured near million - dollar order for Home Deployment Kits by an electric Co - op within Community Broadband market $19.4M N A S D AQ:C L F D 4 $20.4M $26.0M $27.3M $27.1M Quarterly Revenue $84.3M $100.8M Q 1 - 20 Q 1 - 21 Q 1 - 20 Q 2 - 20 Q 3 - 20 Q 4 - 20 Q 1 - 21 Trailing - Twelve Month (TTM) Revenue

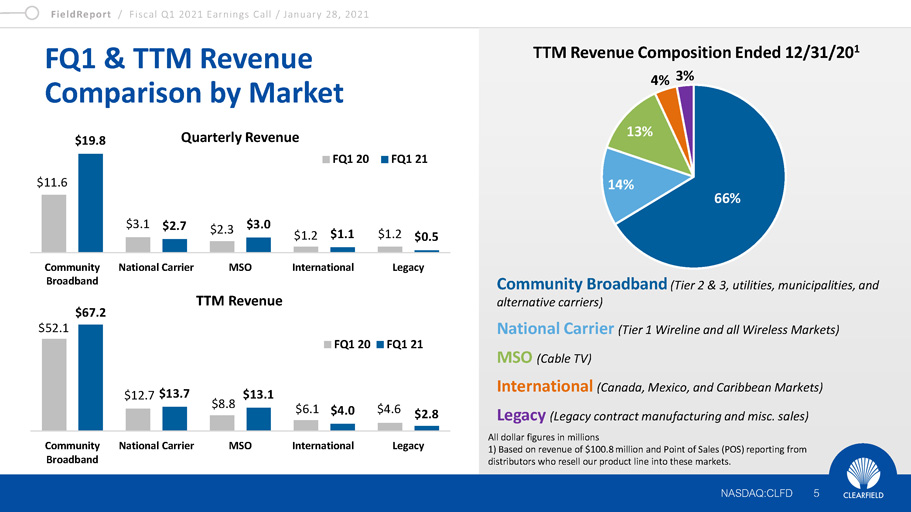

Looking at our market segments by revenue, on slide 5, starting first with our core Community Broadband market. As I mentioned previously, in the first quarter we generated revenue of $19.8 million, which was up 71% from the same period last year. For the trailing 12 months ended December 31, 2020, Community Broadband market revenue totaled $67.2 million, which was up 29% from the comparable period last year.

Our MSO business comprised 11% of our total revenue in fiscal Q1. From a growth standpoint, we built on the momentum we established over the last several quarters, realizing a 30% year-over-year increase in revenue to $3.0 million in the first quarter of fiscal 2021 and a 49% year-over-year increase to $13.1 million for the trailing 12 months ended December 31, 2020.

Revenue in our National Carrier market was up 8% year-over-year to $13.7 million for the trailing 12 months ended December 31, 2020. As I’ve talked about on past FieldReports, our position in the National Carrier market is related to the continuing demand from fiber-to-the-home and fiber-to-the-business applications. As COVID constraints have limited the deployment of 5G solutions into the access part of the network, revenue for the first quarter of fiscal 2021 slipped 12% year-over-year to $2.7 million.

Revenue in our International market was down 8% year-over-year in the first quarter and down 34% year-over-year for the trailing 12 months ended December 31, 2020. Weakness continued in the Caribbean and Mexican markets, however, revenue in the Canadian markets saw an exceptionally strong rebound. We are optimistic of seeing increasing revenue in international markets moving forward.

Revenue in our Legacy business was down 58% year-over-year in Q1 and down 39% year-over-year for the trailing 12 months ended December 31, 2020. This legacy part of our business is highly dependent upon the industrial drivers of two key customers in this segment. We believe the business to be fluctuating from normal levels due to the slowdown in the economy related to COVID.

With that, I’ll now turn the presentation over to Dan, who will walk us through our financial performance for the first quarter of fiscal 2021.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 FQ1 & TTM Revenue Comparison by Market Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Canada, Mexico, and Caribbean Markets) Legacy (Legacy contract manufacturing and misc. sales) All dollar figures in millions 1) Based on revenue of $100.8 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. 66% 14% 13% TTM Revenue Composition Ended 12/31/20 1 4% 3% $52 . 1 $8 . 8 $6 . 1 $4 . 6 $12.7 $13.7 $13 . 1 $4 . 0 $2 . 8 C ommu n i ty Broadband National Carrier M SO International L e g ac y FQ1 20 FQ1 21 Quarterly Revenue TTM Revenue $11 . 6 $3 . 1 $2 . 3 $1 . 2 $1 . 2 $19 . 8 $2 . 7 $3 . 0 $1 . 1 $0 . 5 C ommu n i ty Broadband National Carrier M SO International L e g ac y FQ1 20 FQ1 21 N A S D AQ:C L F D 5 $67 . 2

Thank you, Cheri, and good afternoon, everyone. Its great to be speaking with you today.

Now, looking at our first quarter financial results in more detail…

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Financial Update Dan Herzog CHIEF FINANCIAL OFFICER N A S D AQ:C L F D 6

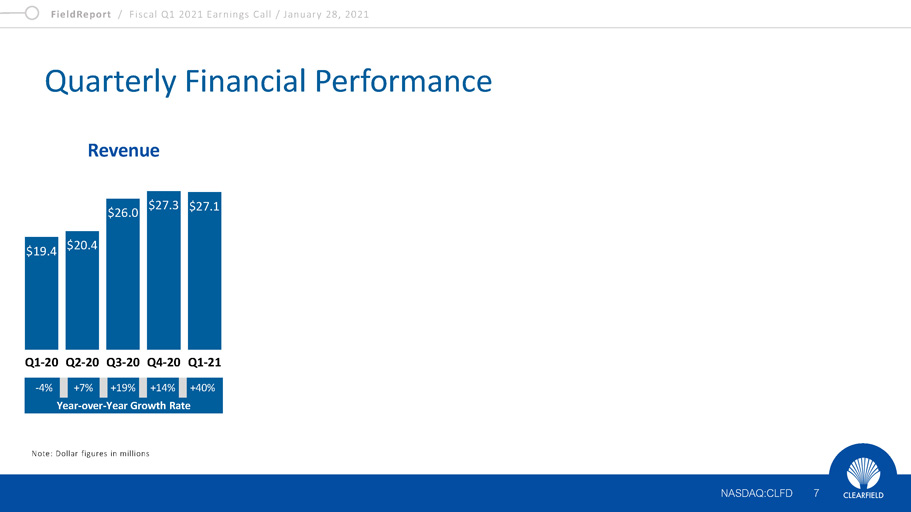

As you can see on slide 7, our revenue in the first quarter of fiscal 2021 increased 40% to $27.1 million from $19.4 million in the same year-ago period. The increase in revenues was primarily due to higher sales in our Community Broadband and MSO markets, partially offset by decreases in our Legacy and National Carrier markets.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Quarterly Financial Performance Note: Dollar figures in millions $19 . 4 N A S D AQ:C L F D 7 $20 . 4 $26 . 0 $27.3 $27.1 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate

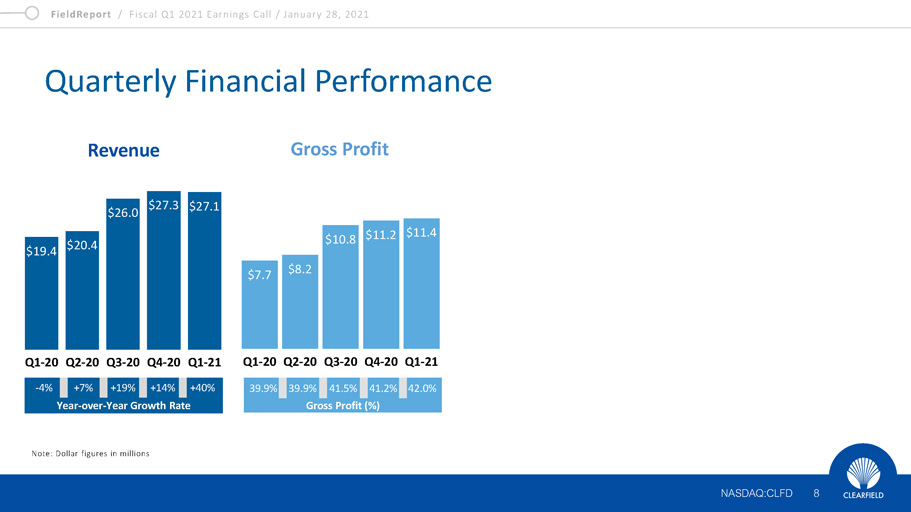

Turning to slide 8, gross profit for the first quarter of fiscal 2021 totaled a record $11.4 million, or 42.0% of total revenue. This was an improvement from $7.7 million, or 39.9% of total revenue, over the first quarter last year. The increase in gross profit dollars was due to higher sales volume. As Cheri mentioned, the increase in gross margin was due to a favorable product mix associated with increased revenues into Community Broadband and cost reduction efforts across our product lines, including increased production at our Mexico manufacturing plants and efficiencies realized from supply chain programs.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Quarterly Financial Performance Note: Dollar figures in millions $19 . 4 $20 . 4 $26 . 0 $27.3 $27.1 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate $7.7 N A S D AQ:C L F D 8 $8.2 $10.8 $11.2 $11.4 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Gross Profit 39.9% 39.9% 41.5% 41.2% 42.0% Gross Profit (%)

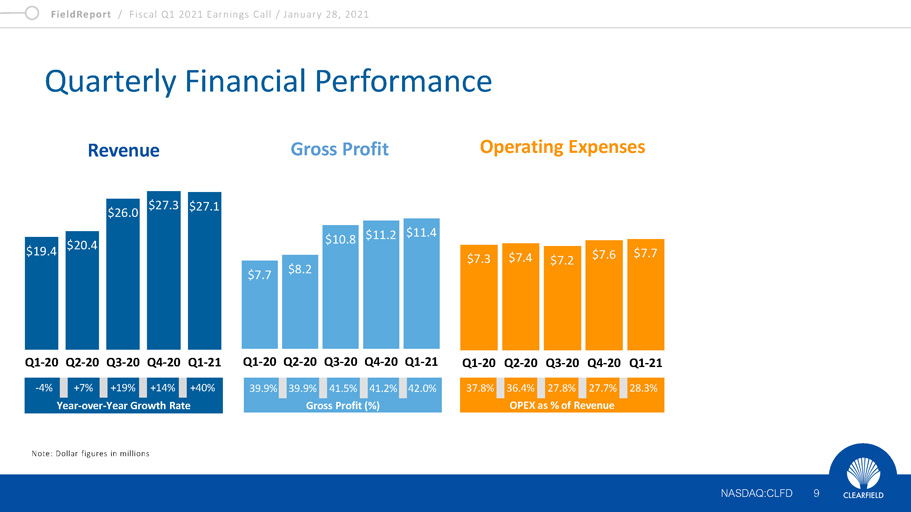

As you can see on slide 9, our operating expenses for the first quarter of fiscal 2021 were $7.7 million, which were up slightly from $7.3 million in the same year-ago quarter. As a percentage of total revenue, operating expenses for the first quarter of fiscal 2021 were 28.3% compared to 37.8% in the same year-ago period. The increase in operating expenses on a dollar basis was primarily due to higher wages and compensation costs related to performance compensation.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Quarterly Financial Performance Note: Dollar figures in millions $19 . 4 $20 . 4 $26 . 0 $27.3 $27.1 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate $7.7 N A S D AQ:C L F D 9 $8.2 $10.8 $11.2 $11.4 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Gross Profit 39.9% 39.9% 41.5% 41.2% 42.0% Gross Profit (%) 37.8% 36.4% 27.8% 27.7% 28.3% OPEX as % of Revenue $7.6 $7.7 $7.3 $7.4 $7.2 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Operating Expenses

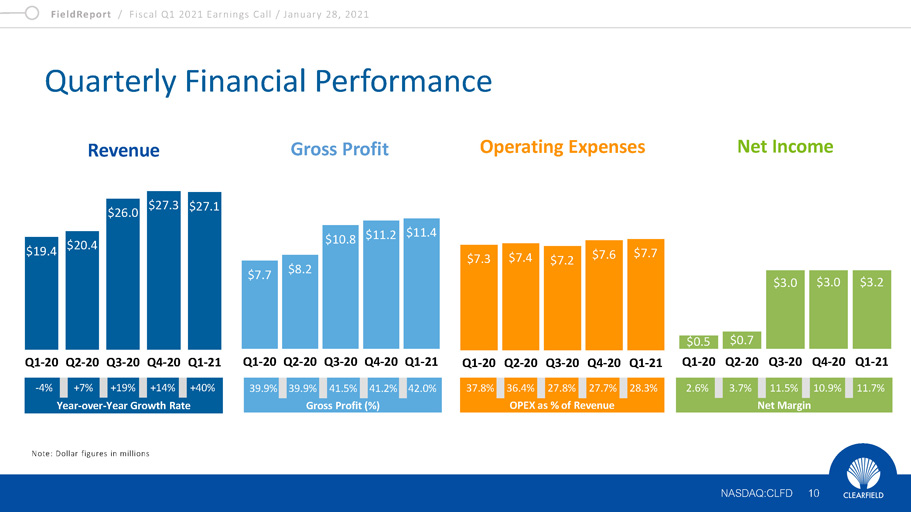

Turning to our profitability measures, on slide 10 income from operations was $3.7 million in the first quarter of fiscal 2021, which compares to $400,000 in the same year-ago quarter. Income tax expense increased to $684,000 in the first quarter of fiscal 2021, up from $123,000 in the first quarter of 2020. Net income totaled $3.2 million, or $0.23 per diluted share, an improvement from $501,000, or $0.04 per diluted share, in the same year-ago quarter.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Quarterly Financial Performance Note: Dollar figures in millions $19 . 4 $20 . 4 $26 . 0 $27.3 $27.1 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Revenue - 4% +7% +19% +14% +40% Year - over - Year Growth Rate $7.7 N A S D AQ:C L F D 10 $8.2 $10.8 $11.2 $11.4 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Gross Profit 39.9% 39.9% 41.5% 41.2% 42.0% Gross Profit (%) 37.8% 36.4% 27.8% 27.7% 28.3% OPEX as % of Revenue $7.6 $7.7 $7.3 $7.4 $7.2 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Operating Expenses 2.6% 3.7% 11.5% 10.9% 11.7% Net Margin $3.0 $3.0 $3.2 $0.5 $0.7 Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Net Income

Before I turn it back over to Cheri, I’d like to provide a brief update on the operational measures we’ve taken to protect and support our business, our personnel and customers since the COVID-19 pandemic took hold and how we are continuing to effectively navigate the current environment, both reflected on slide 11.

I am encouraged to report that Clearfield remains fully operational despite the unprecedented business closures and slowdown caused by the global health crisis. Our non-production employees are working remotely, using collaboration tools and video conferencing to stay connected.

Our production operations in both the U.S. and Mexico are operating close to normal while adhering to state and federal government social distancing guidelines. As a precautionary measure, we have multiple contingency plans in the event our ability to operate is diminished or eliminated at either location. As we talked about last quarter, we dual-source most of our components to cover multiple points of failure and provide purposeful redundancies to remove potential risks. Thankfully, as of today, many of our supply chain partners remain operational and have continued to provide the necessary components for our products. Our supply chain remains intact thanks to our team’s forward planning to ensure sufficient safety stock inventory levels at both our Minnesota and Mexico facilities. As Cheri has indicated previously, we made the decision to maximize the availability of all product lines at all three of our plants by ensuring that each location can manufacture across our broad product portfolio. This strategic decision has allowed us to meet the growing customer orders and enable us to continue to fulfill our order increased backlog going forward.

That concludes my prepared remarks. I will now turn the call back over to Cheri.

Cheri?

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 COVID - 19 Operational Update • Critical manufacturer status • Operating at normal capacity while adhering to state and federal government social distancing guidelines and enhanced safety measures for on - site production personnel • Majority of supply chain remains operational • Established higher minimum stocking levels on component level inventory to ensure customer needs are met N A S D AQ:C L F D 11

Thanks, Dan.

Now, shifting gears to our operational initiatives and focus in fiscal 2021. Our strategic plan has been a multi-year initiative to prepare Clearfield for the accelerated rate of demand, and growth, we are now seeing. As you can see on slide 12 of the FieldReport, we are now ready to come of age, which is the next phase of our growth plan to further strengthen our core business and position our Company for disruptive growth opportunities.

While the underlying objectives are unchanged, the three pillars upholding our ‘Comes of Age’ Plan have evolved to better align with where Clearfield is today as a Company, our end markets and customer needs, and the near- and long-term trends we’re seeing in the industry.

Our first pillar, Building a Better Broadband – One Community at a Time, leverages Clearfield’s longstanding customer and partnership relationships to build brand awareness and expertise. Ultimately, our goal here is to facilitate the enablement of pervasive high-speed broadband to underserved and unserved communities. A major initiative for 2021 is extending our reach within Community Broadband into electrical co-ops, rural utilities and municipalities that are not currently being serviced by a rural telephone company and are still underserved by the major carriers. As part of this effort, our strategy includes partnering with established distributors in these target markets. We anticipate securing these relationships in the coming months.

Clearfield’s position within the Community Broadband market has never been better. Our track record and reputation has positioned us extremely well to continue to grab market share and further capitalize on the expansion that’s currently underway.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Clearfield ‘Comes of Age’ Plan Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities N A S D AQ:C L F D 12

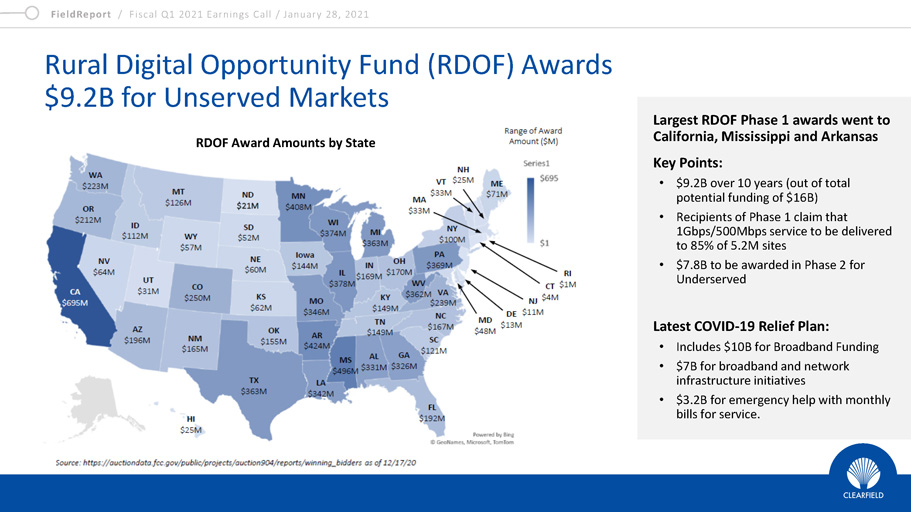

Building on my earlier comments and for the benefit for those newer to our Company or industry, the U.S. Rural Digital Opportunity Fund, or RDOF, is a 10-year program designed to bridge the digital divide to efficiently fund the deployment of broadband networks in rural America. The Federal Communications Commission will direct up to $20.4 billion over 10 years to finance up to gigabit speed broadband networks in unserved rural areas, connecting millions of American homes and businesses to digital opportunity.

On December 7th, the FCC announced that millions of rural Americans will gain access to high-speed Internet service through the RDOF Phase I auction.

As reflected on slide 13 of our FieldReport, auction results show that bidders won funding to deploy high-speed broadband to over 5.2 million unserved homes and businesses, almost 99% of the locations available in the auction. Moreover an overwhelming majority are scheduled to get gigabit-speed broadband. The FCC, which is tasked with figuring out how to administer the program, is taking public comment through February 16.

The financial opportunity for Clearfield is significant. Through the RDOF program, approximately 540,000 homes will be connected annually. Moreover, it’s not a question of if, but rather how and when these homes will be connected. Regardless of the variable inputs, Clearfield is well positioned to capitalize on this opportunity.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Rural Digital Opportunity Fund (RDOF) Awards $9.2B for Unserved Markets Largest RDOF Phase 1 awards went to California, Mississippi and Arkansas Key Points: • $9.2B over 10 years (out of total potential funding of $16B) • Recipients of Phase 1 claim that 1Gbps/500Mbps service to be delivered to 85% of 5.2M sites • $7.8B to be awarded in Phase 2 for Underserved Latest COVID - 19 Relief Plan: • Includes $10B for Broadband Funding • $7B for broadband and network infrastructure initiatives • $3.2B for emergency help with monthly bills for service. RDOF Award Amounts by State

Turning to our second new pillar, Delivering Innovation for True “One-Fiber” Deployment, which is highlighted on slide 14…

This pillar involves three key initiatives:

| 1. | First, leveraging our presence in Community Broadband to enable one-fiber backhaul; |

| 2. | Second, removing obstacles for the integration of wireline and wireless networks; and |

| 3. | Third, bringing fiber management expertise to 5G, NG-PON, and edge computing. |

An area of focus is looking at adjacent product categories to expand our total addressable market. Consistent with our approach of being a ‘fiber to anywhere’ Company, we’re looking at investing in product categories or areas that may not be fiber-rich today but would allow us to introduce products to the market that would enable the lifestyle ubiquitous broadband provides.

One such innovation in this area is the recent approval of our aerial FDH into the networks of a national carrier. As 5G deployments intersect with the utilization of fiber to deliver residential and business broadband, permitting or right-of-way agreements are ongoing obstacles. The aerial FDH provides a new and unique means to deploy fiber management assets satisfying these challenging situations.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Clearfield Has ‘Come of Age’ Plan Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities Delivering Innovation for True “One - Fiber” Deployment • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing NASDAQ:CLFD 14

On slide 15, you can see that the third initiative of our ‘Comes of Age’ pillar is “Scaling Operational Excellence for a Superior Customer Experience.” This approach includes strategically investing in products, manufacturing and supply chain to increase competitiveness and reduce costs.

The investments we’ve made to our operations in Mexico are integral to this effort. The beneficial results we are seeing have yielded both improved efficiencies and cost effectiveness. I’m encouraged to report that our operations in Mexico remain fully operational and are expanding. In early Q2 of fiscal 2021, our initial Mexican facility achieved its ISO audit re-certification while our newest facility in the region achieved its initial ISO certification. We have systematically added personnel at the facilities to meet the growing demand we are seeing for our products and will continue to evaluate our needs on an ongoing basis.

Further, as we scale our business, we are exploring means to expand our footprint in Asia. Our engineering resources, which include boots on the ground in China, are allowing us to expand our efforts in Asia from manufacturing to our specifications to assisting in our engineering design. Utilizing some of the process gains we’ve achieved in our virtual world driven by having our U.S. forces working remotely due to COVID, we are now working directly with Asian design personnel who can help us cost-reduce from the inception of the design, rather than through the two-step process we’ve implemented previously.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Clearfield ‘Comes of Age’ Plan Building a Better Broadband – One Community at a Time • Clearfield’s relationship and brand awareness within Community Broadband is its greatest asset • Attracting utilities, co - ops and CLECs as they enter unserved and underserved communities Delivering Innovation for True “One - Fiber” Deployment • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing Scaling Operational Excellence for a Superior Customer Experience • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Asian partnerships for faster product innovation and cost reduction programs NASDAQ:CLFD 15

Our strong finish to fiscal 2020 provided significant momentum in the first quarter of FY 21, which we were able to capitalize on as demonstrated by the 40% top line growth we achieved and strong profitability metrics. Our consistent performance speaks to the resiliency and durability of our business in a range of environments. Moreover, we are continuing to benefit from and take advantage of favorable industry tailwinds and Clearfield’s established presence within our key growth markets.

Looking ahead, due to the ongoing volatility from COVID-19 we are currently in a position to provide only limited financial guidance. We are, however, confident the demand for fiber-fed broadband will continue throughout fiscal 2021 and beyond. Nearer term, we anticipate second quarter to be consistent with the traditional seasonality of revenue being slightly down on a sequential basis. Longer term, our enhanced ‘Comes of Age’ Plan which targets growth in fiber-fed broadband and 5G access fiber positions us for continued success for Clearfield in the years ahead.

And with that, we’re ready to open the call for your questions.

Operator?

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Key Takeaways Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in a rapidly growing multi - billion - dollar fiber optics industry, especially with the roll - out of 5G and NG - PON2 technologies Healthy balance sheet: $54.4M in cash and investments 13 Year history of profitability and positive free cash flow N A S D AQ:C L F D

Thank you.

We will now be taking questions from the Company’s publishing sell-side analysts.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 17

Operator

And our first question is from Jaeson Schmidt with Lake Street Capital. Please proceed with your question.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Hey guys, thanks for taking my questions. I understand that at lead times can be pretty short for you guys but just curious, if you could comment on the linearity of bookings in the December quarter?

Cheri Beranek

Chief Executive Officer, President & Director

Hi, Jaeson. Define linearity; what do you mean by that?

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Just trying to get sense if order patterns were pretty consistent throughout the quarter or if it was more back-end loaded?

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 18

Cheri Beranek

Chief Executive Officer, President & Director

No, very consistent. So, I mean it was really -- I mean we're having a mild winter, certainly always helps, but I think overall in the general market, we are seeing just a continual demand ongoing as people evaluate and build their environments and then plan for the future. So, no, it was a very nice and consistent quarter.

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. And then, I know you outlined some of the potential tailwinds going forward, obviously you've benefited from some of the tailwinds related to COVID. Just curious, if you could comment on any change in visibility over the past three months?

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 19

Cheri Beranek

Chief Executive Officer, President & Director

We're actually getting kind of -- I would say, increased visibility to business needs. I think the COIVD world has actually created a situation in which communication service providers are really kind of looking out to things by a season by season basis, and trying to work with their suppliers to give them at least some visibility to their plans and needs, not necessarily blanket purchase orders but definitely a little bit more long-range visibility that we would have had in the past. However, I think that's also coupled with some concerns about the availability of labor and installation. We've heard some concerns, especially in the national carrier market about union individuals not wanting to be able to -- require to be able to go into homes; so it's that kind of push/pull that it's created some challenge for our visibility standpoints. But we are continuing to really manage our lead times, we are really industry-leading today at three to four weeks, and then working with our distribution partners to even improve upon that for high volume product so that it will be available from our distribution -- I guess, the distribution partners in three or four days. So we're aggressive about what we see the marketplace heading, and as long as the market -- laborers continue to be available, we're very optimistic.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 20

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay, that's helpful. And then just last one for me and I'll jump back in the queue. Gross margin, a nice uptick in December; how should we think about sort of the opportunity for expansion this fiscal year?

Cheri Beranek

Chief Executive Officer, President & Director

Yes. So the margin was positively affected by the strong dominance of community broadband; with community broadband being up 70% and representing what 65%, 67% of our total business; that business is -- because it's done smaller projects is typically higher margin, and so we certainly benefited from that. With the carrier business, the Tier 1 business being down a little bit in the quarter, that also from the product mix standpoint with representative. So we think 42% is a great target, we don't think it's a scale to move above; so I think we are comfortable that we're doing a lot of great programing to reduce the costs. But from a modeling standpoint, I think this is -- should be kind of the pinnacle of what we can achieve.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 21

Jaeson Schmidt

Lake Street Capital Markets, LLC, Research Division

Okay. Thanks a lot guys.

Cheri Beranek

Chief Executive Officer, President & Director

You're welcome.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 22

Operator

And our next question is from Tim Savageaux with Northland Capital Markets. Please proceed with your question.

Tim Savageaux

Northland Capital Markets, Research Division

Hi, good afternoon, and congrats on the strong results. I have a couple of questions, but I'll start with backlog -- we actually saw obviously, a pretty sharp increase relative to last year, but somewhat of a decline sequentially. I'm wondering if you could discuss the puts and takes in terms of bookings and backlog in the quarter that led to that decline sequentially? Thanks.

Cheri Beranek

Chief Executive Officer, President & Director

Yes, there is a very -- it's a very -- the decline sequentially is very standard, it's very seasonal. We don't typically -- a service provider is not all that excited about putting a purchase order over extending their fiscal year. So we tend to see December bookings go down as their budgets are not yet approved and that they're putting together their plans; so that -- I would always say we've offered backlog as a point of information, but it should be taken with a grain of salt, the backlog is not indicative of future demand.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 23

Tim Savageaux

Northland Capital Markets, Research Division

Well, I guess with that in mind, I mean would you expect or can you comment on what you're seeing thus far this quarter with regard to bookings relative to that? We're understanding that your smaller customers may not have the type of cumbersome budget cycles, you might see among the larger carriers. But…

Cheri Beranek

Chief Executive Officer, President & Director

We're having a great January. So it is -- without giving any future guidance within because we can only do what we can see with the three to four week lead times, but bookings have been good. I do not have a concern in regard to lack of market demand, it's strong. There is a lot of projects and activities in place, community broadband is really excited about the available -- of the energy available for where they can put it together. And then, I think we have --we've worked for years to have the community -- to have the reputation that we have in community broadband, and the support that we're providing. So I believe we're taking share in this marketplace and are positioned to grow with it as the COVID world tends to settle down.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 24

Tim Savageaux

Northland Capital Markets, Research Division

Got it. And then, if I could move over to your commentary on the RDOF process and the potential to accelerate growth from what look to be already pretty strong levels. I wonder if you could be a little more granular on kind of expectations for timing there? You'd referenced kind of some degree of pull-forward in demand. Is it likely that we're like to see -- likely to see a normalization in that pull-forward, maybe in contrast to traditional seasonality in the business prior to seeing any type of acceleration from RDOF projects, maybe later in calendar '21?

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 25

Cheri Beranek

Chief Executive Officer, President & Director

We -- the general frame of thought is that it's always difficult to know what government projects. But the general train of thought is that we'll start to see the beginning of that revenue in July and August. So since our fiscal year ends in September, I don't see the RDOF program having a really significant increase for our numbers this year, it certainly will be one of the mechanisms to improve numbers moving forward. The -- to-date the growth that we're seeing; there has been some business that has been CARES Act funded and we certainly saw some business in that in the December quarter, but I think what we're seeing really is true organic need in the marketplace. The -- I mean, COVID absolutely created the requirement that broadband is necessary. And yes, there were those individuals over the course of the first 7-8 months of the pandemic that were able to immediately put dollars into place, but most of them were really in a place where they're just being able to truly react now and build out their networks in a broader term basis. And one of the things that was really surprising to me and I'll send it to anyone on the call that hasn't seen it -- in the State of Minnesota the -- what traditionally we would view as being community broadband-centric. The Star Tribune, our metropolitan newspaper, published here is where high-speed broadband is available in our state; and what we saw was the 7 County Metro area, and the few of Clearfield customers across the country, across the states such as Paul Bunyan Telephone up in Bemidji and Cross Lake Communications in Brainerd. There is still a huge amount of need out there and I think we're going to see that over the course of the summer. I've listened to some of the same broadcast that you probably have been or some of the others in our market; and I think our timing is sometimes a little bit different for the space. There is a lot of work that has to be done in regard to construction to actually deliver the physical dig and physical infrastructure to each home in business. So we're optimistic about this year, as well as for the fiscal year 2022, when we can take advantage of government initiatives on top of this.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 26

Tim Savageaux

Northland Capital Markets, Research Division

Great, thanks very much.

Operator

At this time, this concludes the company's question-and-answer session. If your question was not taken you may contact Clearfield's Investor Relations team at clfd@gatewayir.com. I'd now like to turn the call back over to Mrs. Beranek for closing remarks.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Q &A Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFI C ER N A S D AQ:C L F D 27

Cheri Beranek

Chief Executive Officer, President & Director

Thank you so very much. It's a difficult time now with the pandemic and the inability to receive vaccinations for those that we love. But I encourage you all to be patient and to keep yourselves safe. Thank you for joining us today. We look forward to updating you again on our progress soon.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021

Thank you for joining us today for Clearfield’s fiscal first quarter 2021 earnings conference call. You may now disconnect.

FieldReport / Fiscal Q1 2021 Earnings Call / January 28, 2021 Contact Us COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net INVESTOR RELATIONS: Matt Glover and Tom Colton Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com N A S D AQ:C L F D 29