Exhibit 99.1

November 4, 2021 Fiscal Q4 & 2021 Earnings Call FieldReport Good afternoon. Welcome to Clearfield’s fiscal fourth quarter and full year 2021 earnings conference call. I will be your operator this afternoon. Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions. I would now like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company's website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website. 1

Important Cautions Regarding Forward - Looking Statements N A S DAQ:CLFD 2 Forward - looking statements contained herein and in any related presentation or in the related Earnings Release are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, anticipated shipping on backlog and future lead times, future availability of components and materials from the Company’s supply chain, the impact of the Rural Digital Opportunity Fund (RDOF) or other government programs on the demand for the Company’s products or timing of customer orders, the Company’s ability to add capacity to meet expected future demand, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: the COVID - 19 pandemic has significantly impacted worldwide economic conditions and could have a material adverse effect on our business, financial condition and operating results; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders; fluctuations in product and labor costs which may not be able to be passed on to customers that could decrease margins; we depend on the availability of sufficient supply of certain materials, such as fiber optic cable and resins for plastics, and global disruptions in the supply chain for these materials could prevent us from meeting customer demand for our products; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent on key personnel; our business is dependent on interdependent management information systems; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; changes in government funding programs may cause our customers and prospective customers to delay, reduce, or accelerate purchases, leading to unpredictable and irregular purchase cycles; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; our success depends upon adequate protection of our patent and intellectual property rights; if the telecommunications market does not expand as we expect, our business may not grow as fast as we expect; we face risks associated with expanding our sales outside of the United States; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2020 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2021 Clearfield, Inc. All Rights Reserved. Please note that during this call, management will be making forward - looking statements regarding future events and the future financial performance of the Company. These forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward - looking statements. It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward - looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10 - K filing with the Securities and Exchange Commission and its subsequent filings on Form 10 - Q provides descriptions of those risks. As a reminder, the slides in this presentation are controlled by you, the listener. Please advance forward through the presentation as the s p e a k e r s p r e s e n t t h e i r r e m a r k s . With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek. Please proceed. 2

N A S DAQ:CLFD 3 I nt ro d u c t i o n & Highlights Good afternoon and thank you everyone for joining us today. I hope you are all continuing to stay safe and healthy. It’s a pleasure to speak with you this afternoon to share Clearfield’s results for the fiscal fourth quarter and full year 2021. Clearfield delivered record - setting financial performance in the fourth quarter and for the full fiscal year 2021 in a market that is changing dramatically. We are in the middle of a historic investment cycle. Due to our consistent focus on customer service, quality product, and our ability to nimbly respond to customers’ changing needs, we believe Clearfield has built an advantageous position in the broadband market and continues t o b e ne f i t f r o m t h e ri s i n g d e m a n d f o r f i b e r . The continued demand for fiber - fed broadband drove a 66% year - over - year increase in net sales in Community Broadband, our largest customer market, which helped us achieve $140.8 million in net sales for fiscal year 2021. Our growth in the period was led by double - digit increases from our Community Broadband market, which was up 64% in the fiscal fourth quarter. The Community Broadband market has historically been unserved, or at least under - served. This market demand is being addressed with organic growth, with existing customers that are putting their own money or financing into their networks, and government - funded programs that are substantial and getting bigger. Bookings led shipments by $55.6 million for the 12 - month period, creating a b a c k l o g o f $ 66 . 4 m illi o n a s o f S e p t e m b e r 30 , 2 021 . 3

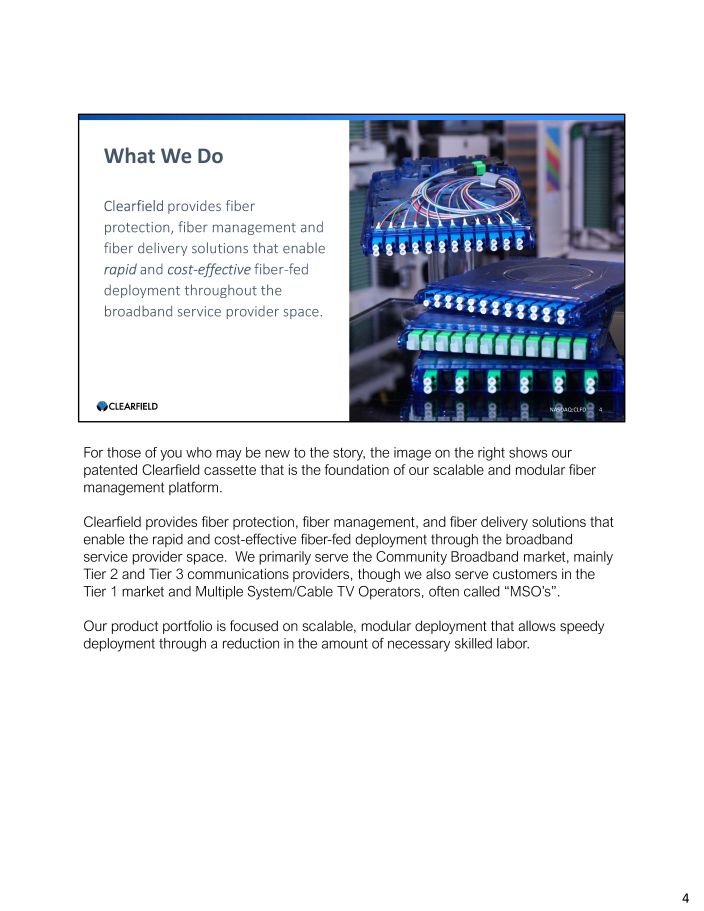

What We Do Clearfield provides fiber protection, fiber management and fiber delivery solutions that enable rapid and cost - effective fiber - fed deployment throughout the broadband service provider space. NASDAQ:CLFD 4 For those of you who may be new to the story, the image on the right shows our patented Clearfield cassette that is the foundation of our scalable and modular fiber management platform. Clearfield provides fiber protection, fiber management, and fiber delivery solutions that enable the rapid and cost - effective fiber - fed deployment through the broadband service provider space. We primarily serve the Community Broadband market, mainly Tier 2 and Tier 3 communications providers, though we also serve customers in the T i e r 1 m a r k e t a n d M u l t i p l e S y s t e m / C a b l e T V O p e r a t o r s , o f t e n c a ll ed “ M S O ’ s ” . Our product portfolio is focused on scalable, modular deployment that allows speedy deployment through a reduction in the amount of necessary skilled labor. 4

OUR MISSION: Enabling the Lifestyle Better Broadband Provides NASDAQ:CLFD 5 At Clearfield, our mission is to Enable the Lifestyle Better Broadband Provides. This was made abundantly clear over the last 18 months as people were working and going to school from home. High speed broadband is increasingly essential to be able to participate in modern society, and fiber - fed broadband in particular is being recognized as the answer for future - proofed connectivity to the American home and business. We are now in a position where everyone wants to be able to deploy fiber – the demand could be exponential. However, the market can only grow as long as there are technicians and engineers available to meet the demand. Industry professionals estimate that we need to double the number of trained technicians and engineers in the U.S. market to deploy all the broadband that is required. However, these professionals have also said they believe that we can only grow the number of technicians by 15% a year. As a result, the deployment of high - speed broadband through fiber will be extended. The market for fiber - fed broadband is not only demand - based, but also supplier - based. Suppliers are seeing their fiber networks are easier to maintain and generate more revenue per subscriber; so this is truly a ‘perfect storm’ of catalysts that will help drive Clearfield’s future growth. With that, I’ll now turn the presentation over to Dan, who will walk us through our financial performance for the fourth quarter and full fiscal year 2021. 5

N A S DAQ:CLFD 6 Financial P e r f o rma n c e Thank you, Cheri, and good afternoon, everyone. Its great to be speaking with you today. Now, looking at our fourth quarter financial results in more detail… 6

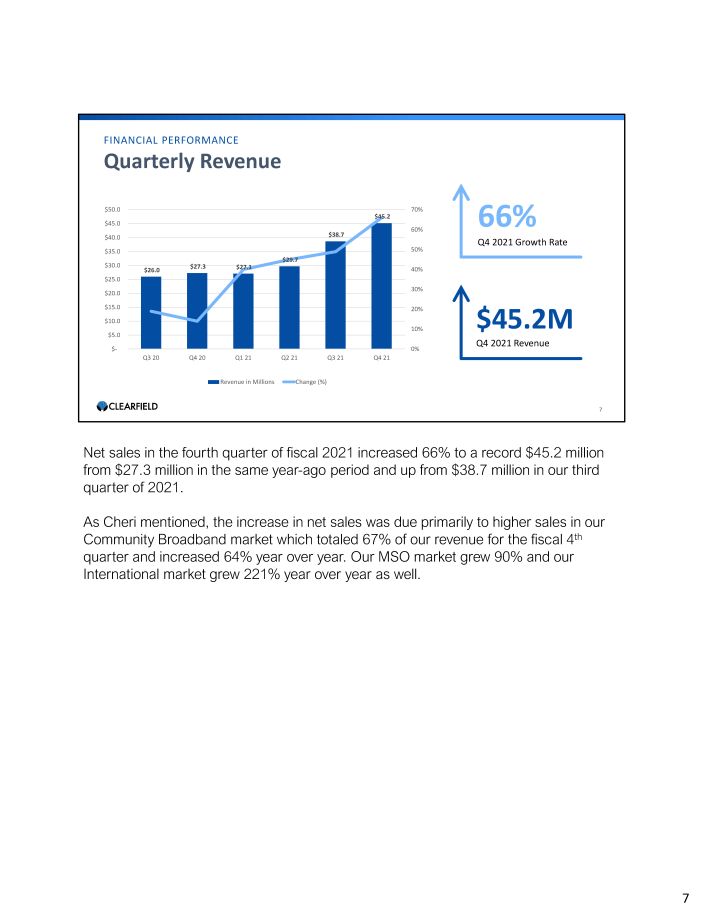

$26.0 $27.3 $27.1 $29.7 $38.7 0% 10% 20% 30% 40% 50% $ 5 .0 $ - $ 1 0.0 $ 1 5.0 $ 2 5.0 $ 2 0.0 $ 3 0.0 $ 3 5.0 $ 4 0.0 $ 5 0.0 70% $45.2 $45.0 60% Q 3 20 Q 4 20 Q1 21 Q 2 21 Q 3 21 Q4 21 Revenue in Millions Change (%) 7 FINANCIAL PERFORMANCE Quarterly Revenue 66% Q4 2021 Growth Rate $ 4 5.2 M Q4 2021 Revenue Net sales in the fourth quarter of fiscal 2021 increased 66% to a record $45.2 million from $27.3 million in the same year - ago period and up from $38.7 million in our third quarter of 2021. As Cheri mentioned, the increase in net sales was due primarily to higher sales in our Community Broadband market which totaled 67% of our revenue for the fiscal 4 th quarter and increased 64% year over year. Our MSO market grew 90% and our International market grew 221% year over year as well. 7

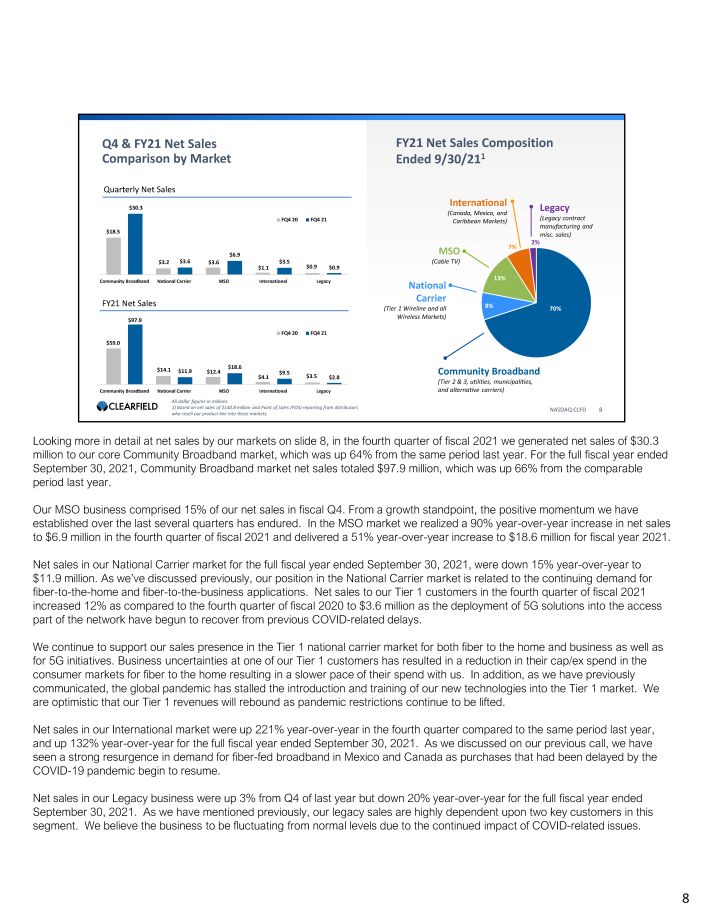

$1 8 . 5 $3 . 2 $3 . 6 $1 . 1 $0 . 9 $3 . 6 $6 . 9 $3 . 5 $0 . 9 Co mm unity B r o a db a n d N a tion a l C a r ri e r M S O International L e g a c y FQ4 20 FQ4 21 Q4 & FY21 Net Sales Comparison by Market N A S DAQ:CLFD 8 FY21 Net Sales Composition Ended 9/30/21 1 Legacy (Legacy contract manufacturing and misc. sales) 70% 8% 13% 7% 2% $5 9 . 0 $4 . 1 $3 . 5 $14.1 $11.9 $18 . 6 $12.4 $9 . 5 $2 . 8 Community Broadband National Carrier MSO International Legacy All dollar figures in millions 1) Based on net sales of $140.8 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. FQ4 20 FQ4 21 Quarterly Net Sales $30.3 FY21 Net Sales $9 7 . 9 Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) N a ti o n al C a rri e r (Tier 1 Wireline and all W i re l ess M ar k e t s) MS O (C ab l e TV) International (Canada, Mexico, and Caribbean Markets) Looking more in detail at net sales by our markets on slide 8, in the fourth quarter of fiscal 2021 we generated net sales of $30.3 million to our core Community Broadband market, which was up 64% from the same period last year. For the full fiscal year ended September 30, 2021, Community Broadband market net sales totaled $97.9 million, which was up 66% from the comparable period last year. Our MSO business comprised 15% of our net sales in fiscal Q4. From a growth standpoint, the positive momentum we have established over the last several quarters has endured. In the MSO market we realized a 90% year - over - year increase in net sales to $6.9 million in the fourth quarter of fiscal 2021 and delivered a 51% year - over - year increase to $18.6 million for fiscal year 2021. Net sales in our National Carrier market for the full fiscal year ended September 30, 2021, were down 15% year - over - year to $11.9 million. As we’ve discussed previously, our position in the National Carrier market is related to the continuing demand for fiber - to - the - home and fiber - to - the - business applications. Net sales to our Tier 1 customers in the fourth quarter of fiscal 2021 increased 12% as compared to the fourth quarter of fiscal 2020 to $3.6 million as the deployment of 5G solutions into the access part of the network have begun to recover from previous COVID - related delays. We continue to support our sales presence in the Tier 1 national carrier market for both fiber to the home and business as well as for 5G initiatives. Business uncertainties at one of our Tier 1 customers has resulted in a reduction in their cap/ex spend in the consumer markets for fiber to the home resulting in a slower pace of their spend with us. In addition, as we have previously communicated, the global pandemic has stalled the introduction and training of our new technologies into the Tier 1 market. We are optimistic that our Tier 1 revenues will rebound as pandemic restrictions continue to be lifted. Net sales in our International market were up 221 % year - over - year in the fourth quarter compared to the same period last year, and up 132 % year - over - year for the full fiscal year ended September 30 , 2021 . As we discussed on our previous call, we have seen a strong resurgence in demand for fiber - fed broadband in Mexico and Canada as purchases that had been delayed by the COVID - 19 pandemic begin to resume . Net sales in our Legacy business were up 3% from Q4 of last year but down 20% year - over - year for the full fiscal year ended September 30, 2021. As we have mentioned previously, our legacy sales are highly dependent upon two key customers in this segment. We believe the business to be fluctuating from normal levels due to the continued impact of COVID - related issues. 8

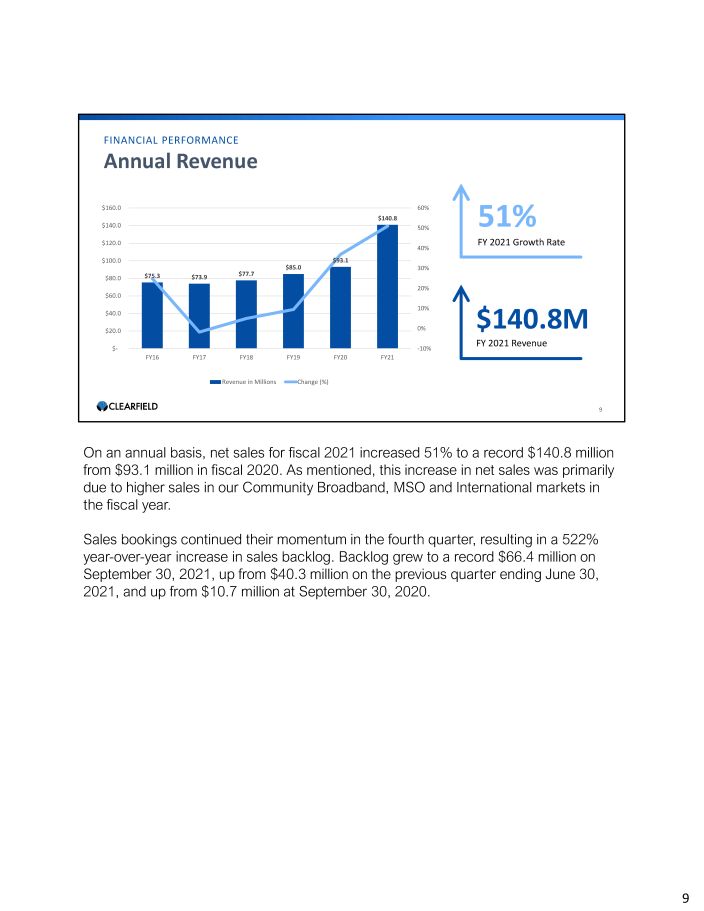

$75.3 $73.9 $77.7 $85.0 $93.1 $140.8 - 10% 0% 10% 20% 30% 40% 50% 60% $ - $ 4 0.0 $ 2 0.0 $ 6 0.0 $ 8 0.0 $ 1 00.0 $ 1 20.0 $ 1 40.0 $ 1 60.0 F Y16 F Y17 F Y18 F Y19 F Y20 F Y21 Revenue in Millions Change (%) 9 FINANCIAL PERFORMANCE Annual Revenue 51% FY 2021 Growth Rate $ 1 40. 8 M FY 2021 Revenue On an annual basis, net sales for fiscal 2021 increased 51% to a record $140.8 million from $93.1 million in fiscal 2020. As mentioned, this increase in net sales was primarily due to higher sales in our Community Broadband, MSO and International markets in the fiscal year. Sales bookings continued their momentum in the fourth quarter, resulting in a 522 % year - over - year increase in sales backlog . Backlog grew to a record $ 66 . 4 million on September 30 , 2021 , up from $ 40 . 3 million on the previous quarter ending June 30 , 2021 , and up from $ 10 . 7 million at September 30 , 2020 . 9

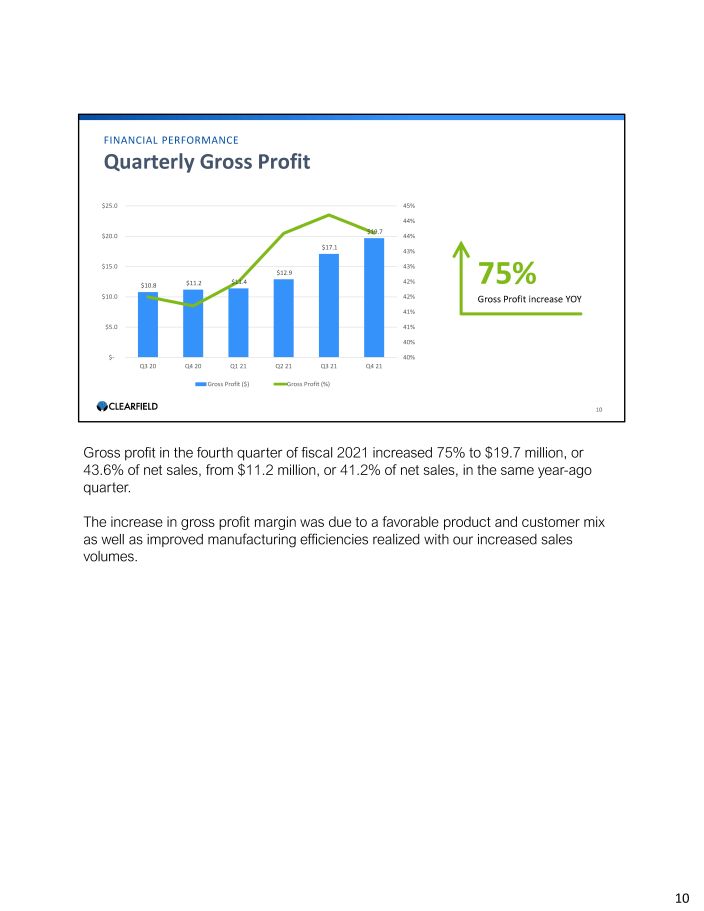

$10 . 8 $11 . 2 $12 . 9 $17 . 1 $19 . 7 41% 40% 41% $11 . 4 42% 43% 43% 44% 45% 44% $ 5 .0 $ 1 0.0 42% $ 1 5.0 $ 2 0.0 $ 2 5.0 $ - 40% Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Gross Profit ($) Gross Profit (%) 10 FINANCIAL PERFORMANCE Quarterly Gross Profit 75% Gross Profit increase YOY Gross profit in the fourth quarter of fiscal 2021 increased 75% to $19.7 million, or 43.6% of net sales, from $11.2 million, or 41.2% of net sales, in the same year - ago quarter. The increase in gross profit margin was due to a favorable product and customer mix as well as improved manufacturing efficiencies realized with our increased sales volumes. 10

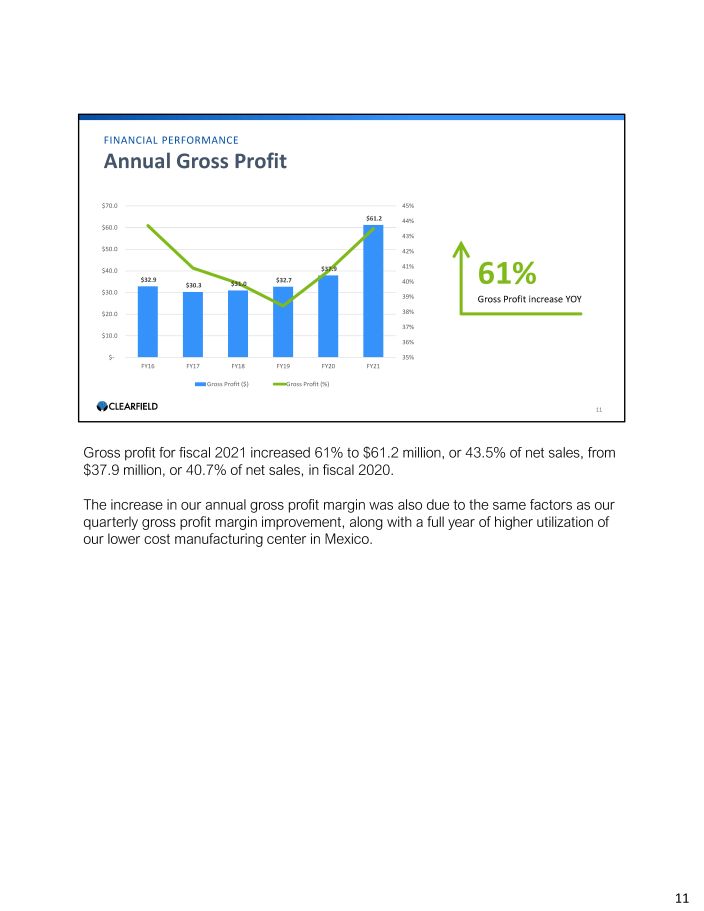

$32.9 $30.3 $31.0 $32.7 $37.9 $61.2 35% 36% 38% 37% 39% 40% 41% 42% 43% 44% 45% $ - $ 1 0.0 $ 2 0.0 $ 3 0.0 $ 4 0.0 $ 5 0.0 $ 6 0.0 $ 7 0.0 F Y16 F Y17 F Y18 F Y19 F Y20 F Y21 Gross Profit ($) Gross Profit (%) 11 FINANCIAL PERFORMANCE Annual Gross Profit 61% Gross Profit increase YOY Gross profit for fiscal 2021 increased 61% to $61.2 million, or 43.5% of net sales, from $37.9 million, or 40.7% of net sales, in fiscal 2020. The increase in our annual gross profit margin was also due to the same factors as our quarterly gross profit margin improvement, along with a full year of higher utilization of ou r l o w e r c o s t m a n u f a c t u ri n g c e n t e r i n M e x i c o . 11

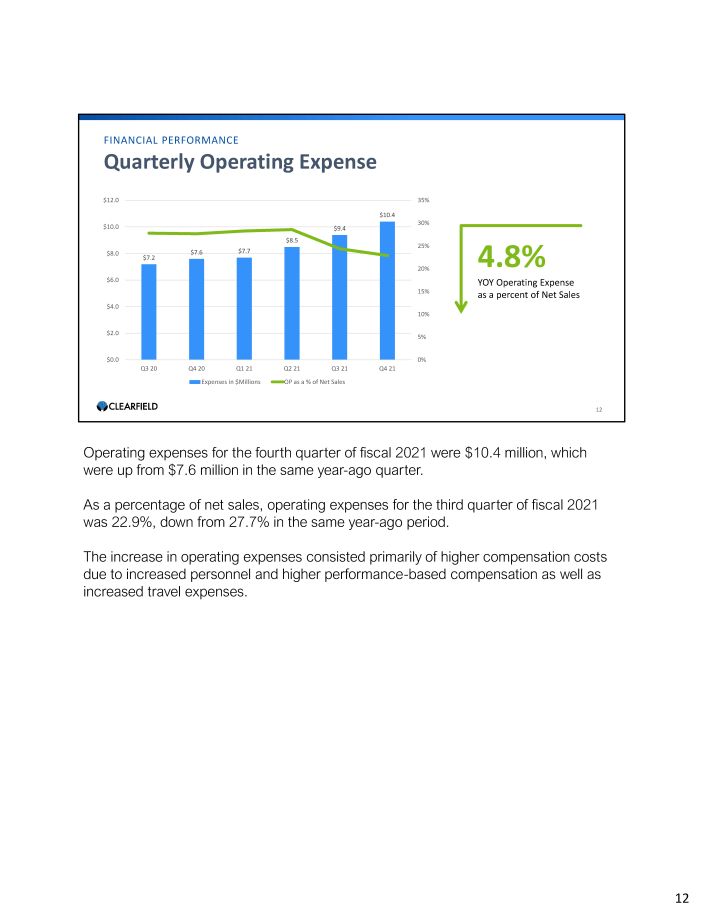

$7 . 2 $7 . 6 $7 . 7 $8 . 5 $9 . 4 $10 . 4 0% 5% 10% 15% 20% 25% 30% 35% $0 . 0 $2 . 0 $4 . 0 $6 . 0 $8 . 0 $10 . 0 Q 3 20 Q 4 20 Q1 21 Q2 21 Q3 21 Q 4 21 Expenses in $Millions OP as a % of Net Sales 12 FINANCIAL PERFORMANCE Quarterly Operating Expense $12.0 4.8% YOY Operating Expense as a percent of Net Sales Operating expenses for the fourth quarter of fiscal 2021 were $10.4 million, which were up from $7.6 million in the same year - ago quarter. As a percentage of net sales, operating expenses for the third quarter of fiscal 2021 was 22.9%, down from 27.7% in the same year - ago period. The increase in operating expenses consisted primarily of higher compensation costs due to increased personnel and higher performance - based compensation as well as increased travel expenses. 12

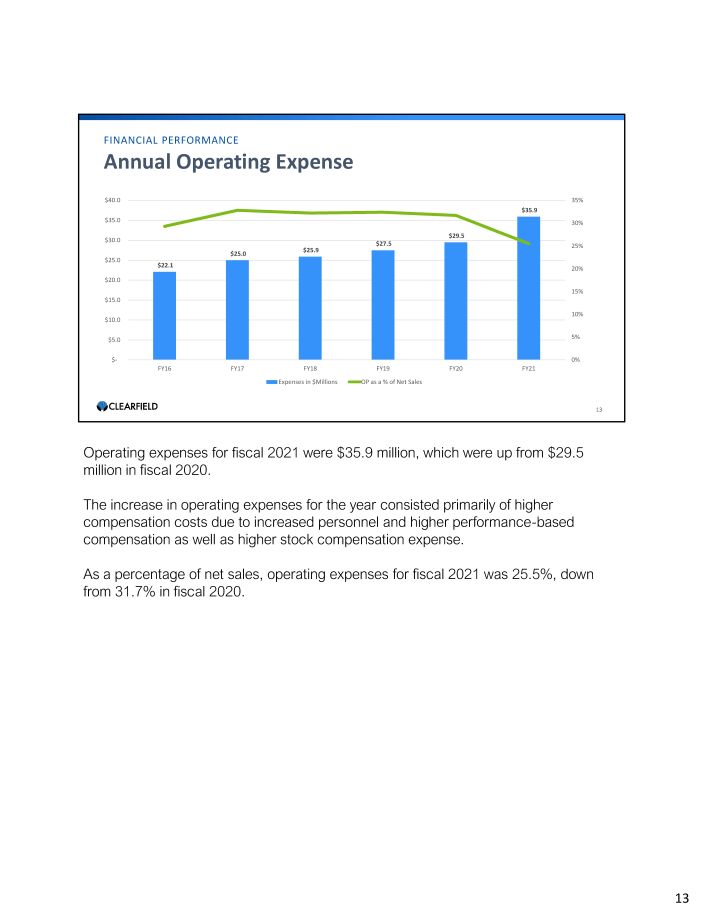

$22.1 $25.0 $25.9 $27.5 $29.5 $35.9 0% 5% 10% 15% 20% 25% 30% 35% $ - $ 1 0.0 $ 5 .0 $ 1 5.0 $ 2 0.0 $ 2 5.0 $ 3 0.0 $ 3 5.0 F Y16 F Y 1 7 F Y18 F Y19 F Y20 F Y21 Expenses in $Millions OP as a % of Net Sales 13 FINANCIAL PERFORMANCE Annual Operating Expense $40.0 Operating expenses for fiscal 2021 were $35.9 million, which were up from $29.5 million in fiscal 2020. The increase in operating expenses for the year consisted primarily of higher compensation costs due to increased personnel and higher performance - based compensation as well as higher stock compensation expense. As a percentage of net sales, operating expenses for fiscal 2021 was 25.5%, down f r o m 3 1 . 7 % i n f i s c a l 202 0 . 13

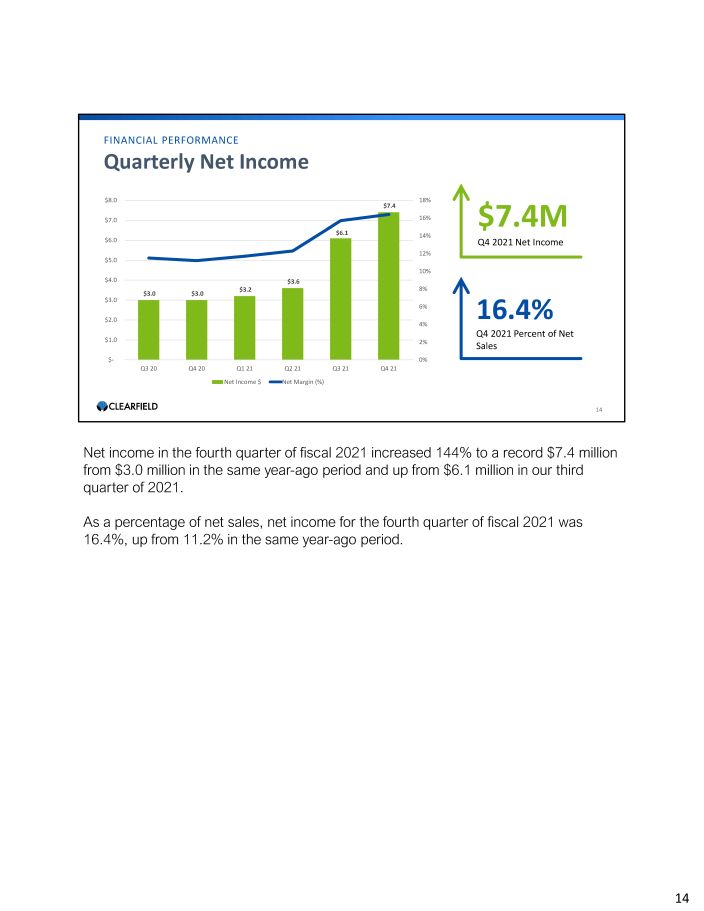

$3.0 $3.0 $3.2 $3.6 $6.1 $7.4 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% $ - $ 1 .0 $ 2 .0 $ 3 .0 $ 4 .0 $ 5 .0 $ 6 .0 $ 7 .0 Q 3 20 Q4 20 Q1 21 Q 2 21 Q 3 21 Q 4 21 Net Income $ Net Margin (%) 14 FINANCIAL PERFORMANCE Quarterly Net Income $8.0 $ 7 .4M Q4 2021 Net Income 16.4% Q4 2021 Percent of Net Sales Net income in the fourth quarter of fiscal 2021 increased 144% to a record $7.4 million from $3.0 million in the same year - ago period and up from $6.1 million in our third quarter of 2021. As a percentage of net sales, net income for the fourth quarter of fiscal 2021 was 16.4%, up from 11.2% in the same year - ago period. 14

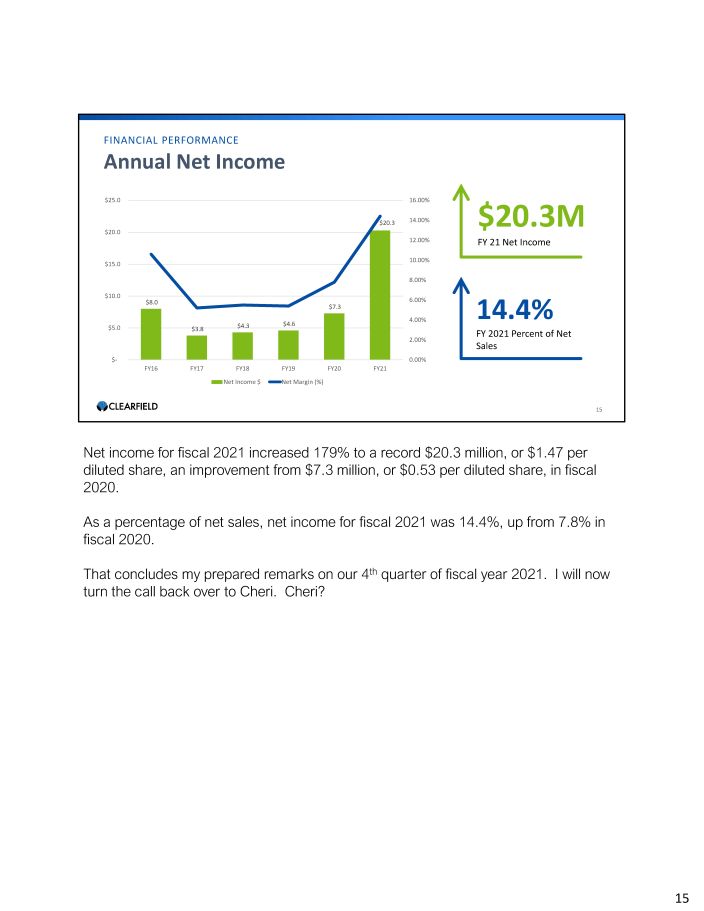

$8 . 0 $3 . 8 $4 . 3 $4 . 6 $7 . 3 $20 . 3 0 . 00% 4 . 00% 2 . 00% 6 . 00% 10 . 00% 8.00% 12 . 00% 14 . 00% 16 . 00% $ - $ 5 .0 $ 1 0.0 $ 1 5.0 $ 2 0.0 F Y16 F Y 1 7 F Y18 F Y19 F Y20 F Y21 Net Income $ Net Margin (%) 15 FINANCIAL PERFORMANCE Annual Net Income $25.0 $ 2 0. 3 M FY 21 Net Income 14.4% FY 2021 Percent of Net Sales Net income for fiscal 2021 increased 179% to a record $20.3 million, or $1.47 per diluted share, an improvement from $7.3 million, or $0.53 per diluted share, in fiscal 2020. As a percentage of net sales, net income for fiscal 2021 was 14.4%, up from 7.8% in fiscal 2020. That concludes my prepared remarks on our 4 th quarter of fiscal year 2021. I will now t u r n t h e c a ll b a c k o v e r t o C h e ri . C h e ri ? 15

N A S DAQ:CLFD 1 6 Business Update & Outlook T h a n k s D a n . 16

Our Value Proposition – Removing Obstacles 1. Craft - friendly – requires less skilled labor and overall labor time 2. Designed to reduce permitting and right - of - way 3. Faster turn - up time for quicker revenue per subscriber NASDAQ:CLFD 17 Since it founding, Clearfield has focused its product line on fiber management and fiber connectivity solutions while providing labor savings and being craft - friendly. As slide 17 points out, we aim to remove the obstacles that would inhibit our customers from adopting fiber - led broadband. As I mentioned, there is a significant shortage of qualified technicians and engineers in the U.S. market. Our products are thoughtfully designed to reduce the skill level required for installation, as well as the overall time needed to deploy these networks. Moreover, in addition to our product categories, we provide on - site labor training to support these deployments. Our Clearfield College training courses are available virtually as well as in person. So, it’s the combination of our high - quality, craft - friendly product and our steadfast focus on customer service, including training, that drives the Clearfield value proposition. 17

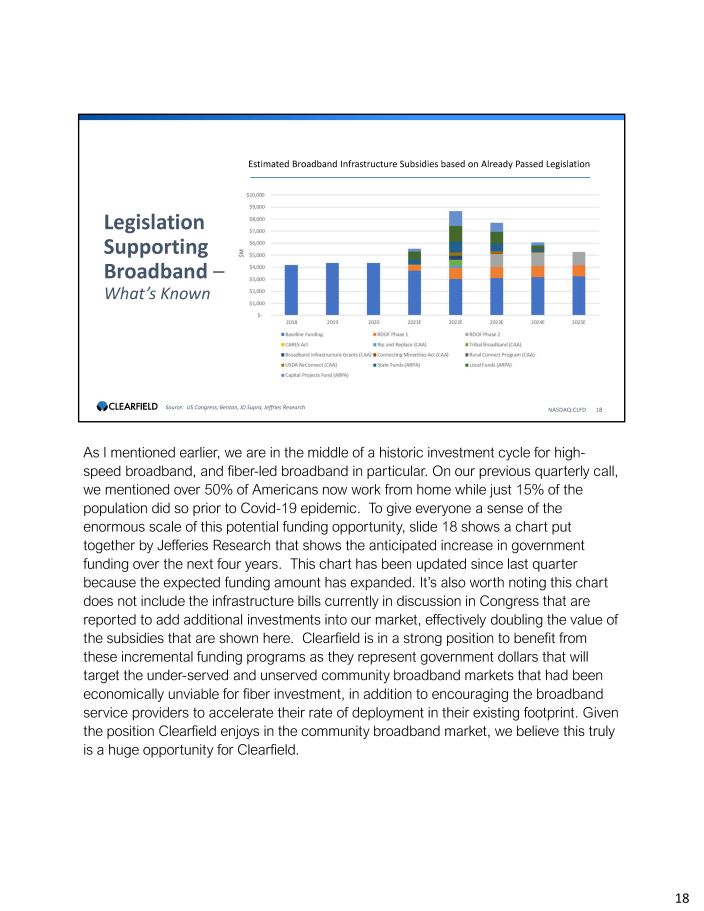

Legislation Supporting Broadband – What’s Known NA S DA Q : C LF D 18 Source: US Congress, Benton, JD Supra, Jeffries Research Estimated Broadband Infrastructure Subsidies based on Already Passed Legislation As I mentioned earlier, we are in the middle of a historic investment cycle for high - speed broadband, and fiber - led broadband in particular. On our previous quarterly call, we mentioned over 50% of Americans now work from home while just 15% of the p o p u l a t i o n d i d s o p ri o r t o C o v i d - 1 9 e p i d e m i c . T o g i v e e v e r y on e a s e n s e o f t h e enormous scale of this potential funding opportunity, slide 18 shows a chart put together by Jefferies Research that shows the anticipated increase in government funding over the next four years. This chart has been updated since last quarter because the expected funding amount has expanded. It’s also worth noting this chart does not include the infrastructure bills currently in discussion in Congress that are reported to add additional investments into our market, effectively doubling the value of the subsidies that are shown here. Clearfield is in a strong position to benefit from these incremental funding programs as they represent government dollars that will target the under - served and unserved community broadband markets that had been economically unviable for fiber investment, in addition to encouraging the broadband service providers to accelerate their rate of deployment in their existing footprint. Given the position Clearfield enjoys in the community broadband market, we believe this truly is a huge opportunity for Clearfield. 18

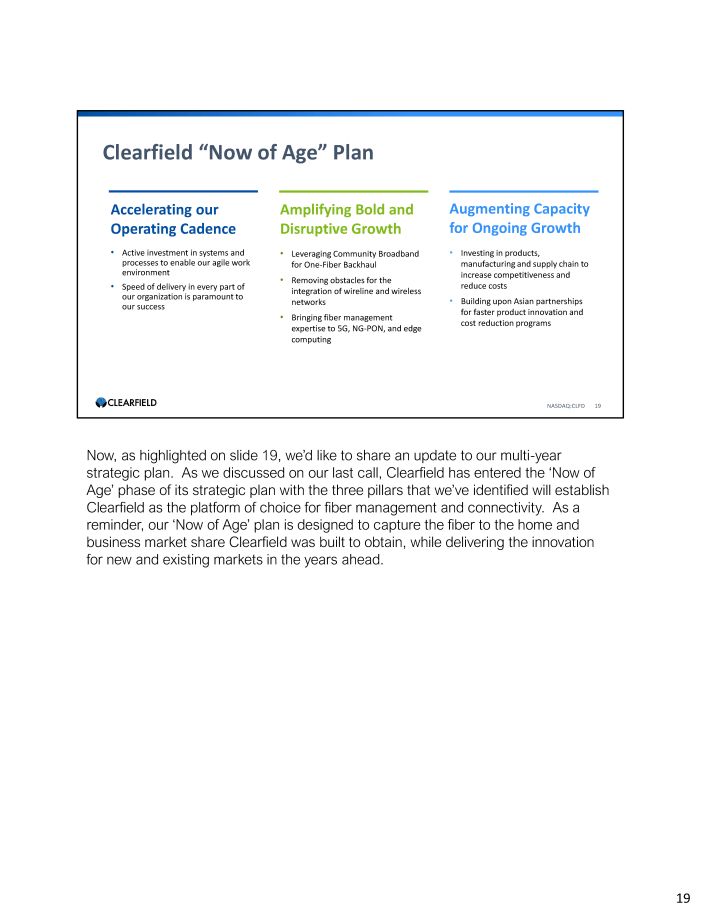

Clearfield “Now of Age” Plan NA S DA Q : C LF D 19 Augmenting Capacity for Ongoing Growth • Investing in products, m a nu f a c t ur i n g and s upply c hain t o increase competitiveness and reduce costs • Building upon Asian partnerships for faster product innovation and cost reduction programs Accelerating our Operating Cadence • Active investment in systems and processes to enable our agile work environment • Speed of delivery in every part of our organization is paramount to our success Amplifying Bold and Disruptive Growth • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing Now, as highlighted on slide 19, we’d like to share an update to our multi - year strategic plan. As we discussed on our last call, Clearfield has entered the ‘Now of Age’ phase of its strategic plan with the three pillars that we’ve identified will establish Clearfield as the platform of choice for fiber management and connectivity. As a reminder, our ‘Now of Age’ plan is designed to capture the fiber to the home and business market share Clearfield was built to obtain, while delivering the innovation f o r n e w a n d e x i s t i n g m a r k e t s i n t h e y ea r s a h ea d . 19

Accelerating our O p e r a ti ng C a d e n c e • Active investment in systems and processes to enable our agile work environment • Speed of delivery in every part of our organization is paramount to our success NA S DA Q : C LF D 20 Accelerating our Operating Cadence . This is Clearfield’s commitment to address the market’s exponential demand for fiber - fed broadband. Our ability to deliver our products on time to our customers is crucial. To meet this huge demand, over the course of FY 2021 we were able to grow 51% with our current facilities, and now with the investment we recently made in our Mexico plant, we are prepared to increase our footprint by 3x early in our second quarter as we move into expanded facilities now being built for Clearfield. So, we are well - positioned to be able to meet the growing o p p o r t u n i t i e s b e f o r e u s i n f i s c a l 202 2 a n d b e y o n d . I’d like to share one recent case study that exemplifies how we’ve approached this pillar. Clearfield recently had an opportunity to work with a leading Tier 2 provider because their incumbent supplier could not provide them with the product they n e e d e d . W e c a m e i n a n d w e r e a b l e t o s u pp l y t h e p r o d u c t i n a t i m e f r a m e t h a t m e t t h e i r needs. Their engineers completed a study that showed due to labor savings they could place twice as many cabinets per week as was being done previously. As a result, we were able to win a supply agreement to provide our passive optical network cabinets for at least 50% of this particular deployment. This case shows that customers need suppliers who can provide product on time and equally important, can reduce their labor required so that the time to revenue can accelerate. 20

Fiber Backhaul Amplifying Bold and Disruptive Growth • Leveraging Community Broadband for One - • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing NASDAQ:CLFD 21 21 Moving on to the second pillar, Amplifying Bold and Disruptive Growth , is our commitment to continue delivering market - changing products for current and future market requirements. The best proof point that we are delivering on this covenant is the $66.4 million backlog we mentioned earlier on this call. We are bringing our fiber management expertise to the market and customers have responded enthusiastically. We have 200 customers in our current backlog, including several distributors representing additional customers, with demand spread so that a quarter of those have orders of greater that $100,000. We are growing in large accounts, certainly, but we are not dependent upon a single customer.

Augmenting Capacity for Ongoing Growth • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Asian partnerships for faster product innovation and cost reduction programs NA S DA Q : C LF D 22 Finally, our third pillar, Augmenting Capacity for Ongoing Growth , is our commitment to scaling Clearfield operations to meet the incredible demand for high - speed broadband. The key here is our agility and the ability to adapt to our customers and their changing needs. We listen to what our customers have been saying about the changes in the market and the issues they currently face with the global supply chain. As a result, we have evolved from being a rapid response supplier to a trusted supplier focused on meeting our customers longer term planning and larger scale deployments. We have entered into agreements with our customers to provide material that they need to their promised ship dates. Our customer service skills and production planning provide us a competitive advantage to this new market dynamic. Of course, this advantage is also subject to our ability to manage suppliers who still have supply chain issues due to the pandemic environment. But we have learned to adapt to the new market dynamic and are building share as a result. 22

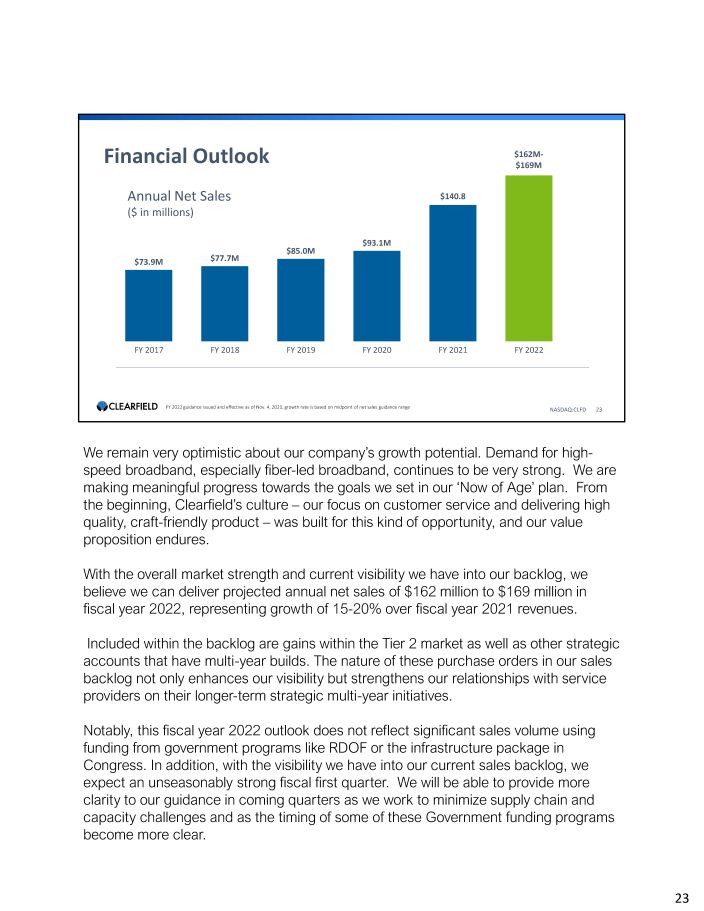

$73.9M $77.7M $85.0M $93.1M $140.8 $162M - $169M F Y 2 0 1 7 F Y 2 0 1 8 F Y 2 0 19 F Y 2 0 20 FY 2 0 21 FY 2 0 2 2 Financial Outlook N A S DAQ:CLFD 2 3 FY 2022 guidance issued and effective as of Nov. 4, 2021; growth rate is based on midpoint of net sales guidance range Annual Net Sales ($ in millions) We remain very optimistic about our company’s growth potential. Demand for high - speed broadband, especially fiber - led broadband, continues to be very strong. We are making meaningful progress towards the goals we set in our ‘Now of Age’ plan. From the beginning, Clearfield’s culture – our focus on customer service and delivering high quality, craft - friendly product – was built for this kind of opportunity, and our value proposition endures. With the overall market strength and current visibility we have into our backlog, we believe we can deliver projected annual net sales of $ 162 million to $ 169 million in fiscal year 2022 , representing growth of 15 - 20 % over fiscal year 2021 revenues . Included within the backlog are gains within the Tier 2 market as well as other strategic accounts that have multi - year builds. The nature of these purchase orders in our sales backlog not only enhances our visibility but strengthens our relationships with service providers on their longer - term strategic multi - year initiatives. Notably, this fiscal year 2022 outlook does not reflect significant sales volume using funding from government programs like RDOF or the infrastructure package in Congress. In addition, with the visibility we have into our current sales backlog, we expect an unseasonably strong fiscal first quarter. We will be able to provide more clarity to our guidance in coming quarters as we work to minimize supply chain and capacity challenges and as the timing of some of these Government funding programs become more clear. 23

Key Takeaways N A S DAQ:CLFD 2 4 Proven business model and management execution Enhanced management team and expansion of total addressable market Strong competitive position in a rapidly growing multi - billion - dollar fiber - fed broadband industry Strong balance sheet: $ 60 M in cash and no debt 14 Year history of profitability and positive free cash flow In summary, we concluded our fiscal 2021 setting new records for financial performance. We are very proud of our track record of consistent profitability and positive cash flow over the last decade. We remain confident the demand for fiber - fed broadband will persist in fiscal 2022 and in the years to come and are actively committing our capital to expand our production capacity and grow and manage our global supply chain to meet that growing demand. We will continue to make progress on our ‘Now of Age’ plan that positions us for continued success. The opportunity ahead of us is tremendous, and we will continue to execute on our proven strategy to grow our market share. And with that, we’re ready to open the call for your questions. Operator? 24

Q & A N A S DAQ:CLFD 2 5 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER T h a n k y o u . We will now be taking questions from the Company’s publishing sell - side analysts. Our first question today will come from Jaeson Schmidt with Lake Street. 25

Q & A N A S DAQ:CLFD 2 6 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER J a e s o n S c h m i d t L a k e S t r e e t C a p i t a l M a r k e t s , L L C , R e s ea r c h D i v i s i o n Hey, guys. Thanks for taking my questions. Congrats on being able to lift that guidance. Just curious, given the momentum you're seeing in the current backdrop, how we should be thinking about seasonality in fiscal 2022? Or if that is even on the table this year? C h e ri B e r a n e k Chief Executive Officer, President & Director I think as we addressed, seasonality is going to be covered. It's a little bit different than normal. I think we're going to see a very – an unseasonably strong first quarter. And I think we'll see diminished seasonality from what we've seen historically because of the fact that we're seeing longer - term perspectives and orders and some of our customers who are looking to put product in inventory so that they can be ready for the summer builds. So in general, I think we'll see a little bit less dominance on the summer and a little bit more consistentcy quarter to quarter. At least that's the visibility at this point. 26

Q & A N A S DAQ:CLFD 2 7 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER J a e s o n S c h m i d t L a k e S t r e e t C a p i t a l M a r k e t s , L L C , R e s ea r c h D i v i s i o n Okay. That's helpful. And then just as a follow - up. I know you mentioned traction with the Tier 2 accounts, but does fiscal '22 guidance or the lift to guidance, assume a s i g n i f i c a n t c o n t ri b u t i o n f r o m T i e r 1 p l a y e r s ? C h e ri B e r a n e k Chief Executive Officer, President & Director Yeah. It does not include anything significant from Tier 1 at this point. We are continuing our sales efforts, and we have been in discussion with several Tier 1 suppliers to help them deal with their capacity limitations and that there has been some challenges at the Tier 1 level for some of our – for their incumbent suppliers to meet demand. We're aggressively continuing to work in that area, but we also are constrained in some of the Tier 1 opportunities due to supply chain issues associated with PVDF and other plastics. 27

Q & A N A S DAQ:CLFD 2 8 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER J a e s o n S c h m i d t L a k e S t r e e t C a p i t a l M a r k e t s , L L C , R e s ea r c h D i v i s i o n O k a y . T h a n k s a l o t g uy s . C h e ri B e r a n e k Chief Executive Officer, President & Director T h a n k y o u . G o o d t o t a l k t o y o u J a e s o n . Operator There being no questions at this time, this will conclude our question - and - answer session. If your question was not taken, you may contact Clearfield's investor relations team at clfd@gatewayir.com. I'd now like to turn the call back over to Ms. Beranek for any closing remarks. 28

Q & A N A S DAQ:CLFD 2 9 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER C h e ri B e r a n e k Chief Executive Officer, President & Director It was a wonderful opportunity to present these numbers for you today. I just want to absolutely call out the amazing work of Clearfield’s employee community, the execution on our strategy and the execution to deliver product in a scalable fashion. I think it's extraordinary, and I couldn't be more proud of what they're doing. I also wish all of you a – I'm very grateful for your support as we approach the Thanksgiving season and wish you and your families a very blessed opportunity to spend time together. Until next quarter. Operator The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect. 29

NASDAQ:CLFD 30 Contact Us COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@clfd.net INVESTOR RELATIONS: Matt Glover and Sophie Pearson Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com 30