UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [x] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to SS.240.14a-11(c) or SS.240.14a-12 |

| CLEARFIELD, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| [x] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or Schedule and the date of its filing. | |

| 1) | Amount previously paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

Clearfield, Inc.

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(763) 476-6866

____________________

NOTICE OF ANNUAL

MEETING OF SHAREHOLDERS

To Be Held February 24, 2022

____________________

TO THE SHAREHOLDERS OF

CLEARFIELD, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Clearfield, Inc., a Minnesota corporation, will be held on Thursday, February 24, 2022, at 2:00 p.m. Central Standard Time for the following purposes:

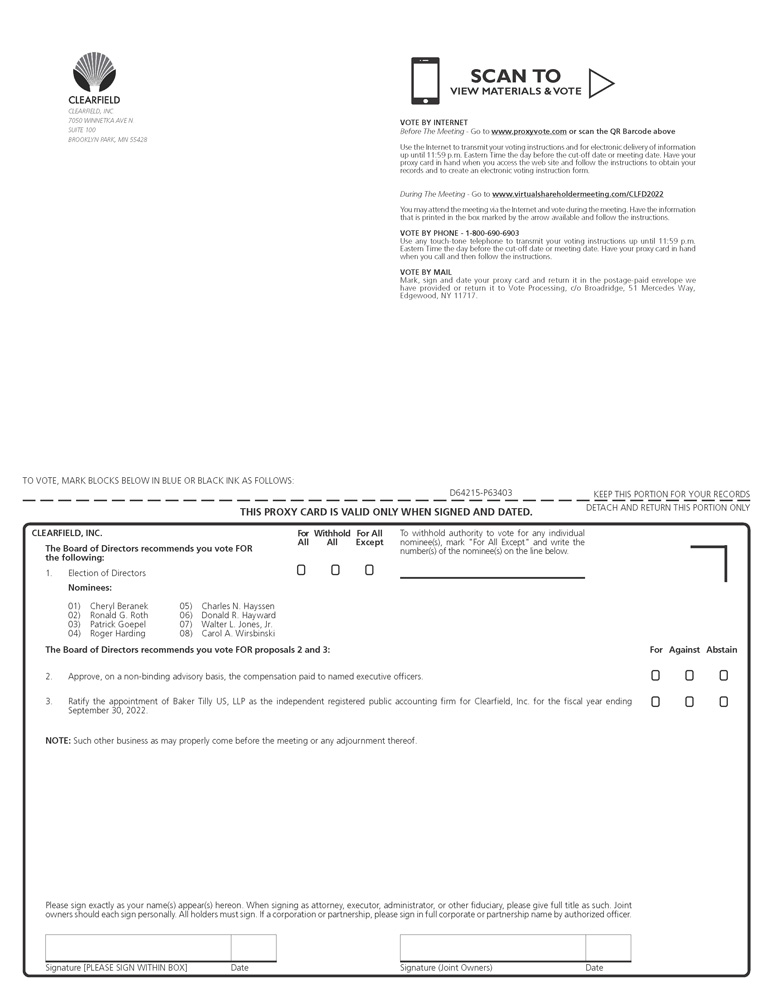

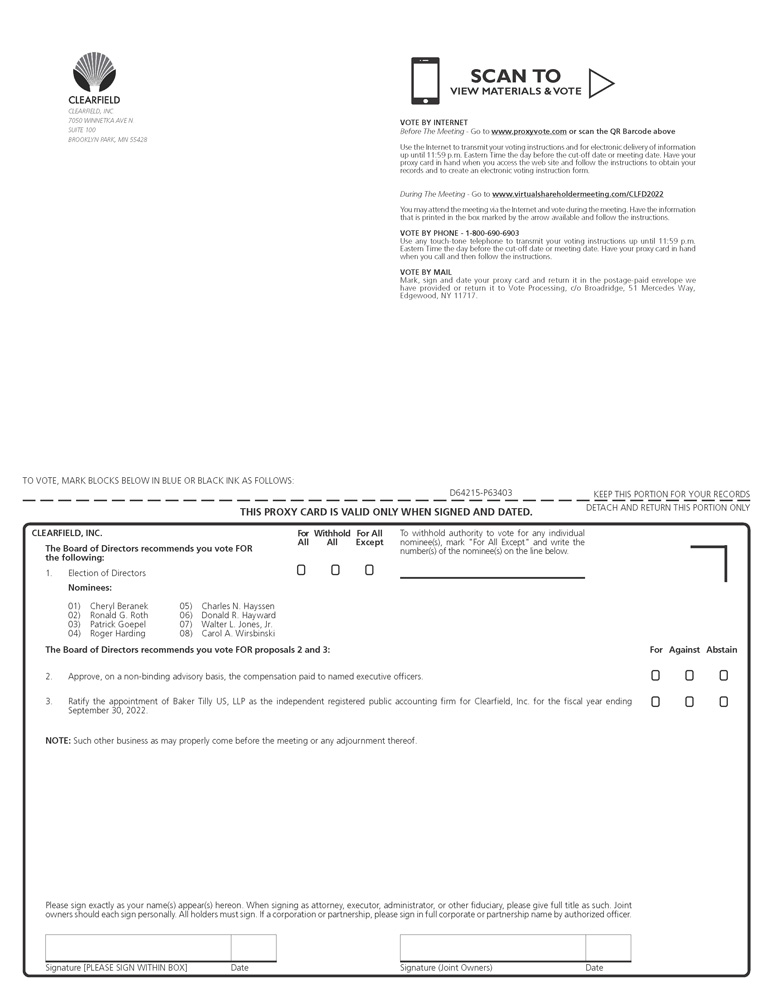

| 1. | Elect eight (8) directors to serve until the next Annual Meeting of the Shareholders or until their respective successors have been elected and qualified. |

| 2. | To approve, on a non-binding advisory basis, the compensation paid to our named executive officers. |

| 3. | Ratify and confirm the appointment of Baker Tilly US, LLP as the independent registered public accounting firm for Clearfield, Inc. for the fiscal year ended September 30, 2022. |

THE 2022 ANNUAL MEETING OF SHAREHOLDERS WILL BE A VIRTUAL MEETING OF SHAREHOLDERS.

You may attend the online meeting and vote your shares electronically during the meeting via the internet by visiting: www.virtualshareholdermeeting.com/CLFD2022. You will need the 16-digit control number that is printed in the box marked by the arrow on the proxy materials you received. We recommend that you log in at least fifteen minutes before the meeting to ensure that you are logged in when the meeting starts.

Only holders of record of Clearfield, Inc.’s common stock at the close of business on December 29, 2021 are entitled to notice of, and to vote at, the Annual Meeting.

| By Order of the Board of Directors /s/ Ronald G. Roth Ronald G. Roth Chairman of the Board of Directors |

January 12, 2022

| WHETHER OR NOT YOU EXPECT TO ATTEND THE ONLINE MEETING, PLEASE VOTE YOUR SHARES IN ONE OF THE WAYS DESCRIBED IN YOUR PROXY MATERIALS AS PROMPTLY AS POSSIBLE. |

IMPORTANT NOTICE REGARDING AVAILABILITY

OF PROXY MATERIALS FOR THE

2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, FEBRUARY 24, 2022

We are making our proxy materials available electronically via the Internet. You may access the following proxy materials at www.proxyvote.com:

— Notice of 2022 Annual Meeting of Shareholders to be held on Thursday, February 24, 2022;

— Proxy Statement for 2022 Annual Meeting of Shareholders; and

— Annual Report on Form 10-K for the fiscal year ended September 30, 2021.

On or about January 12, 2022, we mailed to some of our shareholders a notice of internet availability containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The notice of internet availability includes instructions to vote via the Internet, as well as how to request paper or e-mail copies of our proxy materials. Other shareholders received an e-mail notification that provided instructions on how to access our proxy materials and vote via the Internet or were mailed paper copies of our proxy materials and a proxy card that provides instructions for voting via the Internet, by telephone or by mail.

If you received the notice of internet availability and would prefer to receive printed proxy materials, please follow the instructions included in the notice of internet availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive e-mails with instructions to access these materials via the Internet unless you elect otherwise.

These proxy materials are available free of charge and will remain available through the conclusion of the Annual Meeting. Additionally, we will not collect information, such as “cookies,” that would allow us to identify visitors to the site.

| i |

table of contents

| Page | |

| PROXY STATEMENT | 1 |

| Solicitation of Proxies | 1 |

| Cost and Method of Solicitation | 1 |

| Voting | 1 |

| Differences Between Shareholder of Record and Beneficial Owner | 1 |

| Quorum and Voting Requirements | 2 |

| Casting Your Vote as a Record Holder | 2 |

| Casting Your Vote as a Beneficial Holder | 3 |

| Revoking a Proxy | 3 |

| OWNERSHIP OF VOTING SECURITIES BY PRINCIPAL HOLDERS AND MANAGEMENT | 4 |

| PROPOSAL 1: ELECTION OF DIRECTORS | 5 |

| Information Regarding Nominees | 5 |

| Vote Required for Proposal 1 | 7 |

| PROPOSAL 2: ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION | 8 |

| Vote Required for Proposal 2 | 8 |

| CORPORATE GOVERNANCE HIGHLIGHTS | 9 |

| Our Corporate Governance Practices | 9 |

| 2021 Shareholder Engagement | 9 |

| CORPORATE GOVERNANCE | 10 |

| Board Independence | 10 |

| Committees of the Board of Directors and Committee Independence | 10 |

| Board Leadership Structure | 12 |

| Board’s Role in Risk Oversight | 12 |

| Our Environmental, Social and Governance Principles | 12 |

| Director Nominations | 14 |

| Board Attendance at Board, Committee and Annual Shareholder Meetings | 16 |

| Communications with Directors | 16 |

| Code of Ethics | 17 |

| Policies Prohibiting Employee, Officer and Director Hedging and Pledging | 17 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 17 |

| EXECUTIVE OFFICERS | 18 |

| EXECUTIVE COMPENSATION | 18 |

| Explanation of Compensation | 18 |

| Summary Compensation Table | 22 |

| Outstanding Equity Awards at Fiscal Year-End | 23 |

| Employment Arrangements with Named Executive Officers | 24 |

| DIRECTOR COMPENSATION | 28 |

| PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 29 |

| Vote Required for Proposal 3 | 29 |

| RELATIONSHIP WITH INDEPENDENT ACCOUNTANTS | 29 |

| Accountant Fees and Services | 29 |

| Audit Committee Pre-Approval Procedures | 30 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 30 |

| SHAREHOLDER PROPOSALS AND SHAREHOLDER NOMINEES FOR 2023 ANNUAL MEETING | 30 |

| OTHER BUSINESS | 31 |

| ii |

Clearfield, Inc.

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(763) 476-6866

____________________

PROXY STATEMENT

____________________

Solicitation of Proxies

This proxy statement is provided in connection with the solicitation of proxies by the Board of Directors of Clearfield, Inc. (“we,” “Clearfield” or the “Company”) for use at the Annual Meeting of Shareholders to be held on Thursday, February 24, 2022, at 2:00 p.m. Central Standard Time and at any postponements or adjournments thereof (the “Annual Meeting”). The mailing of this proxy statement to our shareholders commenced on or about January 12, 2022.

About the Virtual Annual Meeting

Due to the public health impact of the COVID-19 pandemic and to prioritize the health and safety of meeting participants, the 2022 Annual Meeting of Shareholders will again be a virtual meeting of the shareholders.

Shareholders at the close of business on the record date, December 29, 2021, are entitled to attend the Annual Meeting by going to www.virtualshareholdermeeting.com/CLFD2022. To be admitted to the Annual Meeting, shareholders must enter the 16-digit control number found on the proxy materials you received, voting instruction form, notice of internet availability of proxy materials, or email previously received. Shareholders may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

Following the formal portion of the Annual Meeting, we expect that our management will give a live video presentation and then answer questions from our shareholders. Shareholders participating in the Annual Meeting live via webcast may submit questions in writing through the virtual meeting platform at www.virtualshareholdermeeting.com/CLFD2022 during the Annual Meeting by typing your question into the “Ask a Question” field and clicking “Submit.”

Cost and Method of Solicitation

This solicitation of proxies to be voted at the Annual Meeting is being made by our Board of Directors. The cost of this solicitation of proxies will be borne by us. In addition to solicitation by mail, our officers, directors and employees may solicit proxies by telephone or in person. We may also request banks, brokers and other nominees to solicit their customers who have a beneficial interest in our common stock registered in the names of nominees and will reimburse such banks, brokers or nominees for their reasonable out-of-pocket expenses.

Voting

The total number of shares of common stock, $0.01 par value outstanding and entitled to vote at the Annual Meeting as of December 29, 2021 was 13,754,785. Each share of common stock is entitled to one vote. Only shareholders of record at the close of business on December 29, 2021 will be entitled to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting by logging in to the internet address above. Whether or not you expect to attend the online Annual Meeting, please vote as promptly as possible in order to ensure your representation at the Annual Meeting. Even if you have given your proxy, you may still vote electronically if you attend the online Annual Meeting. To vote at the Annual Meeting, you must enter the 16-digit control number found on the proxy card, voting instruction form, notice of internet availability of proxy materials, or email you received.

Differences Between Shareholder of Record and Beneficial Owner

You are a shareholder of record if at the close of business on the record date your shares were registered directly in your name with Equiniti Trust Company (doing business as EQ Shareowner Services), our transfer agent.

| 1 |

You are a beneficial owner if at the close of business on the record date your shares were held by a bank, brokerage firm or other nominee and not in your name. Being a beneficial owner means that, like many of our shareholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other nominee provides. If you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee will not be able to vote your shares with respect to any proposal being presented to shareholders at the Annual Meeting except for Proposal 3: Ratification of Appointment of Independent Auditors.

Record holders should review the additional information below under “Casting Your Vote as a Record Holder.”

Beneficial owners should review the additional information below under “Casting Your Vote as a Beneficial Holder.”

Quorum and Voting Requirements

A quorum, consisting of a majority of the shares of common stock entitled to vote at the Annual Meeting, must be present before action may be taken at the Annual Meeting.

Proposal 1 relates to the election of directors. Directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing eight directors, the eight nominees receiving the highest number of votes will be elected. However, in an uncontested election (such as at the Annual Meeting, where the number of nominees does not exceed the number of directors to be elected), any nominee for director who receives more votes “withheld” from his or her election than votes “for” his or her election is required under our Governance Guidelines to promptly tender his or her resignation following certification of the shareholder vote. You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the Board of Directors. If you withhold authority to vote for the election of one of the directors, it has the same effect as a vote against that director.

The affirmative vote of the holders of a majority of the shares present and entitled to vote is required for approval of Proposal 2: Advisory Vote on Named Executive Officer Compensation. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 2.

The affirmative vote of the holders of a majority of the shares present and entitled to vote is required for approval of Proposal 3: Ratification of Appointment of Independent Auditors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 3.

Abstentions will be counted for purposes of calculating whether a quorum is present at the Annual Meeting. If you abstain from voting on Proposal 2 or Proposal 3, it has the same effect as a vote against that proposal. A “broker non-vote” occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting but will not be counted for purposes of determining the number of votes present and entitled to vote with respect to a particular proposal. Thus, a broker non-vote will not affect the outcome of the vote on Proposal 1: Election of Directors or Proposal 2: Advisory Vote on Named Executive Officer Compensation. Brokers and other nominee holders may use their discretion to vote on the proposal to ratify the selection of our independent registered public accounting firm if no instructions are provided.

So far as our management is aware, no matters other than those described in this proxy statement will be acted upon at the Annual Meeting. In the event that any other matters properly come before the Annual Meeting calling for a vote of shareholders, the persons acting as proxies will vote in accordance with their best judgment on such other matters.

Casting Your Vote as a Record Holder

If you are the shareholder of record of your shares and you do not vote by proxy card or instruction form, by telephone, via the Internet or online at the Annual Meeting, your shares will not be voted at the Annual Meeting. If you are a record holder and you vote your shares, the individuals acting as proxies will vote your shares as you have directed. If you just sign and submit your proxy without voting instructions, your shares will be voted “FOR” each director nominee identified in Proposal 1, “FOR” Proposal 2, and “FOR” Proposal 3.

| 2 |

Casting Your Vote as a Beneficial Holder

If you are a beneficial holder and you do not vote by proxy card or instruction form, by telephone, via the Internet or online at the Annual Meeting, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Your broker is entitled to vote in its discretion on Proposal 3: Ratification of Appointment of Independent Auditors.

If you hold your shares beneficially and do not vote or do not provide voting instructions to your broker or nominee, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. This is sometimes called a “broker non-vote.” Brokers and nominees do not have discretionary authority to vote on Proposal 1: Election of Directors or Proposal 2: Advisory Vote on Named Executive Officer Compensation.

As a result, if you hold your shares beneficially and do not vote or do not provide voting instructions to your broker or nominee, no votes will be cast on your behalf on Proposal 1 or Proposal 2. Because of these broker voting rules, all beneficial holders are urged to provide instructions to their brokers or nominees on how to vote their shares at the Annual Meeting.

Make your vote count! Instruct your broker how to cast your vote!

If you hold your shares beneficially, your broker will have discretion to vote any uninstructed shares on Proposal 3: Appointment of Independent Auditors.

Revoking a Proxy

You may change your vote and revoke your proxy at any time before it is voted by:

| · | Sending a written statement to that effect to the Secretary of Clearfield, Inc.; |

| · | Submitting a properly signed proxy card with a later date; |

| · | If you voted by telephone or through the Internet, by voting again either by telephone or through the Internet prior to the close of the voting facility; or |

| · | Voting electronically at the Annual Meeting. |

All shares represented by valid, unrevoked proxies will be voted at the Annual Meeting and any adjournment(s) or postponement(s) thereof. Our principal offices are located at 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, Minnesota 55428, and our telephone number is (763) 476-6866.

| 3 |

OWNERSHIP OF VOTING SECURITIES BY PRINCIPAL HOLDERS AND MANAGEMENT

The following table sets forth certain information as of December 29, 2021 with respect to our common stock beneficially owned by (i) each director and each nominee for director, (ii) each person known to us to beneficially own more than five percent of our common stock, (iii) each executive officer named in the Summary Compensation Table (the “named executive officers”), and (iv) all current executive officers and directors as a group. Unless otherwise indicated, all beneficial owners have sole voting and investment power over the shares held. Except as indicated below, the business address of each individual set forth below is 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, Minnesota 55428.

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned (1) |

Percent of Outstanding |

| BlackRock, Inc. (2) 55 East 52nd Street New York, NY 10055 |

805,091 |

5.9% |

| Ronald G. Roth (3)(4) | 1,426,049 | 10.4% |

| Cheryl Beranek (3)(5) | 474,906 | 3.4% |

| Patrick Goepel (3) | 50,000 | * |

| Roger Harding (3) | 20,614 | * |

| Charles N. Hayssen (3) | 153,453 | 1.1% |

| Donald R. Hayward (3) | 10,891 | * |

| Walter L. Jones, Jr. (3) | 159 | * |

| Carol Wirsbinski (3) | 159 | * |

| John P. Hill (5) | 210,096 | 1.5% |

| Daniel R. Herzog (5) | 58,676 | * |

| All current executive officers and directors as a group (10 persons) | 2,405,003 | 17.4% |

* Less than one percent

| (1) | Includes the following number of shares that could be purchased within 60 days of December 29, 2021 upon the exercise of stock options: Ms. Beranek, 41,925 shares; Mr. Hill, 41,925 shares; Mr. Herzog, 18,732 shares; and all current directors and executive officers as a group, 102,582 shares. |

| (2) | Based upon an Amendment No. 6 to Schedule 13G filed by BlackRock, Inc. on January 29, 2021 in which the shareholder reports sole voting power over 800,405 shares of our common stock and sole dispositive power over 805,091 shares of our common stock as of December 31, 2020. |

| (3) | Currently serves as our director and nominated for election as a director at the Annual Meeting. |

| (4) | Includes 176,760 owned by Mr. Roth’s spouse. |

| (5) | Named Executive Officer. |

| 4 |

PROPOSAL

1:

ELECTION OF DIRECTORS

Eight directors will be elected at the Annual Meeting to serve until the next Annual Meeting of Shareholders or until their successors have been elected and shall qualify. Proxies cannot be voted for a greater number of persons than the number of nominees named. Pursuant to our bylaws, the authorized number of directors is set at eight and the Board of Directors has nominated for election the eight persons named below. All eight nominees are currently serving as directors of Clearfield.

The persons acting as proxies intend to vote the proxies held by them in favor of the nominees named below as directors, unless otherwise directed. Should any nominee for director become unable to serve as a director for any reason, the proxies have indicated they will vote for such other nominee as the Board of Directors may propose. The Board of Directors has no reason to believe that any candidate will be unable to serve if elected and each has consented to being named a nominee.

We know of no arrangements or understandings between a director or nominee and any other person pursuant to which he or she has been selected as a director or nominee. There is no family relationship between any of the nominees, our directors or our executive officers except that Ms. Beranek and Mr. Hill are related through the marriage of their daughter and son, respectively.

Information Regarding Nominees

Set forth below is biographical and other information with respect to each nominee, as well as a discussion of the specific experience, qualifications, attributes and skills that led to the conclusion that the nominee should serve as a director of Clearfield at this time.

Cheryl Beranek, age 59, has served as our director since 2007. Ms. Beranek has also served as our President and Chief Executive Officer since June 2007. From July 2003 to June 2007, Ms. Beranek served as President of our former subsidiary, APA Cables and Networks. Prior to joining the Company, Ms. Beranek was President of Americable from 2002 until July 2003, when we acquired Americable. She also served as the Chief Operating Officer of Americable in 2001 and 2002. Ms. Beranek holds a Bachelor of Science degree from Southwest Minnesota State University and a Master’s of Science degree from North Dakota State University. Since May 14, 2020, Ms. Beranek has served as a director of CyberOptics Corporation (Nasdaq: CYBE), a leading global developer and manufacturer of high-precision 3D sensing technology solutions.

Ms. Beranek is qualified to serve on the Clearfield Board of Directors because she brings to the Board a keen understanding of our business and industry developed through her tenure as our President and Chief Executive Officer and in her previous position as the President of our former subsidiary. Additionally, Ms. Beranek’s role as our President and Chief Executive Officer allows her to provide the Board with her unique insight as a member of management on our business and our operations.

Ronald G. Roth, age 76, has served as our director since 2002. Mr. Roth is currently retired. Mr. Roth was Chairman of the Board and Chief Executive Officer of Waste Systems Corp., a privately held waste hauling and disposal company, for 25 years prior to its sale to a national solid waste management company in 1995. From 1995 to 2001, he was Chairman of the Board of Access Cash International L.L.C., a North American provider of ATMs and related processing and financial services until its sale. Since 1990 he has been an owner of, and has served in various capacities, including Chairman of the Board and an officer, with Phillips Recycling Systems. Mr. Roth holds a Bachelor of Arts degree in marketing from Michigan State University.

Mr. Roth is qualified to serve on the Clearfield Board of Directors because he brings to the Board a strong background in executive management through his service for more than 25 years as the Chief Executive Officer or executive officer of several companies.

Patrick Goepel, age 60, has served as our director since September 1, 2015. Since January 2010, Mr. Goepel has served as the President and Chief Executive Officer of Asure Software, Inc., a publicly-held provider of workplace management software (Nasdaq: ASUR). He previously served as Asure Software’s Interim Chief Executive Officer from September 2009 to January 2010 and has served as its director since August 2009, becoming Chairman of the Asure Software Board in August 2020. Previously, he was the President and Chief Executive Officer of Fidelity Investment’s Human Resource Services Division from 2006 to 2008 and President and Chief Executive Officer of Advantec from 2005 to 2006. A former board member of iEmployee, Mr. Goepel currently serves on the board of directors of APPD Investments, and SafeGuard World International. He also served on the board of AllOver Media Holdings, Inc. until its sale to a private equity firm in March 2015.

| 5 |

Mr. Goepel’s public company executive management and board experience, as well as his background in successful execution of global expansion, operational and M&A initiatives, qualify him to serve as a director of Clearfield. In addition, Mr. Goepel qualifies as an audit committee financial expert.

Roger Harding, age 67, has served as our director since July 14, 2016. From 1972 to 2008, Mr. Harding served in multiple leadership roles with Alcatel-Lucent, including as the Vice President & General Manager, Global Switching from 2001 until his retirement in 2008. Mr. Harding received a Bachelor of Arts degree in business administration and management from the University of Central Oklahoma.

Mr. Harding has a strong background in operations and the execution of operational strategies, as well as a deep understanding of the telecommunications and networking markets. These attributes qualify him to serve as a director of Clearfield. In addition, Mr. Harding qualifies as an audit committee financial expert.

Charles N. Hayssen, age 70, has served as our director since 2008. Since January 2009, Mr. Hayssen has served as the President of Safeway Driving School, a privately-held provider of driver’s education services. From August 2007 to September 2008, Mr. Hayssen was a private investor. From August 2004 until August 2007, Mr. Hayssen was Chief Operating Officer of AllOver Media, Inc., a privately-held out-of-home media company. From September 2002 to April 2004, Mr. Hayssen was the Chief Financial Officer of ThinkEquity Partners LLC, an equity capital markets firm. Mr. Hayssen holds a Bachelor of Arts degree from Dartmouth College and a Masters of Business Administration degree from the University of Chicago Booth School of Business.

Mr. Hayssen brings strong executive management and financial management experience to the Board, as well as experience earlier in his career as a director of a publicly traded company, all of which qualify him to serve as a director of Clearfield. In addition, Mr. Hayssen qualifies as an audit committee financial expert.

Donald R. Hayward, age 64, has served as our director since 2007. From 2006 to his retirement in 2017, Mr. Hayward served as the President of Engel Diversified Industries, a privately held manufacturing company (“EDI”). Beginning in 2017, and until retiring in 2020, Mr. Hayward led Schaffer Manufacturing, a privately held metal fabrication manufacturing company, becoming President in 2018. From 1997 until joining EDI, Mr. Hayward was Director of Corporate Services at Minnesota Technology, Inc. a publicly funded, private non-profit in support of Minnesota’s technology community. Mr. Hayward holds a Bachelor of Science degree in business administration and economics from the University of Wisconsin.

Mr. Hayward’s executive leadership experience, his familiarity with the business and operations of a manufacturing company developed through his service at Schaffer Manufacturing and Engel Diversified Industries, and his background in technology qualify him to serve as a director of Clearfield.

Walter Jones, Jr., age 56, was elected as a director on December 3, 2021. Since December 2015, Mr. Jones has served as a board advisor and operations consultant. Mr. Jones served as an operations and technology executive at Verizon from 1989 to 2015. Most recently, Mr. Jones was the Vice President of Network Transformation from January 2015 to December 2015, Region President of the Consumer Mass Business from July 2013 to January 2015, and Area Vice President of Network from 2008 to July 2013. Mr. Jones holds a Bachelor of Science degree in engineering from Virginia Tech and a Masters of Business Administration degree from the College of William and Mary.

Mr. Jones’s deep background in telecommunications operations and technology, along with his strong understanding of a Tier 1 telecommunications company, qualify him to serve as a director of Clearfield.

Carol Wirsbinski, age 58, was elected as a director on December 3, 2021. Ms. Wirsbinski served as the Chief Operating Officer and a Vice President of Enventis Corporation (Nasdaq: ENVE), formerly known as Hickory Tech Corporation, an integrated communication service provider serving a five state Midwest area, from 2011 until Enventis was acquired in 2014 by Consolidated Communications Holdings, Inc. (Nasdaq: CNSL), a national internet and telecommunications service provider. Following the acquisition, Ms. Wirsbinski served as the Chief Sales Officer of Consolidated Communications Holdings until her retirement in December 2017. Since 2019, Ms. Wirsbinski has served as a Board Member for Somos Inc., a private company providing number information services (NIS) to the telecommunications industry. Ms. Wirsbinski holds a Bachelor of Business Administration in marketing from the University of Wisconsin-Eau Claire.

| 6 |

Ms. Wirsbinski’s substantial experience in executive management, particularly her experience leading transformational growth, and her depth of understanding of the telecommunications industry, particularly the community broadband market, qualify her to serve as a director of Clearfield.

Vote Required for Proposal 1

Under Minnesota law and our bylaws, directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing eight directors, the eight nominees receiving the highest number of votes will be elected.

However, in an uncontested election (where, as at the Annual Meeting, the number of nominees does not exceed the number of directors to be elected), any nominee for director who receives more votes “withheld” from his or her election than votes “for” his or her election is required under our Governance Guidelines to promptly tender his or her resignation following certification of the shareholder vote. Votes withheld from a nominee’s election do not include broker non-votes. The Nominating and Corporate Governance Committee will consider the resignation offer and recommend to the Board whether to accept it. The Board will act on the Nominating and Corporate Governance Committee’s recommendation within 90 days following certification of the shareholder vote. The Board will promptly disclose its decision whether to accept the director’s resignation offer (and the reasons for rejecting the resignation offer, if applicable) in a Current Report on Form 8-K filed with the Securities and Exchange Commission. Any director who tenders his or her resignation as described above will not participate in the Nominating and Corporate Governance Committee’s recommendation or Board action regarding whether to accept the resignation offer. Proxies will be voted in favor of each nominee unless otherwise indicated. In addition, if each member of the Nominating and Corporate Governance Committee receives a majority withheld vote at the same election, then the independent directors who did not receive a majority withheld vote shall appoint a committee amongst themselves to consider the resignation offers and recommend to the Board whether to accept them.

The Board of Directors Recommends

Shareholders Vote FOR the Election of Each Nominee Identified in Proposal 1

_________________________________

| 7 |

PROPOSAL

2:

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Our Board of Directors determined that an advisory vote on named executive officer compensation (commonly referred to as “say-on-pay”) will be held every year. Accordingly, pursuant to the requirements of Section 14A of the Exchange Act and the related rules of the Securities and Exchange Commission, we are asking our shareholders to cast an advisory vote on named executive officer compensation at the Annual Meeting.

The say-on-pay proposal presented at our 2021 Annual Meeting of Shareholders received 62.2% approval by our shareholders. While the say-on-pay proposal presented at our 2021 Annual Meeting of Shareholders was approved by more than a majority of the shares voting, the Compensation Committee and Nominating and Corporate Governance Committee undertook a substantial shareholder engagement effort in 2021. We describe the compensation-related feedback we received, and the actions we have taken in response to that feedback, below under “Corporate Governance Highlights – 2021 Shareholder Engagement.”

As described in detail in the Executive Compensation section of this proxy statement, our named executive officers have the opportunity to earn significant portions of their compensation based on the achievement of specific annual goals intended to drive financial performance of our business and the realization of increased shareholder value. In 2021, the Compensation Committee continued its historic emphasis on performance-based compensation through the 2021 Bonus Plan. The Compensation Committee believes this emphasis on performance-based compensation has been broadly supported by our shareholders in the past at rates higher than the say-on-pay proposal presented at our 2021 Annual Meeting of Shareholders.

Shareholders are encouraged to read the Executive Compensation section of this proxy statement for more information about fiscal year 2021 compensation of our named executive officers.

We are asking our shareholders to indicate their support for our named executive officer compensation as described in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask our shareholder to vote “FOR” the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of Clearfield, Inc. approve, on an advisory basis, the compensation of the named executive officers as disclosed in Clearfield’s proxy statement for the 2022 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

Vote Required for Proposal 2

Approval of this Proposal 2 requires the affirmative vote of the holders of the majority of the shares present and entitled to vote on this Proposal 2.

While this vote is advisory, and not binding on the Compensation Committee or the Board of Directors, it will provide valuable information to us that the Compensation Committee will be able to consider when determining executive compensation philosophy, policies and practices for the remainder of fiscal year 2022 and beyond. It is expected that the next say-on-pay vote will occur at our 2023 Annual Meeting of Shareholders.

The Board of Directors Recommends

Shareholders Vote FOR

Proposal 2: Advisory Vote on Executive Compensation

_______________________

| 8 |

CORPORATE GOVERNANCE HIGHLIGHTS

Our Corporate Governance Practices

As part of Clearfield’s commitment to corporate governance best practices, the Board has adopted the following practices, which are described in more detail in this proxy statement.

| ☐ | Annual election of directors | ☐ | Shareholder right to call special meetings with a 25% ownership threshold |

| ☐ | Directors not elected by a majority of votes cast are subject to Clearfield’s resignation policy | ☐ | Annual say-on-pay vote |

| ☐ | 7 of 8 director nominees are independent | ☐ | No hedging or pledging of stock by Clearfield directors and executive officers |

| ☐ | All independent Board committees | ☐ | Robust clawback policy |

| ☐ | Recent board recruitment efforts | ☐ | Annual review of charters and governance guidelines, with recent enhancements regarding ESG oversight and board diversity |

| ☐ | 50% of director nominees are women or identify as diverse |

2021 Shareholder Engagement

We are committed to a robust and proactive shareholder engagement program. The Board of Directors values the perspectives of our shareholders, and feedback from shareholders on our business, corporate governance, executive compensation, and our ESG program are important considerations for Board and committee discussions throughout the year.

In calendar year 2021, the Compensation Committee and Nominating and Corporate Governance Committee undertook a substantial shareholder engagement effort. We reached out to the ten largest institutional shareholders, who according to public reporting, control approximately 25% of our total outstanding shares, and close to 80% of the shares voted Against last year’s Say on Pay proposal.

Primary participants in our discussions with shareholders in 2021 were the chair of the Nominating and Corporate Governance Committee who is also a member of the Compensation Committee, our Chief Financial Officer and our outside legal counsel. Directors are generally available to participate in our engagement meetings upon request from shareholders. After our engagement discussions, the chair of the Nominating and Corporate Governance Committee provided the feedback received from our shareholders to all directors. The Board, the Compensation Committee, the Nominating and Corporate Governance Committee and our management found these outreach efforts to be very helpful in understanding our investors’ perspectives on various business and governance matters and intends to maintain ongoing discussions with a large number of investors each year.

Some of the actions we have taken in response to feedback from our shareholders, investors and proxy advisory firms over the last year are described below:

| What We Heard | What We Did | |

| Increase Board diversity | We added Walter L. Jones, Jr. and Carol Wirsbinski to the Board in December 2021. | |

| Increase responsiveness to shareholder vote in director elections | We adopted a “plurality plus” vote standard for uncontested director elections, with a director resignation policy, instead of a simple plurality vote standard in December 2021. | |

| Enhance disclosure about analysis of compensation risks | Included a standalone section in this proxy statement entitled “Consideration of Risk in Compensation” that describes our annual compensation risk analysis. | |

| Add additional compensation risk mitigators | We adopted a robust Compensation Recoupment Policy in September 2021 that applies to not only financial restatements and errors in calculation but also if an executive engages in certain conduct that is detrimental to Clearfield. |

| 9 |

In addition, taking into account feedback we received during our engagement with shareholders, we commit to our shareholders to amend the 2007 Plan to remove the liberal definition of a “Change in Control” when we seek shareholder approval of any other amendment to the 2007 Plan, currently expected to be at the 2023 Annual Meeting of Shareholders.

The Compensation Committee and the Board continue to consider additional compensation governance and corporate governance improvements for 2022 and beyond. We welcome the opportunity to engage with Clearfield shareholders and investors on these topics and others in the future.

CORPORATE GOVERNANCE

Board Independence

The Board of Directors undertook a review of director independence in December 2021 as to all six directors then serving, as well as the two new directors elected to the Board on December 3, 2021. As part of that process, the Board reviewed all transactions and relationships between each director (or any member of his or her immediate family) and Clearfield, our executive officers and our auditors, and other matters bearing on the independence of directors. As a result of this review, the Board of Directors affirmatively determined that each of the directors, with the exception of Ms. Beranek, is independent according to the “independence” definition of the Nasdaq Listing Rules. Ms. Beranek is not independent under the Nasdaq Listing Rules because she is employed by Clearfield and serves as our executive officer.

Committees of the Board of Directors and Committee Independence

The Board of Directors has established a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee. The composition and function of these committees are set forth below.

Compensation Committee. The Compensation Committee reviews and approves the compensation and other terms of employment of our Chief Executive Officer and our other executive officers. Among its other duties, the Compensation Committee oversees all significant aspects of our compensation plans and benefit programs. The Compensation Committee annually reviews and approves corporate goals and objectives for the compensation of the Chief Executive Officer and the other executive officers, as well as the Board of Directors’ evaluation of the Chief Executive Officer pursuant to the evaluation process established by the Nominating and Corporate Governance Committee. In connection with its review of compensation of executive officers or any form of incentive or performance-based compensation, the Committee will also review and discuss risks arising from our compensation policies and practices. The Compensation Committee also administers our 2007 Stock Incentive Plan (the “2007 Plan”).

The charter of the Compensation Committee requires that this Committee consist of no fewer than two Board members who satisfy the requirements of the Nasdaq Stock Market, the “non-employee director” requirements of Section 16b-3 of the Securities Exchange Act of 1934, and the “outside director” requirements of Section 162(m) of the Internal Revenue Code. Each member of our Compensation Committee meets these requirements. A copy of the current charter of the Compensation Committee is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com.

| 10 |

During fiscal year 2021, the members of the Compensation Committee were Ronald G. Roth (Chair), Patrick Goepel, Donald R. Hayward, and Roger Harding. During fiscal year 2021, the Compensation Committee met 3 times, including in executive session without management present.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is charged with the responsibility of identifying, evaluating and approving qualified candidates to serve as directors of the Company, ensuring that our Board and governance policies are appropriately structured, developing and recommending a set of corporate governance guidelines, overseeing Board orientation, training and evaluation, and establishing an evaluation process for the Chief Executive Officer, as well as making recommendations to the Board regarding succession plans for the Chief Executive Officer position. The Nominating and Corporate Governance Committee is also responsible for the leadership structure of our Board, including the composition of the Board and its committees, and an annual review of the position of Chairman of the Board. As part of its annual review, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to serve as Chairman and recommending to the Board of Directors any changes in such position. The Nominating and Corporate Governance Committee also has responsibility for overseeing our annual process of self-evaluation by members of the committees and the Board of Directors as a whole. In November 2021, the charter of the Nominating and Corporate Governance Committee was amended to expand its authority and responsibility for ESG issues, risks, and trends, and oversight of our engagement with, and disclosures to, Clearfield shareholders and other interested parties concerning ESG matters. Additionally, with the election of Mr. Jones and Ms. Wirsbinski to the Board in December 2021, the Nominating and Corporate Governance Committee has initiated an enhanced Board orientation and training program that will carry forward into 2022. This program is designed not only to foster an understanding of the Company’s business and strategy, but also to ensure full integration of new directors and opportunities for relationship building among directors to set the stage for meaningful contributions by all directors regardless of tenure.

The charter of the Nominating and Corporate Governance Committee requires that this Committee consist of no fewer than two Board members who satisfy the “independence” requirements of the Nasdaq Stock Market. Each member of our Nominating and Corporate Governance Committee meets these requirements. A copy of the current charter of the Nominating and Corporate Governance Committee is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com.

On December 3, 2021, upon the recommendation of the Nominating and Corporate Governance Committee, the Board approved revisions to our Governance Guidelines to reflect the Board’s commitment to diversity and enhanced corporate governance best practices. Our current Governance Guidelines are also available in the “Corporate Governance” section of our website, found through the link to the “For Investors” section. The current members of the Nominating and Corporate Governance Committee are Donald R. Hayward (Chair), Roger Harding and Ronald G. Roth. During fiscal year 2021, the Nominating and Corporate Governance Committee met 5 times.

Audit Committee. The Audit Committee assists the Board by reviewing the integrity of our financial reporting processes and controls; the qualifications, independence and performance of the independent auditors; and compliance by us with certain legal and regulatory requirements. The Audit Committee has the sole authority to retain, compensate, oversee and terminate the independent auditors. The Audit Committee reviews our annual audited financial statements, quarterly financial statements and filings with the Securities and Exchange Commission. The Audit Committee reviews reports on various matters, including our critical accounting policies, significant changes in our selection or application of accounting principles and our internal control processes. Under its charter, the Audit Committee exercises oversight of significant risks relating to financial reporting and internal control over financial reporting, including discussing these risks with management and the independent auditor and assessing the steps management has taken to minimize these risks. The Audit Committee also pre-approves all audit and non-audit services performed by the independent auditor.

The Audit Committee operates under a written charter and a copy of the current Audit Committee charter is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. Our Audit Committee presently consists of four directors: Charles N. Hayssen (Chair), Patrick Goepel, Roger Harding and Donald R. Hayward. During fiscal year 2021, the Audit Committee met 4 times, including in executive session without management present.

The Board of Directors has determined that all members of the Audit Committee are “independent” directors under the rules of the Nasdaq Stock Market and the rules of the Securities and Exchange Commission. Our Board of Directors has reviewed the education, experience and other qualifications of each of the members of its Audit Committee. After review, the Board of Directors has determined that Mr. Hayssen, Mr. Goepel and Mr. Harding each meet the Securities and Exchange Commission definition of an “audit committee financial expert.” The members of the Audit Committee also meet the Nasdaq Stock Market requirements regarding the financial sophistication and the financial literacy of members of the audit committee. A report of the Audit Committee is set forth below.

| 11 |

Board Leadership Structure

The Board has a non-executive Chairman of the Board and three standing committees that are each led by a chair. The members of each committee are “independent directors” under the Nasdaq Listing Rules and meet the other similar independence requirements applicable to that committee. Our Chief Executive Officer is a director, but she does not serve as chair of the Board and does not serve on any committee.

We believe that the current Board leadership structure is appropriate for Clearfield at this time because it allows the Board and its committees to fulfill their responsibilities, draws upon the experience and talents of all directors, encourages management accountability to the Board, and helps maintain good communication among Board members and with management. In particular, we believe that having our Chief Executive Officer serve as a member of the Board and having a separate individual serve as Chairman of the Board allows the independent directors and the Chief Executive Officer to contribute their different perspectives and roles to our strategy development. Our current Board leadership structure is part of the policies reflected in our Governance Guidelines and the Nominating and Corporate Governance Committee is empowered through its charter to consider and make changes to the structure if necessary.

Board’s Role in Risk Oversight

We face a number of risks, including financial, technological, operational, regulatory, strategic and competitive risks. Management is responsible for the day-to-day management of risks we face, while the Board has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors ensures that the processes for identification, management and mitigation of risk by our management are adequate and functioning as designed.

Our Board exercises its oversight both through the full Board and through the three standing committees of the Board: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The three standing committees exercise oversight of the risks within their areas of responsibility, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees.

The Board and the three committees receive information used in fulfilling their oversight responsibilities through our executive officers and advisors, including our outside legal counsel and our independent registered public accounting firm. At meetings of the Board, management makes presentations to the Board regarding our business strategy, operations, financial performance, ESG issues, fiscal year budgets, technology, quality, regulatory, and other matters. Many of these presentations include information relating to the challenges and risks to our business and the Board and management engage in discussion on these topics.

Each of the committees also receives reports from management regarding matters relevant to the work of that committee. These management reports are supplemented by information relating to risk from our advisors. Additionally, following committee meetings, the Board receives reports by each committee chair regarding the committee’s considerations and actions. In this way, the Board also receives additional information regarding the risk oversight functions performed by each of these committees.

Our Environmental, Social and Governance Principles

We believe that it is important that environmental, social and governance (“ESG”) issues have Board level oversight. In order to ensure adequate oversight and ultimate accountability by the Board relating to environmental and social issues, the Board amended the charter of the Nominating and Corporate Governance Committee to expand its authority and responsibility for ESG. The Nominating and Corporate Governance Committee will periodically review and assess our significant ESG issues, risks, and trends, and oversee our engagement with and disclosures to shareholders and other interested parties concerning ESG matters. Our Board also receives regular reports from our management, presentations on specific topics, and monitors our ESG-related initiatives and their implementation.

| 12 |

At Clearfield, we believe that how we do business is just as important as how well we do. This is reflected in our company values and our focus on outcome-based thinking in which we:

| · | Listen |

| · | Recognize |

| · | Understand |

| · | Collaborate |

| · | Deliver |

| · | Celebrate |

At Clearfield, we LISTEN to our customers, RECOGNIZE our skills and talents, UNDERSTAND our customer’s needs, and COLLABORATE with each other to DELIVER the best solution. And then we CELEBRATE our success.

We utilize outcome-based thinking to work toward our desired goals, including in key areas of environmental sustainability and social responsibility. In 2022, we intend to continue our efforts to formalize and enhance environmental sustainability and social responsibility programs as well as to increase the transparency and disclosure about these programs.

Below we summarize some of our initiatives and programs in the areas of environmental sustainability and social responsibility.

Environmental Sustainability. We have a number of company-wide programs in place to protect the environment, including a robust recycling program in all of our facilities and processes compliant with European Union’s Directive 2002/95/EC, Restriction of the Use of certain Hazardous Substances in Electrical and Electronic Equipment (RoHS). Clearfield also has numerous certifications, including ISO 9001:2015. These certifications reflect our dedication to a rigorous quality management system that supports the goal of customer satisfaction and organizational efficiency. From Clearfield’s perspective, this necessarily includes efficient use of materials in our manufacturing process to minimize manufacturing waste. We are also committed to reduce our use of electricity and water through efficient technologies.

Social Responsibility. We believe our human capital management strategies are deeply aligned with our company values and allow us to recognize our skills and talents, collaborate with each other, and celebrate our success. These strategies include company-wide programs to reinforce our company values and build our corporate culture, as well as a rigorous training programs for manufacturing and other technical employees to allow them to develop the necessary skillset for their roles and promote career development.

In the face of the unprecedented challenges of COVID-19 that we continued to experience in 2021, we again turned to our values to guide us in developing measures to ensure the safety and health of our workforce and customers. Under U.S. federal and state guidance in response to the COVID-19 pandemic, Clearfield’s operations are classified as part of a CISA critical infrastructure sector and similar categorization in Minnesota.

In response to the onset of the COVID-19 pandemic in the United States, we transitioned our corporate employees at our Brooklyn Park headquarters to remote work arrangements in March 2020 and they currently continue remote work. In accordance with the CDC and WHO guidelines, we implemented and have continued health and safety measures for the production staff that remain onsite at our Brooklyn Park facility. We have maintained our manufacturing capacity in Brooklyn Park with these personnel at near historic levels. Similarly, we have implemented the recommended health and safety measures for the production staff that remains onsite at our Tijuana, Mexico manufacturing facilities. These measures include, among other things, workplace health, hygiene, sanitization, social distancing guidance and alterations to our manufacturing operations in order to accommodate our COVID-19 safety plan.

| 13 |

Throughout the COVID-19 pandemic, we are closely monitoring the operations and staffing levels at our Brooklyn Park facility and our two manufacturing facilities in Tijuana, Mexico. To date, we have not experienced any significant COVID-19 exposure incidents at our manufacturing facilities.

We believe that implementing these measures to protect our employees and their families, which also allowed our production facilities to remain operational, contributed to our overall performance in 2021 and positioned us for future growth.

Director Nominations

The Nominating and Corporate Governance Committee will consider candidates for Board membership suggested by its members, other Board members, as well as management and shareholders. Shareholders who wish to recommend a prospective nominee should follow the procedures set forth in Section 2.14 of our bylaws as described in the section of this proxy statement entitled “Shareholder Proposals for Nominees.” The Nominating and Corporate Governance Committee has not adopted a formal policy for increasing or decreasing the size of the Board of Directors. Our Governance Guidelines provides that the Board should generally have between six and nine directors. The Board of Directors is currently comprised of eight directors. The Nominating and Corporate Governance Committee believes that an eight person Board of Directors is appropriate. At eight directors, the Board of Directors has a diversity of talent and experience to draw upon, is able to appropriately staff the committees of the Board and is able to engage the directors in Board and committee service, all while maintaining efficient function and communication among members. If appropriate, the Board may determine to increase or decrease its size, including in order to accommodate the availability of an outstanding candidate.

Criteria for Nomination to the Board; Diversity Considerations. The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending qualified candidates for nomination as directors. The Nominating and Corporate Governance Committee has not adopted minimum qualifications that nominees must meet in order for the Nominating and Corporate Governance Committee to recommend them to the Board of Directors, as the Nominating and Corporate Governance Committee believes that each nominee should be evaluated based on his, her or their merits as an individual, taking into account the needs of Clearfield and the Board of Directors. The Nominating and Corporate Governance Committee has determined that it will evaluate each prospective nominee against the following standards and qualifications:

| · | Diversity in terms of gender, race, ethnicity, sexual orientation and other characteristics that we believe contribute to high quality decision-making, problem-solving and efficiency among the Board; |

| · | Knowledge, experience, skills and expertise relevant to our business and the work of the Board of Directors and its committees, as well as diversity of these characteristics among the Board; |

| · | Background, including demonstrated high personal and professional ethics and integrity; |

| · | The ability to exercise good business judgment and enhance the Board’s ability to manage and direct the affairs and business of Clearfield; |

| · | Commitment, including the willingness to devote adequate time to the work of the Board and its committees; |

| · | The ability to represent the interests of all shareholders and not a particular interest group; |

| · | The skills needed by the Board, within the context of the existing composition of the Board, including knowledge of our industry and business or experience in business, finance, law, education, research or government; and |

| · | The candidate’s qualification as “independent” under Nasdaq or other standards and qualification to serve on Board committees. |

| · | When evaluating candidates for nomination as new directors, the Nominating and Corporate Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups. |

| · | The Nominating and Corporate Governance Committee also considers other relevant factors as it deems appropriate. |

In reviewing prospective nominees, the Nominating and Corporate Governance Committee reviews the number of public company boards on which a director nominee serves to determine if the nominee will have the ability to devote adequate time to the work of our Board and its committees. Our Governance Guidelines provide that non-employee directors should serve on no more than four boards of other publicly-held companies, subject to Board waiver with respect to this guideline on a case-by-case basis.

| 14 |

In December 2021, the Board adopted a formal policy with respect to diversity through our Governance Guidelines. Under that policy, when evaluating candidates for nomination as new directors, the Nominating and Corporate Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups. As part of the director recruitment process that culminated in the election of Mr. Jones and Ms. Wirsbinski on December 3, 2021, the Nominating and Corporate Governance Committee considered a set of candidates consisting exclusively of women and individuals from historically underrepresented groups.

As part of the nominee selection process for this Annual Meeting, the Nominating and Corporate Governance Committee reviewed the knowledge, experience, skills, expertise, and other characteristics of each director nominee. Based upon that review, the Nominating and Corporate Governance Committee believes that each director contributes to the Board’s diversity in terms of knowledge, experience, skills, expertise, and other demographics that particular director brings to the Board.

The Nominating and Corporate Governance Committee also considers such other relevant factors as it deems appropriate. The Nominating and Corporate Governance Committee will consider persons recommended by the shareholders using the same standards used for other nominees.

Clearfield Board Diversity. Recently adopted Nasdaq listing requirements require each listed company to have, or explain why it does not have, two diverse directors on the board, including at least one diverse director who self-identifies as female and one diverse director who self-identifies as an underrepresented minority or LGBTQ+ (subject to the exceptions). Our current Board composition is in compliance with the Nasdaq diversity requirement.

The table below provides certain highlights of the composition of our board members, each of whom are nominees for election at the Annual Meeting. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| Board Diversity Matrix (As of December 3, 2021) | ||||

| Total Number of Directors | 8 | |||

| Female | Male | Non- Binary |

Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 2 | 6 | 0 | 0 |

| Part II: Demographic Background | ||||

| African American or Black | 0 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 5 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 1 | |||

| Did Not Disclose Demographic Background | 0 | |||

Process for Identifying and Evaluating Nominees. The process for identifying and evaluating nominees to the Board of Directors is initiated by identifying a slate of candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board and, if the Nominating and Corporate Governance Committee deems appropriate, a third-party search firm. Under our Governance Guidelines, when evaluating candidates for nomination as new directors, the Nominating and Corporate Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups. The Nominating and Corporate Governance Committee evaluates these candidates by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. One or more Nominating and Corporate Governance Committee members and other directors may interview the prospective nominees in person, by video or by telephone. After completing the evaluation, the Nominating and Corporate Governance Committee makes a recommendation to the full Board of the nominees to be presented for the approval of the shareholders or for election to fill a vacancy.

| 15 |

Board Nominees for the 2022 Annual Meeting. The nominees for the Annual Meeting were selected by the Nominating and Corporate Governance Committee in December 2021. Other than Mr. Jones and Ms. Wirsbinski, the nominees were elected by shareholders at the 2021 Annual Meeting of Shareholders. Mr. Jones and Ms. Wirsbinski were elected as directors on December 3, 2021 by the Board upon the recommendation of the Nominating and Corporate Governance Committee. Following the 2021 Annual Meeting of Shareholders, the Nominating and Corporate Governance Committee undertook a director recruitment process after considering the needs of the Board and the Company, with a special focus on enhancing the diversity of the Board and the depth of telecommunications industry expertise represented on the Board. With this direction from the Nominating and Corporate Governance Committee, each of Mr. Jones and Ms. Wirsbinski were identified as director candidates by our Chief Executive Officer from her professional networks. We have not engaged a third-party search firm to assist us in identifying potential director candidates, but the Nominating and Corporate Governance Committee may choose to do so in the future. Under our Governance Guidelines, the Nominating and Corporate Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups.

Shareholder Proposals for Nominees. The Nominating and Corporate Governance Committee will consider written proposals from shareholders for nominees for director. Any such nominations should be submitted to the Nominating and Corporate Governance Committee c/o the Secretary of Clearfield, Inc. To be considered, the written notice must be timely received and in proper form as described in our bylaws and in the section of this proxy statement entitled “Shareholder Proposals and Shareholder Nominees for 2023 Annual Meeting.”

Board Attendance at Board, Committee and Annual Shareholder Meetings

During fiscal year 2021, the Board of Directors met 5 times. Each nominee for director attended at least 75% of the meetings of the Board and committees on which he or she served during fiscal year 2021. The Board of Directors regularly meets in executive session without the presence of members of management, including the Chief Executive Officer. We do not have a formal policy on attendance at meetings of our shareholders. However, we encourage all Board members to attend all meetings, including the annual meeting of shareholders. All of the directors then serving attended the 2021 Annual Meeting of Shareholders.

Communications with Directors

Shareholders may communicate with the Board of Directors as a group, the chair of any committee of the Board of Directors, or any individual director by sending an e-mail to board@seeclearfield.com or by directing the communication in care of the Secretary of Clearfield, to the address set forth on the front page of this proxy statement. Shareholders making a communication in this manner will receive a confirmation of receipt of the communication if the Secretary is provided with an address for that purpose and the shareholder does not otherwise request that no confirmation be sent.

All communications that are not excluded for the reasons stated below will be forwarded unaltered to the director(s) to which the communication is addressed or to the other appropriate director(s). Communications received from shareholders will be forwarded as part of the materials sent before the next regularly scheduled Board or committee meeting, although the Board has authorized the Secretary, in his or her discretion, to forward communications on a more expedited basis if circumstances warrant.

The Board of Directors has authorized the Secretary to exclude a communication on matters that are unrelated to the duties and responsibilities of the Board, such as:

| · | Product inquiries, complaints or suggestions |

| · | New product suggestions |

| · | Resumes and other forms of job inquiries |

| · | Surveys |

| · | Business solicitations or advertisements |

In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded. Any excluded communication will be made available to the Board of Directors upon request of any director.

| 16 |

If shareholders have a communication that is a nomination of a director or is a proposal for shareholder action, the communication must be directed to the Secretary and must conform to the requirements of Clearfield’s bylaws. For more information, please review our bylaws and the sections of this proxy statement entitled “Director Nominations – Shareholder Proposals for Nominees” and “Shareholder Proposals and Shareholder Nominees for 2023 Annual Meeting.”

Code of Ethics

We have adopted a code of ethics that applies to all directors, officers and employees, including our principal executive officer, principal financial officer and controller. This code of ethics is included in our Code of Business Conduct and Ethics Policy which is publicly available under the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. To the extent permitted, we intend to disclose any amendments to, or waivers from, the code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions or with respect to the required elements of the code of ethics on our website under the “Corporate Governance” section.

Policies Prohibiting Employee, Officer and Director Hedging and Pledging

Clearfield’s insider trading policy prohibits our directors, executive officers, and designated employees from purchasing our securities on margin, borrowing against any account in which our securities are held, or otherwise pledging our securities as collateral for a loan. These insiders also may not enter into hedging or monetization transactions, such as zero-cost collars, forward sale contracts, or any arrangement that is designed to hedge or offset any decrease in the market value of our stock.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following report of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the 1934 Securities Exchange Act, as amended, except to the extent that we specifically incorporate it by reference in such filing.

In accordance with its charter, the Audit Committee reviewed and discussed the audited financial statements with management and Baker Tilly US, LLP, our independent registered public accounting firm. The discussions with Baker Tilly US, LLP also included the matters required by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

Baker Tilly US, LLP provided to the Audit Committee the written disclosures and the letter regarding its independence as required by the Public Company Accounting Oversight Board. This information was discussed with Baker Tilly US, LLP.

Based on the review and discussions referred to above, the Audit Committee recommended to our Board that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2021.

BY: THE AUDIT COMMITTEE

Charles N. Hayssen (Chair)

Patrick Goepel

Roger Harding

Donald R. Hayward

| 17 |

EXECUTIVE OFFICERS

Set forth below is biographical and other information for our current executive officers. Information about Ms. Cheryl Beranek, our President and Chief Executive Officer, may be found in this proxy statement under the heading “Election of Directors.”

John P. Hill, 56, was appointed as our Chief Operating Officer effective October 30, 2008. Prior to being appointed in this position, Mr. Hill had been our Vice President of Engineering and Product Management since 2007. He also served as our Vice President of Product Management and Development from 2004 to 2007 and was our first Vice President of Sales from 2003 to 2004. Mr. Hill attended Macalester College and the University of Minnesota.

Daniel R. Herzog, 57, has been Chief Financial Officer since August 25, 2011 and served as Interim Chief Financial Officer from February 19, 2011 until his appointment in August 2011. He served as Clearfield’s Vice President of Administration from June 2009, until his appointment as Interim Chief Financial Officer, which also includes the duties of Vice President of Administration. Mr. Herzog previously served as our Comptroller and principal accounting officer from September 2003 through February 2006. Mr. Herzog held positions of Controller and Chief Financial Officer in his 13 years at Americable, which was acquired by Clearfield in 2003. Mr. Herzog received his Bachelors of Arts degree in Accounting in 1986 from Gustavus Adolphus College in St. Peter, Minnesota.

EXECUTIVE COMPENSATION

Explanation of Compensation

The following is an explanation of compensation during fiscal year 2021 to the persons who are referred to in this proxy statement as our “named executive officers”:

| · | Cheryl Beranek, our President and Chief Executive Officer |

| · | Daniel R. Herzog, our Chief Financial Officer |

| · | John P. Hill, our Chief Operating Officer |

This section is intended to provide a framework within which to understand the actual compensation awarded to, earned or held by each named executive officer during fiscal year 2021 as reported in the accompanying compensation tables.

Our Compensation Philosophy

Our philosophy with respect to the compensation of executive officers is based upon the following principles:

| · | Base salaries should be set at levels that recognize the significant potential compensation opportunities available through performance-based compensation; and |

| · | Performance-based compensation should constitute a significant portion of the executive’s overall compensation and be available to the executive when they individually deliver, and we as a company deliver, high performance. |

The Compensation Committee reviews our compensation philosophy and our compensation programs regularly (no less than annually). The Compensation Committee’s review is two-fold: first, to ensure our philosophy and programs meet our objectives of providing compensation that attracts and retains superior executive talent and encourages our executive officers to achieve our business goals and second, to identify changes and trends in executive compensation policies and practices.

Overview of Compensation Process – Use of Compensation Consultant and Role of Management

The responsibility of the Compensation Committee is to review and approve the compensation and other terms of employment of our Chief Executive Officer and our other executive officers. The Compensation Committee has also been appointed by the Board of Directors to administer our equity compensation plans, which for fiscal year 2021 consisted of the 2007 Plan.