Exhibit 99.1

January 27, 2022 Fiscal Q1 2022 Earnings Call FieldReport Good afternoon. Welcome to Clearfield’s fiscal first quarter 2022 earnings conference c a l l . I w ill b e y o u r o p e r a t o r t h i s a f t e r n o o n . Joining us for today’s presentation are the Company's President and CEO, Cheri Beranek and CFO, Dan Herzog. Following their commentary, we will open the call for questions. I would now like to remind everyone that this call will be recorded and made available for replay via a link in the investor relations section of the Company's website. This call is also being webcasted and accompanied by a PowerPoint presentation called the FieldReport, which is also available in the investor relations section of the Company's website. 1

Important Cautions Regarding Forward - Looking Statements N A S DAQ:CLFD 2 Forward - looking statements contained herein and in any related presentation or in the related Earnings Release are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, anticipated shipping on backlog and future lead times, future availability of components and materials from the Company’s supply chain, the impact of the Rural Digital Opportunity Fund (RDOF) or other government programs on the demand for the Company’s products or timing of customer orders, the Company’s ability to add capacity to meet expected future demand, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: the COVID - 19 pandemic has significantly impacted worldwide economic conditions and could have a material adverse effect on our business, financial condition and operating results; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders; fluctuations in product and labor costs which may not be able to be passed on to customers that could decrease margins; we depend on the availability of sufficient supply of certain materials, such as fiber optic cable and resins for plastics, and global disruptions in the supply chain for these materials could prevent us from meeting customer demand for our products; we rely on our manufacturing operations to produce product to ship to customers and manufacturing constraints and disruptions could result in decreased future revenue; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent on key personnel; cyber - security incidents on our information technology systems, including ransomware, data breaches or computer viruses, could disrupt our business operations, damage our reputation, and potentially lead to litigation; our business is dependent on interdependent management information systems; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; changes in government funding programs may cause our customers and prospective customers to delay, reduce, or accelerate purchases, leading to unpredictable and irregular purchase cycles; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; our success depends upon adequate protection of our patent and intellectual property rights; if the telecommunications market does not expand as we expect, our business may not grow as fast as we expect; we face risks associated with expanding our sales outside of the United States; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2021 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2022 Clearfield, Inc. All Rights Reserved. Please note that during this call, management will be making forward - looking statements regarding future events and the future financial performance of the Company. These forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in the forward - looking statements. It’s important to note also that the Company undertakes no obligation to update such statements except as required by law. The Company cautions you to consider risk factors that could cause actual results to differ materially from those in the forward - looking statements contained in today’s press release, FieldReport, and in this conference call. The risk factors section in Clearfield’s most recent Form 10 - K filing with the Securities and Exchange Commission and its subsequent filings on Form 10 - Q provides descriptions of those risks. As a reminder, the slides in this presentation are controlled by you, the listener. Please advance forward through the presentation as the s p e a k e r s p r e s e n t t h e i r r e m a r k s . With that, I would like to turn the call over to Clearfield’s CEO, Cheri Beranek. Please proceed. 2

N A S DAQ:CLFD 3 I nt ro d u c t i o n & Highlights Good afternoon and thank you everyone for joining us today. We hope you are all continuing to stay safe and healthy considering the recent surge of COVID. It’s a pleasure to speak with you this afternoon to share Clearfield’s results for the fiscal first quarter of 2022 and to provide an update on the business and market trends. Clearfield delivered another record - setting financial performance in the fiscal first quarter of 2022, in a market that continues to evolve and grow with each passing quarter. As we have mentioned on prior calls, we are in the middle of a truly remarkable investment cycle for broadband deployment. Since our founding, Clearfield has worked diligently to build an advantageous position in the community broadband market, with a reputation for superior customer service and a craft - friendly product. As our record financial results demonstrate, we are well - positioned to continue benefitting from the growing demand for fiber to the home and fiber to the business, due to our steadfast commitment to best - in - class customer service, high - quality products, and our ability to swiftly adapt to the needs of our customers. Our product offerings, which are designed to reduce the time and skill required for the delivery of optical cable, are now being recognized by a growing group of customers, as a means by which to accelerate moving existing subscribers off copper and adding subscribers due to the bandwidth and low latency that fiber - fed broadband enables. The continued robust demand for fiber - fed broadband helped us to achieve a quarterly record $51 million in net sales for the fiscal first quarter of 2022. Community Broadband, our largest customer market, grew 81% over the prior year quarter. It is worth noting that Community Broadband now represents an increasing gamut of markets – this includes municipalities, utilities, and even suburbs and urban neighborhoods that have traditionally been overlooked as they do not have the density or ROI metrics. We also reported a record order backlog at the end of the first quarter. Bookings led shipments by $35 million for the 3 - month period, creating a record backlog of $101 million as of December 31, 2021. We continue to maintain a strong financial position, with $58 million in cash and investments without debt on our balance sheet. This healthy cash position enables us to fund the inventory growth necessary to respond to customer demand and to build up a cushion of safety stock that ensures that we can meet our customers’ promised ship dates. We are also investing in growing our capacity, as we have two new facilities coming online in the coming months. 3

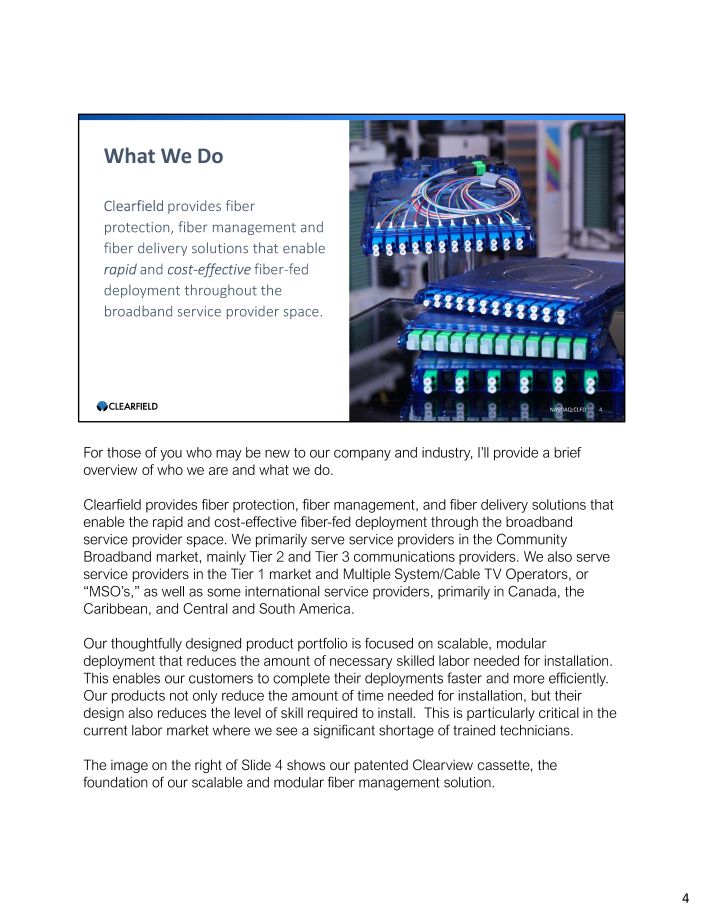

What We Do Clearfield provides fiber protection, fiber management and fiber delivery solutions that enable rapid and cost - effective fiber - fed deployment throughout the broadband service provider space. NASDAQ:CLFD 4 For those of you who may be new to our company and industry, I’ll provide a brief o v e r v i e w o f w h o w e a r e a n d w h a t w e d o . Clearfield provides fiber protection, fiber management, and fiber delivery solutions that enable the rapid and cost - effective fiber - fed deployment through the broadband service provider space. We primarily serve service providers in the Community Broadband market, mainly Tier 2 and Tier 3 communications providers. We also serve service providers in the Tier 1 market and Multiple System/Cable TV Operators, or “MSO’s,” as well as some international service providers, primarily in Canada, the Caribbean, and Central and South America. Our thoughtfully designed product portfolio is focused on scalable, modular deployment that reduces the amount of necessary skilled labor needed for installation. This enables our customers to complete their deployments faster and more efficiently. Our products not only reduce the amount of time needed for installation, but their design also reduces the level of skill required to install. This is particularly critical in the current labor market where we see a significant shortage of trained technicians. The image on the right of Slide 4 shows our patented Clearview cassette, the foundation of our scalable and modular fiber management solution. 4

OUR MISSION: Enabling the Lifestyle Better Broadband Provides NASDAQ:CLFD 5 As you can see on slide 5, our mission at Clearfield is to Enable the Lifestyle Better Broadband Provides . As we have seen for the last several years, high - speed broadband has become necessary for people to be able to work, attend school, and fully participate in today’s modern society. Broadband is changing the way we communicate with each other, and fiber is the means to enable that change. Clearfield’s founding vision was to provide the necessary products to build a better broadband network. This vision is not something we implemented last year but rather it’s who we are as an organization. We have built a product line, sales organization and operational infrastructure to s e r v i c e t h e g r o w t h i n f i b e r d e p l o y m e n t f o r e v e r y c o m m uni t y . With that, I’ll now turn the presentation over to Dan, who will walk us through our financial p e r f o r m a n c e f o r t h e f i r s t q u a r t e r o f 20 2 2 . 5

N A S DAQ:CLFD 6 Financial P e r f o rma n c e Thank you, Cheri, and good afternoon, everyone. It’s a pleasure to be speaking with you today about our first quarter of our fiscal year 22 results. So, looking at our first quarter financial results in more detail… 6

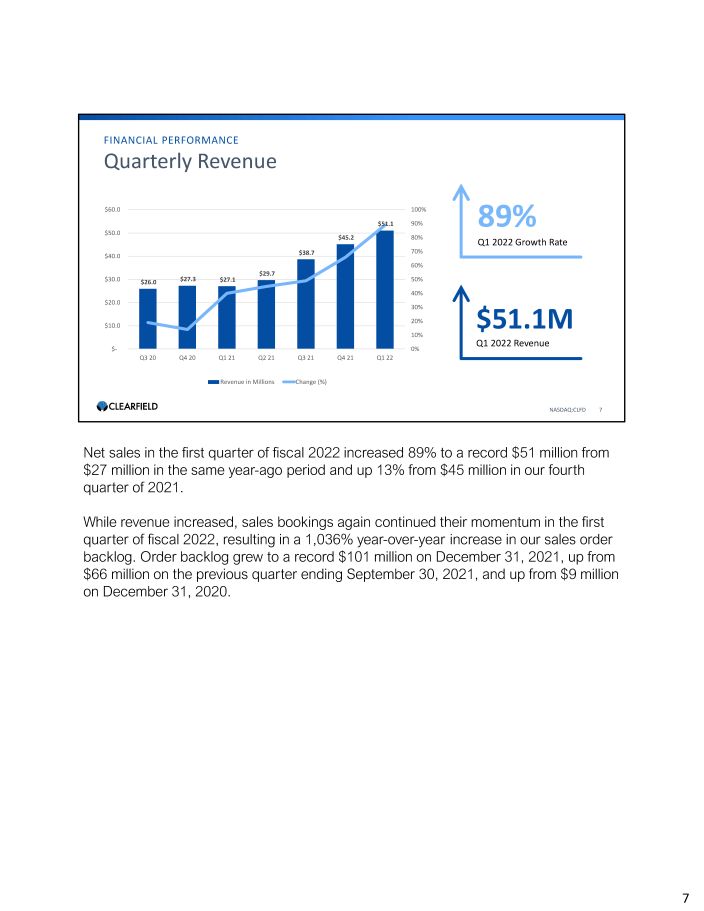

$26.0 $27.3 $27.1 $29.7 $38.7 0% 10% 30% 20% 50% 40% 60% 70% $ - $ 1 0.0 $ 2 0.0 $ 3 0.0 $ 4 0.0 $ 6 0.0 100% $51.1 90% $50.0 $45.2 80% Q 3 20 Q 4 20 Q1 21 Q 2 21 Q 3 21 Q 4 21 Q1 22 Revenue in Millions Change (%) FINANCIAL PERFORMANCE Quarterly Revenue 89% Q1 2022 Growth Rate $ 5 1.1 M Q1 2022 Revenue N A S DAQ:CLFD 7 Net sales in the first quarter of fiscal 2022 increased 89% to a record $51 million from $27 million in the same year - ago period and up 13% from $45 million in our fourth quarter of 2021. While revenue increased, sales bookings again continued their momentum in the first quarter of fiscal 2022, resulting in a 1,036% year - over - year increase in our sales order backlog. Order backlog grew to a record $101 million on December 31, 2021, up from $66 million on the previous quarter ending September 30, 2021, and up from $9 million on December 31, 2020. 7

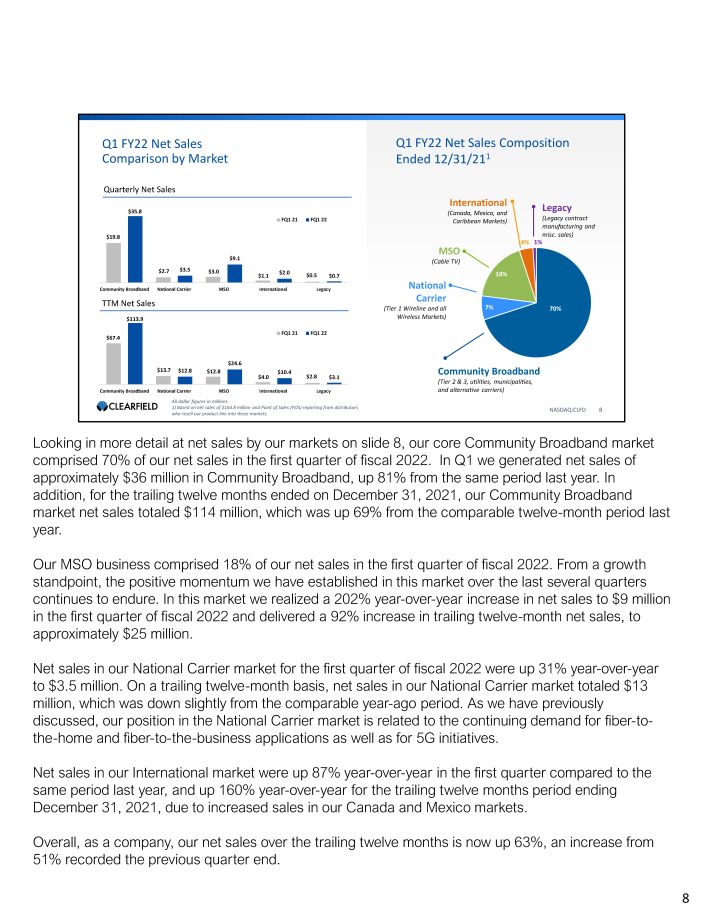

$1 9 . 8 $2 . 7 $3 . 0 $3 . 5 $2 . 0 $1 . 1 $0 . 5 $0 . 7 Co mm unity B r o a db a n d N a tion a l C a r ri e r M S O In t e r n a t i on a l L e g a c y FQ1 21 FQ1 22 Q1 FY22 Net Sales Comparison by Market Q1 FY22 Net Sales Composition Ended 12/31/21 1 70% 7% 18% Legacy (Legacy contract manufacturing and misc. sales) 4% 1% $6 7 . 4 $12 . 8 $4 . 0 $1 3 . 7 $1 2 . 8 $24 . 6 $10 . 4 $2.8 $3.1 Community Broadband National Carrier MSO International Legacy All dollar figures in millions 1) Based on net sales of $164.8 million and Point of Sales (POS) reporting from distributors who resell our product line into these markets. FQ1 21 FQ1 22 TTM Net Sales $1 1 3 . 9 Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) N a ti o n al C a rri e r (Tier 1 Wireline and all W i re l ess M ar k e t s) MSO $9 . 1 (C ab l e TV) International (Canada, Mexico, and Caribbean Markets) N A S DAQ:CLFD 8 Quarterly Net Sales $35.8 Looking in more detail at net sales by our markets on slide 8, our core Community Broadband market comprised 70% of our net sales in the first quarter of fiscal 2022. In Q1 we generated net sales of approximately $36 million in Community Broadband, up 81% from the same period last year. In addition, for the trailing twelve months ended on December 31, 2021, our Community Broadband market net sales totaled $114 million, which was up 69% from the comparable twelve - month period last year. Our MSO business comprised 18% of our net sales in the first quarter of fiscal 2022. From a growth standpoint, the positive momentum we have established in this market over the last several quarters continues to endure. In this market we realized a 202% year - over - year increase in net sales to $9 million in the first quarter of fiscal 2022 and delivered a 92% increase in trailing twelve - month net sales, to approximately $25 million. Net sales in our National Carrier market for the first quarter of fiscal 2022 were up 31% year - over - year to $3.5 million. On a trailing twelve - month basis, net sales in our National Carrier market totaled $13 million, which was down slightly from the comparable year - ago period. As we have previously discussed, our position in the National Carrier market is related to the continuing demand for fiber - to - the - home and fiber - to - the - business applications as well as for 5G initiatives. Net sales in our International market were up 87% year - over - year in the first quarter compared to the same period last year, and up 160% year - over - year for the trailing twelve months period ending December 31, 2021, due to increased sales in our Canada and Mexico markets. Overall, as a company, our net sales over the trailing twelve months is now up 63%, an increase from 51% recorded the previous quarter end. 8

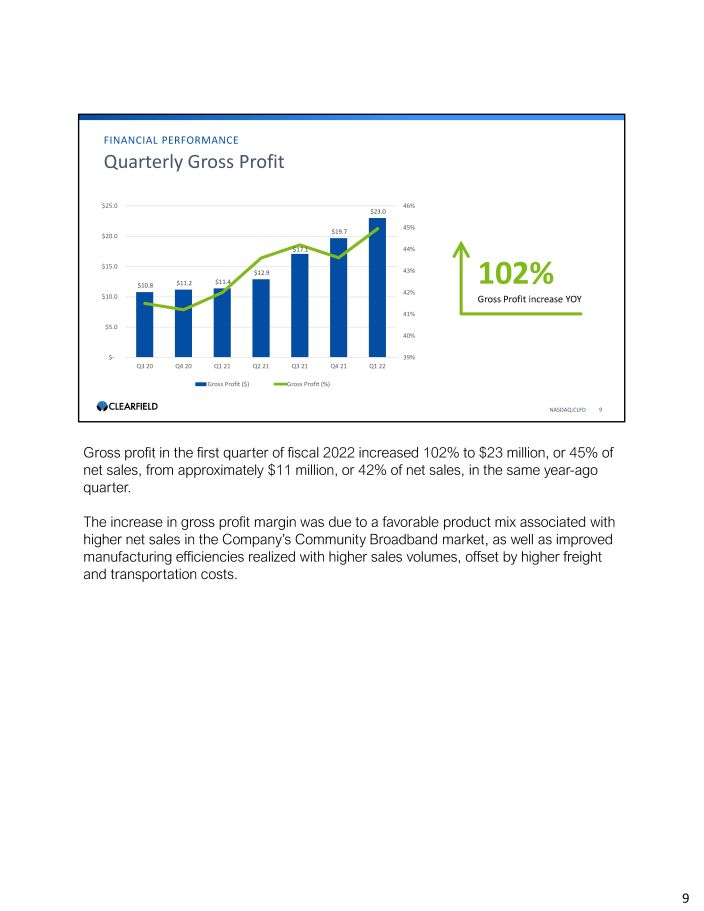

$10 . 8 $11 . 2 $11 . 4 $12 . 9 $17 . 1 $19 . 7 $23 . 0 39% 40% 41% 42% 43% 44% 45% 46% $ - $ 5 .0 $ 1 0.0 $ 1 5.0 $ 2 0.0 $ 2 5.0 Q 3 20 Q4 20 Q 1 21 Q2 21 Q 3 21 Q4 21 Q 1 22 Gross Profit ($) Gross Profit (%) FINANCIAL PERFORMANCE Quarterly Gross Profit 102% Gross Profit increase YOY N A S DAQ:CLFD 9 Gross profit in the first quarter of fiscal 2022 increased 102% to $23 million, or 45% of net sales, from approximately $11 million, or 42% of net sales, in the same year - ago quarter. The increase in gross profit margin was due to a favorable product mix associated with higher net sales in the Company’s Community Broadband market, as well as improved manufacturing efficiencies realized with higher sales volumes, offset by higher freight and transportation costs. 9

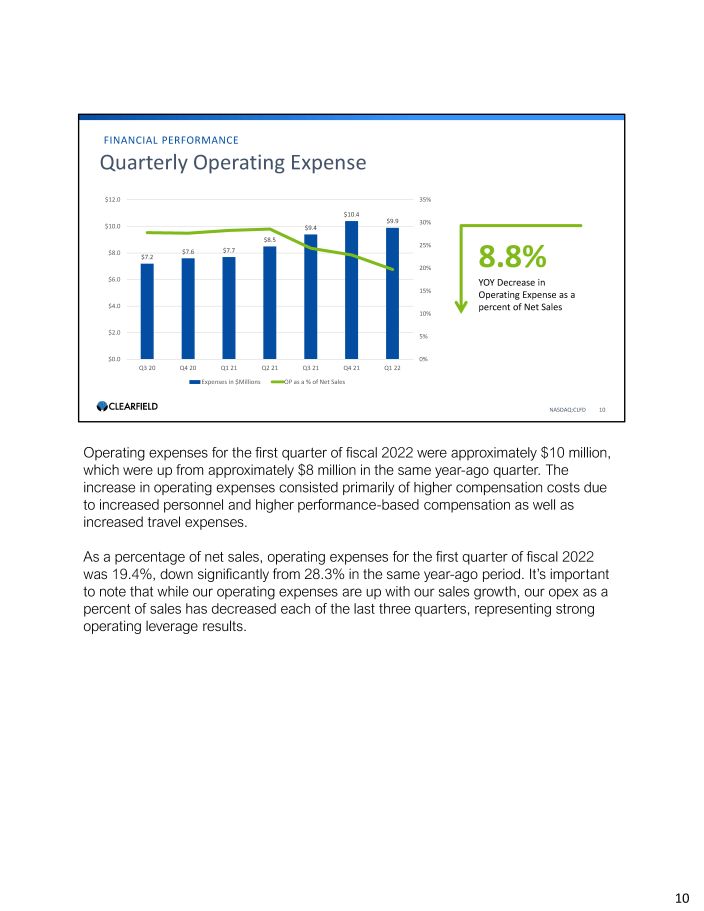

$7 . 2 $7 . 6 $7 . 7 $8 . 5 $9 . 4 $10 . 4 $9 . 9 0% 5% 10% 15% 20% 25% 30% 35% $0 . 0 $2 . 0 $4 . 0 $6 . 0 $8 . 0 $10 . 0 Q 3 20 Q 4 20 Q1 21 Q2 21 Q3 21 Q 4 21 Q 1 22 Expenses in $Millions OP as a % of Net Sales 8.8% YOY Decrease in Operating Expense as a percent of Net Sales FINANCIAL PERFORMANCE Quarterly Operating Expense $12.0 N A S DAQ:CLFD 10 Operating expenses for the first quarter of fiscal 2022 were approximately $10 million, which were up from approximately $8 million in the same year - ago quarter. The increase in operating expenses consisted primarily of higher compensation costs due to increased personnel and higher performance - based compensation as well as increased travel expenses. As a percentage of net sales, operating expenses for the first quarter of fiscal 2022 was 19.4%, down significantly from 28.3% in the same year - ago period. It’s important to note that while our operating expenses are up with our sales growth, our opex as a percent of sales has decreased each of the last three quarters, representing strong operating leverage results. 10

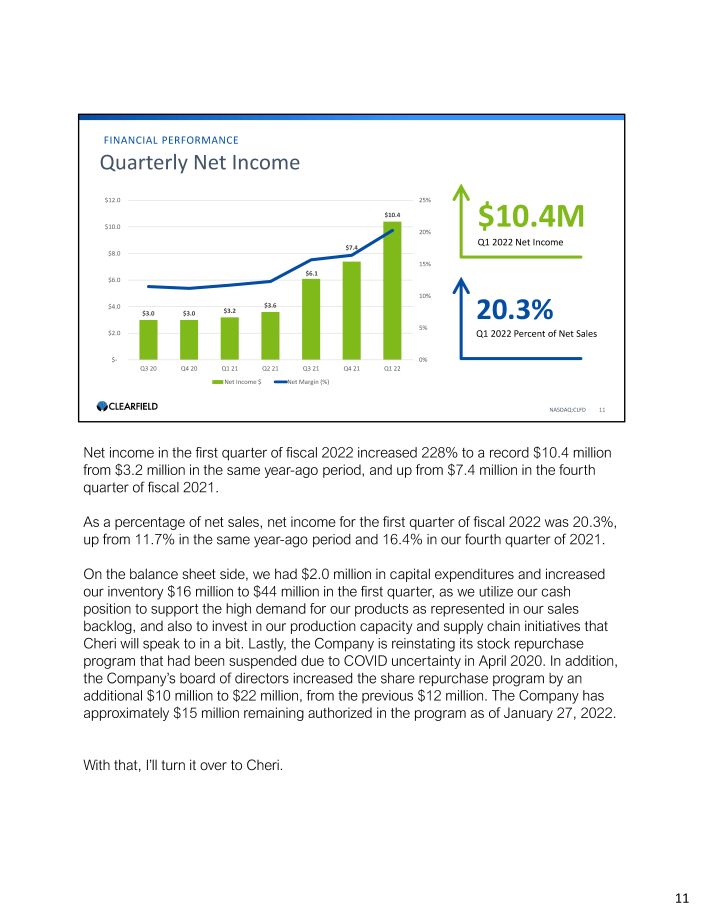

$3.0 $3.0 $3.2 $3.6 $6.1 $7.4 $10.4 0% 5% 10% 15% 20% 25% $ - $ 2 .0 $ 4 .0 $ 6 .0 $ 8 .0 $ 1 0.0 Q 3 20 Q 4 20 Q 1 21 Q 2 21 Q 3 21 Q4 21 Q1 22 Net Income $ Net Margin (%) $ 1 0. 4 M Q1 2022 Net Income 20.3% Q1 2022 Percent of Net Sales FINANCIAL PERFORMANCE Quarterly Net Income $12.0 N A S DAQ:CLFD 11 Net income in the first quarter of fiscal 2022 increased 228% to a record $10.4 million from $3.2 million in the same year - ago period, and up from $7.4 million in the fourth quarter of fiscal 2021. As a percentage of net sales, net income for the first quarter of fiscal 2022 was 20.3%, up from 11.7% in the same year - ago period and 16.4% in our fourth quarter of 2021. On the balance sheet side, we had $2.0 million in capital expenditures and increased our inventory $16 million to $44 million in the first quarter, as we utilize our cash position to support the high demand for our products as represented in our sales backlog, and also to invest in our production capacity and supply chain initiatives that Cheri will speak to in a bit. Lastly, the Company is reinstating its stock repurchase program that had been suspended due to COVID uncertainty in April 2020. In addition, the Company’s board of directors increased the share repurchase program by an a d d i t i o n a l $ 10 m illi o n t o $2 2 m illi on , f r o m t h e p r e v i o u s $1 2 m illi on . T h e C o m p a ny h a s approximately $15 million remaining authorized in the program as of January 27, 2022. W i t h t h a t , I ’ ll t u r n i t o v e r t o C h e r i . 11

N A S DAQ:CLFD 1 2 Business Update & Outlook T h a n k s f o r t h e f i n a n c i a l u pd a t e , D a n . 12

Our Value Proposition – Removing Obstacles 1. Craft - friendly – requires less skilled labor and overall labor time 2. Designed to reduce permitting and right - of - way 3. Faster turn - up time for quicker revenue per subscriber NASDAQ:CLFD 13 The Clearfield value proposition is driven by our thoughtfully designed fiber management and fiber connectivity products. Since its founding, Clearfield was built to scale. As we mentioned earlier, Clearfield has been positioned from the beginning to provide fiber products to communities that have historically been underserved or unserved. We have made it our goal to remove the obstacles that would prevent our customers from adopting fiber - led broadband. 13

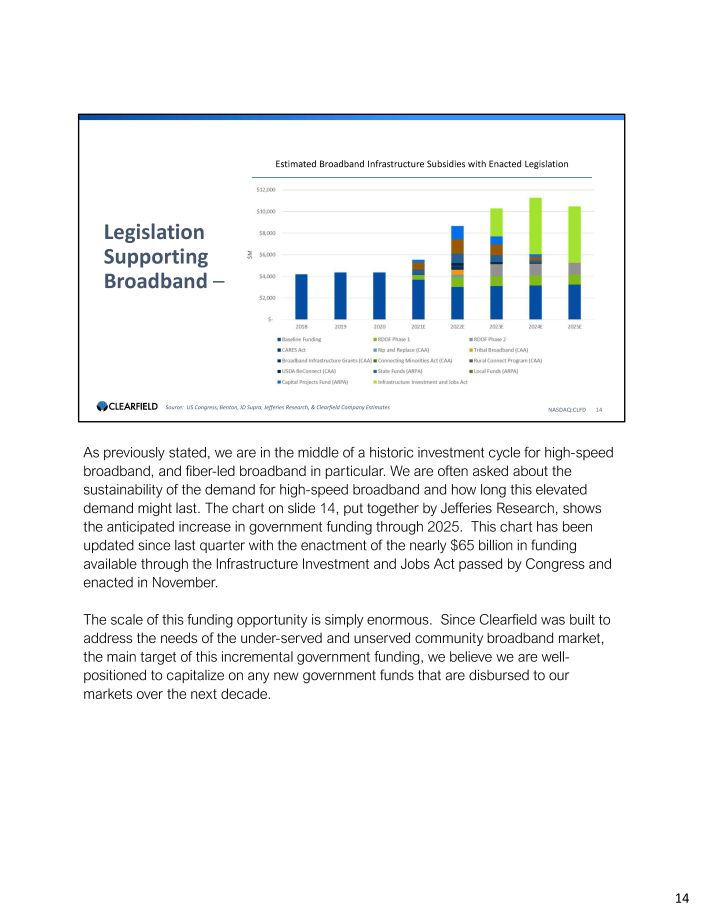

Legislation Supporting Broadband – NA S DA Q : C LF D 14 Source: US Congress, Benton, JD Supra, Jefferies Research, & Clearfield Company Estimates Estimated Broadband Infrastructure Subsidies with Enacted Legislation As previously stated, we are in the middle of a historic investment cycle for high - speed broadband, and fiber - led broadband in particular. We are often asked about the sustainability of the demand for high - speed broadband and how long this elevated demand might last. The chart on slide 14, put together by Jefferies Research, shows the anticipated increase in government funding through 2025. This chart has been updated since last quarter with the enactment of the nearly $65 billion in funding available through the Infrastructure Investment and Jobs Act passed by Congress and enacted in November. The scale of this funding opportunity is simply enormous. Since Clearfield was built to address the needs of the under - served and unserved community broadband market, the main target of this incremental government funding, we believe we are well - positioned to capitalize on any new government funds that are disbursed to our m a r k e t s o v e r t h e n e x t d e c a d e . 14

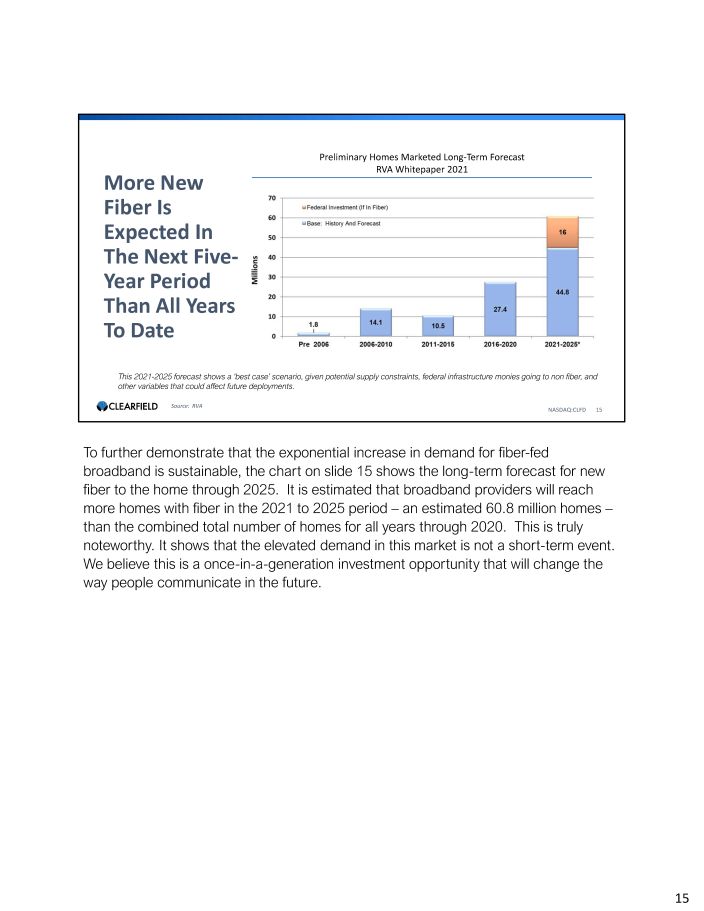

More New Fiber Is Expected In The Next Five - Year Period Than All Years To Date NA S DA Q : C LF D 15 Preliminary Homes Marketed Long - Term Forecast RVA Whitepaper 2021 This 2021 - 2025 forecast shows a ‘best case’ scenario, given potential supply constraints, federal infrastructure monies going to non fiber, and other variables that could affect future deployments. Source: RVA To further demonstrate that the exponential increase in demand for fiber - fed broadband is sustainable, the chart on slide 15 shows the long - term forecast for new fiber to the home through 2025. It is estimated that broadband providers will reach more homes with fiber in the 2021 to 2025 period – an estimated 60.8 million homes – than the combined total number of homes for all years through 2020. This is truly noteworthy. It shows that the elevated demand in this market is not a short - term event. We believe this is a once - in - a - generation investment opportunity that will change the w ay p e o p l e c o mmu n i c a t e i n t h e f u t u r e . 15

Clearfield “Now of Age” Plan N A S D AQ :CL FD 1 6 Augmenting Capacity for Ongoing Growth • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Domestic and Global partnerships for faster product innovation and cost reduction programs Accelerating our Operating Cadence • Active investment in systems and processes to enable our agile work environment • Speed of delivery in every part of our organization is paramount to our success Amplifying Bold and Disruptive Growth • Leveraging Community Broadband for One - Fiber Backhaul • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing As we have discussed on prior calls, Clearfield’s ‘Now of Age’ plan, as shown on Slide 16, is our multi - year strategic plan to establish Clearfield as the platform of choice for fiber management and connectivity. The three pillars of the ‘Now of Age’ plan are intended to enhance Clearfield’s market position with the aim of capturing the fiber to the home and business market share that the company was built to obtain, while simultaneously powering the innovation for new and e x i s t i n g m a r k e t s i n t h e y e a r s a h e a d . As we navigate this extraordinary market opportunity, we have recently expanded our Board of Directors. We elected two new directors to our Board in December who will help guide Clearfield as we progress through our Now of Age plan. Carol Wirsbinski has over 30 years of experience within the telecommunications industry, with deep expertise in the Community Broadband market, and Walter Jones, Jr. spent three decades working with Tier One operators, developing significant expertise in network operations and fiber - focused enterprise transformations. We are thrilled to have Carol and Walter, as well as the rest of our Board, guiding and advising us through this historic investment cycle. 16

Accelerating our O p e r a ti ng C a d e n c e • Active investment in systems and processes to enable our agile work environment • Speed of delivery in every part of our organization is paramount to our success NA S DA Q : C LF D 17 A c c e l e r a t i n g o u r O p e r a t i n g C a d e n c e . This is Clearfield’s commitment to address the market’s exponential demand for fiber - fed broadband and ensure our operations can nimbly respond to our customers’ demands. To that end, as previously mentioned, in the last quarter we substantially increased our inventory, to over $40 million, to be able to effectively meet our customers’ needs. We have made significant investments in inventory to ensure that we can deliver our product on time to our promised ship dates. This in turn allows our customers to effectively manage their service technicians and new install technicians, who are in high demand given the present labor market shortage. Previously, our customers counted on us for quick term delivery. Now, things have changed such that we are working with customers on their business plans, receiving purchase orders one to six months in advance. This allows us to gain visibility into the particular products that our customers intend to deploy, and consequently we are well - prepared to ship the requested products in alignment with their deployment schedules. Our ability to deliver our products on time to our customers is crucial so that their deployment schedules are maintained and their time to revenue can accelerate. Moreover, this timeliness enables us to pick up incremental market share when our competitors are unable to fulfil their customers’ orders and we can address their product needs. However, it is important to stat, that the supply chain challenges that are rampant across all industries are continuing to challenge us and could serve as an obstacle throughout the coming quarters. 17

Fiber Backhaul Amplifying Bold and Disruptive Growth • Leveraging Community Broadband for One - • Removing obstacles for the integration of wireline and wireless networks • Bringing fiber management expertise to 5G, NG - PON, and edge computing NASDAQ:CLFD 18 18 The second pillar of our Now of Age plan is Amplifying Bold and Disruptive Growth. This is Clearfield’s commitment to continue delivering market - changing products for current and future market requirements. Today’s build programs for fiber to the home and business, will represent tomorrow’s integration of wireline and wireless networks and further backhaul opportunities. The best proof point that we are delivering on this pillar is the significant $101 million backlog we mentioned at the beginning of this call. To put this number into perspective – our current backlog is up over 1000% in one year, and up 53% sequentially from our last quarter. Our ability to be responsive assisted us in getting ahead of our competition. We put systems and capacity plans in place to be able to respond and capture incremental business opportunities, and customers have responded enthusiastically. We anticipate the growth in our backlog will begin to stabilize as the build season begins this spring and customers more aggressively take delivery against their existing orders. Our current backlog is comprised of a broad set of customers; as we mentioned on our last call, there are over 200 customers in the backlog, including several distributors which represent additional customers to whom our products are sold. A large component of our backlog are regional broadband service providers within the Community Broadband market, including two 10% customers for this quarter. While the traditional broadband provider focuses on a single - state area, regional broadband service providers address a multi - state market. Because these companies have not deployed fiber at this scope in the past, we believe this represents a significant growth opportunity for Clearfield. Finally, on the product front, our engineering organization has been working to broaden our product categories and expand our total available market in fiscal 2022. We look forward to providing updates on our product pipeline in the near future which include solutions for future 5G and edge computing opportunities.

Augmenting Capacity for Ongoing Growth • Investing in products, manufacturing and supply chain to increase competitiveness and reduce costs • Building upon Domestic and Global partnerships for faster product innovation and cost reduction programs NA S DA Q : C LF D 19 Our third pillar, Augmenting Capacity for Ongoing Growth , is Clearfield’s commitment to scaling its operations to meet the incredible demand for high - speed broadband. Our agility and the ability to adapt to our customers and their changing needs are the key facets of this pillar. In order to meet the significant demand for our products, we will open a new distribution center in Minnesota within our fiscal Q2, which would effectively double the company’s U.S. footprint. Furthermore, as we have previously announced, our new manufacturing center in Mexico will also come online in Q2, providing 300,000 square feet of capacity, effectively tripling our footprint in Mexico. We are aggressively recruiting to expand our workforce in these facilities As we previously mentioned, we are investing in our capacity, including investing in developing and outfitting these new facilities as well as other supply chain enhancements. Managing the supply chain during this period of uncertainty has also been a key priority for Clearfield. To ensure we can continue to ship product to our customers without delays, we have built up a network of partners that can increase our capacity in response to growing demand. As an example of this capacity, we have doubled the number of facilities that manufacture our cassettes and are now producing these in multiple countries. This enhancement, which did require an investment in tooling in our supply chain, helps safeguard against any supply chain interruptions. Lastly, we are keeping our options open for ways to further augment our capacity and grow demand. This includes continued organic growth as well as the right inorganic opportunities that would enable us to keep growing with our customers. 19

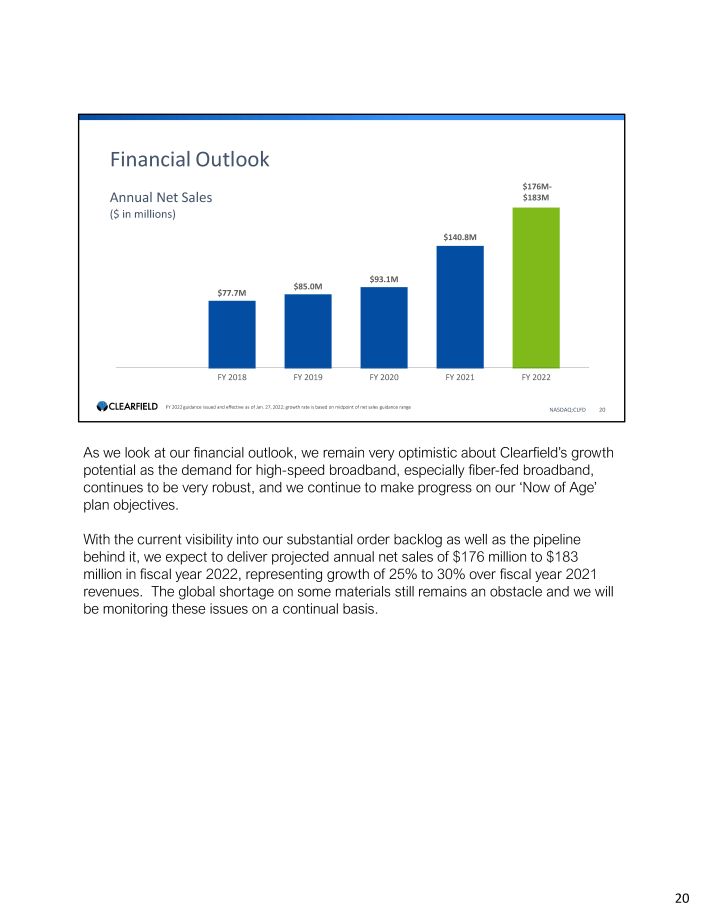

$77.7M $85.0M $93.1M $140.8M $176M - $183M F Y 2 0 1 8 F Y 2 0 1 9 F Y 2 0 20 F Y 2 0 21 F Y 2 0 2 2 FY 2022 guidance issued and effective as of Jan. 27, 2022; growth rate is based on midpoint of net sales guidance range Financial Outlook Annual Net Sales ($ in millions) N A S DAQ:CLFD 20 As we look at our financial outlook, we remain very optimistic about Clearfield’s growth potential as the demand for high - speed broadband, especially fiber - fed broadband, continues to be very robust, and we continue to make progress on our ‘Now of Age’ plan objectives. With the current visibility into our substantial order backlog as well as the pipeline behind it, we expect to deliver projected annual net sales of $176 million to $183 million in fiscal year 2022, representing growth of 25% to 30% over fiscal year 2021 revenues. The global shortage on some materials still remains an obstacle and we will be monitoring these issues on a continual basis. 20

Key Takeaways N A S DAQ:CLFD 2 1 Proven business model and management execution Proven management team focused on expanding global manufacturing capacity Strong competitive position in a rapidly growing multi - billion - dollar fiber - fed broadband industry with long - term government funding programs and initiatives Strong balance sheet: $ 58 M in cash and no debt 14 Year history of profitability and positive free cash flow In summary: Clearfield had a phenomenal first quarter, one that has positioned us well for the remainder of fiscal 2022. Our Q1 financial results set another quarterly record, and our order backlog of $101 million gives us the confidence to increase our guidance for the fiscal year. We continue making progress on the three pillars of the ‘Now of Age’ plan that is calibrated to enhance Clearfield’s market position. Again, we believe we are in the middle of a remarkable investment cycle for broadband deployment. Demand for fiber - fed broadband remains very strong, and we are actively expanding our capacity to capture this growing demand and to expand our market share. We remain focused on executing our proven strategy to establish Clearfield as the platform of choice for fiber management and connectivity, securing the market l e a d e r s h i p t h a t w e w e r e b u il t t o a c h i e v e . And with that, we’re ready to open the call for your questions. Operator? 21

Q & A N A S DAQ:CLFD 2 2 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER T h a n k y o u . We will now be taking questions from the Company’s publishing sell - side analysts. Our first question comes from Jaeson Schmidt with Lake Street Capital Markets. J a e s o n S c h m i d t L a k e S t r e e t C a p i t a l M a r k e t s , L L C , R e s ea r c h D i v i s i o n Congrats on the results and updated guidance. I really want to start with that backlog number, obviously, a massive jump both sequentially and year - over - year. You did note that it was very broad - based across over 200 customers. But just curious if there were any other dynamics going on. Was this due to kind of year - end budget? Just trying to figure out what really drove that big jump? 22

Q & A N A S DAQ:CLFD 2 3 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER C h e ri B e r a n e k P r e s i d e nt & C E O We'll have a couple of things. I think as we noted in the materials this quarter, we did have two 10% customers who are regional service providers. And because they run multi - state networks and have much more long range in their planning cycles, we expect to be able to have those regional service providers continue at a pretty significant clip as we move forward, and they are a meaningful percentage of that backlog. I think the other thing that we saw is that customers, wherever they looked, were finding that product is becoming difficult to get in a quick turn basis and really wanted to ensure that they would work with us to provide the actual products that they individually needed. And so a really broad base of companies are looking at their environments and really want to be able to establish the network of supply chain that they need and they're looking at how to do it in a more effective way. And so we have a nice take - up of plug and play technology, labor light technology, the kinds of products that we can produce for them in a quick turn environment, and our in - cassette splicing within our cabinets is really being widely respected because it has been demonstrated to be easy to train and to reduce the amount of time per deployment so that they can p l a c e t wi c e a s m a n y c a b i n e t s a s t h e y w e r e d o i n g p r e v i o u s l y . 23

Q & A N A S DAQ:CLFD 2 4 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER J a e s o n S c h m i d t L a k e S t r e e t C a p i t a l M a r k e t s , L L C , R e s ea r c h D i v i s i o n Okay . That's really helpful . And just following up on some of those comments, I'd just be curious to get your take on what you think inventory levels are at distributors . And you did note everyone's sort of worried about being able to source components . Are you at all concerned or seeing any sort of double ordering from customers? C h e ri B e r a n e k P r e s i d e nt & C E O We have very limited amount of inventory at distributors and that most of our product is even if it shifts through distributors is predominantly shipped on a drop ship basis so that we know exactly where it's going. So we have not, at this point, really established a stocking program for distributors. We really ask our distributors to be the eyes and ears, oftentimes a logistical partner for ordering and single point of ordering access for all their needs. That's really what the distributor has done for us. We've not seen, in general, double ordering . What we have seen is customers who need to kind of look at their world and as they order early and then need to kind of look at their world and say, okay, I might tweak this a little bit . I might have to change these orders . And so we've been cognizant of that . But at the same time, due to the modularity of our product line, that hasn't caused an inventory risk for us, but rather just allows those customers to continue to tweak their plan and to work the plan based upon the design that they f i n a l i z e i n t o t h e b u il d s e a s o n . 24

Q & A N A S DAQ:CLFD 2 5 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER J a e s o n S c h m i d t L a k e S t r e e t C a p i t a l M a r k e t s , L L C , R e s ea r c h D i v i s i o n Okay. Got it. And then just the last one for me, and I'll jump back in the queue. As it relates to the capacity expansion in Mexico, just curious how we should think about that potentially impacting gross margin? Or is this a situation where you're not kind of transferring any product lines and I mean there really wouldn't be any sort of headwinds there? C h e ri B e r a n e k P r e s i d e nt & C E O We’re significantly – we intend to be able to manufacture everything that we’re doing in the facility in Mexico. And so it is absolutely a cost reduction opportunity for us. But we also are in a world in which supply costs are going up. And so we’re trying to use the Mexican facility as a means by which to lower our labor costs and by lowering our labor costs, try to keep our pricing to our end customers as flat as possible. So our philosophy is that we are a manufacturing partner, a supply chain partner for our customers. And that as we cost - reduce solutions, we try to keep that as transparent to our customers and not have to increase pricing to them. So modeling gross profit forward, there’ll be a little bit of a hit in probably not yet this quarter much because that will come online in March. But the quarter of April through June, it might have a 1% hit just because of the overhead that hasn’t going to be quite absorbed, maybe 1%, 1.5%. But modelling forward, we’re in a good place. I mean we’re – we could have some hits, but it’s in a good place right now. 25

Q & A N A S DAQ:CLFD 2 6 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER Operator O u r n e x t q u e s t i o n c o m e s f r o m R y a n K o o nt z w i t h N e e d h a m . R y a n K oo n t z N ee d h a m & C o m pa n y , L L C , R e s e a r c h D i v i s i o n Congrats on the incredible results. The -- as far as your great bookings go, how would you quantify or qualify the impact from ARPA and RDOF subsidy programs and the strength you're seeing here in the near term? C h e ri B e r a n e k P r e s i d e nt & C E O As it relates to the backlog, our performance to date and the backlog, there really isn't a lot in there. Some of the early stuff, the state associated stuff is a little bit. But mostly, we're at a point where we're just starting to talk to customers who are planning their networks with government funding dollars. So we think we'll see some impact due to the government initiatives and funding programs probably late third quarter and into fourth quarter. But really, that's about '23 and beyond. 26

Q & A N A S DAQ:CLFD 2 7 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER R y a n K oo n t z N ee d h a m & C o m pa n y , L L C , R e s e a r c h D i v i s i o n Got it . Super helpful . And how about the pickup in cable, it sounds like some really nice momentum there . Can you maybe walk us through the applications and the types of customers that are starting to boost your cable business? C h e ri B e r a n e k P r e s i d e nt & C E O Mostly in the cable TV business, what we're seeing is a strong leadership in what we would call Tier 2 operators. The operators who are investing in their networks and not the national carriers yet, but companies like Midcontinent, companies like Cable One who are really committed to their particular communities and who are investing in fiber - fed broadband alongside their Docsis implementation. We're also starting to see an emerging amount of work also coming from the larger carriers who are just deepening their fiber networks for future opportunities. So hub collapses, active cabinets with fiber installed. Just a means of protecting what they have and trying to make sure that their customers' experience remains positive to try to minimize churn in their subscriber base. R y a n K oo n t z N ee d h a m & C o m pa n y , L L C , R e s e a r c h D i v i s i o n So it sounds like a combination of kind of Docsis upgrades and as well as new fiber - to - the - home builds in cable? C h e ri B e r a n e k P r e s i d e nt & C E O A b s o l u t e l y . T h a t ' s e x a c t l y r i g h t . 27

Q & A N A S DAQ:CLFD 2 8 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER R y a n K oo n t z N ee d h a m & C o m pa n y , L L C , R e s e a r c h D i v i s i o n Great. And on your product mix, are you seeing much of a mix shift there between your passing product versus connected products? Any kind of mix shifts going on there for you? C h e ri B e r a n e k P r e s i d e nt & C E O I would say right now, we are a little bit heavier in the products associated with passing the home. So that’s going to be outside planned products like cabinets and terminals. I think that’s a little bit seasonal and we will, especially in the backlog, we’re seeing more orientation for the summer builds about the connectivity, the drop cables and the connectivity products. Also because the take rates typically as a step 1, step 2. They’re going to pass the homes first and then come in and identify market to the individual owners, homeowners for who’s the – take their fiber due to some of the shortage of fiber. What we’re seeing is not a lot of make - ready for drag cable and that they’re actually marketing to the individual home owner before they provide the fiber service. 28

Q & A N A S DAQ:CLFD 2 9 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER Operator Our next question comes from Tim Savageaux with Northland Capital Markets. T i m S a v a g e a u x Northland Capital Markets, Research Division Good afternoon, And I'll add my congratulations. And you mentioned seasonality a moment ago. And while your guidance has increased nicely, I imagine you expect some here in the periods where you normally see weather or other seasonal drivers. So I wonder if you can talk about that. We've seen different type of seasonal results than we have in the past from various suppliers. I wonder what Clearfield is expecting there. And then it looks like at this point, you're expecting your first quarter to be kind of the high watermark for the year. I wonder how I can reconcile that with your tripling capacity in Mexico coming online? And what are the puts and takes there? 29

Q & A N A S DAQ:CLFD 3 0 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER C h e ri B e r a n e k P r e s i d e nt & C E O We're very optimistic for the long term. And as I said, this is, I think, truly just the beginning. And with the funding initiatives that are coming forward for '23 and beyond, we have every indication of being -- we're going to be ready and have the capacity by which to be ready at that point. That said, I think the materials that we currently -- or the backlog that we currently have is majority of it is scheduled to ship in the next 6 months. And so we do have capacity in theory available to expand beyond some of the forecasted numbers that we put in place. However, it is becoming increasingly difficult to obtain additional product and inventory positions. And so we're taking -- using our cash to take the inventory that we need, but simple things like grommet tape, which right now has -- there's a global shortage of grommet tape, right? We use that on every product that we ship. And so those kinds of things could slow us down or potentially create a problem for the delivery of some of the backlog that we have. So we're still conservative and we want to make sure that we -- until we can stabilize some of the supply chain challenges that just kind of come out of like a curve ball. We've got to be cautious about kind of the long - term numbers that we put out there. 30

Q & A N A S DAQ:CLFD 3 1 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER T i m S a v a g e a u x Northland Capital Markets, Research Division Got it. And understood on kind of maybe staying on that front a little bit, and you historically targeted annual growth rates, what, double digits, mid - teens, obviously, are well above that last fiscal year. But given all the changes that you are kind of noting in terms of the amount of fiber to be deployed, the broadband subsidies, I mean, should we -- and understanding these numbers will move around. But should we be thinking about kind of a new elevated baseline for the growth of the company over the next few years? C h e ri B e r a n e k P r e s i d e nt & C E O That would be – while we don’t have long - term financial guidance. That certainly would be our call in that we’re investing in the capacity, in the systems, the materials, the buildings to be able to respond to both the private equity financing of these networks as well as the government - funded ones. And so we believe there will be demand that will allow us to grow beyond our historical compounded annual growth rate. And it’s now our job as a management team by which to execute toward that. 31

Q & A N A S DAQ:CLFD 3 2 C h e r i B e r a n e k PRESIDENT & CEO D a n H e r z o g CHIEF FINANCIAL OFFICER Operator At this time, this concludes the company's question - and - answer session. If your question was not taken, you may contact Clearfield's Investor Relations team at CLFD@gatewayir.com. I'd now like to turn the call back over to Ms. Beranek for closing remarks. C h e ri B e r a n e k P r e s i d e nt & C E O Thanks so much. It’s been a wonderful pleasure to be able to speak with you today. The quarter has been fabulous. The team has been fabulous. I can’t thank our procurement groups or manufacturing groups enough as well as our sales organization that just continues to be able to stay in front of the customer and provide the resources that are necessary. And I want to thank you, the investors who are – we don’t take your support for granted, and we will continue to work to earn it every day moving forward. Operator Thank you for joining us today for Clearfield's Fiscal First Quarter 2022 Earnings C o n f e r e n c e C a l l . Y o u may n ow d i s c o n n e c t . 32

NASDAQ:CLFD 33 Contact Us COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. I R @se e c l ea r fi e l d . c o m INVESTOR RELATIONS: Matt Glover and Sophie Pearson Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com 33