Exhibit 99.2

Clearfield FieldReport : Fiscal Q4 & 2022 Earnings Call November 17, 2022 1

Important Cautions Regarding Forward - Looking Statements NASDAQ:CLFD 2 Forward - looking statements contained herein and in any related presentation or in the related Earnings Release are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “outlook,” or “continue” or comparable terminology are intended to identify forward - looking statements. Such forward looking statements include, for example, statements about the Company’s future revenue and operating performance, anticipated shipping on backlog and future lead times, future availability of components and materials from the Company’s supply chain, future availability of labor impacting our customers’ network builds, the impact of the Rural Digital Opportunity Fund (RDOF) or other government programs on the demand for the Company’s products or timing of customer orders, the Company’s ability to add capacity to meet expected future demand, and trends in and growth of the FTTx markets, market segments or customer purchases and other statements that are not historical facts. These statements are based upon the Company's current expectations and judgments about future developments in the Company's business. Certain important factors could have a material impact on the Company's performance, including, without limitation: adverse global economic conditions and geopolitical issues could have a negative effect on our business, and results of operations and financial condition; our planned growth may strain our business infrastructure, which could adversely affect our operations and financial condition; the acquisition of Nestor Cables and integration activities could adversely affect our operating results; the COVID - 19 pandemic has significantly impacted worldwide economic conditions and could have a material adverse effect on our business, financial condition and operating results; we rely on single - source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders; fluctuations in product and labor costs which may not be able to be passed on to customers that could decrease margins; we depend on the availability of sufficient supply of certain materials, such as fiber optic cable and resins for plastics, and global disruptions in the supply chain fo r these materials could prevent us from meeting customer demand for our products; we rely on our manufacturing operations to produce product to ship to customers and manufacturing constraints and disruptions could result in decreased future revenue; a significant percentage of our sales in the last three fiscal years have been made to a small number of customers; further consolidation among our customers may result in the loss of some customers and may reduce sales during the pendency of business combinations and related integration activities; we may be subject to risks associated with acquisitions; product defects or the failure of our products to meet specifications could cause us to lose customers and sales or to incur unexpected expenses; we are dependent on key personnel; cyber - security incidents on our information technology systems, including ransomware, data breaches or computer viruses, could disrupt our business operations, damage our reputation, and potentially lead to litigation; our business is dependent on interdependent management information systems; to compete effectively, we must continually improve existing products and introduce new products that achieve market acceptance; changes in government funding programs may cause our customers and prospective customers to delay, reduce, or accelerate purchases, leading to unpredictable and irregular purchase cycles; intense competition in our industry may result in price reductions, lower gross profits and loss of market share; our success depends upon adequate protection of our patent and intellectual property rights; if the telecommunications market does not expand as we expect, our business may not grow as fast as we expect; we face risks associated with expanding our sales outside of the United States; and other factors set forth in Part I, Item IA. Risk Factors of Clearfield's Annual Report on Form 10 - K for the year ended September 30, 2021 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events unless required by law. © Copyright 2022 Clearfield, Inc. All Rights Reserved.

NASDAQ:CLFD 3 Introduction & Highlights

NASDAQ:CLFD NASDAQ:CLFD Enabling the Lifestyle Better Broadband Provides 4

What We Do Clearfield provides fiber protection, fiber management and fiber delivery solutions that enable rapid and cost - effective fiber - fed deployment throughout the broadband service provider space. NASDAQ:CLFD 5

NASDAQ:CLFD 6 Nestor Cables Acquisition Overview Finland - based subsidiary of Clearfield; one of the leading developers and manufacturers of fiber optic cable solutions in Northern Europe • Vertically integrates the supply of FieldShield fiber optic cables • Leverages Nestor’s deep technical expertise to extend supply of FieldShield fiber into the North American market • Reduces the cost and complexity of freight by establishing Mexico - based production of fiber cable • Extends reach of cassette - based fiber management solutions to European market

NASDAQ:CLFD 7 Financial Performance

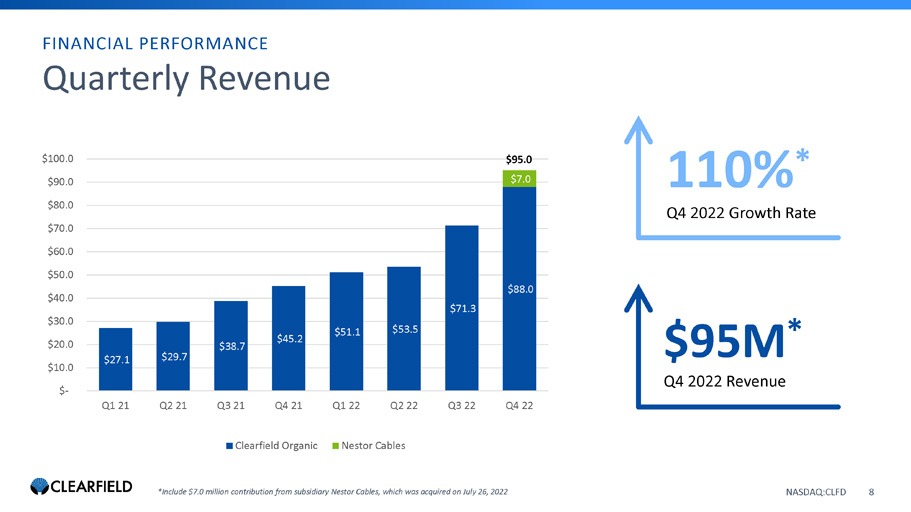

Quarterly Revenue $27.1 $29.7 $38.7 $45.2 $51.1 $53.5 $71.3 $88.0 $7.0 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Clearfield Organic Nestor Cables FINANCIAL PERFORMANCE 110% * Q4 2022 Growth Rate $95M * Q4 2022 Revenue NASDAQ:CLFD 8 *Include $7.0 million contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022 $95.0

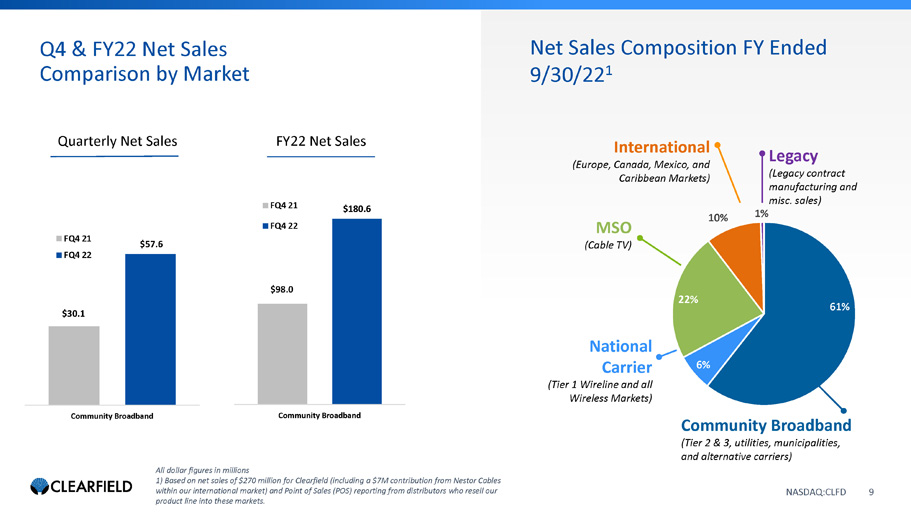

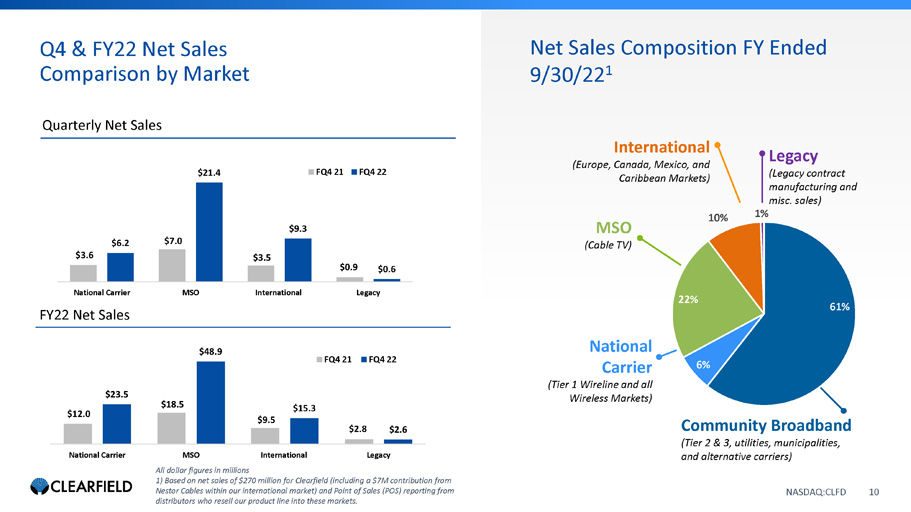

Q4 & FY22 Net Sales Comparison by Market NASDAQ:CLFD All dollar figures in millions 1) Based on net sales of $270 million for Clearfield (including a $7M contribution from Nestor Cables within our international market) and Point of Sales (POS) reporting from distributors who resell our product line into these markets. Net Sales Composition FY Ended 9/30/22 1 Legacy (Legacy contract manufacturing and misc. sales) 61% 6% 22% 10% 1% $98.0 $180.6 Community Broadband FQ4 21 FQ4 22 Quarterly Net Sales FY22 Net Sales Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International (Europe, Canada, Mexico, and Caribbean Markets) NASDAQ:CLFD 9 $30.1 $57.6 Community Broadband FQ4 21 FQ4 22

$3.6 $7.0 $3.5 $0.9 $6.2 $21.4 $9.3 $0.6 National Carrier MSO International Legacy FQ4 21 FQ4 22 Q4 & FY22 Net Sales Comparison by Market NASDAQ:CLFD $12.0 $18.5 $9.5 $2.8 $23.5 $48.9 $15.3 $2.6 National Carrier MSO International Legacy FQ4 21 FQ4 22 Quarterly Net Sales FY22 Net Sales NASDAQ:CLFD 10 All dollar figures in millions 1) Based on net sales of $270 million for Clearfield (including a $7M contribution from Nestor Cables within our international market) and Point of Sales (POS) reporting from distributors who resell our product line into these markets. Net Sales Composition FY Ended 9/30/22 1 Legacy (Legacy contract manufacturing and misc. sales) Community Broadband (Tier 2 & 3, utilities, municipalities, and alternative carriers) National Carrier (Tier 1 Wireline and all Wireless Markets) MSO (Cable TV) International ( Europe, Canada, Mexico, and Caribbean Markets) 61% 6% 22% 10% 1%

Annual Revenue $77.7 $85.0 $93.1 $140.8 $270.9 $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 FY18 FY19 FY20 FY21 FY 22 11 FINANCIAL PERFORMANCE 92% FY 2022 Growth Rate $270.9M FY 2022 Consolidated Revenue

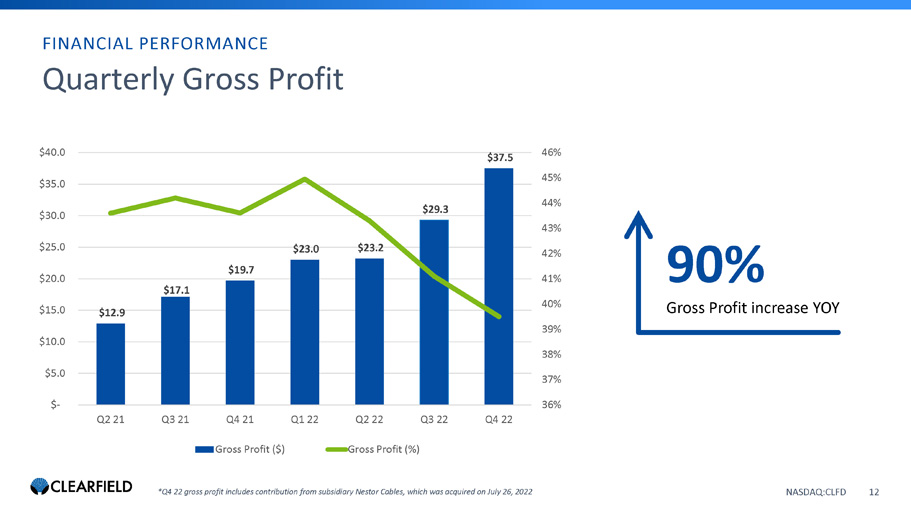

Quarterly Gross Profit $12.9 $17.1 $19.7 $23.0 $23.2 $29.3 $37.5 36% 37% 38% 39% 40% 41% 42% 43% 44% 45% 46% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Gross Profit ($) Gross Profit (%) FINANCIAL PERFORMANCE 90% Gross Profit increase YOY NASDAQ:CLFD 12 *Q4 22 gross profit includes contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022

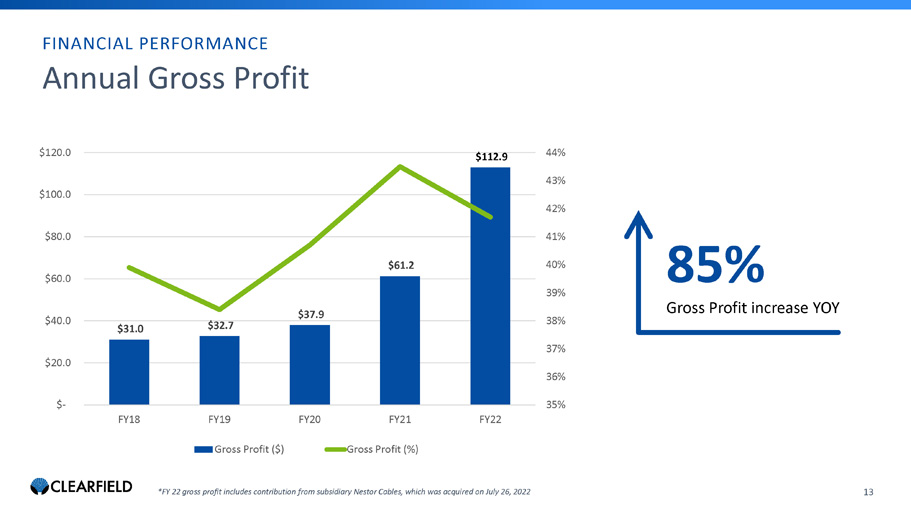

Annual Gross Profit $31.0 $32.7 $37.9 $61.2 $112.9 35% 36% 37% 38% 39% 40% 41% 42% 43% 44% $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 FY18 FY19 FY20 FY21 FY22 Gross Profit ($) Gross Profit (%) 13 FINANCIAL PERFORMANCE 85% Gross Profit increase YOY *FY 22 gross profit includes contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022

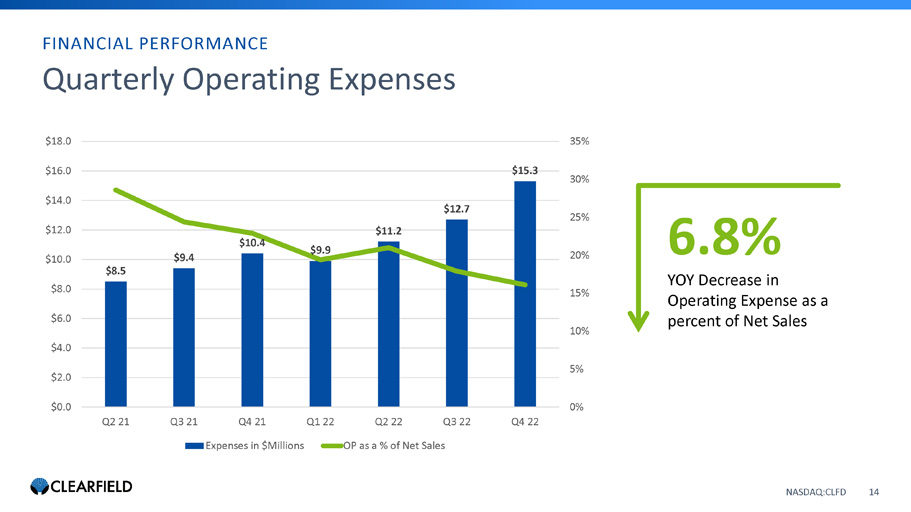

$8.5 $9.4 $10.4 $9.9 $11.2 $12.7 $15.3 0% 5% 10% 15% 20% 25% 30% 35% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Expenses in $Millions OP as a % of Net Sales FINANCIAL PERFORMANCE 6.8% YOY Decrease in Operating Expense as a percent of Net Sales NASDAQ:CLFD 14 Quarterly Operating Expenses

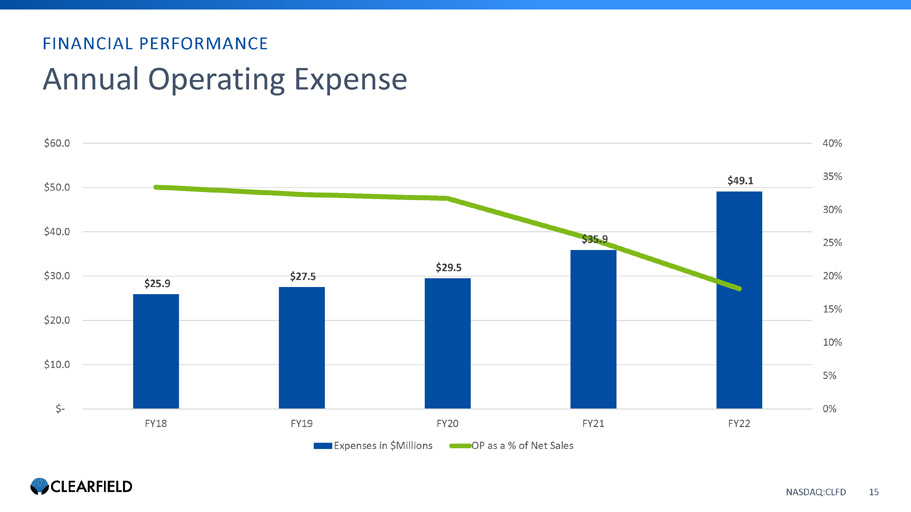

Annual Operating Expense $25.9 $27.5 $29.5 $35.9 $49.1 0% 5% 10% 15% 20% 25% 30% 35% 40% $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 FY18 FY19 FY20 FY21 FY22 Expenses in $Millions OP as a % of Net Sales FINANCIAL PERFORMANCE NASDAQ:CLFD 15

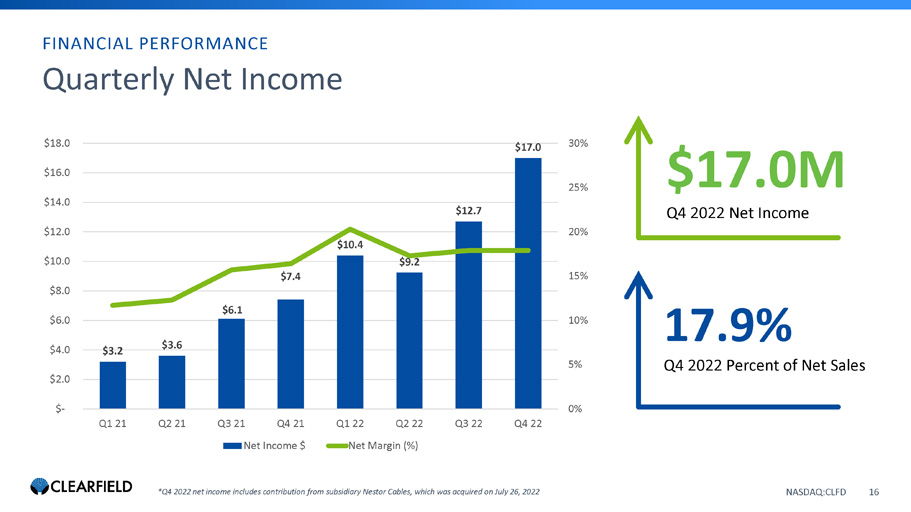

$3.2 $3.6 $6.1 $7.4 $10.4 $9.2 $12.7 $17.0 0% 5% 10% 15% 20% 25% 30% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Net Income $ Net Margin (%) $17.0M Q4 2022 Net Income 17.9% Q4 2022 Percent of Net Sales FINANCIAL PERFORMANCE NASDAQ:CLFD 16 Quarterly Net Income *Q4 2022 net income includes contribution from subsidiary Nestor Cables, which was acquired on July 26, 2022

Annual Net Income $4.3 $4.6 $7.3 $20.3 $49.4 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 FY18 FY19 FY20 FY21 FY22 Net Income $ Net Margin (%) FINANCIAL PERFORMANCE $49.4M FY 2022 Net Income 18.2% FY 2022 Percent of Net Sales NASDAQ:CLFD 17

NASDAQ:CLFD 18 Business Update & Outlook

NASDAQ:CLFD NASDAQ:CLFD NASDAQ:CLFD 19 Leverage our decade - long excellence in Community Broadband Execute capacity growth in advance of market opportunity Accelerate infrastructure investment Position innovation at the forefront of our value proposition

NASDAQ:CLFD NASDAQ:CLFD Leverage our decade - long excellence in Community Broadband NASDAQ:CLFD 20

NASDAQ:CLFD NASDAQ:CLFD Execute Capacity Growth in Advance of Market Opportunity NASDAQ:CLFD 21

NASDAQ:CLFD NASDAQ:CLFD Accelerate infrastructure investment NASDAQ:CLFD 22

NASDAQ:CLFD NASDAQ:CLFD Position innovation at the forefront of our value proposition NASDAQ:CLFD 23

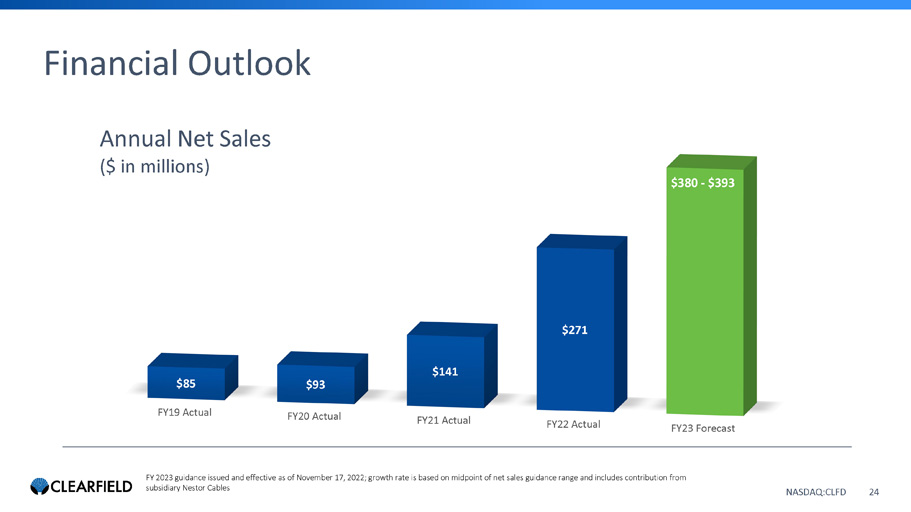

FY19 Actual FY20 Actual FY21 Actual FY22 Actual FY23 Forecast $85 $93 $141 $271 NASDAQ:CLFD FY 2023 guidance issued and effective as of November 17, 2022; growth rate is based on midpoint of net sales guidance range a nd includes contribution from subsidiary Nestor Cables Annual Net Sales ($ in millions) NASDAQ:CLFD 24 Financial Outlook $380 - $393

Cheri Beranek PRESIDENT & CEO Dan Herzog CHIEF FINANCIAL OFFICER Q&A NASDAQ:CLFD 25

NASDAQ:CLFD 26 Contact Us COMPANY CONTACT: Cheri Beranek President & CEO Clearfield, Inc. IR@seeclearfield.com INVESTOR RELATIONS: Matt Glover and Sophie Pearson Gateway Investor Relations (949) 574 - 3860 CLFD@gatewayir.com