Cheryl Beranek

Age: 61

Director Since: December 2007

Committees:

● None

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to SS.240.14a-11(c) or SS.240.14a-12 |

|

|

|

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

CLEARFIELD, INC.

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(763) 476-6866

____________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held February 22, 2024

____________________

TO THE SHAREHOLDERS OF CLEARFIELD, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Clearfield, Inc., a Minnesota corporation, will be held on Thursday, February 22, 2024, at 2:00 p.m. Central Standard Time for the following purposes:

|

1. |

Elect eight (8) directors to serve until the next Annual Meeting of the Shareholders or until their respective successors have been elected and qualified. |

|

2. |

To approve, on a non-binding advisory basis, the compensation paid to our named executive officers. |

|

3. |

Ratify and confirm the appointment of Baker Tilly US, LLP as the independent registered public accounting firm for Clearfield, Inc. for the fiscal year ended September 30, 2024. |

THE 2024 ANNUAL MEETING OF SHAREHOLDERS WILL BE A VIRTUAL MEETING OF SHAREHOLDERS.

You may attend the online meeting and vote your shares electronically during the meeting via the internet by visiting: www.virtualshareholdermeeting.com/CLFD2024. You will need the 16-digit control number that is printed on your notice of internet availability of proxy materials or the box marked by the arrow on your proxy card or on the voting instructions that accompanied your proxy materials. We recommend that you log in at least 15 minutes before the meeting to ensure that you are logged in when the meeting starts.

Only holders of record of Clearfield, Inc.’s common stock at the close of business on December 27, 2023 are entitled to notice of, and to vote at, the Annual Meeting.

| By Order of the Board of Directors | |

| /s/ Frank J. Brixius Jr. | |

| Frank J. Brixius Jr. | |

| Secretary |

January 11, 2024

|

WHETHER OR NOT YOU EXPECT TO ATTEND THE ONLINE MEETING, |

IMPORTANT NOTICE REGARDING AVAILABILITY

OF PROXY MATERIALS FOR THE

2024 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, FEBRUARY 22, 2024

We are making our proxy materials available electronically via the Internet. You may access the following proxy materials at www.proxyvote.com:

— Notice of 2024 Annual Meeting of Shareholders to be held on Thursday, February 22, 2024;

— Proxy Statement for 2024 Annual Meeting of Shareholders; and

— Annual Report on Form 10-K for the fiscal year ended September 30, 2023.

On or about January 11, 2024, we mailed to some of our shareholders a notice of internet availability containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The notice of internet availability includes instructions to vote via the Internet, as well as how to request paper or e-mail copies of our proxy materials. Other shareholders received an e-mail notification that provided instructions on how to access our proxy materials and vote via the Internet or were mailed paper copies of our proxy materials and a proxy card that provides instructions for voting via the Internet, by telephone or by mail.

If you received the notice of internet availability and would prefer to receive printed proxy materials, please follow the instructions included in the notice of internet availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive e-mails with instructions to access these materials via the Internet unless you elect otherwise.

These proxy materials are available free of charge and will remain available through the conclusion of the Annual Meeting. Additionally, we will not collect information, such as “cookies,” that would allow us to identify visitors to the site.

TABLE OF CONTENTS

CLEARFIELD, INC.

7050 Winnetka Avenue North, Suite 100

Brooklyn Park, Minnesota 55428

(763) 476-6866

____________________

____________________

This proxy statement is provided in connection with the solicitation of proxies by the Board of Directors of Clearfield, Inc. (“we,” “Clearfield” or “the Company”) for use at the Annual Meeting of Shareholders to be held on Thursday, February 22, 2024, at 2:00 p.m. Central Standard Time and at any postponements or adjournments thereof (the “Annual Meeting”). The mailing of this proxy statement to our shareholders commenced on or about January 11, 2024.

About the Virtual Annual Meeting

The Annual Meeting will again be a virtual meeting of the shareholders. The Board of Directors believes holding the Annual Meeting in a virtual format allows for greater engagement with our shareholders wherever they may be located, while minimizing the time and cost associated with planning, holding and arranging logistics for an in-person meeting.

Shareholders at the close of business on the record date, December 27, 2023, are entitled to attend the Annual Meeting by going to www.virtualshareholdermeeting.com/CLFD2024. To be admitted to the Annual Meeting, shareholders must enter the 16-digit control number found on the proxy materials you received, voting instruction form, notice of internet availability of proxy materials, or email previously received. Shareholders may vote during the Annual Meeting by following the instructions available on the meeting website during the Annual Meeting.

Following the formal portion of the Annual Meeting, we expect that our management will give a presentation and then answer questions from our shareholders. Shareholders participating in the Annual Meeting live via webcast may submit questions in writing through the virtual meeting platform at www.virtualshareholdermeeting.com/CLFD2024 during the Annual Meeting by typing their question into the “Ask a Question” field and clicking “Submit.”

Cost and Method of Solicitation

This solicitation of proxies to be voted at the Annual Meeting is being made by our Board of Directors. The cost of this solicitation of proxies will be borne by the company. In addition to solicitation by mail, our officers, directors and employees may solicit proxies by telephone or in person. We may also request banks, brokers and other nominees to solicit their customers who have a beneficial interest in our common stock registered in the names of nominees and will reimburse such banks, brokers or nominees for their reasonable out-of-pocket expenses.

Record Date and Outstanding Shares

The number of shares of common stock, $0.01 par value outstanding and entitled to vote at the Annual Meeting as of December 27, 2023 was 14,989,567. Each share of common stock is entitled to one vote. Only shareholders of record at the close of business on December 27, 2023 will be entitled to vote at the Annual Meeting.

Differences Between Shareholders of Record and Beneficial Owners

If your shares are registered directly in your name with our transfer agent, Equiniti Trust Company (doing business as EQ Shareowner Services), you are the “shareholder of record.” If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of those shares, and your shares are held in street name.

Quorum and Voting Requirements

A quorum, consisting of a majority of the shares of common stock entitled to vote at the Annual Meeting, must be present before action may be taken at the Annual Meeting. A shareholder is counted as present at the Annual Meeting if the shareholder attends the online Annual Meeting or the shareholder has properly submitted a proxy by internet, telephone or signing and returning the enclosed proxy or other voting instruction form.

Proposal 1 relates to the election of directors. Directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing eight directors, the eight nominees receiving the highest number of votes will be elected. However, in an uncontested election (such as at the Annual Meeting, where the number of nominees does not exceed the number of directors to be elected), any nominee for director who does not receive a majority of votes cast for his or her election is required under our Governance Guidelines to promptly tender his or her resignation following certification of the shareholder vote. The Nominating and Corporate Governance Committee will consider the resignation and recommend to the Board of Directors whether to accept it. The Board of Directors will act on the Nominating and Corporate Governance Committee’s recommendation within 90 days following certification of the shareholder vote, and will promptly disclose its decision whether to accept or reject the resignation and the reasons therefor. You may either vote “FOR,” “AGAINST” or “ABSTAIN” for each nominee for the Board of Directors.

The affirmative vote of the holders of a majority of the shares present and entitled to vote is required for approval of Proposal 2: Advisory Vote on Named Executive Officer Compensation. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 2.

The affirmative vote of the holders of a majority of the shares present and entitled to vote is required for approval of Proposal 3: Ratification of Appointment of Independent Auditors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposal 3.

Abstentions and broker non-votes will be counted towards a quorum. If you vote “ABSTAIN” on Proposal 2, it has the same effect as a vote against that proposal. If you hold your shares in street name and do not provide voting instructions to your broker or nominee, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker or nominee does not have discretionary authority to vote under the rules of the New York Stock Exchange. Shares that constitute broker non-votes will be present at the Annual Meeting for determining whether a quorum exists, but are not considered entitled to vote on the proposal in question.

We understand that Proposal 3 is considered a “routine” proposal under New York Stock Exchange rules. If you are a beneficial owner and your shares are held in the name of a broker or other nominee, the broker or other nominee is permitted to vote your shares on Proposal 3, even if the broker or other nominee does not receive voting instructions from you. As a result, we do not anticipate any broker non-votes with respect to Proposal 3. With respect to Proposals 1 and 2, your broker or nominee may not vote your shares without receiving voting instructions from you.

So far as our management is aware, no matters other than those described in this proxy statement will be acted upon at the Annual Meeting. In the event that any other matters properly come before the Annual Meeting calling for a vote of shareholders, the persons acting as proxies will vote in accordance with their best judgment on such other matters.

Whether or not you plan to attend the Annual Meeting, you may vote your shares in advance of the Annual Meeting.

If you are a shareholder of record, you may give a proxy to be voted at the Annual Meeting either:

|

● |

electronically, by following the instructions provided in the Notice of Internet Availability of Proxy Materials or proxy card; or |

|

● |

if you received printed proxy materials, you may also vote by mail or telephone as instructed on the proxy card. |

If you hold shares beneficially in street name, you may also vote by proxy over the Internet by following the instructions in the Notice of Internet Availability of Proxy Materials or, if you received printed proxy materials, you may also vote by mail or telephone by following the instructions in the voting instruction card provided to you by your broker, bank, trustee or nominee.

If you receive more than one Notice of Internet Availability of Proxy Materials, proxy card or voting instruction card, it means you hold shares of Clearfield common stock in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or voting instruction card or, if you vote by telephone or via the Internet, vote once for each proxy card, voting instruction card or Notice of Internet Availability of Proxy Materials you receive.

Shares of common stock represented by valid, unrevoked proxies will be voted at the Annual Meeting and, when the shareholder has given instructions, will be voted in accordance with those instructions. If no instructions on how to vote are given in a signed proxy, the shares will be voted in accordance with the recommendation of the Board of Directors, which is FOR each of the nominees in Proposal 1 and FOR Proposals 2 and 3.

You also may vote your shares electronically during the Annual Meeting. You will need the 16-digit control number found on the proxy materials you received, voting instruction form, notice of internet availability of proxy materials, or email previously received. Please have your 16-digit control number readily available and log on to the Annual Meeting by visiting www.virtualshareholdermeeting.com/CLFD2024 and enter your 16-digit control number. You may begin to log into the meeting platform beginning at 1:30 p.m. CST on February 22, 2024. The Annual Meeting will begin promptly at 2:00 p.m. CST on February 22, 2024.

All shares represented by valid, unrevoked proxies will be voted at the Annual Meeting and any adjournment(s) or postponement(s) thereof.

If you are a shareholder of record, you may change your vote or revoke your proxy at any time before the vote at the Annual Meeting by:

|

● |

delivering to the Secretary of Clearfield a written notice, bearing a date later than your proxy, stating that you revoke the proxy; |

|

● |

submitting a properly signed proxy card or other voting instruction form with a later date; |

|

● |

submitting a new vote by telephone or through the internet prior to the close of the voting facilities; or |

|

● |

attending the Annual Meeting and voting at the online Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

If your shares are held in street name, you must contact your broker, bank or nominee to revoke your proxy or vote at the Annual Meeting.

Any written notice of revocation should be delivered to the attention of Frank J. Brixius Jr., Secretary of Clearfield, Inc. at our address: 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, Minnesota 55428. Our telephone number is (763) 476-6866.

OWNERSHIP OF VOTING SECURITIES BY PRINCIPAL HOLDERS AND MANAGEMENT

The following table sets forth certain information as of December 27, 2023 with respect to our common stock beneficially owned by (i) each director and each nominee for director, (ii) each person known to us to beneficially own more than five percent of our common stock, (iii) each executive officer named in the Summary Compensation Table (the “named executive officers”), and (iv) all current executive officers and directors as a group. Unless otherwise indicated, all beneficial owners have sole voting and investment power over the shares held. Except as indicated below, the business address of each beneficial owner set forth below is 7050 Winnetka Avenue North, Suite 100, Brooklyn Park, Minnesota 55428.

|

Name and Address of Beneficial Owner |

Number of Shares |

Percent of |

|

Executive Officers and Directors |

||

|

Ronald G. Roth(2)(3) |

1,432,517 |

9.6% |

|

Cheryl Beranek(2)(4) |

495,332 |

3.3% |

|

Patrick Goepel(2) |

41,368 |

* |

|

Roger Harding(2) |

21,482 |

* |

|

Charles N. Hayssen(2) |

137,821 |

* |

|

Donald R. Hayward(2) |

9,958 |

* |

|

Walter L. Jones, Jr.(2) |

1,880 |

* |

|

Carol Wirsbinski(2) |

2,039 |

* |

|

John P. Hill(4) |

233,533 |

1.6% |

|

Daniel R. Herzog(4) |

78,521 |

* |

|

All current executive officers and directors as a group (10 persons) |

2,454,451 |

16% |

|

Other Beneficial Owners |

||

|

BlackRock, Inc.(5) |

1,051,002 |

7.0% |

|

The Vanguard Group(6) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 |

802,619 |

5.4% |

|

* |

Less than one percent |

|

(1) |

Includes the following number of shares that could be purchased within 60 days of December 27, 2023 upon the exercise of stock options: Ms. Beranek, 39,641 shares; Mr. Hill, 39,641 shares; Mr. Herzog, 25,286 shares; and all current directors and executive officers as a group, 104,568 shares. |

|

(2) |

Currently serves as our director and nominated for election as a director at the Annual Meeting. |

|

(3) |

Includes 176,760 shares owned by Mr. Roth’s spouse. |

|

(4) |

Named Executive Officer. |

|

(5) |

Based upon an Amendment No. 3 to Schedule 13G filed by BlackRock, Inc. on January 8, 2024, in which the shareholder reports sole voting power over 1,036,024 shares of our common stock and sole dispositive power over 1,051,002 shares of our common stock as of December 31, 2023. |

|

(6) |

Based upon a Schedule 13G filed by The Vanguard Group on February 9, 2023, in which the shareholder reports shared voting power over 20,043 shares of our common stock, sole dispositive power over 772,886 shares of our common stock, and shared dispositive power over 29,733 shares of our common stock as of December 30, 2022 |

PROPOSAL 1:

ELECTION OF DIRECTORS

Eight directors will be elected at the Annual Meeting to serve until the next Annual Meeting of Shareholders or until their successors have been elected and shall qualify. Proxies cannot be voted for a greater number of persons than the number of nominees named. Pursuant to our bylaws, the authorized number of directors is set at eight and the Board of Directors has nominated for election the eight persons named below. All eight nominees are currently serving as directors of Clearfield.

The persons acting as proxies intend to vote the proxies held by them in favor of the nominees named below as directors, unless otherwise directed. Should any nominee for director become unable to serve as a director for any reason, the proxies have indicated they will vote for such other nominee as the Board of Directors may propose. The Board of Directors has no reason to believe that any candidate will be unable to serve if elected and each has consented to being named a nominee.

We know of no arrangements or understandings between a director or nominee and any other person pursuant to which he or she has been selected as a director or nominee. There is no family relationship between any of the nominees, our directors or our executive officers except that Ms. Beranek and Mr. Hill are related through the marriage of their daughter and son, respectively.

Information Regarding Nominees

Set forth below is biographical and other information with respect to each nominee, as well as a discussion of the specific experience, qualifications, attributes, and skills that led to the conclusion that the nominee should serve as a director of Clearfield at this time.

|

Cheryl Beranek Age: 61 Director Since: December 2007 Committees: ● None

|

Professional Background and Experience | ||

| ● | President and Chief Executive Officer, Clearfield, Inc. (2007 – present) | ||

| ● | President, APA Cables and Networks, Inc., a cable assembly and contract manufacturing operation and former subsidiary of Clearfield (2003 – 2007) | ||

| ● | President, Americable, a niche-market provider of fiber termination and distribution equipment (2002 - 2003) | ||

| ● | Chief Operating Officer, Americable (2001 - 2002) | ||

| ● | Vice President of Marketing, Transition Networks Inc., a manufacturer of networking equipment for the worldwide fiber optic premise market (1996 – 2001) | ||

| Qualifications | |||

| Ms. Beranek is qualified to serve on the Clearfield Board of Directors because she brings to the Board a keen understanding of our business and industry developed through her tenure as our President and Chief Executive Officer and in her previous position as the President of our former subsidiary. Additionally, Ms. Beranek’s role as our President and Chief Executive Officer allows her to provide the Board with her unique insight as a member of management on our business and our operations. | |||

| Other Directorships | |||

| ● | Director, Key Tronic Corporation (Nasdaq: KTCC) (January 2024 – present) | ||

| ● | Director, CyberOptics Corporation (Nasdaq: CYBE) (May 2020 – November 2022) (CyberOtpics was acquired by Nordson Corporation in November of 2022) | ||

|

Patrick F. Goepel Age: 62 Director Since: 2015 Committees: ● Audit ● Compensation

|

Professional Background and Experience | ||

| ● | CEO, Asure Software, Inc. (Nasdaq: ASUR), a provider of workplace management software (2010 – present) | ||

| ● | Interim CEO, Asure Software, Inc. (2009 – 2010) | ||

| ● | President and CEO, Human Resources Services Division, Fidelity Investments, a provider of financial planning, advisory, wealth management and brokerage services (2006 – 2008) | ||

| ● | President and CEO, Advantec, a provider of human resources outsourcing and professional employer organization services (2005 – 2006) | ||

| Qualifications | |||

| Mr. Goepel’s public company executive management and board experience, as well as his background in successful execution of global expansion, operational and M&A initiatives, qualify him to serve as a director of Clearfield. In addition, Mr. Goepel qualifies as an audit committee financial expert. | |||

| Other Directorships | |||

| ● | Chairman of the Board, Asure Software, Inc. (August 2020 – present), and Director (2009 – present) | ||

| ● | Director, APPD Investments (2007 – present) (private) | ||

| ● | Director, SafeGuard World International (2015 – present) (private) | ||

|

Roger G. Harding Age: 68 Director Since: 2016 Committees: ● Audit

|

Professional Background and Experience | ||

| ● | Private investor (2008 – present) | ||

| ● | Vice President & General Manager, Global Switching, Alcatel-Lucent, a multinational provider of telecommunications equipment and services (2001 – 2008) | ||

| ● | Business & Operations Senior Director, Special Customer Operations, Alcatel-Lucent (1995 – 2001) | ||

| Qualifications | |||

| Mr. Harding has a strong background in operations and the development and execution of key strategies and operating practices, as well as a deep understanding of the telecommunications and networking markets. These attributes qualify him to serve as a director of Clearfield. In addition, Mr. Harding qualifies as an audit committee financial expert. | |||

| Other Directorships | |||

| ● | None | ||

|

Charles N. Hayssen Age: 72 Director Since: 2008 Committees: ● Audit (Chair)

|

Professional Background and Experience | ||

| ● | President, Safeway Driving Schools, a privately held provider of driver’s education services (2009 – August 2021) | ||

| ● | Private investor (2007 – 2008) | ||

| ● | Chief Operating Officer, AllOver Media, Inc., a privately-held out-of-home media company (2004 – 2007) | ||

| ● | Chief Financial Officer, ThinkEquity Partners LLC, an equity capital markets firm (2002 – 2004) | ||

| Qualifications | |||

| Mr. Hayssen brings strong executive management and financial management experience to the Board, as well as experience earlier in his career as a director and audit committee chair of a publicly traded company, all of which qualify him to serve as a director of Clearfield. In addition, Mr. Hayssen qualifies as an audit committee financial expert. | |||

| Other Directorships | |||

| ● | None | ||

|

Donald R. Hayward Age: 66 Director Since: 2007 Committees: ● Audit ● Nominating and Corporate Governance (Chair)

|

Professional Background and Experience | ||

| ● | President, Schaffer Manufacturing, a privately held metal fabrication manufacturing company serving a variety of industries, including telecommunications (September 2017 – October 2020) | ||

| ● | Executive advisor, Schaffer Manufacturing (September 2016 – August 2017; November 2020 – April 2021) | ||

| ● | President, Engel Diversified Industries, a privately held manufacturer of fabricated metal products serving multiple industries (2006 – 2017) | ||

| ● | Director of Corporate Services, Minnesota Technology, Inc., a publicly funded, private non-profit in support of Minnesota’s technology community (1997 – 2006) | ||

| Qualifications | |||

| Mr. Hayward’s executive leadership experience, his familiarity with the business and operations of a manufacturing company developed through his service at Schaffer Manufacturing and Engel Diversified Industries, and his background in technology developed through his service at Minnesota Technology, where he specialized in business growth, concentrating on strategic and leadership development, qualify him to serve as a director of Clearfield, where, among things, he concentrates on board-level matters relating to ESG, succession planning, and strategic development. | |||

| Other Directorships | |||

| ● | None | ||

|

Walter L. Jones, Jr. Age: 58 Director Since: December 2021 Committees: ● Compensation ● Nominating and Corporate Governance

|

Professional Background and Experience | ||

| ● | Advisor, Harmoni Towers, an owner, operator, and builder of mission-critical communications infrastructure (August 2021 – present) | ||

| ● | Independent board advisor and operations consultant (2015 – present) | ||

| ● | Vice President of Network Transformation, Verizon Communications Inc., one of the world’s leading providers of communications, technology, information and entertainment products and services to consumers, businesses, and government entities (2015) | ||

| ● | Region President of Consumer Mass Business, Verizon Communications Inc. (2013 – 2015) | ||

| ● | Area Vice President of Network, Verizon Communications Inc. (2008 – 2013) | ||

| Qualifications | |||

| Mr. Jones’s deep background in telecommunications operations and technology, along with his strong understanding of a Tier 1 telecommunications company, qualify him to serve as a director of Clearfield. Mr. Jones is recognized as NACD Directorship Certified by the National Association of Corporate Directors. | |||

| Other Directorships | |||

| ● | None | ||

|

Ronald G. Roth Age: 78 Director Since: 2002 Chairman Since: 2002 Committees: ● Compensation ● Nominating and Corporate Governance

|

Professional Background and Experience | ||

| ● | Chairman of the Board and investor, Phillips Recycling Systems, a privately-held recycler of scrap and waste materials (1990 – 2007) | ||

| ● | Chairman of the Board and investor, Access Cash International LLC, a privately-held provider of ATMs and related processing and financial services (1995 to 2000) | ||

| ● | Chairman of the Board, CEO and investor, Waste Systems Corp., a privately-held waste hauling and disposal company (1970 – 1995) | ||

| Qualifications | |||

| Mr. Roth is qualified to serve on the Clearfield Board of Directors because he brings to the Board a strong background in executive management, mergers and acquisitions, business development and marketing through his service for more than 35 years as a Chairman of the Board, executive and owner of several companies. | |||

| Other Directorships | |||

| ● | None | ||

|

Carol A. Wirsbinski Age: 60 Director Since: December 2021 Committees: ● Compensation (Chair) ● Nominating and Corporate Governance

|

Professional Background and Experience | ||

| ● | Chief Sales Officer, Consolidated Communications Holdings, Inc. (Nasdaq: CNSL), a national internet and telecommunications service provider (2014 – 2017) | ||

| ● | Chief Operating Officer and Corporate Vice President, Enventis Corporation (formerly known as Hickory Tech Corporation) (Nasdaq: ENVE), an integrated communication service provider serving a five state Midwest area (2011 – 2014) | ||

| ● | President and Chief Executive Officer, Citilink Broadband Solutions, a wireless broadband service provider (2009 – 2010) | ||

| ● | Senior Vice President of Sales, CEB, Inc., a provider of consumer research and strategic advisory services (2007 – 2008) | ||

| ● | Senior Vice President, Minnesota and North Dakota, Integra Telecom, an infrastructure and telecommunications service provider (2000 – 2006) | ||

| Qualifications | |||

| Ms. Wirsbinski’s substantial experience in executive management, particularly her experience leading transformational growth, and her depth of understanding of the telecommunications industry, particularly the community broadband market, qualify her to serve as a director of Clearfield. | |||

| Other Directorships | |||

| ● | Director, Underline Infrastructure Inc. (December 2022 – present) (private) | ||

| ● | Director, Somos Inc. (March 2019 – March 2022) (private) | ||

Under Minnesota law and our bylaws, directors are elected by a plurality of the votes cast at the Annual Meeting by holders of common stock voting for the election of directors. This means that since shareholders will be electing eight directors, the eight nominees receiving the highest number of votes will be elected.

However, in an uncontested election (where, as at the Annual Meeting, the number of nominees does not exceed the number of directors to be elected), any nominee for director who does not receive a majority of votes cast for his or her election is required under our Governance Guidelines to promptly tender his or her resignation following certification of the shareholder vote. Votes against a nominee’s election do not include broker non-votes. The Nominating and Corporate Governance Committee will consider the resignation offer and recommend to the Board whether to accept it. The Board will act on the Nominating and Corporate Governance Committee’s recommendation within 90 days following certification of the shareholder vote. The Board will promptly disclose its decision whether to accept the director’s resignation offer (and the reasons for rejecting the resignation offer, if applicable) in a Current Report on Form 8-K filed with the Securities and Exchange Commission. Any director who tenders his or her resignation as described above will not participate in the Nominating and Corporate Governance Committee’s recommendation or Board action regarding whether to accept the resignation offer. Proxies will be voted in favor of each nominee unless otherwise indicated. In addition, if each member of the Nominating and Corporate Governance Committee receives a majority against vote at the same election, then the independent directors who did not receive a majority against vote shall appoint a committee amongst themselves to consider the resignation offers and recommend to the Board whether to accept them.

The Board of Directors Recommends

Shareholders Vote FOR the Election of Each Nominee Identified in Proposal 1

_________________________________

PROPOSAL 2:

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Our Board of Directors determined that an advisory vote on named executive officer compensation (commonly referred to as “say-on-pay”) will be held every year. Accordingly, pursuant to the requirements of Section 14A of the Exchange Act and the related rules of the Securities and Exchange Commission, we are asking our shareholders to cast an advisory vote on named executive officer compensation at the Annual Meeting.

Clearfield is a performance-driven, financially focused company with a long track record of strong performance. As described in detail in the Executive Compensation section of this proxy statement, our named executive officers have the opportunity to earn significant portions of their compensation based on the achievement of specific annual goals intended to drive financial performance of our business and the realization of increased shareholder value.

In addition to our consistent focus on pay-for-performance, we have undertaken a multi-year shareholder engagement effort. We received compensation-related and governance-related feedback and took numerous actions in response to that feedback in 2021, 2022 and 2023. The say-on-pay proposal presented at our 2023 Annual Meeting of Shareholders received 84% approval by our shareholders. We attribute the strong shareholder support for the say-on-pay proposal to our engagement efforts and our responsiveness to shareholder feedback. We describe the compensation-related feedback we received, and the actions we have taken in response to that feedback, below under “Corporate Governance Highlights – Shareholder Engagement.”

We are asking our shareholders to indicate their support for our named executive officer compensation as described in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask our shareholder to vote “FOR” the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of Clearfield, Inc. approve, on an advisory basis, the compensation of the named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (including in the Compensation Discussion and Analysis, the accompanying compensation tables and related narrative).

While this vote is advisory, and not binding on the Compensation Committee or the Board of Directors, it will provide valuable information to us that the Compensation Committee will be able to consider when determining executive compensation philosophy, policies, and practices for the remainder of fiscal year 2023 and beyond.

Advisory approval of this Proposal 2 requires the affirmative vote of the holders of the majority of the shares present and entitled to vote on this Proposal 2.

The Board of Directors Recommends

Shareholders Vote FOR

Proposal 2: Advisory Vote on Executive Compensation

_______________________

EQUITY COMPENSATION PLAN INFORMATION

The following table describes shares of our common stock that are available on September 30, 2023, for purchase under outstanding stock-based awards, or reserved for issuance under stock-based awards or other rights that may be granted in the future, under our equity compensation plans:

|

Plan Category |

Number of securities to be |

Weighted-average exercise price |

Number of securities remaining |

|||||||||

|

Equity compensation plans approved by security holders |

344,699 | $ | 37.04 | 1,259,982 | ||||||||

|

Equity compensation plans not approved by security holders |

- | N/A | - | |||||||||

|

Total |

344,699 | $ | 37.04 | 1,259,982 | ||||||||

|

(1) |

Consists of outstanding stock options to acquire 254,124 shares of common stock, and 90,575 outstanding time-based restricted shares granted under the Company's equity compensation plans. |

|

(2) |

Consists of the weighted average exercise price of stock options granted under the Company's equity compensation plans. |

There are no equity compensation plans not approved by our shareholders and all outstanding equity awards have been granted pursuant to shareholder-approved plans.

CORPORATE GOVERNANCE HIGHLIGHTS

Our Corporate Governance Practices

As part of Clearfield’s commitment to corporate governance best practices, the Board has adopted the following practices, which are described in more detail in this proxy statement.

| ✔ |

Annual election of all directors |

✔ |

Shareholder right to call special meetings with a 25% ownership threshold |

|

| ✔ |

Directors elected by a majority of votes cast in an uncontested election |

✔ |

Annual say-on-pay vote |

|

| ✔ |

7 of 8 director nominees are independent |

✔ |

No hedging or pledging of stock by Clearfield directors and executive officers |

|

| ✔ |

Independent Board chair and committees |

✔ |

Robust clawback policy |

|

| ✔ |

Two new independent directors in two years |

✔ |

Annual review of charters and governance guidelines |

|

| ✔ |

50% of director nominees are women or identify as diverse |

✔ |

Regular executive sessions of the Board and its committees |

|

| ✔ |

Active shareholder engagement |

✔ |

Robust share ownership guidelines for executive officers and directors |

|

| ✔ |

Robust policy against over-boarding |

✔ |

Board oversight of material risks |

We are committed to a robust and proactive shareholder engagement program. The Board of Directors values the perspectives of our shareholders, and feedback from shareholders on our business, corporate governance, executive compensation, and our ESG program are important considerations for Board and committee discussions throughout the year.

In calendar year 2021, the Compensation Committee and Nominating and Corporate Governance Committee began a substantial, multi-year shareholder engagement effort that continued into 2023. In calendar year 2023, we reached out to the 15 largest institutional shareholders, who, according to public reporting, control approximately 49% of our total outstanding shares. While some of our top shareholders declined engagement this year, our group was able to get feedback from shareholders representing approximately 11% of our shares outstanding.

Primary participants in our discussions with shareholders in calendar year 2023 and early calendar year 2024 were the chair of the Nominating and Corporate Governance Committee, the chair of the Compensation Committee, our Chief Financial Officer, and our General Counsel. Directors are generally available to participate in our engagement meetings upon request from shareholders. After our engagement discussions, the chair of the Nominating and Corporate Governance Committee provided the feedback received from our shareholders to all directors.

The Board, the Compensation Committee, the Nominating and Corporate Governance Committee and our management have found these outreach efforts over the past several years to be very helpful in understanding our investors’ perspectives on various business and governance matters. Some of the feedback and actions taken over the past several years included:

|

What We Heard |

What We Did |

|

|

Increase Board diversity |

We added Walter L. Jones, Jr. and Carol Wirsbinski to the Board in December 2021. |

|

|

Increase responsiveness to shareholder vote in director elections |

We adopted a majority vote standard for uncontested director elections with a director resignation policy in December 2021. |

|

|

Enhance disclosure about analysis of compensation risks |

Included a stand-alone section in our proxy statements entitled “Consideration of Risk in Compensation” that describes our annual compensation risk analysis. |

|

|

Increase executive compensation disclosure and transparency, including greater detail on performance targets/goals/maximums |

We significantly expanded the transparency of our compensation decisions, practices and policies as described in the Compensation Discussion and Analysis section and other sections of our proxy statements. |

|

|

Add additional compensation risk mitigators |

We adopted a robust Compensation Recoupment Policy in September 2021, and amended the policy in September 2023, that applies not only to financial restatements, but also to errors in calculation or certain conduct that is detrimental to Clearfield. |

|

|

Review Tax Gross Up Plan |

In January 2023, consistent with its long-standing practice, the Compensation Committee determined that Clearfield would not approve any additional participants in the Tax Gross Up Plan (currently limited to two executives) and would not amend or modify the Tax Gross Up Plan to expand any benefit to any executive officer participant in the Tax Gross Up Plan. |

|

|

Add additional compensation risk mitigators |

In September 2022, our Board of Directors adopted stock ownership guidelines for our executive officers and the non-employee directors and adopted an equity granting policy to document the Compensation Committee’s well-established, disciplined process for granting equity awards. See “– Compensation Discussion and Analysis – Our Other Compensation Policies” for a summary of the stock ownership guidelines and the equity granting policy. |

|

|

Eliminate outdated or shareholder “unfriendly” provisions of the 2007 Stock Compensation Plan (the “2007 Plan”), such as the “liberal” change in control definition. |

In 2023, the Board of Directors adopted, and our shareholders approved, the Clearfield, Inc. 2022 Stock Compensation Plan (the “2022 Plan”), which replaced the 2007 Plan. The 2022 Plan does not have a liberal definition of a change in control and reflects other feedback from our shareholders, investors and proxy advisory firms. |

|

|

Introduce performance-based metrics to the long-term equity incentive program. |

In November 2023, the Compensation Committee added performance stock units (PSUs) to the executive compensation program for fiscal 2024. See “– Compensation Discussion and Analysis – Compensation Decisions for 2024” for a summary of the PSU grants for fiscal 2024. |

The Compensation Committee and the Board continue to consider additional compensation governance and corporate governance improvements for 2023 and beyond. We welcome the opportunity to engage with Clearfield shareholders and investors on these topics and others in the future.

The Board of Directors undertook a review of director independence in December 2023 as to all eight directors then serving. As part of that process, the Board reviewed all transactions and relationships between each director (or any member of his or her immediate family) and Clearfield, our executive officers and our auditors, and other matters bearing on the independence of directors. As a result of this review, the Board of Directors affirmatively determined that each of the directors, with the exception of Ms. Beranek, is independent according to the “independence” definition of the Nasdaq Listing Rules. Ms. Beranek is not independent under the Nasdaq Listing Rules because she is employed by Clearfield and serves as our executive officer.

Committees of the Board of Directors and Committee Independence

The Board of Directors has established a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee. The composition (as of December 27, 2023) and function of these committees are set forth below.

|

Compensation Committee |

Nominating and Corporate |

Audit Committee |

||

|

Carol A. Wirsbinski (Chair) |

Donald R. Hayward (Chair) |

Charles N. Hayssen (Chair) |

||

|

Patrick F. Goepel |

Walter L. Jones, Jr. |

Patrick F. Goepel |

||

|

Walter L. Jones, Jr. |

Ronald G. Roth |

Roger G. Harding |

||

|

Ronald G. Roth |

Carol A. Wirsbinski |

Donald R. Hayward |

Compensation Committee (14 meetings in fiscal 2023)

The Compensation Committee reviews and approves the compensation and other terms of employment of our Chief Executive Officer and our other executive officers. Among its other duties, the Compensation Committee oversees all significant aspects of our executive compensation plans and benefit programs. The Compensation Committee annually reviews and approves corporate goals and objectives for the compensation of the Chief Executive Officer and the other executive officers, as well as the Board of Directors’ evaluation of the Chief Executive Officer pursuant to the evaluation process established by the Nominating and Corporate Governance Committee. In connection with its review of compensation of executive officers or any form of incentive or performance-based compensation, the Compensation Committee will also review and discuss risks arising from our compensation policies and practices. The Compensation Committee also administers our 2022 Stock Compensation Plan (the “2022 Plan”), which replaced the 2007 Stock Compensation Plan (the “2007 Plan”) upon approval by our shareholders in February 2023. Until it was replaced by the 2022 Plan, the Compensation Committee administered the 2007 Plan.

The charter of the Compensation Committee requires that this Committee consist of no fewer than two Board members who satisfy the requirements of the Nasdaq Stock Market and the “non-employee director” requirements of Section 16b-3 of the Securities Exchange Act of 1934. Each member of our Compensation Committee meets these requirements. A copy of the current charter of the Compensation Committee is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com.

Nominating and Corporate Governance Committee (8 meetings in fiscal 2023)

The Nominating and Corporate Governance Committee is charged with the responsibility of identifying, evaluating and approving qualified candidates to serve as directors of Clearfield, ensuring that our Board and governance policies are appropriately structured, developing and recommending a set of corporate governance guidelines, overseeing Board orientation, training and evaluation, and establishing an evaluation process for the Chief Executive Officer, as well as making recommendations to the Board regarding succession plans for the Chief Executive Officer position. The Nominating and Corporate Governance Committee is also responsible for the leadership structure of our Board, including the composition of the Board and its committees, and an annual review of the position of Chair of the Board. As part of its annual review, the Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to serve as Chair and recommending to the Board of Directors any changes in such position. The Nominating and Corporate Governance Committee also has responsibility for overseeing our annual process of self-evaluation by members of the committees and the Board of Directors as a whole. Additionally, the Nominating and Corporate Governance Committee is responsible for reviewing and assessing Clearfield’s significant environmental, social and governance (ESG) issues, risks, and trends, and oversees Clearfield's engagement with and disclosure to shareholders and other interested parties concerning ESG matters.

The charter of the Nominating and Corporate Governance Committee requires that this Committee consist of at least two Board members who satisfy the “independence” requirements of the Nasdaq Stock Market. Each member of our Nominating and Corporate Governance Committee meets these requirements. A copy of the current charter of the Nominating and Corporate Governance Committee is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com.

Audit Committee (4 meetings in fiscal 2023)

The Audit Committee assists the Board by reviewing the integrity of our financial reporting processes and controls; the qualifications, independence, and performance of the independent auditors; and compliance by us with certain legal and regulatory requirements. The Audit Committee has the sole authority to retain, compensate, oversee, and terminate the independent auditors. The Audit Committee reviews our annual audited financial statements, quarterly financial statements and filings with the Securities and Exchange Commission. The Audit Committee reviews reports on various matters, including our critical accounting policies, significant changes in our selection or application of accounting principles and our internal control processes. Under its charter, the Audit Committee exercises oversight of significant risks relating to financial reporting and internal control over financial reporting, including discussing these risks with management and the independent auditor and assessing the steps management has taken to minimize these risks. The Audit Committee also pre-approves all audit and non-audit services performed by the independent auditor.

The Audit Committee operates under a written charter that is available by following the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. The Board of Directors has determined that all members of the Audit Committee are “independent” directors under the rules of the Nasdaq Stock Market and the rules of the Securities and Exchange Commission. Our Board of Directors has reviewed the education, experience, and other qualifications of each of the members of its Audit Committee. After review, the Board of Directors has determined that Messrs. Hayssen, Goepel and Harding each meet the Securities and Exchange Commission definition of an “audit committee financial expert.” The members of the Audit Committee also meet the Nasdaq Stock Market requirements regarding the financial sophistication and the financial literacy of members of the audit committee. A report of the Audit Committee is set forth below.

The Board has a non-executive Chair of the Board and three standing committees that are each led by a chair. The members of each committee are “independent directors” under the Nasdaq Listing Rules and meet the other similar independence requirements applicable to that committee. Our Chief Executive Officer is a director, but she does not serve as chair of the Board and does not serve on any committees.

We believe the current Board leadership structure is appropriate for Clearfield at this time because it allows the Board and its committees to fulfill their responsibilities, draws upon the experience and talents of all directors, encourages management accountability to the Board, and helps maintain good communication among Board members and with management. In particular, we believe that having our Chief Executive Officer serve as a member of the Board and having a separate individual serve as Chair of the Board allows the independent directors and the Chief Executive Officer to contribute their different perspectives and roles to our strategy development. Our current Board leadership structure is part of the policies reflected in our Governance Guidelines and the Nominating and Corporate Governance Committee is empowered through its charter to consider and make changes to the structure if necessary.

Board’s Role in Risk Oversight

We face a number of risks, including financial, technological, operational, regulatory, strategic, and competitive risks. Management is responsible for the day-to-day management of risks we face, while the Board has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors ensures that the processes for identification, management, and mitigation of risk by our management are adequate and functioning as designed.

Our Board exercises its oversight both through the full Board and through the three standing committees of the Board: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The three standing committees exercise oversight of the risks within their areas of responsibility, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees.

The Board and the three committees receive information used in fulfilling their oversight responsibilities through our executive officers and advisors, including our outside legal counsel and our independent registered public accounting firm. At meetings of the Board, management makes presentations to the Board regarding our business strategy, operations, financial performance, ESG issues, fiscal year budgets, technology, quality, regulatory, and other matters. Many of these presentations include information relating to the challenges and risks to our business and the Board and management engage in discussion on these topics.

Each of the committees also receives reports from management regarding matters relevant to the work of that committee. These management reports are supplemented by information relating to risk from our advisors. Additionally, following committee meetings, the Board receives reports by each committee chair regarding the committee’s considerations and actions. In this way, the Board also receives additional information regarding the risk oversight functions performed by each of these committees.

Environmental, Social and Governance

We are committed to the continuous evolution of our environmental, social, and governance (ESG) program. This year, we engaged a third party to support us in strengthening our policies, enhancing transparency and disclosure, and building new strategies to address relevant ESG risks and opportunities. We believe that integrating ESG considerations into our business strategies will not only drive long-term value for our shareholders but also positively impact the communities in which we operate. We will continue to work toward improvement around our ESG priorities during 2024 and aim to provide additional ESG disclosures in 2024.

ESG Oversight. Our Board of Directors and executive leadership team take an active role in overseeing and guiding our ESG initiatives. We have established an ESG Working Group comprised of cross-functional employees with executive level support and oversight that is tasked with developing our ESG program and integrating ESG matters into our corporate strategy and decision-making processes. Our Board of Directors also maintains responsibility for ESG, specifically through the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee reviews and assesses our significant ESG issues, risks, and trends, and oversees our engagement with and disclosures to shareholders and other interested parties concerning ESG matters. The Board and the Nominating and Corporate Governance Committee receives regular updates on our ESG program from representatives of the ESG Working Group.

Environmental Management. We aim to understand and manage the impact of our products and operations to minimize our environmental footprint. We have several company-wide programs in place to protect the environment and track our energy consumption and are committed to reducing our use of water and electricity through efficient technologies, such as the use of LED lighting in our facilities and other efficiency measures. We also have a robust recycling program in all our facilities and processes compliant with European Union’s Directive 2002/95/EC, Restriction of the Use of certain Hazardous Substances in Electrical and Electronic Equipment (RoHS). As part of this, we strive to use materials efficiently in our manufacturing process to minimize manufacturing waste.

Human Capital Management. We prioritize human capital management by fostering a culture of inclusivity, learning, and well-being. We strive to provide a safe and supportive work environment that values diversity, encourages professional development, and promotes collaboration. We provide rigorous training programs for manufacturing and other technical employees to allow them to develop the necessary skillset for their roles and promote their career development. Through our learning management system (LMS) launched in 2023, we will continue to expand the training and development opportunities offered to our employees. Additionally, we maintain open channels of communication to engage with our employees, including weekly companywide hybrid meetings.

Diversity and Inclusion. We are committed to promoting a diverse workforce, where all employees feel respected, valued, and empowered. We leverage our applicant tracking system to work toward increasing representation across all levels of our organization, including leadership roles. We maintain a strict policy prohibiting harassment and discrimination of any kind.

Quality and Safety. Ensuring the quality and safety of our products is of utmost importance. We maintain stringent quality control processes and adhere to all relevant regulatory standards to guarantee the safety and reliability of our products. Our rigorous quality management system is ISO 9001:2015 certified and we are working toward implementing measures to monitor risks and performance throughout our supply chain.

Business Ethics. Our commitment to ethical conduct is reflected in our Code of Ethics and Business Conduct, which outlines principles and guidelines for our directors, officers, employees, and other representatives, such as contractors, to follow. This code is publicly available under the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. We promote transparent and honest communication and have adopted a Whistleblower Policy that governs the investigation and reporting of suspected improper activities that violate our Code of Ethics and Business Conduct.

The Nominating and Corporate Governance Committee will consider candidates for Board membership suggested by its members, other Board members, as well as management and shareholders. Shareholders who wish to recommend a prospective nominee should follow the procedures set forth in Section 2.14 of our bylaws as described in the section of this proxy statement entitled “Shareholder Proposals for Nominees.” The Nominating and Corporate Governance Committee has not adopted a formal policy for increasing or decreasing the size of the Board of Directors. Our Governance Guidelines provide that the Board should generally have between six and nine directors. The Board of Directors is currently comprised of eight directors. The Nominating and Corporate Governance Committee believes that an eight-person Board of Directors is appropriate at this time. At eight directors, the Board of Directors has a diversity of talent and experience to draw upon, is able to appropriately staff the committees of the Board and is able to engage the directors in Board and committee service, all while maintaining efficient function and communication among members. If appropriate, the Board may determine to increase or decrease its size, including in order to accommodate the availability of an outstanding candidate.

Criteria for Nomination to the Board; Diversity Considerations. The Nominating and Corporate Governance Committee is responsible for identifying, evaluating, and recommending qualified candidates for nomination as directors. The Nominating and Corporate Governance Committee has not adopted minimum qualifications that nominees must meet in order for the Nominating and Corporate Governance Committee to recommend them to the Board of Directors, as the Nominating and Corporate Governance Committee believes that each nominee should be evaluated based on his or her merits as an individual, taking into account the needs of Clearfield and the Board of Directors. The Nominating and Corporate Governance Committee has determined that it will evaluate each prospective nominee against the following standards and qualifications:

| ● |

Diversity in terms of gender, race, ethnicity, sexual orientation, and other characteristics that we believe contribute to high quality decision-making, problem-solving and the effectiveness of the Board |

| ● |

Knowledge, experience, skills, and expertise relevant to our business and the work of the Board and its committees, as well as diversity of these characteristics among the Board |

| ● |

Background, including demonstrated high personal and professional ethics and integrity |

| ● |

The ability to exercise good business judgment and enhance the Board’s ability to manage and direct the affairs and business of the Clearfield |

| ● |

Commitment, including the willingness to devote adequate time to the work of the Board and its committees |

| ● |

The ability to represent the interests of all shareholders and not a particular interest group |

| ● |

The skills needed by the Board, within the context of the existing composition of the Board, including knowledge of our industry and business or experience in global business, sales and marketing, finance, and other disciplines relevant to the Company’s success |

| ● |

The candidate’s qualification as “independent” under the listing standards of the Nasdaq Stock Market or other standards and qualification to serve on Board committees |

The N&CG Committee also considers other relevant factors as it deems appropriate.

The Board has adopted a formal policy with respect to diversity through our Governance Guidelines. Under that policy, when evaluating candidates for nomination as new directors, the Nominating and Corporate Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups.

In reviewing prospective nominees, the Nominating and Corporate Governance Committee reviews the number of public company boards on which a director nominee serves to determine if the nominee will have the ability to devote adequate time to the work of our Board and its committees. Our Governance Guidelines provide that (a) non-employee directors should serve on no more than four boards of publicly held companies (including the Board), (b) non-employee directors who are serving as a chief executive officer of a public company should serve on no more than two boards of publicly held companies (including the Board), and (c) officers of the Company should serve on no more than two boards of for-profit companies (publicly or privately held) (including the Board), provided in each case that such service does not adversely affect the person’s ability to perform his or her duties to the Company. On a case-by-case basis, the Nominating and Corporate Governance Committee may approve, in its discretion, service by a non-employee director or officer of the Company on more boards than set forth above.

As part of the nominee selection process for this Annual Meeting, the Nominating and Corporate Governance Committee reviewed the knowledge, experience, skills, expertise, and other characteristics of each director nominee. Based upon that review, the Nominating and Corporate Governance Committee believes that each director contributes to the Board’s diversity in terms of knowledge, experience, skills, expertise, and other demographics that particular director brings to the Board.

The Nominating and Corporate Governance Committee also considers such other relevant factors as it deems appropriate. The Nominating and Corporate Governance Committee will consider persons recommended by the shareholders using the same standards used for other nominees.

Clearfield Board Diversity. Recently adopted Nasdaq listing requirements require each listed company to have, or explain why it does not have, two diverse directors on the board, including at least one diverse director who self-identifies as female and one diverse director who self-identifies as an underrepresented minority or LGBTQ+ (subject to the exceptions). Our current Board composition is in compliance with the Nasdaq diversity requirement.

The table below provides certain highlights of the composition of our board members, each of whom are nominees for election at the Annual Meeting. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

|

Board Diversity Matrix (As of December 27, 2023) |

||||

|

Total Number of Directors |

8 |

|||

|

Female |

Male |

Non- |

Did Not |

|

|

Part I: Gender Identity |

||||

|

Directors |

2 |

6 |

0 |

0 |

|

Part II: Demographic Background |

||||

|

African American or Black |

0 |

1 |

0 |

0 |

|

Alaskan Native or Native American |

0 |

0 |

0 |

0 |

|

Asian |

0 |

0 |

0 |

0 |

|

Hispanic or Latinx |

0 |

0 |

0 |

0 |

|

Native Hawaiian or Pacific Islander |

0 |

0 |

0 |

0 |

|

White |

2 |

5 |

0 |

0 |

|

Two or More Races or Ethnicities |

0 |

0 |

0 |

0 |

|

LGBTQ+ |

1 |

|||

|

Did Not Disclose Demographic Background |

0 |

|||

Director Nominee Skills, Experience and Background. The following is a summary of some of the skills, experience, and background that our director nominees bring to the Board:

|

Executive and Senior |

Strategic |

Business Development |

Telecommunications |

|

Financial Expertise |

Acquisitions and |

Operations |

Manufacturing |

|

Public Company |

Sales and Marketing |

Risk Management |

Governance |

Process for Identifying and Evaluating Nominees. The process for identifying and evaluating nominees to the Board of Directors is initiated by identifying a slate of candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board and, if the Nominating and Corporate Governance Committee deems appropriate, a third-party search firm. Under our Governance Guidelines, when evaluating candidates for nomination as new directors, the Nominating and Corporate Governance Committee will consider, and will ask any search firm that it engages to provide, a set of candidates that includes qualified women and individuals from historically underrepresented groups. The Nominating and Corporate Governance Committee evaluates these candidates by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. One or more Nominating and Corporate Governance Committee members and other directors may interview the prospective nominees in person, by video or by telephone. After completing the evaluation, the Nominating and Corporate Governance Committee makes a recommendation to the full Board of the nominees to be presented for the approval of the shareholders or for election to fill a vacancy.

Board Nominees for the 2024 Annual Meeting. The nominees for the Annual Meeting were selected by the Nominating and Corporate Governance Committee in December 2023. All nominees were elected by shareholders at the 2023 Annual Meeting of Shareholders. We have not engaged a third-party search firm to assist us in identifying potential director candidates, but the Nominating and Corporate Governance Committee may choose to do so in the future.

Shareholder Proposals for Nominees. The Nominating and Corporate Governance Committee will consider written proposals from shareholders for nominees for director. Any such nominations should be submitted to the Nominating and Corporate Governance Committee c/o the Secretary of Clearfield, Inc. To be considered, the written notice must be timely received and in proper form as described in our bylaws and in the section of this proxy statement entitled “Shareholder Proposals and Shareholder Nominees for 2025 Annual Meeting.”

Board Attendance at Board, Committee and Annual Shareholder Meetings

During fiscal 2023, the Board of Directors met 8 times. Each nominee for director attended at least 75% of the meetings of the Board and committees on which he or she served during fiscal 2023. The Board of Directors regularly meets in executive session without the presence of members of management, including the Chief Executive Officer. Our Governance Guidelines require that each director make all reasonable efforts to attend the annual meeting of shareholders. Seven of the eight directors then serving attended the 2023 Annual Meeting of Shareholders.

Shareholders may communicate with the Board of Directors as a group, the chair of any committee of the Board of Directors, or any individual director by sending an e-mail to board@seeclearfield.com or by directing the communication in care of the Secretary of Clearfield, to the address set forth on the front page of this proxy statement. Shareholders making a communication in this manner will receive a confirmation of receipt of the communication if the Secretary is provided with an address for that purpose and the shareholder does not otherwise request that no confirmation be sent.

All communications that are not excluded for the reasons stated below will be forwarded unaltered to the director(s) to which the communication is addressed or to the other appropriate director(s). Communications received from shareholders will be forwarded as part of the materials sent before the next regularly scheduled Board or committee meeting, although the Board has authorized the Secretary, in his or her discretion, to forward communications on a more expedited basis if circumstances warrant.

The Board of Directors has authorized the Secretary to exclude a communication on matters that are unrelated to the duties and responsibilities of the Board, such as:

|

● |

Product inquiries, complaints, or suggestions |

|

● |

New product suggestions |

|

● |

Resumes and other forms of job inquiries |

|

● |

Surveys |

|

● |

Business solicitations or advertisements |

In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded. Any excluded communication will be made available to the Board of Directors upon request of any director.

If shareholders have a communication that is a nomination of a director or is a proposal for shareholder action, the communication must be directed to the Secretary and must conform to the requirements of Clearfield’s bylaws. For more information, please review our bylaws and the sections of this proxy statement entitled “Director Nominations – Shareholder Proposals for Nominees” and “Shareholder Proposals and Shareholder Nominees for 2025 Annual Meeting.”

We have adopted a code of ethics that applies to all directors, officers, and employees, including our principal executive officer, principal financial officer and controller. This code of ethics is included in our Code of Ethics and Business Conduct which is publicly available under the link to “Corporate Governance” in the “For Investors” section of our website at www.SeeClearfield.com. To the extent permitted, we intend to disclose any amendments to, or waivers from, the code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions or with respect to the required elements of the code of ethics on our website under the “Corporate Governance” section.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following report of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the 1934 Securities Exchange Act, as amended, except to the extent that we specifically incorporate it by reference in such filing.

In accordance with its charter, the Audit Committee reviewed and discussed the audited financial statements with management and Baker Tilly US, LLP, our independent registered public accounting firm. The discussions with Baker Tilly US, LLP also included the matters required by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

Baker Tilly US, LLP provided to the Audit Committee the written disclosures and the letter regarding its independence as required by the Public Company Accounting Oversight Board. This information was discussed with Baker Tilly US, LLP.

Based on the review and discussions referred to above, the Audit Committee recommended to our Board that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023.

BY: THE AUDIT COMMITTEE

Charles N. Hayssen (Chair)

Patrick F. Goepel

Roger G. Harding

Donald R. Hayward

Set forth below is biographical and other information for our current executive officers. Information about Ms. Beranek, our President and Chief Executive Officer, may be found in this proxy statement under the heading “Election of Directors.”

John P. Hill, 58, was appointed as our Chief Operating Officer effective October 30, 2008. Prior to being appointed in this position, Mr. Hill had been our Vice President of Engineering and Product Management since 2007. He also served as our Vice President of Product Management and Development from 2004 to 2007 and was our first Vice President of Sales from 2003 to 2004. Mr. Hill attended Macalester College and the University of Minnesota.

Daniel R. Herzog, 59, has been Chief Financial Officer since August 25, 2011, and served as Interim Chief Financial Officer from February 19, 2011, until his appointment in August 2011. He served as Clearfield’s Vice President of Administration from June 2009, until his appointment as Interim Chief Financial Officer, which also includes the duties of Vice President of Administration. Mr. Herzog previously served as our Comptroller and principal accounting officer from September 2003 through February 2006. Mr. Herzog held positions of Controller and Chief Financial Officer in his 13 years at Americable, which was acquired by Clearfield in 2003. Mr. Herzog received his Bachelors of Arts degree in Accounting in 1986 from Gustavus Adolphus College in St. Peter, Minnesota.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (CD&A) describes our compensation philosophy, programs, and practices for our named executive officers. Our named executive officers for fiscal 2023, whose compensation is discussed in this CD&A, are as follows:

|

Name |

Title |

|

Cheryl Beranek |

President and Chief Executive Officer |

|

Daniel R. Herzog |

Chief Financial Officer |

|

John P. Hill |

Chief Operating Officer |

This CD&A also is intended to provide a framework within which to understand the actual compensation awarded to, earned, or held by each named executive officer during fiscal 2023 as reported in the accompanying compensation tables.

Our 2023 Business and Financial Results

Clearfield is a leader in fiber connectivity. We design, manufacture, and distribute fiber protection, fiber management and fiber delivery solutions to enable rapid and cost-effective fiber-fed deployment throughout the broadband service provider space primarily across North America.

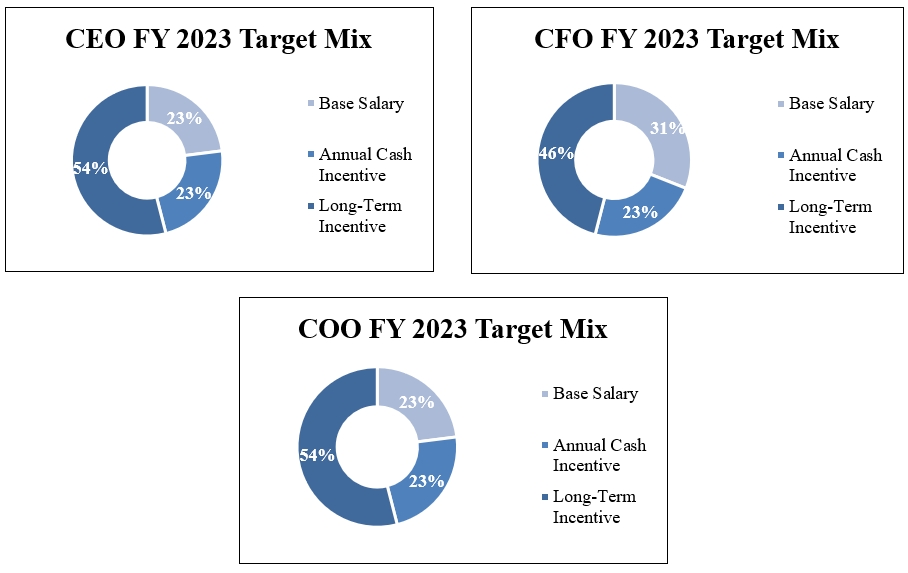

Our compensation program for fiscal 2023 was designed to create a strong link between pay and Clearfield’s performance. A significant portion of our executives’ compensation for fiscal 2023 was tied to the achievement of defined performance goals and other key business, strategic and operational achievements that the Compensation Committee believes align management’s efforts with key drivers of long-term shareholder value.

|

Key Results and Achievements in Fiscal 2023 |

|

| ● |

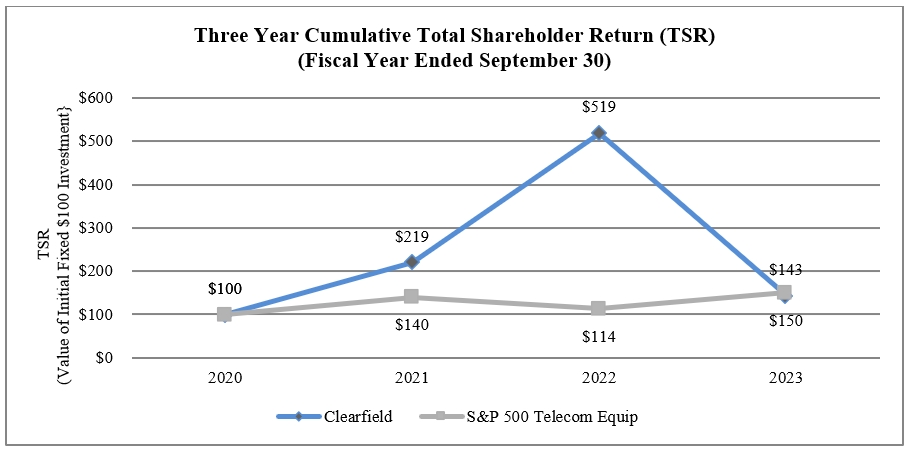

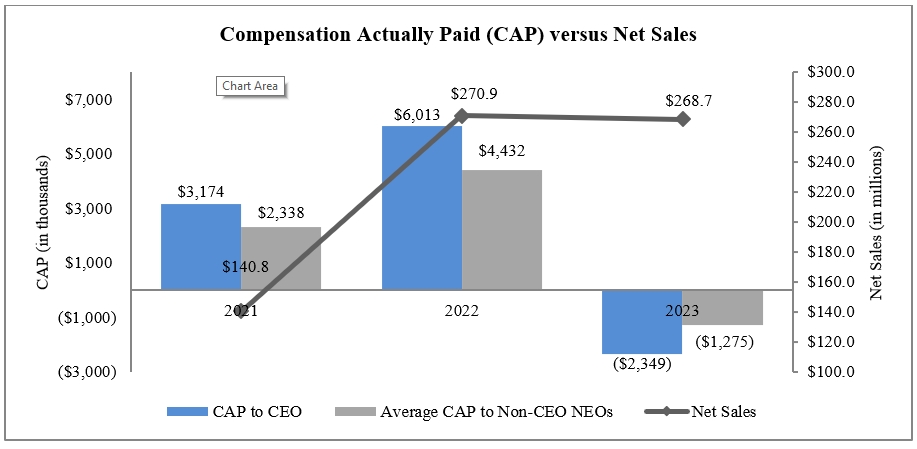

Net sales decreased 0.8% to $268.7 million for fiscal 2023 from $270.9 million in fiscal 2022. |

| ● |

Gross margin for fiscal 2023 was 31.7% compared to 41.7% for fiscal 2022. Gross margin was negatively affected by excess production capacity and the inclusion of Nestor Cables (a lower gross margin profile business acquired in July of 2022) in full year results. |

| ● |

Operating expenses for fiscal 2023 decreased 2.4% to $48.0 million, or 17.9% of net sales, from $49.1 million, or 18.1% of net sales, in fiscal 2022. |

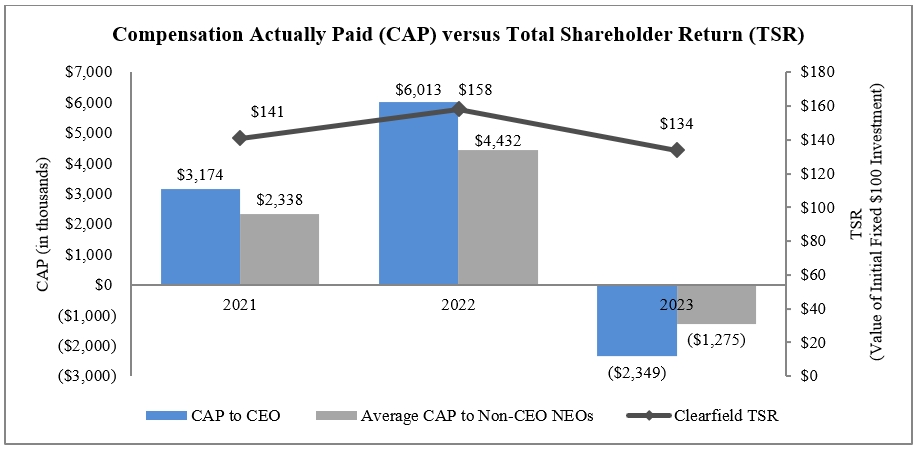

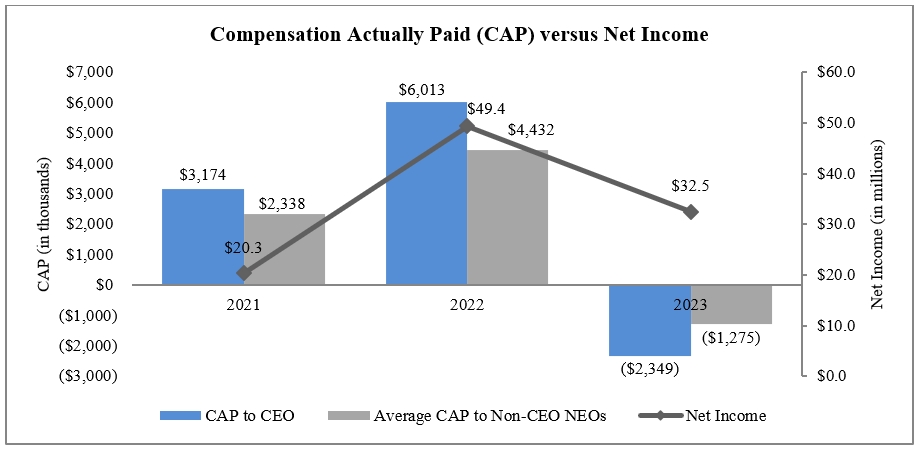

| ● |