| x |

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of

1934

|

| ¨ |

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of

1934

|

|

Minnesota

|

41-1347235

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(I.R.S.

Employer Identification No.)

|

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

Non-accelerated

filer x

|

|

4

|

||

|

ITEM

1.

|

4

|

|

|

ITEM

1A.

|

9

|

|

|

ITEM

1B.

|

17

|

|

|

ITEM

2.

|

17

|

|

|

ITEM

3.

|

17

|

|

|

ITEM

4.

|

18

|

|

|

|

18

|

|

|

ITEM

5.

|

20

|

|

|

ITEM

6.

|

20

|

|

|

ITEM

7.

|

20

|

|

|

ITEM

7A.

|

30

|

|

|

ITEM

8.

|

31

|

|

|

ITEM

9.

|

51

|

|

|

ITEM

9A.

|

52

|

|

|

ITEM

9B.

|

52

|

|

|

|

52

|

|

|

ITEM

10.

|

52

|

|

|

ITEM

11.

|

52

|

|

|

ITEM

12.

|

52

|

|

|

ITEM

13.

|

53

|

|

|

ITEM

14.

|

53

|

|

|

54

|

||

|

ITEM

15.

|

54

|

|

|

55

|

||

|

56

|

||

|

57

|

||

|

58

|

||

|

ITEM

1.

|

|

·

|

Ultraviolet

(UV) Detector-Based Products

We

currently manufacture value-added products built around UV detectors

fabricated by Optronics and procured externally. These products

are:

|

|

·

|

SunUV®

Personal UV Monitor

The SunUV®

Personal UV Monitor (formerly, SunUVWatch®)

is a personal ultraviolet (UV) radiation monitor that also incorporates

a

time/day/date function. It detects UV radiation that is hazardous

to human

health. In fiscal year 2006, we developed and introduced an attractive

new

PUVM plastic/metal model that offers two key advantages for the product

line. The SunUVStation consumer product complements the Personal

UV

Monitor, and together they were intended to provide Optronics a product

line in the sun protection area. The SunUVStation offers a larger

display

that indicates the UV Index on a colorful 7” diameter analog face for

backyard, pool, patio, campground, or other locations where groups

of

people are exposed to the sun.

|

|

·

|

Industrial

Products: Profiler M UV Meter

Optronics’ Profiler

M

radiometer was created for the printing and coating industries that

use UV

curing. The instrument measures the intensity and distribution of

four UV

bands inside curing chambers. Data from the instrument can be transferred

to a computer for analysis using proprietary CureControl

software

supplied as part of the purchase.

|

|

·

|

Power

Amplifiers

|

|

·

|

In

the 4th

quarter of fiscal year 2006 we completed the sale of our epitaxial

foundry

to an unrelated, third party for total consideration of $1.9 million

in

cash and a license back of the technology within a specified field

of use.

The transaction included sale of APA’s multi-wafer metal organic chemical

vapor deposition system, the technical know-how associated with the

growth

of state-of-the-art epitaxial layers, two heterojunction field effect

transistor patents (United States patent 5,192,987 and United States

patent 5,296,395), an additional pending patent (now allowed, United

States patent application claiming priority of United States provisional

application No. 60/428,856), and associated intellectual property.

Terms

of the transaction allowed APA to market and sell products for

applications greater than 1 GHz and provide revenue sharing based

on

future licensing agreements regarding these patents. The transaction

allowed APA to terminate the lease of an off-site facility utilized

by the

epitaxial foundry and resulted in termination of three employees

associated with the development and growth of epi-layers. The sale

was

intended to decrease operating costs while enabling early entry into

power

amplifier markets utilizing GaN power transistors procured from outside

sources. Such transistors have demonstrated impressive performance

while

maintaining excellent reliability. During the later part of fiscal

2007,

the Company elected to suspend the development of the power amplifier

due

mainly to market uncertainties, and the reliability and stability

of the

Gallium Nitride (GaN) transistors available in the market.

|

|

·

|

Fiber

Distribution Central Office Frame Systems

APACN Fiber Distribution Systems (“FDS”) are high density, easy access

fiber distribution panels and cable management systems that are designed

to reduce installation time, guarantee bend radius protection and

improve

traceability. In the 144-port count configuration, APACN is the industry

leader for density, saving the customer expensive real estate in

the

central office. The product line fully supports a wide range of panel

configurations, densities, connectors, and adapters that can be utilized

on a stand-alone basis or integrated into the panel system. The unique

interchangeable building block design delivers feature rich solutions

which are able to meet the needs of a broad range of network deployments.

|

|

·

|

Fiber

Distribution Outside Plant Cabinets APACN’s

Fiber Scalability Center (“FSC”) is a modular and scalable fiber

distribution platform designed for “grow-as-you-go cost containment” as

fiber goes beyond the control of a central office and closer to the

user.

This allows rollout of FTTH services by communication service providers

without a large initial expense. Each outside plant cabinet stores

feeder

and distribution splices, splitters, connectors and slack cable neatly

and

compactly, utilizing field-tested designs to maximize bend radius

protection, connector access, ease of cable routing and physical

protection, thereby minimizing the risk of fiber damage. The FSC

product

has been designed to scale with the application environment as demand

requires and to reduce service turn-up time for the

end-user.

|

|

·

|

Optical

Components

APACN packages optical components for signal coupling, splitting,

termination, multiplexing, demultiplexing and attenuation to seamlessly

integrate with the APACN FDS. This value-added packaging allows the

customer to source from a single supplier and reduce space requirements.

The products are built and tested to meet the strictest industry

standards

ensuring customers trouble-free performance in extreme outside plant

environments.

|

|

·

|

Cable

Assemblies

APACN manufactures high quality fiber and copper assemblies with an

industry-standard or customer-specified configuration. Industry-standard

assemblies built include but are not limited to: single mode fiber,

multimode fiber, multi-fiber, CATV node assembly, DS1 Telco, DS 3

(734/735) coax, Category 5e and 6, SCSI, Token Ring, and V.35. In

addition, APACN’s engineering services team works alongside the

engineering design departments of our OEM customers to design and

manufacturer custom solutions for both in-the-box as well as network

connectivity assemblies specific to that customer’s product line.

|

|

ITEM

1A.

|

RISK

FACTORS.

|

|

·

|

Challenges

associated with integrating the operations, personnel, etc., of an

acquired company;

|

|

·

|

Potentially

dilutive issuances of equity

securities;

|

|

·

|

Reduced

cash balances and or increased debt and debt service

costs;

|

|

·

|

Risks

associated with geographic or business markets different than those

we are

familiar with; and

|

|

·

|

Diversion

of management attention from current

responsibilities.

|

|

·

|

Difficulties

in achieving adequate yields from new manufacturing

lines,

|

|

·

|

Difficulty

maintaining the precise manufacturing processes required by our products

while increasing capacity,

|

|

·

|

The

inability to timely procure and install the necessary equipment,

and

|

|

·

|

Lack

of availability of qualified manufacturing

personnel.

|

|

·

|

Seek

lower cost suppliers of raw materials or

components.

|

|

·

|

Work

to further automate our assembly

process.

|

|

·

|

Develop

value-added solutions.

|

|

·

|

Seek

offshore sources for manufacturing and assembly

services.

|

|

·

|

local

economic and market conditions;

|

|

·

|

political

and economic instability;

|

|

·

|

fluctuations

in foreign currency exchange rates;

|

|

·

|

tariffs

and other barriers and

restrictions;

|

|

·

|

geopolitical

and environmental risks; and

|

|

·

|

changes

in diplomatic or trade relationships and natural

disasters.

|

|

·

|

delayed

market acceptance of our products;

|

|

·

|

delays

in product shipments;

|

|

·

|

unexpected

expenses and diversion of resources to replace defective products

or

identify the source of errors and correct

them;

|

|

·

|

damage

to our reputation and our customer

relationships;

|

|

·

|

delayed

recognition of sales or reduced sales;

and

|

|

·

|

product

liability claims or other claims for damages that may be caused by

any

product defects or performance

failures.

|

|

Name

|

Age

|

Position

|

|

Dr.

Anil K. Jain

|

61

|

Chief

Executive Officer/President/Chief Financial Officer of APA Enterprises,

Inc.

|

|

Cheri

Beranek Podzimek

|

44

|

President,

APACN

|

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS.

|

|

ITEM

2.

|

PROPERTIES

|

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

|

ITEM

4.

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

|

ITEM

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS.

|

|

Fiscal

2007

|

High

|

Low

|

|||||

|

Quarter

ended June 30, 2006

|

$

|

2.23

|

$

|

1.25

|

|||

|

Quarter

ended September 30, 2006

|

1.59

|

1.21

|

|||||

|

Quarter

ended December 31, 2006

|

1.56

|

1.25

|

|||||

|

Quarter

ended March 31, 2007

|

1.67

|

1.21

|

|||||

|

Fiscal

2006

|

High

|

Low

|

|||||

|

Quarter

ended June 30, 2005

|

$

|

1.62

|

$

|

1.20

|

|||

|

Quarter

ended September 30, 2005

|

1.48

|

1.18

|

|||||

|

Quarter

ended December 31, 2005

|

1.35

|

1.10

|

|||||

|

Quarter

ended March 31, 2006

|

2.01

|

1.17

|

|||||

|

|

|

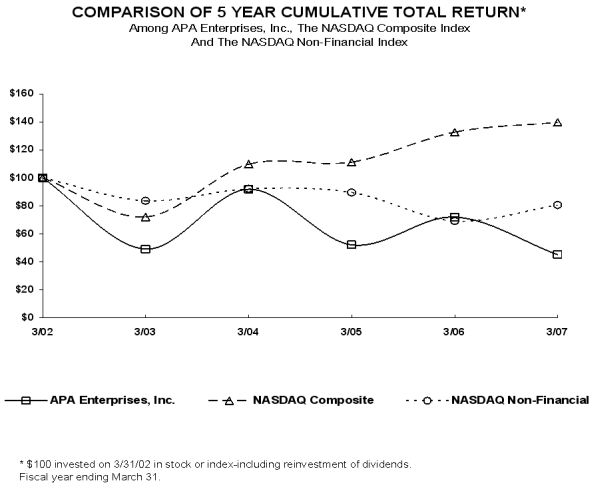

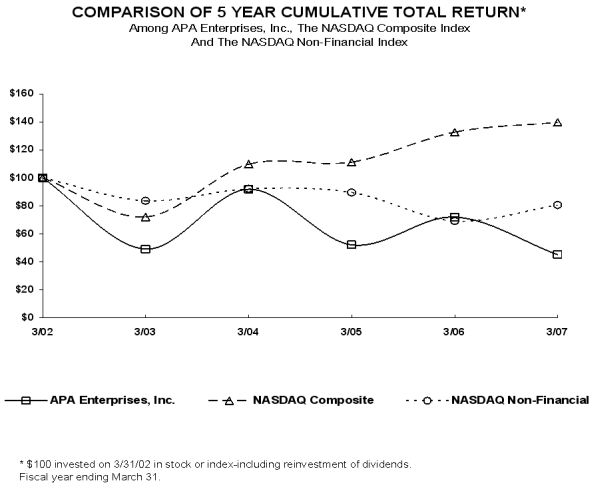

3/02

|

3/03

|

3/04

|

3/05

|

3/06

|

3/07

|

|

APA

Enterprises, Inc.

|

100.00

|

49.08

|

91.88

|

52.03

|

71.96

|

45.02

|

|

|

NASDAQ

Composite

|

100.00

|

72.11

|

109.76

|

111.26

|

132.74

|

139.65

|

|

|

NASDAQ

Non-Financial

|

100.00

|

83.60

|

92.15

|

89.56

|

69.13

|

80.48

|

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

|

2007

|

2006

|

2005

|

2004

|

2003

|

||||||||||||

|

Statements

of Operations Data:

|

||||||||||||||||

|

Revenues

|

$

|

18,560,178

|

$

|

15,956,203

|

$

|

14,112,605

|

$

|

11,909,465

|

$

|

436,157

|

||||||

|

Net

loss

|

(2,147,310

|

)

|

(3,348,848

|

)

|

(3,420,038

|

)

|

(6,535,147

|

)

|

(5,009,434

|

)

|

||||||

|

Net

loss per share, basic and diluted

|

(.18

|

)

|

(.28

|

)

|

(.29

|

)

|

(.55

|

)

|

(.42

|

)

|

||||||

|

Weighted

average number of shares, basic and diluted

|

11,872,331

|

11,872,331

|

11,872,331

|

11,872,331

|

11,873,914

|

|||||||||||

|

Balance

Sheet Data:

|

||||||||||||||||

|

Total

assets

|

$

|

15,722,558

|

$

|

19,593,571

|

$

|

22,074,014

|

$

|

26,083,516

|

$

|

31,884,526

|

||||||

|

Long-term

obligations, including current portion

|

197,599

|

1,360,961

|

1,578,836

|

1,811,759

|

2,173,682

|

|||||||||||

|

Shareholders’

equity

|

13,476,484

|

15,579,442

|

18,922,161

|

22,363,061

|

28,918,943

|

|||||||||||

|

ITEM

7.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

·

|

Stock

option accounting;

|

|

·

|

Accounting

for income taxes; and

|

|

·

|

Valuation

and evaluating impairment of long-lived assets and

goodwill

|

|

Total

|

Less

than

1

Year

|

1-3

years

|

4-5

years

|

After

5

years

|

||||||||||||

|

Long-term

debt (1)

|

$

|

221

|

$

|

82

|

$

|

139

|

$

|

0

|

$

|

0

|

||||||

|

Operating

leases

|

1,932

|

350

|

667

|

476

|

439

|

|||||||||||

|

Total

Contractual Cash Obligations

|

$

|

2,153

|

$

|

432

|

$

|

806

|

$

|

476

|

$

|

439

|

||||||

|

ITEM

7A.

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK.

|

|

ITEM

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA.

|

|

Quarter

Ended

|

|||||||||||||

|

June

30,

2005

|

September

30, 2005

|

December

31, 2005

|

March

31, 2006(1)

|

||||||||||

|

Statement

of Operations Data

|

|||||||||||||

|

Net

revenue

|

$

|

3,571,598

|

$

|

4,127,140

|

$

|

4,446,087

|

$

|

3,811,378

|

|||||

|

Gross

profit

|

725,110

|

904,070

|

1,024,333

|

863,591

|

|||||||||

|

Net

loss

|

(891,006

|

)

|

(1,063,628

|

)

|

(1,275,786

|

)

|

(118,428

|

)

|

|||||

|

Net

loss per share, basic and diluted

|

$

|

(0.08

|

)

|

$

|

(0.09

|

)

|

$

|

(0.11

|

)

|

$

|

(0.01

|

)

|

|

|

Quarter

Ended

|

|||||||||||||

|

June

30,

2006

|

September

30, 2006

|

December

31, 2006

|

March

31, 2007(2)

|

||||||||||

|

Statement

of Operations Data

|

|||||||||||||

|

Net

revenue

|

$

|

5,123,029

|

$

|

4,924,161

|

$

|

4,518,591

|

$

|

3,994,397

|

|||||

|

Gross

profit

|

1,329,987

|

1,359,577

|

1,224,613

|

898,558

|

|||||||||

|

Net

loss

|

(112,018

|

)

|

(400,433

|

)

|

(429,368

|

)

|

(1,205,491

|

)

|

|||||

|

Net

loss per share, basic and diluted

|

$

|

(0.01

|

)

|

$

|

(0.03

|

)

|

$

|

(0.04

|

)

|

$

|

(0.10

|

)

|

|

|

(1)

|

During

the fourth quarter of fiscal year 2006, the Company recorded a deferred

income tax liability of $272,000 related to goodwill from

acquisitions.

|

|

(2)

|

During

the fourth quarter of fiscal year 2007, the Company recorded a goodwill

impairment charge of $852,000 ($519,717 after

tax).

|

|

ASSETS

|

2007

|

2006

|

|||||

|

CURRENT

ASSETS

|

|||||||

|

Cash

and cash equivalents

|

$

|

6,763,369

|

$

|

8,947,777

|

|||

|

Accounts

receivable

|

1,823,060

|

1,892,483

|

|||||

|

Inventories

|

1,490,290

|

1,836,843

|

|||||

|

Prepaid

expenses

|

155,472

|

173,040

|

|||||

|

Bond

reserve funds

|

-

|

126,385

|

|||||

|

Total

current assets

|

10,232,191

|

12,976,528

|

|||||

|

PROPERTY,

PLANT AND EQUIPMENT, net

|

2,210,891

|

2,623,412

|

|||||

|

OTHER

ASSETS

|

|||||||

|

Bond

reserve funds

|

-

|

343,241

|

|||||

|

Goodwill

|

2,570,511

|

3,422,511

|

|||||

|

Assets

held for sale

|

328,312

|

-

|

|||||

|

Other

|

380,653

|

227,879

|

|||||

|

3,279,476

|

3,993,631

|

||||||

|

$

|

15,722,558

|

$

|

19,593,571

|

||||

|

LIABILITIES

AND SHAREHOLDERS’ EQUITY

|

2007

|

2006

|

|||||

|

CURRENT

LIABILITIES

|

|||||||

|

Current

maturities of long-term debt

|

$

|

69,528

|

$

|

1,342,481

|

|||

|

Accounts

payable

|

952,549

|

1,353,828

|

|||||

|

Accrued

compensation

|

887,981

|

815,046

|

|||||

|

Accrued

expenses

|

100,668

|

211,840

|

|||||

|

Total

current liabilities

|

2,010,726

|

3,723,195

|

|||||

|

LONG-TERM

DEBT, net of current maturities

|

128,071

|

18,480

|

|||||

|

DEFERRED

RENT

|

78,116

|

-

|

|||||

|

DEFERRED

INCOME TAXES

|

29,161

|

272,454

|

|||||

|

Total

liabilities

|

2,246,074

|

4,014,129

|

|||||

|

COMMITMENTS

AND CONTINGENCIES

|

-

|

-

|

|||||

|

SHAREHOLDERS’

EQUITY

|

|||||||

|

Undesignated

shares, 4,999,500 authorized shares; no shares issued and

outstanding

|

-

|

-

|

|||||

|

Preferred

stock, $.01 par value; 500 authorized shares; no shares issued and

outstanding

|

-

|

-

|

|||||

|

Common

stock, $.01 par value; 50,000,000 authorized shares; 11,872,331 shares

issued and outstanding at March 31, 2007 and 2006

|

118,723

|

118,723

|

|||||

|

Additional

paid-in capital

|

52,018,729

|

51,968,366

|

|||||

|

Accumulated

foreign currency translation

|

(8,164

|

)

|

(2,153

|

)

|

|||

|

Accumulated

deficit

|

(38,652,804

|

)

|

(36,505,494

|

)

|

|||

|

Total

shareholders equity

|

13,476,484

|

15,579,442

|

|||||

|

$

|

15,722,558

|

$

|

19,593,571

|

||||

|

2007

|

2006

|

2005

|

||||||||

|

Revenues

|

$

|

18,560,178

|

$

|

15,956,203

|

$

|

14,112,605

|

||||

|

Cost

of revenues

|

13,747,443

|

12,439,099

|

11,424,295

|

|||||||

|

Gross

profit

|

4,812,735

|

3,517,104

|

2,688,310

|

|||||||

|

Operating

expenses

|

||||||||||

|

Research

and development

|

473,528

|

1,408,778

|

1,103,972

|

|||||||

|

Selling,

general and administrative

|

6,675,227

|

6,763,068

|

5,379,483

|

|||||||

|

Goodwill

impairment charge

|

852,000

|

-

|

-

|

|||||||

|

Gain

on sale of assets (net)

|

(433,433

|

)

|

(1,198,295

|

)

|

(208,837

|

)

|

||||

|

7,567,322

|

6,973,551

|

6,274,618

|

||||||||

|

Loss

from operations

|

(2,754,587

|

)

|

(3,456,447

|

)

|

(3,586,308

|

)

|

||||

|

Interest

income

|

390,249

|

322,411

|

225,964

|

|||||||

|

Interest

expense

|

(41,941

|

)

|

(90,819

|

)

|

(105,254

|

)

|

||||

|

Other

income(expense), net

|

21,476

|

151,578

|

49,698

|

|||||||

|

369,784

|

383,170

|

170,408

|

||||||||

|

Loss

before income taxes

|

(2,384,803

|

)

|

(3,073,277

|

)

|

(3,415,900

|

)

|

||||

|

Income

taxes

|

(237,493

|

)

|

275,571

|

4,138

|

||||||

|

Net

loss

|

$

|

(2,147,310

|

)

|

$

|

(3,348,848

|

)

|

$

|

(3,420,038

|

)

|

|

|

Net

loss per share

|

||||||||||

|

Basic

and diluted

|

$

|

(0.18

|

)

|

$

|

(0.28

|

)

|

$

|

(0.29

|

)

|

|

|

Weighted

average shares outstanding

|

||||||||||

|

Basic

and diluted

|

11,872,331

|

11,872,331

|

11,872,331

|

|||||||

|

Undesignated

shares

|

Preferred

stock

|

Common

stock

|

Additional

paid-in

|

Foreign

currency

|

Accumulated

|

Total

shareholders’

|

||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

capital

|

translation

|

deficit

|

equity

|

|||||||||||||||||||||

|

Balance

at March 31, 2004

|

-

|

-

|

$

|

-

|

11,872,331

|

$

|

118,723

|

$

|

51,980,946

|

$

|

-

|

$

|

(29,736,608

|

)

|

$

|

22,363,061

|

||||||||||||

|

Options

issued as compensation

|

-

|

-

|

-

|

-

|

-

|

(21,244

|

)

|

-

|

-

|

(21,244

|

)

|

|||||||||||||||||

|

Foreign

currency translation

|

-

|

-

|

-

|

-

|

-

|

-

|

382

|

-

|

382

|

|||||||||||||||||||

|

Net

loss

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(3,420,038

|

)

|

(3,420,038

|

)

|

|||||||||||||||||

|

Comprehensive

loss

|

(3,419,656

|

)

|

||||||||||||||||||||||||||

|

Balance

at March 31, 2005

|

-

|

-

|

-

|

11,872,331

|

118,723

|

51,959,702

|

382

|

(33,156,646

|

)

|

18,922,161

|

||||||||||||||||||

|

Change

in options issued as compensation

|

-

|

-

|

-

|

-

|

-

|

8,664

|

-

|

8,664

|

||||||||||||||||||||

|

Foreign

currency translation

|

-

|

-

|

-

|

-

|

-

|

-

|

(2,535

|

)

|

-

|

(2,535

|

)

|

|||||||||||||||||

|

Net

loss

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(3,348,848

|

)

|

(3,348,848

|

)

|

|||||||||||||||||

|

Comprehensive

loss

|

(3,351,383

|

)

|

||||||||||||||||||||||||||

|

Balance

at March 31, 2006

|

-

|

-

|

-

|

11,872,331

|

118,723

|

51,968,366

|

(2,153

|

)

|

(36,505,494

|

)

|

15,579,442

|

|||||||||||||||||

|

Stock

based compensation expense

|

-

|

-

|

-

|

-

|

-

|

50,363

|

-

|

-

|

50,363

|

|||||||||||||||||||

|

Foreign

currency translation

|

-

|

-

|

-

|

-

|

-

|

-

|

(6,011

|

)

|

-

|

(6,011

|

)

|

|||||||||||||||||

|

Net

loss

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(2,147,310

|

)

|

(2,147,310

|

)

|

|||||||||||||||||

|

Comprehensive

loss

|

(2,153,321

|

)

|

||||||||||||||||||||||||||

|

Balance

at March 31, 2007

|

-

|

-

|

$

|

-

|

11,872,331

|

$

|

118,723

|

$

|

52,018,729

|

$

|

(8,164

|

)

|

$

|

(38,652,804

|

)

|

$

|

13,476,484

|

|||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Cash

flows from operating activities:

|

||||||||||

|

Net

loss

|

$

|

(2,147,310

|

)

|

$

|

(3,348,848

|

)

|

$

|

(3,420,038

|

)

|

|

|

Adjustments

to reconcile net loss to net cash provided by (used in) operating

activities, net of acquisitions:

|

||||||||||

|

Depreciation

and amortization

|

651,399

|

1,061,199

|

1,003,573

|

|||||||

|

Deferred

income taxes

|

(243,293

|

)

|

272,454

|

-

|

||||||

|

Gain

on sale of assets

|

(433,433

|

)

|

(1,198,295

|

)

|

(208,837

|

)

|

||||

|

Stock

based compensation expense

|

50,363

|

8,664

|

(21,244

|

)

|

||||||

|

Goodwill

impairment charge

|

852,000

|

-

|

-

|

|||||||

|

Foreign

currency translation

|

(6,011

|

)

|

(2,535

|

)

|

382

|

|||||

|

Changes

in operating assets and liabilities, net of acquisitions:

|

||||||||||

|

Accounts

receivable, net

|

69,423

|

(446,235

|

)

|

341,293

|

||||||

|

Inventories

|

346,553

|

(566,190

|

)

|

303,535

|

||||||

|

Prepaid

expenses and other assets

|

(135,206

|

)

|

136,111

|

(134,910

|

)

|

|||||

|

Accounts

payable and accrued expenses

|

(361,400

|

)

|

807,697

|

(110,679

|

)

|

|||||

|

Net

cash used in operating activities

|

(1,356,915

|

)

|

(3,275,978

|

)

|

(2,246,925

|

)

|

||||

|

Cash

flows from investing activities:

|

||||||||||

|

Purchases

of property and equipment

|

(581,446

|

)

|

(427,631

|

)

|

(429,457

|

)

|

||||

|

Proceeds

from sale of assets

|

626,807

|

1,936,756

|

229,000

|

|||||||

|

Cash

paid for business acquisitions

|

-

|

-

|

(48,772

|

)

|

||||||

|

Net

cash provided by (used in) investing activities

|

45,361

|

1,509,125

|

(249,229

|

)

|

||||||

|

Cash

flows from financing activities:

|

||||||||||

|

Payment

of long-term debt

|

(872,854

|

)

|

(97,875

|

)

|

(232,923

|

)

|

||||

|

Bond

reserve funds

|

-

|

(987

|

)

|

(2,341

|

)

|

|||||

|

Net

cash used in financing activities

|

(872,854

|

)

|

(98,862

|

)

|

(235,264

|

)

|

||||

|

Decrease

in cash and cash equivalents

|

(2,184,408

|

)

|

(1,865,715

|

)

|

(2,731,418

|

)

|

||||

|

Cash

and cash equivalents at beginning of year

|

8,947,777

|

10,813,492

|

13,544,910

|

|||||||

|

Cash

and cash equivalents at end of year

|

$

|

6,763,369

|

$

|

8,947,777

|

$

|

10,813,492

|

||||

|

Supplemental

cash flow information:

|

||||||||||

|

Cash

paid during the year for:

|

||||||||||

|

Interest

|

$

|

41,841

|

$

|

90,816

|

$

|

99,337

|

||||

|

Income

taxes

|

5,800

|

3,117

|

4,138

|

|||||||

|

Noncash

investing and financing transactions:

|

||||||||||

|

Debt

incurred for purchase of equipment

|

$

|

179,118

|

$

|

-

|

$

|

-

|

||||

|

Bond

reserve funds used to pay down debt

|

$

|

469,626

|

$

|

-

|

$

|

-

|

||||

|

Debt

relieved in exchange for land

|

$

|

-

|

$

|

120,000

|

$

|

-

|

||||

|

Nature

of Business

|

|

APA

Enterprises, Inc., formerly APA Optics, Inc., (the Company) is a

manufacturer of a broad range of standard and custom connectivity

products

to customers throughout the United States with a concentration in

Minnesota. These products include fiber distribution systems, optical

components, Outside Plant (“OSP”) cabinets, and fiber and copper cable

assemblies that serve the communication service provider, including

Fiber-to-the-Home (“FTTH”),

large enterprise, and original equipment manufacturers (“OEMs”) markets.

The Company also manufactures and markets a range of gallium nitride-based

devices.

|

|

Foreign

Currency Translation

|

|

The

Company uses the United States dollar as its functional currency

for its

subsidiary in India. India’s financial statements were translated into

U.S. Dollars at the year end exchange rate, while income and expenses

are

translated at the average exchange rates during the year. There was

no

significant foreign exchange translation gain or losses during fiscal

years ended March 31, 2007, 2006 and 2005.

|

|

Revenue

Recognition

|

|

Revenue

is recognized when persuasive evidence of an arrangement exists,

the

product has been delivered, the fee is fixed, acceptance by the customer

is reasonably certain and collection is probable. The Company records

freight revenues billed to customer as revenue and the related cost

in

cost of revenues.

|

|

Cash

and Cash Equivalents

|

|

The

Company considers all highly liquid investments with original maturities

of three months or less to be cash equivalents. Cash equivalents

at

March 31, 2007 and 2006 consist entirely of short-term money market

accounts. Cash equivalents are stated at cost, which approximates

fair

value.

|

|

Cash

of approximately $47,000 and $104,000 was on deposit in foreign financial

institutions at March 31, 2007 and 2006. The Company maintains cash

balances at several financial institutions, and at times, such balances

exceed insured limits. The Company has not experienced any losses

in such

accounts and believes it is not exposed to any significant credit

risk on

cash.

|

|

Inventories

consist of finished goods, raw materials and work in process and

are

stated at the lower of average cost (which approximates the first-in,

first-out method) or market. Cost is determined using material costs,

labor charges, and allocated factory overhead charges.

|

|

Property,

Plant and Equipment

|

|

Property,

plant and equipment are stated at cost, less accumulated depreciation

and

amortiza-tion. Depreciation and amortization are provided on the

straight-line method for book and tax purposes over the follow-ing

estimated useful lives of the

assets:

|

|

Years

|

|

|

Building

|

20

|

|

Equipment

|

3

-

7

|

|

Leasehold

improvements

|

7

-

10 or life of lease

|

|

The

Company completed its annual impairment testing of goodwill in the

fourth

quarters of 2005, 2006, and 2007. This test indicated that goodwill

recorded as of March 31, 2007 for APACN was impaired, principally

due to

weakness in operating results of this subsidiary. The Company recognized

the related non-cash, pre-tax impairment charge of $852,000 ($519,717

after tax) for the year ended March 31,

2007.

|

|

March

31,

|

March

31,

|

||||||

|

2006

|

2005

|

||||||

|

Net

loss to common shareholders - as reported

|

$

|

(3,348,848

|

)

|

$

|

(3,420,038

|

)

|

|

|

Less:

Total stock-based employee compensation expense determined under

fair

value method for all awards, net of related tax effects

|

108,472

|

129,914

|

|||||

|

Net

loss - pro forma

|

$

|

(3,457,320

|

)

|

$

|

(3,549,952

|

)

|

|

|

Basic

and diluted net loss per common share - as reported

|

$

|

(.28

|

)

|

$

|

(.29

|

)

|

|

|

Basic

and diluted net loss per common share - pro forma

|

$

|

(.29

|

)

|

$

|

(.30

|

)

|

|

|

March

31, 2007

|

March

31, 2006

|

March

31, 2005

|

||||||||

|

Expected

volatility

|

64

|

%

|

75

|

%

|

75

|

%

|

||||

|

Expected

life (in years)

|

5

years

|

5

years

|

5

years

|

|||||||

|

Expected

dividends

|

0

|

%

|

0

|

%

|

0

|

%

|

||||

|

Risk-free

interest rate

|

4.78

|

%

|

3.90

|

%

|

3.40

|

%

|

||||

|

Due

to their short-term nature, the carrying value of current financial

assets

and liabilities approximates their fair values. The fair value of

long-term obligations, if recalculated based on current interest

rates,

would not significantly differ from the recorded

amounts.

|

|

Basic

net loss per share is computed by dividing net loss by the weighted

average number of common shares outstanding. Diluted net loss per

share is

computed by dividing net loss by the weighted average number of common

shares outstanding and common share equivalents related to stock

options

and warrants, when dilutive.

|

|

2007

|

2006

|

||||||

|

Raw

materials

|

$

|

1,146,161

|

$

|

1,588,816

|

|||

|

Work-in-process

|

33,783

|

48,474

|

|||||

|

Finished

goods

|

310,346

|

199,553

|

|||||

|

$

|

1,490,290

|

$

|

1,836,843

|

||||

|

2007

|

2006

|

||||||

|

Land

|

$

|

116,195

|

$

|

116,195

|

|||

|

Buildings

|

1,924,407

|

1,809,881

|

|||||

|

Manufacturing

equipment

|

1,006,856

|

4,802,514

|

|||||

|

Office

equipment

|

1,138,897

|

863,131

|

|||||

|

Vehicles

|

10,934

|

10,648

|

|||||

|

Leasehold

improvements

|

1,139,392

|

1,135,728

|

|||||

|

5,336,681

|

8,738,097

|

||||||

|

Less

accumulated depreciation and amortization

|

3,125,790

|

6,114,685

|

|||||

|

$

|

2,210,891

|

$

|

2,623,412

|

||||

|

The

following is a summary of the outstanding debt at

March 31:

|

|

2007

|

2006

|

||||||

|

South

Dakota Governor’s Office of Economic Development and the Aberdeen

Development Corporation Bond, 5.8% to 6.75%,paid in full during fiscal

2007

|

$

|

-

|

$

|

1,320,000

|

|||

|

Low

interest economic development loans, 0%, due in various installments

through fiscal 2011

|

-

|

-

|

|||||

|

Other

|

197,599

|

40,961

|

|||||

|

197,599

|

1,360,961

|

||||||

|

Less

current maturities

|

69,528

|

1,342,481

|

|||||

|

$

|

128,071

|

$

|

18,480

|

||||

|

Years

ending March 31,

|

||||

|

2008

|

$

|

69,528

|

||

|

2009

|

63,273

|

|||

|

2010

|

64,798

|

|||

|

$

|

197,599

|

|||

|

2007

|

2006

|

||||||

|

Current

deferred income tax assets:

|

|||||||

|

Inventories

|

$

|

196,966

|

$

|

160,129

|

|||

|

Accrued

expenses

|

199,945

|

194,841

|

|||||

|

396,911

|

354,970

|

||||||

|

Long-term

deferred income tax assets:

|

|||||||

|

Intangibles

|

32,513

|

12,766

|

|||||

|

Net

operating loss carryforwards

|

13,502,995

|

13,173,801

|

|||||

|

13,535,508

|

13,186,567

|

||||||

|

Total

deferred income tax assets

|

13,932,419

|

13,541,537

|

|||||

|

Long-term

deferred income tax liabilities:

|

|||||||

|

Property

and equipment depreciation

|

36,067

|

151,104

|

|||||

|

Goodwill

|

29,161

|

272,454

|

|||||

|

65,228

|

423,558

|

||||||

|

Total

net deferred income taxes

|

13,867,191

|

13,117,979

|

|||||

|

Valuation

allowance

|

(13,896,352

|

)

|

(13,390,433

|

)

|

|||

|

Total

|

$

|

(29,161

|

)

|

$

|

(272,454

|

)

|

|

|

Percent

of Pre-tax Income

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Federal

statutory rate

|

(34

|

%)

|

(34

|

%)

|

(34

|

%)

|

||||

|

State

income taxes

|

(5

|

%)

|

(5

|

%)

|

(5

|

%)

|

||||

|

Permanent

differences

|

9

|

%

|

7

|

%

|

1

|

%

|

||||

|

Other

|

(1

|

%)

|

1

|

%

|

0

|

%

|

||||

|

Change

in valuation allowance

|

21

|

%

|

40

|

%

|

38

|

%

|

||||

|

Tax

rate

|

(10

|

%)

|

9

|

%

|

0

|

%

|

||||

|

2007

|

2006

|

2005

|

||||||||

|

Current:

|

||||||||||

|

Federal

|

$

|

-

|

$

|

-

|

$

|

-

|

||||

|

State

|

5,800

|

3,117

|

4,138

|

|||||||

|

Deferred:

|

||||||||||

|

Federal

|

228,973

|

1,301,731

|

869,866

|

|||||||

|

State

|

33,673

|

193,949

|

127,921

|

|||||||

|

Valuation

allowance

|

(505,939

|

)

|

(1,223,226

|

)

|

(997,787

|

)

|

||||

|

Income

tax expense (benefit)

|

$

|

(237,493

|

)

|

$

|

275,571

|

$

|

4,138

|

|||

|

Number of

shares

|

Weighted

average

exercise price

|

Weighted

average

fair

value

|

||||||||

|

Outstanding

at March 31, 2004

|

385,115

|

$

|

3.74

|

|||||||

|

Granted

|

72,000

|

1.79

|

$

|

1.13

|

||||||

|

Canceled

|

(220,485

|

)

|

3.60

|

|||||||

|

Outstanding

at March 31, 2005

|

236,630

|

3.28

|

||||||||

|

Granted

|

65,000

|

1.39

|

0.88

|

|||||||

|

Canceled

|

(25,160

|

)

|

3.75

|

|||||||

|

Outstanding

at March 31, 2006

|

276,470

|

2.80

|

||||||||

|

Granted

|

40,000

|

1.31

|

$

|

0.77

|

||||||

|

Cancelled

|

(83,320

|

)

|

4.60

|

|||||||

|

Outstanding

at March 31, 2007

|

233,150

|

$

|

1.90

|

|||||||

|

Options

outstanding

|

|||||||||||||

|

Range

of

exercise

prices

|

Number

outstanding

|

Weighted

average

Remaining

contractual

life

|

Weighted

average

exercise

price

|

Aggregate

intrinsic

value

|

|||||||||

|

$0.00-$1.29

|

15,000

|

5.42

years

|

$

|

1.28

|

$

|

19,200

|

|||||||

|

1.30-2.91

|

|

213,150

|

3.58

years

|

1.82

|

387,016

|

||||||||

|

5.53-8.90

|

5,000

|

0.08

years

|

7.22

|

36,100

|

|||||||||

|

233,150

|

3.62

years

|

$

|

1.90

|

$

|

442,316

|

||||||||

|

Options

exercisable

|

|||||||||||||

|

Range

of

exercise

prices

|

Number

outstanding

|

Weighted

average

remaining

contractual

life

|

Weighted

average

exercise

price

|

Aggregate

intrinsic

value

|

|||||||||

|

$0.00-$1.29

|

-

|

-

|

$

|

-

|

$

|

-

|

|||||||

|

1.30-2.91

|

94,950

|

2.91

years

|

2.04

|

193,575

|

|||||||||

|

5.53-8.90

|

5,000

|

0.08

years

|

7.22

|

36,100

|

|||||||||

|

99,950

|

2.77

years

|

$

|

2.30

|

$

|

229,675

|

||||||||

|

Warrants

outstanding

|

Exercise

price

per

share

|

Expiration

date

|

||||||||

|

Balance

at March 31, 2004

|

590,822

|

$

|

3.00

- 17.84

|

2005

- 2008

|

||||||

|

Issued

|

-

|

-

|

-

|

|||||||

|

Expired

|

(144,091

|

)

|

14.72

|

2005

|

||||||

|

Balance

at March 31, 2005

|

446,731

|

3.00

-17.84

|

2005

- 2008

|

|||||||

|

Issued

|

-

|

-

|

-

|

|||||||

|

Expired

|

(89,421

|

)

|

6.00-17.84

|

2006

|

||||||

|

Balance

at March 31, 2006

|

357,310

|

3.00

- 7.00

|

2007

- 2008

|

|||||||

|

Issued

|

-

|

-

|

-

|

|||||||

|

Expired

|

(7,310

|

)

|

7.00

|

2007

|

||||||

|

Balance

at March 31, 2007

|

350,000

|

3.00

|

2008

|

|||||||

|

Year

ending March 31

|

Operating

leases

|

|||

|

2008

|

$

|

349,583

|

||

|

2009

|

350,820

|

|||

|

2010

|

315,531

|

|||

|

2011

|

235,590

|

|||

|

2012

|

240,654

|

|||

|

Thereafter

|

439,275

|

|||

|

Total

minimum lease payments

|

$

|

1,931,453

|

||

|

Optronics

|

Cables

& Networks

|

Eliminations

|

Consolidated

|

||||||||||

|

Year

ended March 31, 2007

|

|||||||||||||

|

External

revenues

|

$

|

196

|

$

|

18,364

|

$

|

-

|

$

|

18,560

|

|||||

|

Gross

profit (loss)

|

(447

|

)

|

5,260

|

-

|

4,813

|

||||||||

|

Operating

loss

|

(2,177

|

)

|

(578

|

)

|

-

|

(2,755

|

)

|

||||||

|

Depreciation

and amortization

|

415

|

236

|

-

|

651

|

|||||||||

|

Capital

expenditures

|

326

|

435

|

-

|

761

|

|||||||||

|

Assets

|

16,399

|

7,107

|

(7,783

|

)

|

15,723

|

||||||||

|

Year

ended March 31, 2006

|

|||||||||||||

|

External

revenues

|

$

|

400

|

$

|

15,879

|

$

|

(323

|

)

|

$

|

15,956

|

||||

|

Gross

profit (loss)

|

(674

|

)

|

4,195

|

(4

|

)

|

3,517

|

|||||||

|

Operating

loss

|

(3,407

|

)

|

(49

|

)

|

-

|

(3,456

|

)

|

||||||

|

Depreciation

and amortization

|

798

|

263

|

-

|

1,061

|

|||||||||

|

Capital

expenditures

|

289

|

138

|

-

|

427

|

|||||||||

|

Assets

|

19,333

|

7,879

|

(7,618

|

)

|

19,594

|

||||||||

|

Year

ended March 31, 2005

|

|||||||||||||

|

External

revenues

|

$

|

490

|

$

|

14,027

|

$

|

(404

|

)

|

$

|

14,113

|

||||

|

Gross

profit (loss)

|

(1,133

|

)

|

3,821

|

-

|

2,688

|

||||||||

|

Operating

profit (loss)

|

(3,920

|

)

|

334

|

-

|

(3,586

|

)

|

|||||||

|

Depreciation

and amortization

|

774

|

230

|

-

|

1,004

|

|||||||||

|

Capital

expenditures

|

397

|

79

|

-

|

476

|

|||||||||

|

Assets

|

22,253

|

7,188

|

(7,367

|

)

|

22,074

|

||||||||

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE.

|

|

ITEM

9A.

|

CONTROLS

AND PROCEDURES

|

|

ITEM

9B.

|

OTHER

INFORMATION

|

|

ITEM

10.

|

DIRECTORS

AND EXECUTIVE OFFICERS OF THE

REGISTRANT

|

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER

MATTERS

|

|

(a)

|

(b)

|

(c)

|

||||||||||

|

Plan

category

|

Number

of securities to be issued upon exercise of options, warrants or

rights

|

Weighted-average

exercise price of outstanding options, warrants and rights

|

Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column

(a))

|

|||||||||

|

Equity

compensation plans approved by security holders

|

233,150

|

$ |

1.90

|

716,850

|

||||||||

|

Equity

compensation plans not approved by security holders

|

350,000

|

$ |

3.00

|

Not

applicable*

|

||||||||

|

Total

|

583,150

|

$ |

2.56

|

716,850

|

||||||||

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

|

ITEM

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

|

ITEM

15.

|

EXHIBITS

AND FINANCIAL STATEMENT SCHEDULES

|

|

(i)

|

Report

of Independent Registered Public Accounting Firm for the years

ended March

31, 2007, 2006 and 2005

|

|

(ii)

|

Consolidated

Balance Sheets as of March 31, 2007 and

2006

|

|

(iii)

|

Consolidated

Statements of Operations for the years ended March 31, 2007, 2006

and

2005

|

|

(iv)

|

Consolidated

Statement of Shareholders’ Equity for the years ended March 31, 2007, 2006

and 2005

|

|

(v)

|

Consolidated

Statements of Cash Flows for the years ended March 31, 2007, 2006

and

2005

|

|

(vi)

|

Notes

to the Consolidated Financial Statements for the years ended March

31,

2007, 2006 and 2005

|

|

(2)

|

Financial

Statement Schedules: See Schedule II on page following

signatures.

|

|

(b)

|

Exhibits.

See Exhibit Index.

|

|

APA

Enterprises, Inc.

|

|||

|

Date:

June 22, 2007

|

By

|

/s/

Anil K. Jain

|

|

|

Anil

K. Jain

|

|||

|

President

and Chief Executive Officer

|

|||

|

Signature

|

Title

|

Date

|

||

|

/s/

Anil K. Jain

|

President,

Chief Executive Officer, Chief

|

June

22 , 2007

|

||

|

Anil

K. Jain

|

Financial

Officer and Director (principal executive officer and principal financial

officer)

|

|||

|

/s/

Chris M. Goettl

|

Principal

accounting officer

|

June

22 , 2007

|

||

|

Chris

M. Goettl

|

||||

|

/s/

John G. Reddan

|

Director

|

June

22 , 2007

|

||

|

John

G. Reddan

|

||||

|

/s/

Ronald G. Roth

|

Director

|

June

22, 2007

|

||

|

Ronald

G. Roth

|

||||

|

/s/

Stephen L. Zuckerman MD

|

Director

|

June

22, 2007

|

||

|

Stephen

L. Zuckerman

|

|

Additions

|

||||||||||||||||

|

Description

|

Balance

at Beginning

of

Period

|

Charged

to:

Cost

and

Expenses

|

Charged

to:

Other

Accounts

|

Deductions

|

Balance

at

End

of Period

|

|||||||||||

|

Allowance

for doubtful accounts

|

||||||||||||||||

|

March

31, 2007

|

$

|

77,831

|

$

|

-

|

$

|

5,550(1

|

)

|

$

|

4,881(2

|

)

|

$

|

78,500

|

||||

|

March

31, 2006

|

57,107

|

18,000

|

6,121(1

|

)

|

3,397(2

|

)

|

77,831

|

|||||||||

|

March

31, 2005

|

49,038

|

33,000

|

10,692(1

|

)

|

35,623(2

|

)

|

57,107

|

|||||||||

|

Number

|

Description

|

Page

Number or Incorporated

by

Reference to

|

||

|

2.1

|

Asset

Purchase Agreement between APACN and CSP, Inc.

|

Exhibit

2.1 to Form 8-K filed March 31, 2003

|

||

|

2.1

|

Asset

Purchase Agreement between APACN and Americable, Inc.

|

Exhibit

2.1 to Form 8-K filed July 2, 2003

|

||

|

2.2

|

Agreement

Not to Compete with Peter Lee as part of CSP asset

purchase

|

Exhibit

2.2 to Form 8-K filed March 31, 2003

|

||

|

2.3

|

Asset

Purchase Agreement between APA Enterprises, Inc. and Software Moguls

India

Private Limited and S M Infoexpert Private Limited

|

Exhibit

2.3 to Registrant’s Report on Form 10-K for the fiscal year ended March

31, 2005

|

||

|

3.1

|

Restated

Articles of Incorporation, as amended to date

|

Exhibit

3.1 to Registrant’s Report on Form 10-Q for the quarter ended September

30, 2000

|

||

|

3.1

(a)

|

Restated

Articles of Incorporation, as amended to date thru August 25,

2004

|

Exhibit

3.1 to Registrant’s Report on Form 10-Q for the quarter ended September

30, 2004

|

||

|

3.2

|

Bylaws,

as amended and restated to date

|

Exhibit

3.2 to Registrant’s Report on Form 10-KSB for the fiscal year ended March

31, 1999

|

||

|

4.1(a)

|

State

of South Dakota Board of Economic Development $300,000 Promissory

Note,

REDI Loan: 95-13-A

|

Exhibit

4.1(a) to the Report on 10-QSB for the quarter ended June 30, 1996

(the

“June 1996 10-QSB”)

|

||

|

4.1(b)

|

State

of South Dakota Board of Economic Development Security Agreement

REDI Loan

No: 95-13-A dated May 28, 1996

|

Exhibit

4.1(b) to the June 1996 10-QSB

|

||

|

4.2(a)

|

$700,000

Loan Agreement dated June 24, 1996 by and between Aberdeen Development

Corporation and APA Enterprises, Inc.

|

Exhibit

4.2(a) to the June 1996 10-QSB

|

||

|

4.2(b)

|

$300,000

Loan Agreement dated June 24, 1996 between Aberdeen Development

Corporation and APA Enterprises, Inc.

|

Exhibit

4.2(b) to the June 1996 10-QSB

|

||

|

4.2(c)

|

$250,000

Loan Agreement dated June 24, 1996 by and between Aberdeen Development

Corporation and APA Enterprises, Inc.

|

Exhibit

4.2(c) to the June 1996 10-QSB

|

|

Number

|

Description

|

Page

Number or Incorporated

by

Reference to

|

||

|

4.2(d)

|

$300,000

Loan Agreement dated June 24, 1996 by and between Aberdeen Development

Corporation and APA Enterprises, Inc.

|

Exhibit

4.2(d) to the June 1996 10-QSB

|

||

|

4.2(e)

|

Amended

Loan Agreement with Aberdeen Development Corporation and APA Enterprises,

Inc.

|

Exhibit

4.2(e) to Registrants Report on Form 10-K for fiscal year ended March

31,

2004

|

||

|

4.2(f)

|

Purchase

Agreement for land with Aberdeen Development Corporation and APA

Enterprises, Inc.

|

Exhibit

4.2(f) to Registrant’s Report on Form 10-K for the fiscal year ended March

31, 2005

|

||

|

4.3(a)

|

Loan

Agreement between South Dakota Economic Development Finance and APA

Enterprises, Inc.

|

Exhibit

4.3(a) to the June 1996 10-QSB

|

||

|

4.3(b)

|

Mortgage

and Security Agreement - One Hundred Day Redemption from APA Enterprises,

Inc. to South Dakota Economic Development Finance Authority dated

as of

June 24, 1996

|

Exhibit

4.3(b) to the June 1996 10-QSB

|

||

|

4.4(a)

|

Subscription

and Investment Representation Agreement of NE Venture,

Inc.

|

Exhibit

4.4(a) to the June 1996 10-QSB

|

||

|

4.4(b)

|

Form

of Common Stock Purchase Warrant for NE Venture, Inc.

|

Exhibit

4.4(b) to the June 1996 10-QSB

|

||

|

4.5(a)

|

Certificate

of Designation for 2% Series A Convertible Preferred Stock

|

Exhibit

4.5(a) filed as a part of Registration Statement on Form S-3 (Commission

File No. 333-33968)

|

||

|

4.5(b)

|

Form

of common stock warrant issued in connection with 2% Series A Convertible

Preferred Stock

|

Exhibit

4.5(b) filed as a part of Registration Statement on Form S-3 (Commission

File No. 333-33968)

|

||

|

4.6

|

Common

Stock Purchase Warrant issued to Ladenburg Thalmann & Co. Inc. to

purchase 84,083 shares

|

Exhibit

4.6 to Registrant’s Report on Form 10-K for fiscal year ended March 31,

2000 (“2000 10-K”)

|

||

|

4.7

|

Share

Rights Agreement dated October 23, 2000 by and between the Registrant

and

Wells Fargo Bank Minnesota NA as Rights Agent

|

Exhibit

1 to the Registration Statement on Form 8-A filed November 8,

2000

|

||

|

4.8

|

Common

Stock Warrant Purchase Agreement with Peter Lee as part of CSP asset

purchase

|

Exhibit

4.8 to Form 8-K filed March 31, 2003

|

||

|

10.1(a)

|

Sublease

Agreement between the Registrant and Jain-Olsen Properties and Sublease

Agreement and Option Agreement between the Registrant and Jain-Olsen

Properties

|

Exhibit

10.1 to the Registration Statement on Form S-18 filed with the Chicago

Regional Office of the Securities and Exchange Commission on June

26, 1986

|

|

Number

|

Description

|

Page

Number or Incorporated

by

Reference to

|

||

|

10.1(b)

|

Amendment

and Extension of Sublease Agreement dated August 31, 1999

|

Exhibit

10.1(b) to 2000 10-K

|

||

|

10.1(c)

|

Lease

Agreement between Registrant and Jain-Olsen Properties

|

Exhibit

10.1(c) to Registrant’s Form 10Q-SB for quarter ended September 30,

2004

|

||

|

*10.2(a)

|

Stock

Option Plan for Nonemployee Directors

|

Exhibit

10.3a to Registrant’s Report on Form 10-KSB for the fiscal year ended

March 31, 1994 (the “1994 10-KSB”)

|

||

|

*10.2(b)

|

Form

of option agreement issued under the Nonemployee Directors

Plan

|

Exhibit

10.3b to 1994 10-KSB

|

||

|

*10.3

|

1997

Stock Compensation Plan

|

Exhibit

10.3 to Registrant’s Report on Form 10-KSB for the fiscal year ended

March 31, 1997

|

||

|

*10.4

|

Insurance

agreement by and between the Registrant and Anil K. Jain

|

Exhibit

10.5 to Registrant’s Report on Form 10-K for the fiscal year ended March

31, 1990

|

||

|

*10.5

|

Form

of Agreement regarding Repurchase of Stock upon Change in Control

Event

with Anil K. Jain and Kenneth A. Olsen

|

Exhibit

10.1 to Registrant’s Report on Form 10-QSB for the quarter ended September

30, 1997 (“September 1997 10-QSB”)

|

||

|

*10.6

|

Form

of Agreement regarding Employment/Compensation upon Change in Control

with

Messrs. Jain and Olsen

|

Exhibit

10.2 to the September 1997 10-QSB

|

||

|

*10.7

|

Form

of Agreement regarding Indemnification of Directors and Officers

with

Messrs. Jain, Olsen, Ringstad, Roth, Von Wald and

Zuckerman

|

Exhibit

10.7 to Registrant’s Report on From 10-K for the fiscal year ended March

31, 2002.

|

||

|

10.8

|

Sublease

agreement between Newport and APACN

|

Exhibit

10.8 to Registrant’s Report of Form 10-QSB for the quarter ended June 30,

2003

|

||

|

10.9

|

Sublease

agreement between Veeco Compound Semiconductor and APA Enterprises,

Inc.

|

Exhibit

10.9 to Registrant’s Report of Form 10-K for the fiscal year ended March

31, 2004

|

||

|

10.9(b)

|

Amendment

to sublease between Veeco Compound Semiconductor and APA Enterprises,

Inc.

|

Exhibit

10.9 (b) to Registrant’s Report on Form 10-QSB for the quarter ended

September 30, 2004

|

||

|

*10.10

|

Ken

Olsen Separation Agreement

|

Exhibit

10.10 to Registrant’s Report on Form 10-K for the fiscal year ended March

31, 2004

|

||

|

*10.11

|

Stock

option agreement with Cheri Podzimek, President of APACN

|

Exhibit

10.11 to Registrant’s Report on Form 10-K for the fiscal year ended March

31, 2005

|

|

Number

|

Description

|

Page

Number or Incorporated

by

Reference to

|

||

|

10.12

|

Agreements

on sale of MOCVD Assets

|

Exhibit

10.12 to Registrant’s Report on for 8-K filed March 10,

2006

|

||

|

10.13

|

Patent

and Technology and Revenue Sharing License Agreement

|

Exhibit

10.13 to Registrant’s Report on for 8-K filed March 10,

2006

|

||

|

10.14

|

Lease

agreement between Bass Lake Realty, LLC and APACN

|

Exhibit

10.14 to Registrant's Report of Form 10-K for fiscal year ended March

31,

2006

|

||

|

*10.15

|

2007

Stock Compensation Plan

|

Exhibit

10.15 to Registrant’s Registration Statement on Form S-8 POS filed on

August 24, 2007

|

||

|

14

|

Code

of Ethics

|

Exhibit

14 to Registrant’s Report on Form 10-K for the fiscal year ended March 31,

2004