Latest News

Latest Presentation

Upcoming Event

2026 Annual Meeting of Shareholders

Latest Financial Results

FY Q4 2025

Fiscal Year Ended Sep 30, 2025

$41.1M

Net Sales (Revenue)

34.6%

Gross Margin

$0.13

EPS

Latest Annual Filing

For Fiscal Year Ending Sep 30, 2025

Report Links

Annual Report Document Links

View 10-KFor complete information regarding our financials, see our periodic filings

FY 2025 Operating Highlights

Annual Net Sales

Annual Net Income

As of September 30, 2025 • Q4 2025 Earnings Release

Email Alerts

Stay informed and receive company updates straight to your inbox.

Stock Snapshot

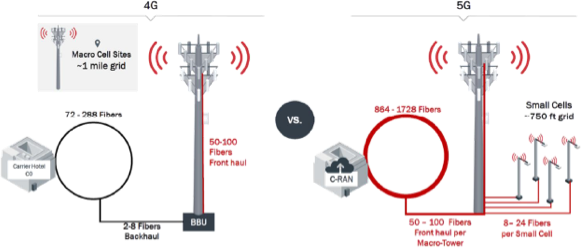

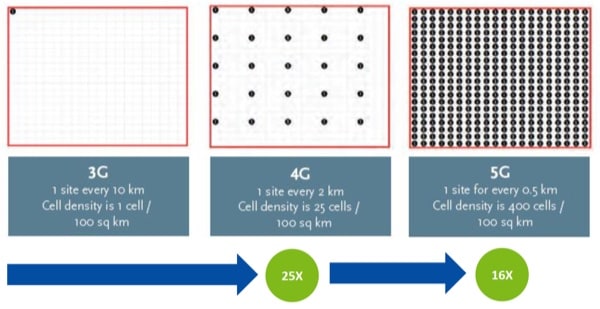

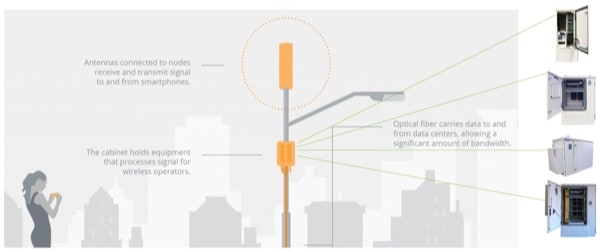

A Scalable Fiber Management and Delivery Platform

Clearfield, Inc. (NASDAQ: CLFD) designs, manufactures and distributes fiber optic management, protection and delivery products for communications networks. Our “fiber to anywhere” platform serves the unique requirements of leading ILECS, CLECs, MSO/cable TV companies, and the broadband needs of the Utility/Municipality, Enterprise, Data Center and Military markets. Clearfield offers the industry’s only fiber management and delivery platform that scales to align capital equipment expenditure alongside subscriber revenue through a single architecture.

To be an industry leader means knowing the customer’s requirements, and then exceeding them. Clearfield leads the industry by helping service providers reduce the high costs associated with deploying, managing, protecting and scaling a fiber optic network. We do this by bringing customer-focused designs to the marketplace, building simplicity into the design and delivering the lowest total cost of ownership.

Headquartered in Minneapolis, MN, Clearfield deploys millions of fiber ports each year throughout North America and beyond.

Clearfield at a Glance

Founded

Customers

Strong Track Record of Growth and Profitability

Employees

Quarterly Financial Performance

Revenue

(In millions)

Gross Profit

(In millions)

Operating Expenses

(In millions)

Investor Contact Information

Company

Clearfield, Inc.

7050 Winnetka Avenue N

Minneapolis, MN 55428

Investor Relations

The Blueshirt Group

Greg McNiff

T: 773-485-7191

clearfield@blueshirtgroup.com

Transfer Agent

EQ Shareowner Services

1110 Centre Pointe Curve

Suite 101

Mendota Heights, MN 55120-4100

T: 800-401-1957

www.shareowneronline.com